How Much Is Homeowners Insurance? [Budgeting Basics]

![How Much Is Homeowners Insurance? [In 2024]](https://cdn.builder.io/api/v1/image/assets%2F87a865fc472c4b69863d5e7f8aa60d5c%2Ffdeed3cab3f24223b9885c4974743850)

You've probably wondered if you can afford that brown bungalow on the corner or that white Tudor across town, but how much is homeowners insurance for these places?

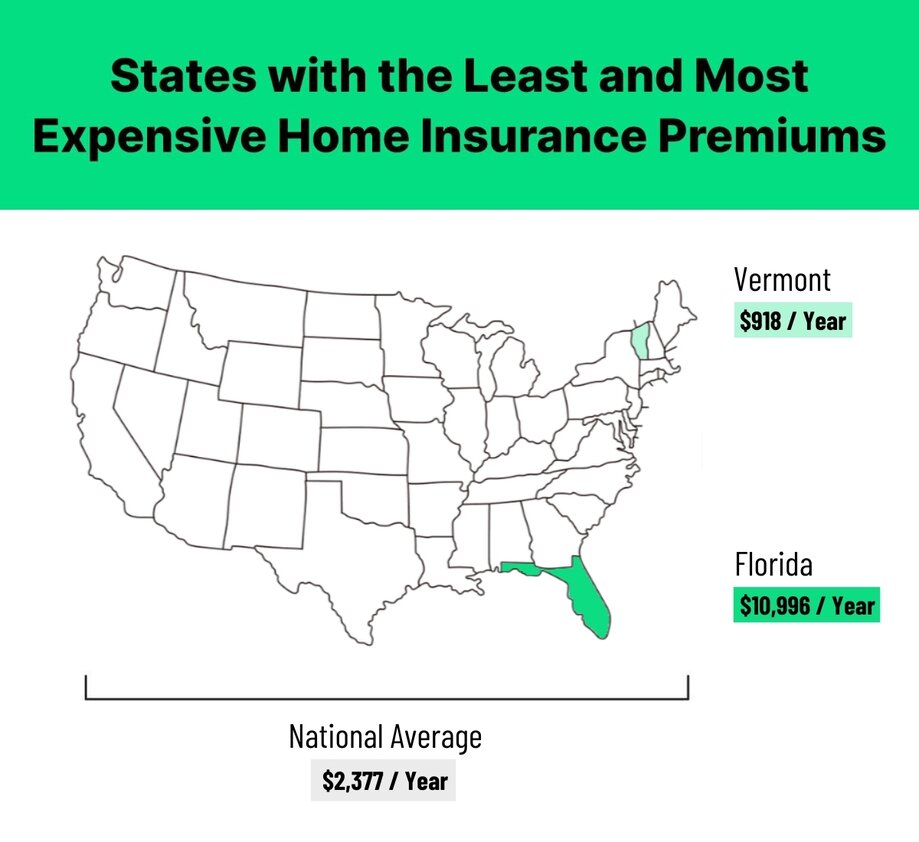

On average, homeowners insurance in the U.S. costs about $2,377 per year, according to a recent report from Insurify. It covers your home and other structures, personal belongings, and injuries on your property.

Let's explore which states have the most and least expensive home insurance rates and why your estimates might be a little higher than you thought. (Spoiler: did you know your home’s distance from a fire station can affect your premiums?)

Key takeaways

- Homeowners insurance costs an average of $2,377 a year in 2023 and is expected to rise to $2,522 in 2024 (a 6% increase), though that number varies by location.

- The most expensive states for homeowners insurance are Florida, Louisiana, Oklahoma, Texas, and Mississippi.

- The cheapest states for homeowners insurance include Vermont, Maine, Hawaii, Alaska, and Oregon.

Average homeowners insurance cost by state

Why is it that average home insurance costs in some states can be so far below the national average while others are so far above it? A lot of it has to do with how likely it is that your state will experience natural disasters like hurricanes, fires and tornadoes.

In addition, the average cost of homeowners insurance in the U.S. continues to rise each year. (If you were buying home insurance back in 2008, for example, you probably would’ve paid about $830 vs. today’s national average of $2,377.)

Suppose you live in a coastal state that typically sees multiple hurricanes each year. In that case, you should expect homeowners insurance prices to be higher than if you live in a state that rarely sees hurricanes or other significant disasters. Let’s look at the average cost of homeowners insurance by state.

