Hippo Housepower Report: Homeowners Gain Ground, Face New Challenges in 2026

A home holds more than financial equity. It's where people mark milestones, make memories, and find safety. Each year, we survey U.S. homeowners to uncover where they're thriving and where they still need support.

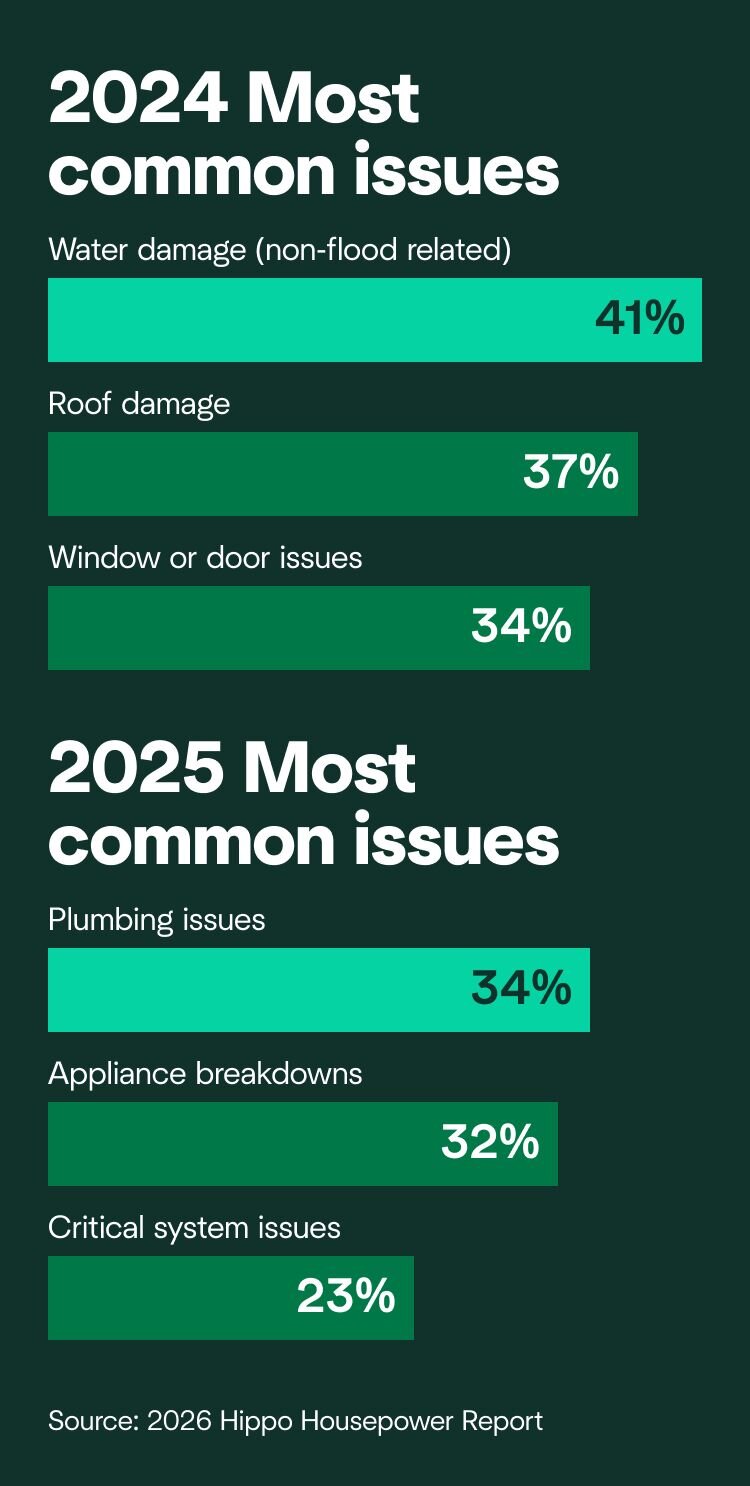

This year’s findings show the highest homeowner satisfaction rates in three years, but also a decline in preparedness and preventive maintenance. This can carry serious consequences; when homeowners neglect maintenance, their properties become more vulnerable to the unexpected.

