Young Homeowners Fear Natural Disasters Most, Despite Preparation

The increasing intensity and frequency of natural disasters can leave homeowners scrambling to protect their most valuable asset: their homes. From the Midwest's tornado alley to hurricane-prone coastal regions, severe weather is a growing concern. Our Financial Goals Report reflects this trend, identifying "home upgrades to prepare for severe weather" as a top financial priority for homeowners.

In our new survey of over 2,000 U.S. homeowners, we uncovered surprising generational trends in disaster preparedness. Explore these insights to discover how homeowners of all ages are approaching natural disasters and how they can help safeguard their homes against potentially devastating damage.

Key takeaways

- Over one in five (23%) younger U.S. homeowners (ages 18-29) feel at least somewhat vulnerable to natural disasters. This aligns with findings from our Severe Weather Prep Report, which found 95% of younger respondents took at least one step to protect their homes from extreme weather events.

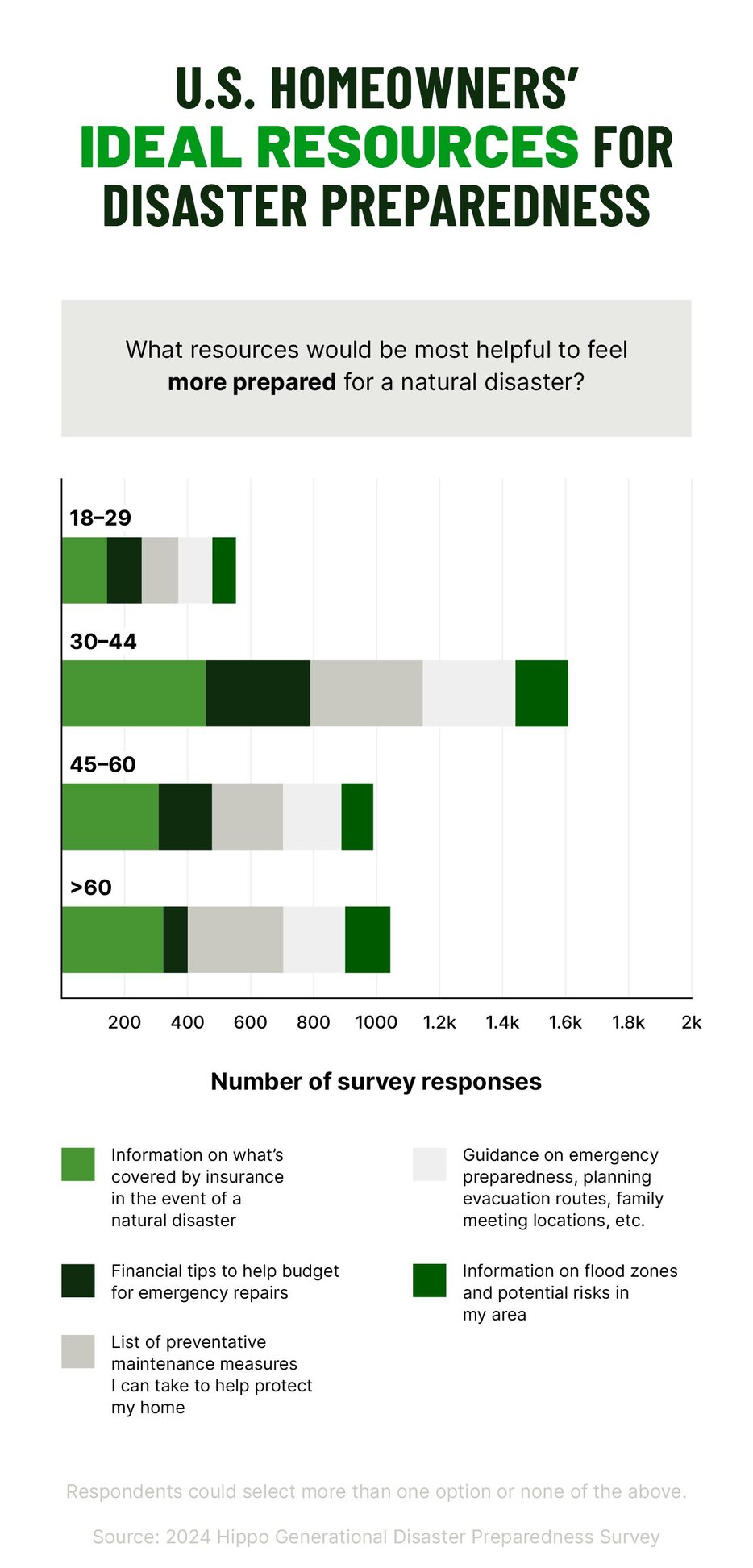

- 22% of homeowners 60 years or older claimed they don’t need any additional information to feel more prepared for a natural disaster compared to only 4% of 18-29-year-olds, 2% of 30-44-year-olds, and 5% of 45-60-year-olds.

- While 81% of older U.S. homeowners (ages 60+) feel confident in their homes' resilience, 40% have not considered completing tasks designed to protect their homes from damage by severe weather e.g. drainage improvements, roof reinforcements. This highlights a generational gap in preparedness: Older homeowners show less urgency, while younger homeowners are more proactive and concerned.

- Overall, the majority of homeowners are seeking proactive ways to protect their homes from property damage caused by natural disasters. This includes 62% of all responding homeowners who want more information on what’s covered by their insurance and 50% who would like a list of preventative maintenance measures to help prevent property damage.

96% of responding young homeowners prepare their homes for natural disasters

- Installing storm shutters or impact-resistant windows (41%)

- Adding a reinforced roof or garage door (34%)

- Prepping flood barriers with resources like sandbags or flood doors (30%)

- Installing a sump pump (25%)

- Making drainage improvements (32%)

Stark majority of older homeowners haven’t considered increased protection measures

- Information on what’s covered by insurance in the event of a natural disaster (49%)

- List of preventative maintenance measures I can take to help protect my home (46%)

- Guidance on emergency preparedness, planning evacuation routes, family meeting locations, etc. (30%)

- Information on flood zones and potential risks in my area (23%)

- Financial tips to help budget for emergency repairs (12%)

62% of U.S. homeowners believe clarity on insurance coverage could help ease disaster anxiety—regardless of age

- Review and update home insurance to ensure the policy is up-to-date and provides adequate coverage for natural disasters. Consider purchasing additional coverage to fill insurance gaps.

- Develop a comprehensive plan that includes emergency contact information, evacuation routes, and a communication strategy for family members.

- Secure the home with reinforced windows and doors, trim trees and shrubs that could pose a risk during storms, and secure or store heavy furniture and appliances to prevent them from tipping over.

- Regularly service home safety features like sump pumps, backup power sources, and weather-resistant materials