We ranked these annual home insurance rates from most to least expensive so you can see where your state falls on the list.

- Florida: $10,996

- Louisiana: $6,354

- Oklahoma: $5,444

- Colorado: $4,072

- Texas: $4,456

- Mississippi: $4,312

- Alabama: $3,939

- Nebraska: $3,962

- Arkansas: $3,368

- New Mexico: $3,362

- Kansas: $3,437

- South Carolina: $3,082

- Tennessee: $2,470

- Kentucky: $2,476

- Missouri: $2,706

- Georgia: $2,426

- Minnesota: $2,332

- Illinois: $2,050

- Rhode Island: $2,036

- Iowa: $2,120

- North Carolina: $2,110

- New York: $2,257

- North Dakota: $2,519

- Wyoming: $2,159

- South Dakota: $2,562

- Virginia: $1,600

- Idaho: $1,636

- Montana: $1,778

- Maryland: $1,670

- Arizona: $1,961

- Indiana: $1,866

- Massachusetts: $1,863

- Michigan: $1,840

- California: $1,782

- Connecticut: $1,764

- Utah: $1,369

- Ohio: $1,342

- Wisconsin: $1,462

- Washington: $1,437

- Pennsylvania: $1,306

- New Jersey: $1,267

- Delaware: $1,207

- Washington, D.C.: $1,203

- New Hampshire: $1,225

- Nevada: $1,224

- Oregon: $1,232

- Alaska: $1,116

- Hawaii: $1,150

- Maine: $1,322

- Vermont: $918

Note: These average annual home insurance rates are based on 2023 Insurify data.

Most expensive states for homeowners insurance

When you break down average home insurance costs by zip code, you find that rates are highest in Louisiana, Florida, Texas, Oklahoma and Kansas. It’s no coincidence that all of these states experience severe weather events, such as hurricanes and tornadoes.

Not surprisingly, more disasters each year mean more risk to your home and a higher chance that you’ll file a claim. That means that if you live in a state where natural disasters are common, your house insurance costs will be higher.

Cheapest states for homeowners insurance

On the other hand, average homeowners insurance costs are lowest in Vermont, Maine, Hawaii, Alaska, and Oregon. Of course, no place in America is completely shielded from natural disasters. However, these states typically see fewer floods, tornadoes, hurricanes and, in some cases, lightning strikes than others.

If you live in a state where natural disasters are less common, you and your insurance company take on less risk, so your average home insurance rates should be lower than other areas.

Average homeowners cost by coverage amount

How much home insurance costs will also depend a lot on the amount of dwelling coverage you have. That’s the part of your policy that covers your home and other structures on your property (like garages, sheds, fences and porches).

Many companies require you to have enough dwelling coverage to cover 100% of your property’s replacement cost. When you purchase your policy, you may have the option to purchase extended replacement cost coverage, which may reimburse you for up to 125% of your policy’s dwelling coverage limits.

Here’s how much homeowners insurance costs countrywide based on how much dwelling coverage you have, according to the National Association of Insurance Commissioners (NAIC).

Dwelling coverage range | Average annual premium for an H0-3 policy |

|---|---|

Under $50,000 | N/A |

$50,000–$74,999 | $765 |

$75,000–$99,999 | $855 |

$100,000–$124,999 | $926 |

$125,000–$149,999 | $984 |

$150,000–$174,999 | $1,035 |

$175,000–$199,999 | $1,080 |

$200,000–$299,999 | $1,181 |

$300,000–$399,999 | $1,336 |

$400,000–$499,999 | $1,541 |

$500,000 and above | $2,224 |

Another thing to keep in mind is that your premiums will rise as you purchase more liability coverage. (That’s the coverage for bodily injuries and physical damage on your property.) Typical plans provide at least $100,000 in liability coverage, but you should purchase as much as you need.

How much of each component of homeowners insurance you should have

Ideally, you should have enough homeowners insurance to do the following:

- Rebuild your home and other structures on your property (dwelling coverage)

- Replace your personal belongings (personal property coverage)

- Cover injuries on your property (liability coverage)

- Maintain your quality of life while living somewhere else if your house becomes unlivable (additional living expense coverage)

In general, here are some good guidelines to follow when determining how much homeowners insurance you need:

- Dwelling coverage: 100% of your property’s replacement cost

- Other structures coverage: 20–30% of your dwelling coverage

- Personal property insurance coverage: 50–70% of your dwelling coverage

- Liability insurance coverage: at least $100,000

- Loss of use coverage: 20% of your dwelling coverage

Your home insurance costs will depend heavily on the coverage amounts you select for each of these components.

