Understanding Other Structures Coverage

The primary purpose of homeowners insurance coverage is to protect the main parts of a house, such as the home’s walls and roof. But what about other structures that aren’t connected to the primary dwelling? Are they covered, too?

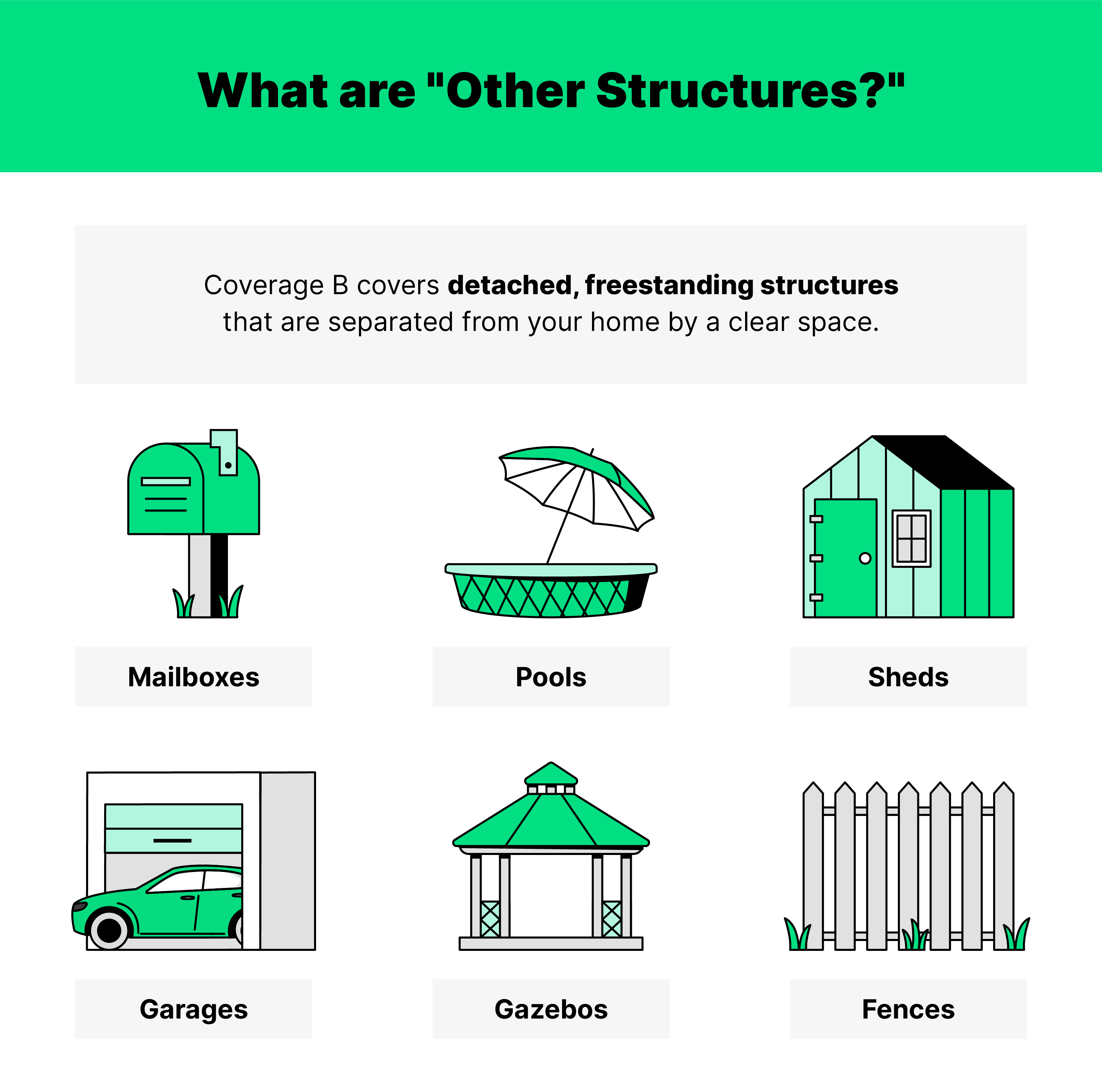

Other structures coverage—also called Coverage B insurance—is one component of your homeowners insurance policy. It protects detached structures on your property that aren't physically connected to your home. This means that by buying your standard homeowners policy, you could enjoy the same peace of mind with pool, shed, gazebo, deck, and even fence coverage.