Our Housepower Report builds on our annual series tracking the behaviors, spending habits, and preparedness of more than 1,600 U.S. homeowners. These efforts reveal key insights on repair costs, climate risks, the role of AI in insurance decisions, and more.

Key takeaways

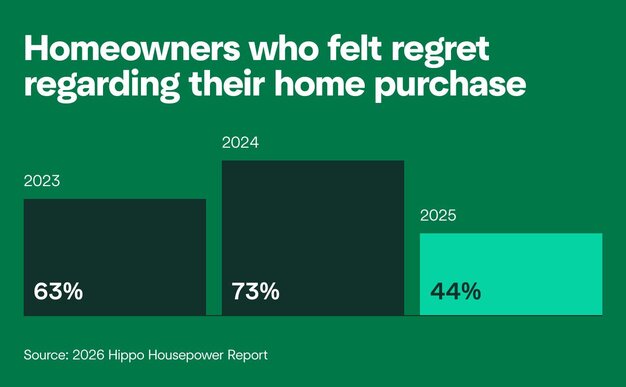

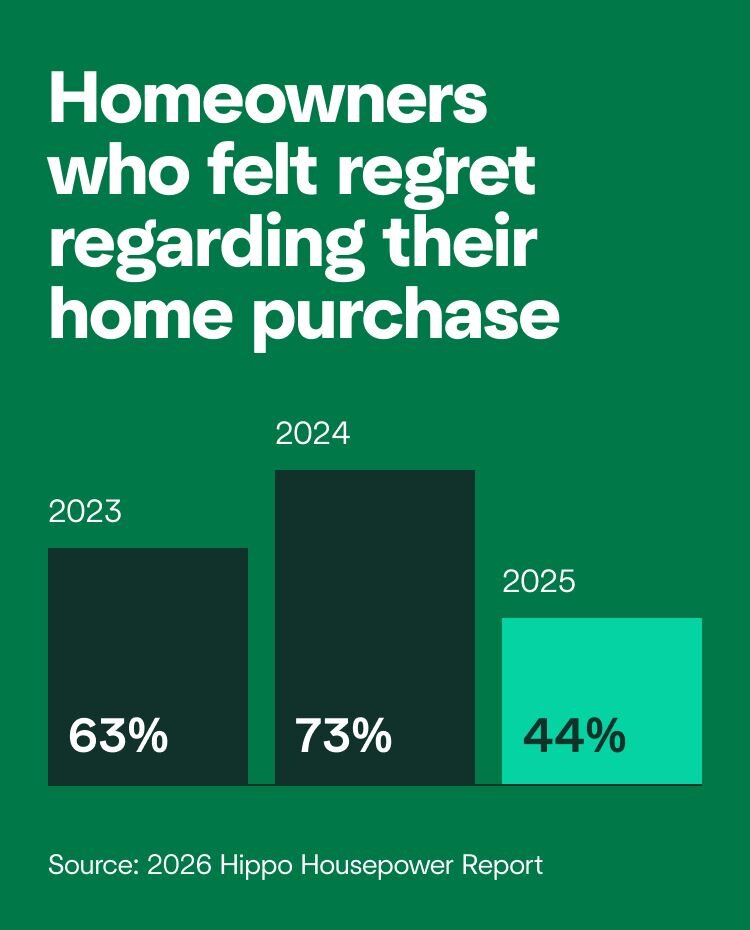

- In 2025, 56% of U.S. homeowners report no regrets about their home purchase—up from 27% in 2024. This could suggest growing satisfaction in homeownership despite ongoing responsibilities and costs.

- Over a third (38%) are satisfied with the amount of home maintenance they completed in 2025, down from 44% in 2024.