Other factors that affect the cost of homeowners insurance

You’ve already seen that the state you live in, the amount of natural disaster risk you face and the amount of coverage you select all affect your home insurance costs. Here are some other factors that affect the price of homeowners insurance:

- Your home’s age: Older homes typically cost more to insure because they cost more to replace than newer ones. For example, old wooden floors, trims, and moldings typically require more time and specialized knowledge to be replaced.

- Your roof’s age and quality: Your roof bears the brunt of the snow, rain, wind, and whatever else hits your home. An old roof or one that’s not equipped to handle the weather spells trouble for your home and leads to higher home insurance rates.

- Your home’s size: The bigger your home, the more expensive it is to replace, and the more you will pay in property insurance costs.

- Your insurance/credit score: Your insurance score is computed by your insurance company and represents the probability that you’ll file a claim. It’s based, in part, on your credit score. If you have a low credit score, you’ll likely have a relatively low insurance score and possibly pay a higher average price for home insurance.

- How close you live to a fire station: The closer you live to a fire station, the quicker firefighters can respond to disasters, and the lower your home insurance costs will be. (Keep in mind that if you live in an area serviced by volunteer or rural fire departments, you’ll likely pay higher premiums.)

- How close you live to a coast: Similarly, if you live close to the water, your home faces a higher risk of damage from natural disasters, so the average cost of home insurance will be higher than if you live inland.

- Your loss history report: When insurance companies pay out claims, they enter that information into various databases. That information stays tethered to homes. That means that if your home has a long claims history, you should expect to pay higher premiums.

- Your earthquake, flood or brush fire risks: Many people are surprised to learn that typical homeowners insurance policies don't cover earthquakes, floods or brush fires. If you live in a floodplain, an area prone to earthquakes or a brush-filled canyon, you will need to explore additional coverage options for these conditions.

- Other risks on your property: Pools and trampolines are fun, but they can also lead to injuries on your property. You should expect to pay more in liability insurance.

How to save more on your home insurance

Now that you know how much homeowners insurance typically costs, you may wonder how to save money on premiums. Even if you live in an area with high home insurance rates, there are steps you can take to save money.