The details of your policy’s other structures coverage will vary from carrier to carrier and even from one policy to the next. Here’s a look at what a Coverage B homeowners policy typically entails, though, and whether it’s enough to protect the additional structures on your property that aren’t connected to your dwelling.

Key takeaways

-

For homeowners, Coverage B offers protection for the structures not directly attached to the home.

-

When defining Coverage B, other structures include things like sheds, gazebos, pools, guest houses, and casitas.

-

Other structures insurance coverage is typically included in most homeowners policies automatically.

-

Though Coverage B is often automatically set to 10% of your home’s dwelling coverage limit, this can usually be adjusted higher or lower if you need different protection, though this may also adjust your premiums.

What is other structures coverage, aka coverage B?

Coverage B, also known as other structures coverage, is the portion of your homeowners insurance policy that protects the structures on your property that aren't directly connected to your home. When buying certain types of home insurance coverage, such as HO-3 homeowners insurance, other structures coverage is automatically included in the policy.

How does other structures coverage work?

If eligible structures are damaged or destroyed by a covered peril, your homeowners insurance policy’s Coverage B will generally help repair or replace them up to your policy’s coverage limits.

In order to be considered other structures under this type of coverage, fixtures must be separated from your home by a clear space or fence. Things like attached decks, attached garages, or solar panels—each of which is typically fixed to the walls or roof of the home—are not generally covered by other structures protection.

Some of these attached or connected structures may already be covered by your policy’s dwelling coverage, while you may need to purchase separate coverage (like solar panel insurance) for the rest.

What is considered other structures on a homeowners insurance?

Your standard homeowners policy will typically cover not only your home’s primary structure but things attached to it, such as a garage, front porch, patio or deck, etc. If a structure is detached but still resides on the property, it may be covered by your other structures limits instead.

So, what are other structures in home insurance considered? A few examples of covered structures include:

-

Fences

-

Detached garages

-

Gazebos

-

Sheds

-

Carports

-

Guest houses

-

Barns

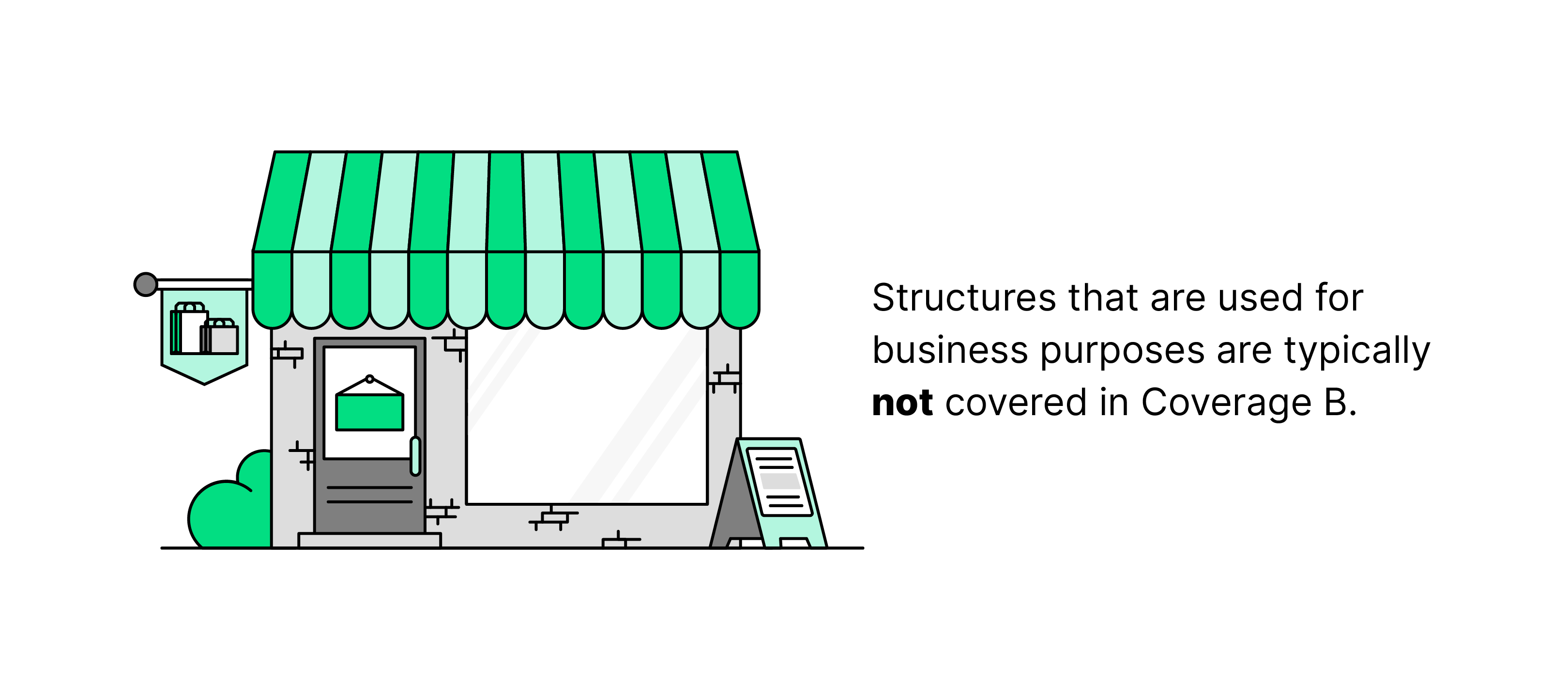

It’s important to note that some accessory dwelling units (ADUs), such as guest houses and tiny homes on the property, may be excluded from Coverage B on some policies. This is especially true if the structure is rented out to others or used for business purposes. Be sure to check your policy documents to understand what is — and what is not — covered by your carrier.

What does other structures coverage cover against?

Depending on your selected type of homeowners insurance, other structures may be protected against open or specifically named perils. If one of the allowed perils damages or destroys your structures, your coverage can pay for repairs or even replacement.

Covered perils could include hazards like lightning, wind storms, hail, fire, snow damage, and other natural disasters. Your policy may even cover your structure against vandalism and theft.

What is not covered by coverage B?

As mentioned, coverage B isn't designed to protect structures attached to your home's primary dwelling, such as an attached garage or solar panels on the roof.

Coverage B also has many of the same exclusions as a typical home insurance policy. For example, there are limits to the damages allowed under Coverage B, and some forms of damage are excluded entirely from your other structures coverage.

Typical exclusions to other structures coverage include things like

-

Normal wear and tear

-

Damages from pests or rodents

-

Flooding

-

Mold damage

-

Intentional damages

-

Damage due to negligence

-

Other structures used for business purposes, including short-term rentals

If you want to protect your other structures against some of these types of perils, you could either purchase a home warranty or, in some cases, add things like flood insurance coverage or a landlord insurance policy if applicable, and your insurance company offers them.

Other structures coverage won’t usually cover the contents inside your other structures, either; think gardening equipment in a greenhouse, a riding lawnmower in the shed, or furniture in your guest house. Instead, these things are typically covered by your policy’s personal property insurance coverage.

How much coverage B do I need?

Coverage B is usually written into your homeowners insurance policy and covers other structures for up to 10% of your dwelling coverage. This would mean a homeowners policy with $450,000 in dwelling coverage would generally have about $45,000 in other structures coverage.