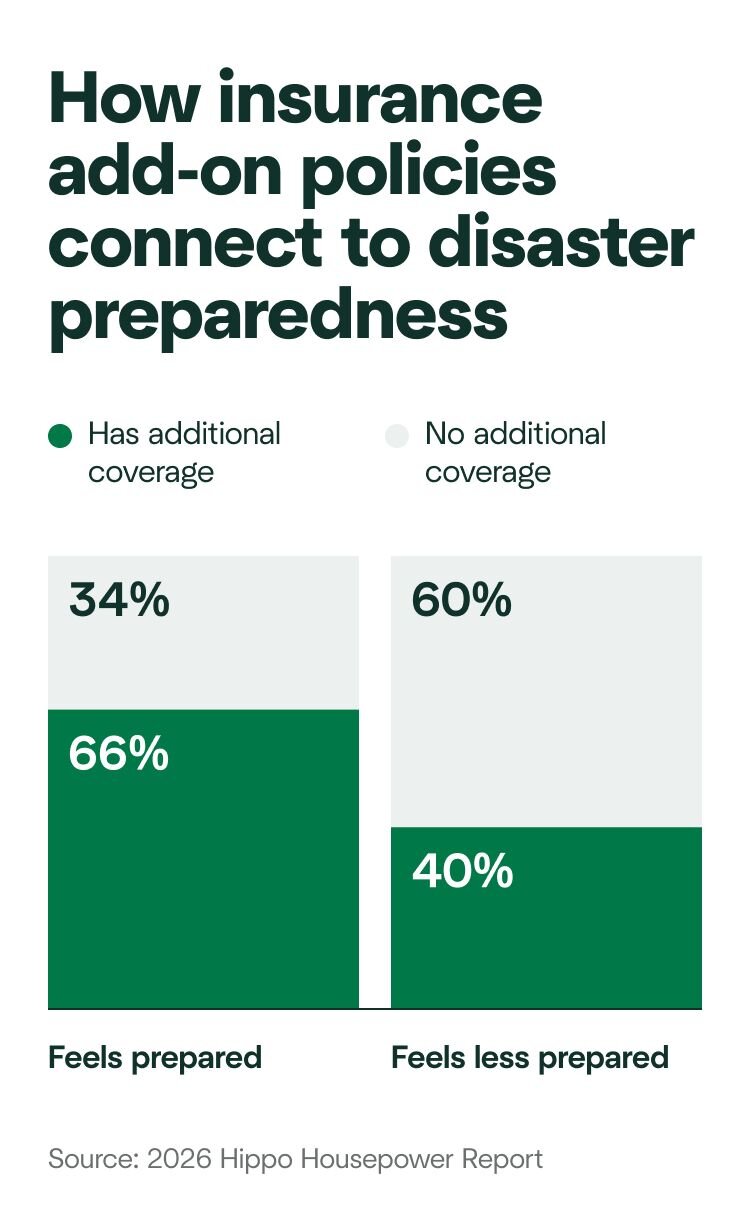

- In 2024, just over half of homeowners felt very prepared for extreme weather. By 2025, that number fell nearly 20 percentage points— underscoring the need for more emergency planning and supplemental coverage.

- Nearly half expect to use AI tools, like ChatGPT or Google Gemini, to better understand their insurance policies, explore additional coverage options, compare providers, and more.

Homeowner regrets drop to lowest level in 3 years

Top 5 homeowner regrets year-over-year

Rank | 2024 Regrets | 2025 Regrets |

|---|---|---|

#1 | I had to compromise on features I really wanted. | Maintenance and upkeep require more effort than I planned for. |

#2 | I'm paying a mortgage rate that is higher than I can comfortably afford. | I’ve faced more unexpected issues than I anticipated. |

#3 | I’ve faced more unexpected issues than I anticipated. | Homeownership costs more than I thought it would. |

#4 | My home insurance premiums are higher than expected. | My home insurance premiums are higher than expected. |

#5 | Homeownership costs more than I thought it would. | I had to compromise on features I really wanted. |

- Stabilizing mortgage rates: After peaking above 7%, mortgage rates fell to near three-year lows in 2025, hovering around 6.3%.1,2 Lower rates may fuel optimism and reduce financial strain for homeowners.