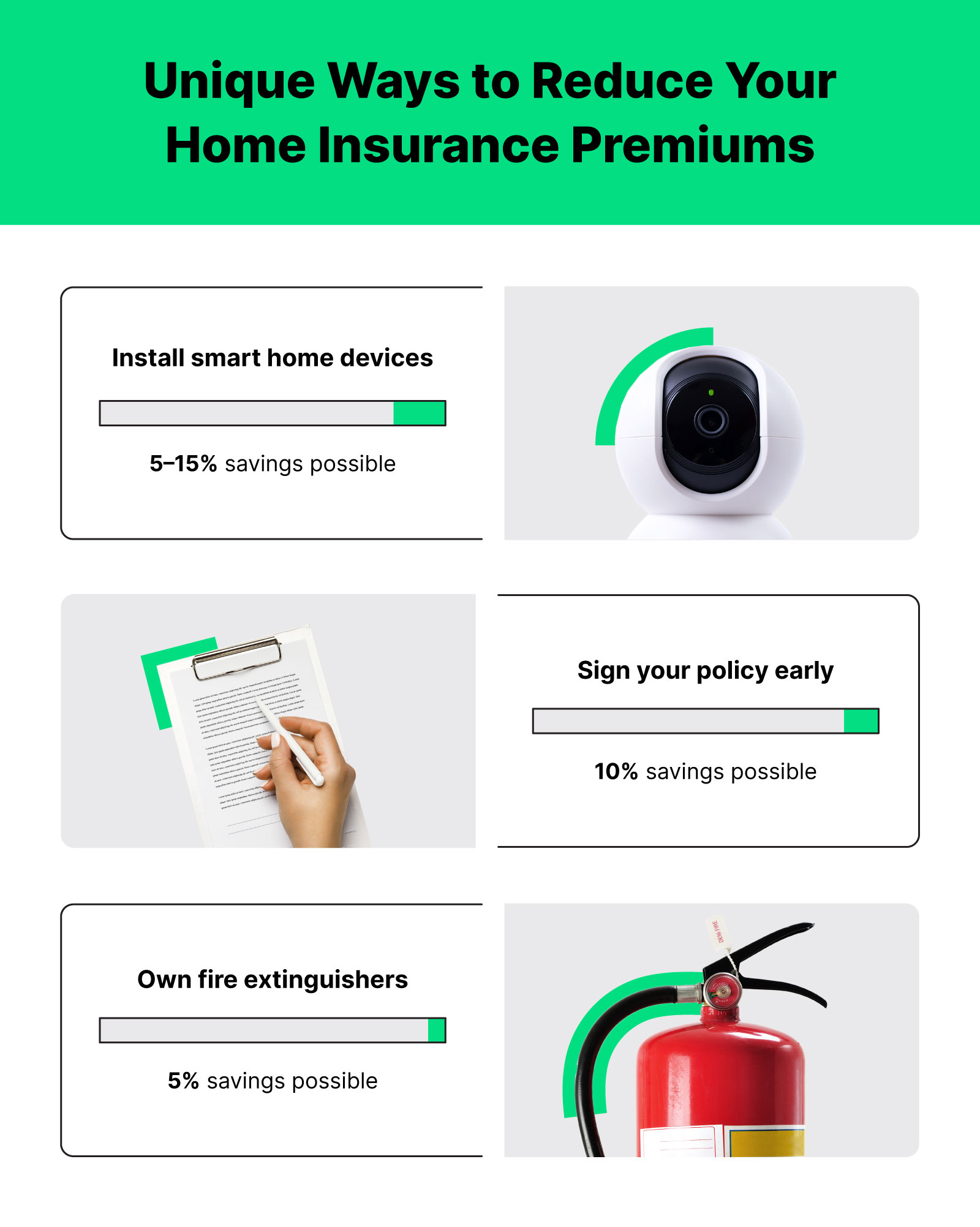

First, installing smart home devices can reduce your premiums by up to 15%, and it’s a win-win. Insurance providers love water shut-off valves, smoke detectors, cameras and alarm systems because these devices can detect problems before they happen and lower the number of claims you have to file. You benefit from these high-tech gadgets because they're fun to use, keep your home safe, and reduce energy costs.

You can also qualify for home insurance discounts in a number of other ways:

- Having multiple insurance policies with the same company (up to a 25% discount)

- Signing up for coverage before your existing policy expires or before you close on your new home (about 10% in savings)

- Going several years without filing a claim (up to 20% in savings)

- Paying for your home without a mortgage (up to 10% in savings)

- Owning a fire extinguisher (up to 5% in savings)

- Living in a gated community (up to 20% in savings)

- Insuring a newly constructed home (up to 30% in savings)

Finally, you might also consider raising your homeowners insurance deductible to lower your rates. That means that you’ll be responsible for paying more out of pocket if you file a claim, but it also means that your premiums typically decrease.

In the same way that all homes aren’t the same, the average cost of home insurance isn’t the same. That's why shopping around at multiple companies is important to ensure you're getting the best price.

Also, check out this home maintenance checklist to ensure you’re keeping your home in tip-top shape and reducing the risk of harm to your home and belongings.

Still have questions?

Want to learn more about how much homeowners insurance is? Here are some frequently asked questions.

What if I am running a business out of my home?

Running a business from your home typically requires more coverage than a typical homeowners insurance policy provides. If your business involves storing inventory, regular client visits, or operating equipment, you’ll likely need home insurance for your home-based business. Adding this coverage can increase your homeowners insurance rates, but it’s important to have both so you’re adequately protected.

Is home insurance cheaper if you pay yearly?

Yes, many home insurance companies give discounts for paying yearly instead of monthly because it lowers their administrative costs and reduces the risk that you won’t pay. Making your payments annually can go a long way in reducing your average home insurance cost over time.

Does bundling home insurance save you money?

Absolutely—insurance companies often give discounts to loyal customers who have more than one policy with them. So, if you’re open to having your home and auto insurance with the same company, for example, it can often reduce how much you typically pay for home insurance.

Why does home insurance ask about dogs?

Home insurance providers ask about dogs because certain breeds can increase liability risks, which can increase your typical home insurance rates. Knowing what type of dog you have and their typical behavior helps the insurer assess the likelihood of you filing a claim for dog bites or other incidents.

Does my home insurance cost affect my mortgage payment?

It can. If you have an escrow account, your home insurance premium is rolled into your mortgage payment. So, higher insurance costs will lead to a higher mortgage payment.