This might not be enough for you, depending on your structures and their replacement value. Someone with a basic shed out back may be more than protected with the standard 10% coverage limit. However, someone with a pool, guest house, and gazebo on their property could need notably more coverage to adequately protect themselves and their structures.

In addition to increasing policy limits, some homeowners might want to consider adding certain policy endorsements or purchasing separate policies to protect their structures better.

For example, windstorm insurance could be beneficial (or even required) if you live in a coastal area prone to hurricanes. Water backup coverage can protect you against clogged lines and sewer-related damages. And if you’re wondering, does homeowners insurance cover mold damage to my home and other structures? You might be surprised to learn that the answer is often No. For that, you might want to consider purchasing a mold endorsement.

Is coverage B ACV or RCV?

When it comes to insurance companies paying for covered damages, there are two acronyms you need to know: ACV and RCV. Your options will dictate how your dwellings, structures, and personal property will be repaired or replaced and whether you’ll need to cover a portion of those damages yourself.

Actual cash value coverage, or ACV, will pay for the current value of your damaged or destroyed property, considering depreciation and the item’s condition. If your ten-year-old shed is destroyed in a windstorm, for instance, actual cash value insurance coverage will reimburse you for its value at the time of the storm… which may not be enough to replace it with a comparable new shed. You could find yourself covering the difference out of pocket.

Replacement cost value coverage, or RCV, is designed to provide policyholders with the replacement cost of any destroyed property. Regardless of the item’s condition, age, or other depreciation factors, RCV policies will make you whole again. Using the same shed as an example, RCV coverage will pay to purchase and construct a new shed in the destroyed one’s place without factoring in its age or condition.

When purchasing your policy, you can generally choose between RCV and ACV coverage. ACV policies tend to cost less than RCV policies, which can be important if premium costs are a big factor for you.

Can I remove coverage B from my homeowners policy?

Other structures coverage is automatically written into most homeowners insurance policies to adequately protect your entire property and generally can't be removed. You aren't paying an extra premium for this beneficial coverage, though, so it is actually a win-win: The included Coverage B protection will ensure that your structures are protected at no added cost to you.

Don’t have a fence, shed, guest house, or other common structure that would fall under this coverage? Look at the curb. A freestanding mailbox also counts and would be protected by other structures coverage with most carriers.

How much does other structures coverage cost?

There isn’t an additional premium for Coverage B that’s automatically written into your standard homeowners insurance. Generally, your other structures will be covered for up to 10% of your dwelling insurance, and you aren’t paying anything extra for this portion of coverage.

However, if you choose to increase your protection — either by adding endorsements to your policy or bumping your insurance Coverage B portion limits — you will often see your premiums rise.

Still have questions?

Interested in learning more about other structures coverage? Here are some commonly asked questions to keep you informed.

What is included in other structures?

Other structures coverage typically includes things like detached garages, detached decks, gazebos, guest houses, swimming pools, outdoor kitchens, and sheds. Be sure to read your policy documents to understand exactly what is and is not covered by your homeowners insurance.

What is excluded under Coverage B other structures?

Coverage B is intended for other structures not attached to your home’s primary dwelling, so attached decks, attached garages, patios, and even your home’s roof would be excluded. Other structures coverage excludes normal wear and tear, damage caused by excluded perils, and damage from pests and rodents.

Is a swimming pool considered an other structure?

Yes, swimming pools are typically considered other structures and, as such, are generally covered by a homeowners policy’s Coverage B limits against eligible perils. Some other structures coverage examples include things like sheds, decks, gazebos, and guest houses.

Does house insurance cover structural damage?

Your homeowners insurance policy will cover structural damages to your dwelling as long as a covered peril causes them.

Is a patio considered an other structure?

A patio can be considered an other structure (for Coverage B purposes) as long as it is detached from the primary dwelling by a clear space. If it is attached to your home, it would likely be protected by your policy’s standard dwelling coverage instead.