- Rising inventory gives buyers options: Housing inventory climbed to 1.55 million active listings by late 2025, roughly 14% higher than a year earlier. This marks the strongest supply recovery since 2020. With more homes on the market, buyers have more negotiating power and face less pressure to compromise on features.3

- DIY ambitions meeting reality: Regrets connected specifically to maintenance may be climbing because the majority of homeowners are taking on the work themselves. In 2024, 83% of homeowners said they would complete DIY maintenance tasks in 2025, with 55% doing “most home maintenance” without outside help. These homeowners may have found the workload more demanding than they expected.

Still, homeowner sentiment isn’t consistent across the U.S. Different regions face unique issues that shape how homeowners feel about their properties.

Regions where homeowners have the most regrets

Region | State breakdown |

|---|---|

East South Central | 64% of homeowners in Alabama, Kentucky, Mississippi, and Tennessee report no regrets on their home purchase. |

Middle Atlantic | 61% of homeowners in New Jersey, New York, and Pennsylvania report no regrets on their home purchase. |

West South Central |

Region | State breakdown |

|---|---|

Pacific | 49% of homeowners in Alaska, California, Hawaii, Oregon, and Washington reported no regrets around their home purchase. |

West North Central | 54% of homeowners in Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota reported no regrets around their home purchase. |

Mountain | |

East North Central |

Boomers lead in satisfaction, millennials lead in regrets

No regrets about their home purchase | Generations |

|---|---|

71% | Baby Boomers (born 1946-1964) |

55% | Generation X (born 1965-1980) |

47% | Millennials (born 1981-1996) |

49% | Generation Z (born 1997-2012) |

Proactive maintenance continues to be a top priority for homeowners

- To protect the overall condition of their home (56%)

- To prevent unexpected and costly damage (41%)

- To achieve peace of mind and reduce stress (41%)

Homeowners’ biggest financial worries

Rank | Gen Z | Millennials | Gen X | Baby Boomers |

|---|---|---|---|---|

#1 | Home safety or security (41%) | Utility bills (40%) | Utility bills (38%) | Utility bills (31%) |

#2 | Utility bills (35%) | Surprise repairs (34%) | Surprise repairs (36%) | Surprise repairs (30%) |

#3 | Surprise repairs (32%) | Major appliance replacement (30%) | Property taxes or HOA fees (27%) | Home insurance (29%) |

Younger homeowners feel more pride—but more pain—from home repairs

AI becomes a new insurance advisor for consumers

- 54% plan to use AI to check whether they’re paying a fair price

- 48% plan to compare different insurance providers and policies

- 48% plan to explore additional coverage options they should consider

- 40% plan to use it to better understand their current policy

Millennials and Gen Z face the toughest financial pressures in homeownership

Faced financial instability | Generation |

|---|---|

67% | Baby Boomers (born 1946-1964) |

77% | Generation X (born 1965-1980) |

82% | Millennials (born 1981-1996) |

85% | Generation Z (born 1997-2012) |

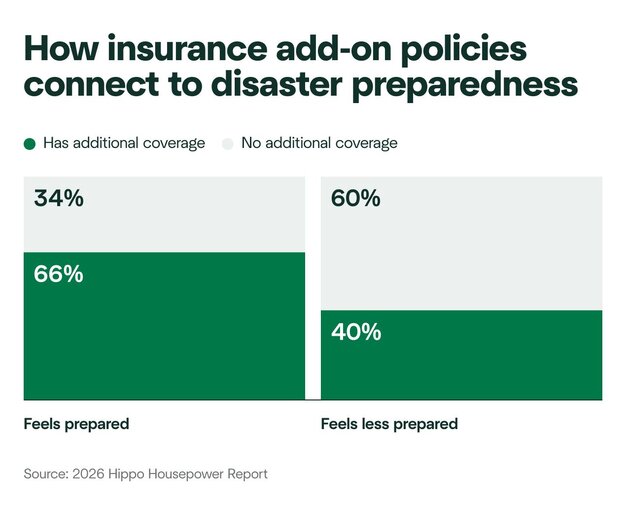

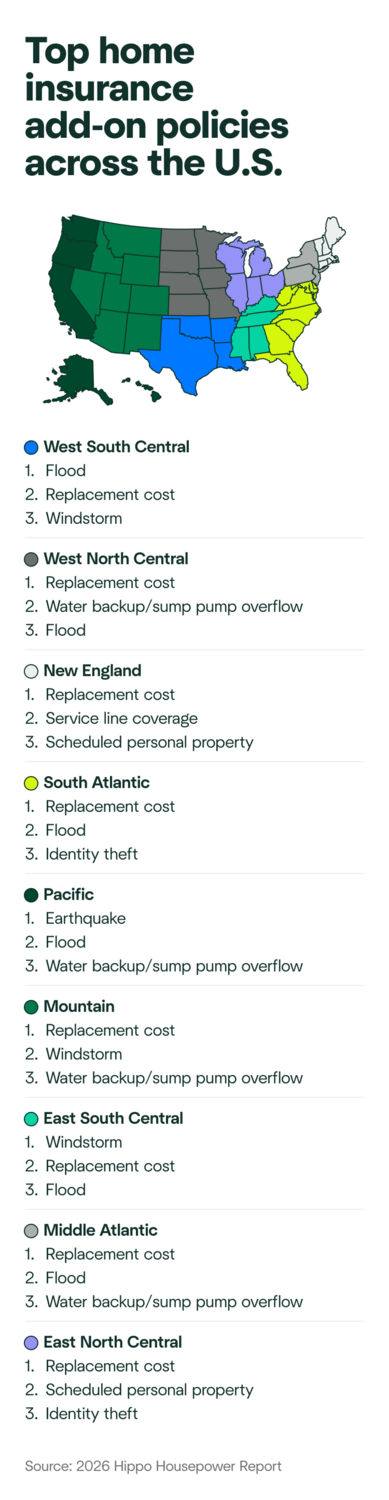

Homeowners add coverage riders—but many still misjudge their risk

Extreme weather causes homeowners to rethink preparedness nationwide

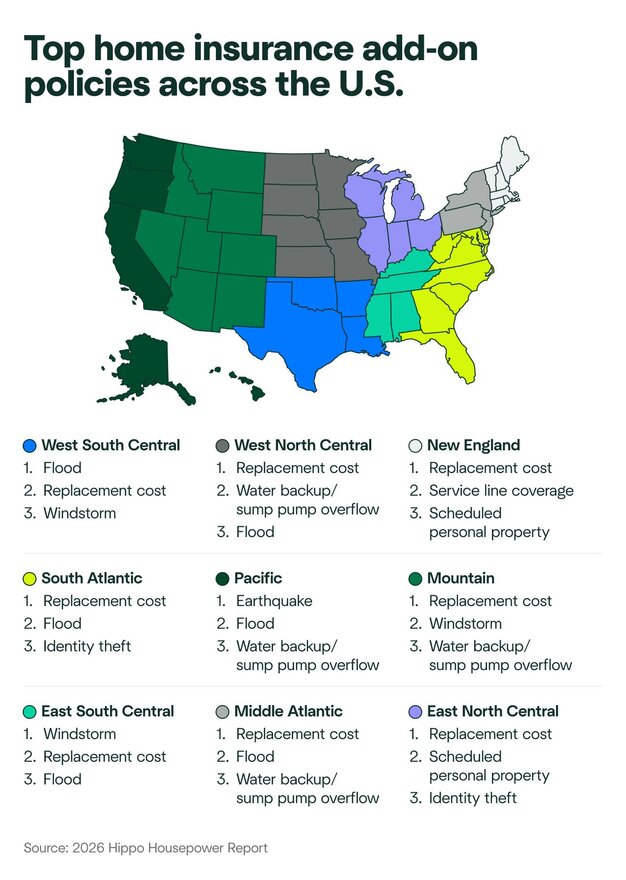

Regional differences reveal gaps in extreme weather insurance coverage

- 28% reported adding earthquake insurance

- 22% opted for flood coverage

- 22% added water backup coverage

- 43% for peace of mind and reducing out-of-pocket risks

- 37% for covering extreme weather excluded from their base policy

- 33% because an insurance agent or provider recommended it

Advice from current homeowners: Stay protected and prepared in 2026

% who recommend | Advice from current homeowners |

|---|---|

50% | Schedule and budget for regular, proactive home maintenance and emergencies |

35% | Research financing options and ways to manage mortgage payments |

35% | Invest in home upgrades that improve property value |

32% | Make home upgrades to improve energy efficiency and sustainability |

- Create an emergency fund specifically for home repairs. Only 32% of homeowners have done this, yet unexpected repairs impact the financial stability of one in three homeowners.

- Review your insurance coverage annually. Standard policies don't cover everything. The homeowners who invest in additional coverage are the ones who feel most prepared.

- Develop an emergency plan before you need it. Just 35% of homeowners have created or plan to create one. Knowing what to do when disaster strikes can reduce stress and potential damage.

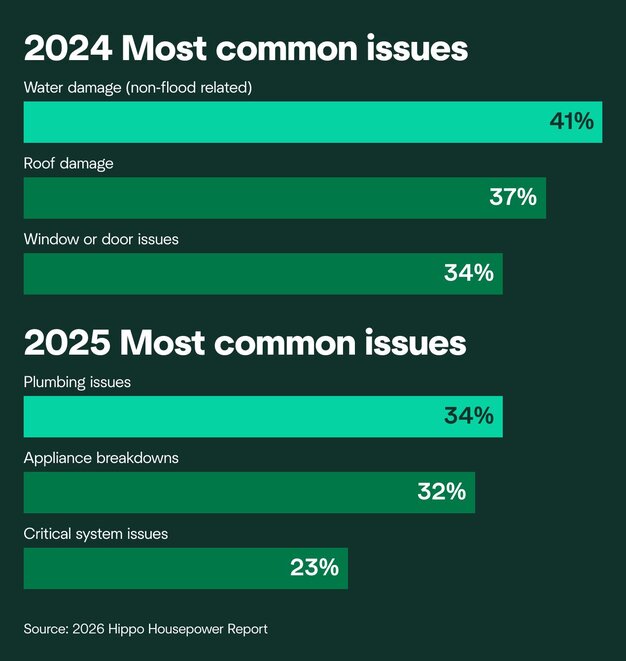

- Focus on system maintenance, not just cosmetic upkeep. Plumbing, appliances, and critical systems top the list of unexpected problems. Regular inspections can help catch small issues before they become expensive emergencies.

- Consider energy efficiency upgrades. Current homeowners recommend this to new buyers for a reason. These improvements could support reduced utility costs while making homes more resilient to extreme temperatures.

Methodology

External sources

- CBS News. (2025, September). Mortgage interest rates just fell to a 3-year low. Here's why (and what to do now).

- Associated Press. (2025, September). Average rate on a 30-year mortgage edges higher after declining four weeks in a row.

- CBS42. (2025, October). U.S. Real Estate Market Gains Momentum in Late 2025 as Inventory Rises and Prices Stabilize.

- Federal Reserve Bank of Atlanta. (2025, September). Homeownership Affordability Monitor.

- Realtor.com. (2025, September). 2025 Realtor.com Housing and Climate Risk Report.

Related Articles

Hippo Housepower Report: Home Protection Priorities in 2025

Hippo’s Annual Housepower Report

2022 Hippo Housepower Report: How Homeowners are Responding to Essential Maintenance During a Shifting Economy

Homeowner's Guide to Extreme Weather in 2026: What's Next and How To Prepare

Is Your Fixer-Upper a Mistake? 1 in 5 U.S. Homeowners Said Yes