Homebuyers Want Disaster-Resilient Homes and 88% Will Pay More for Them

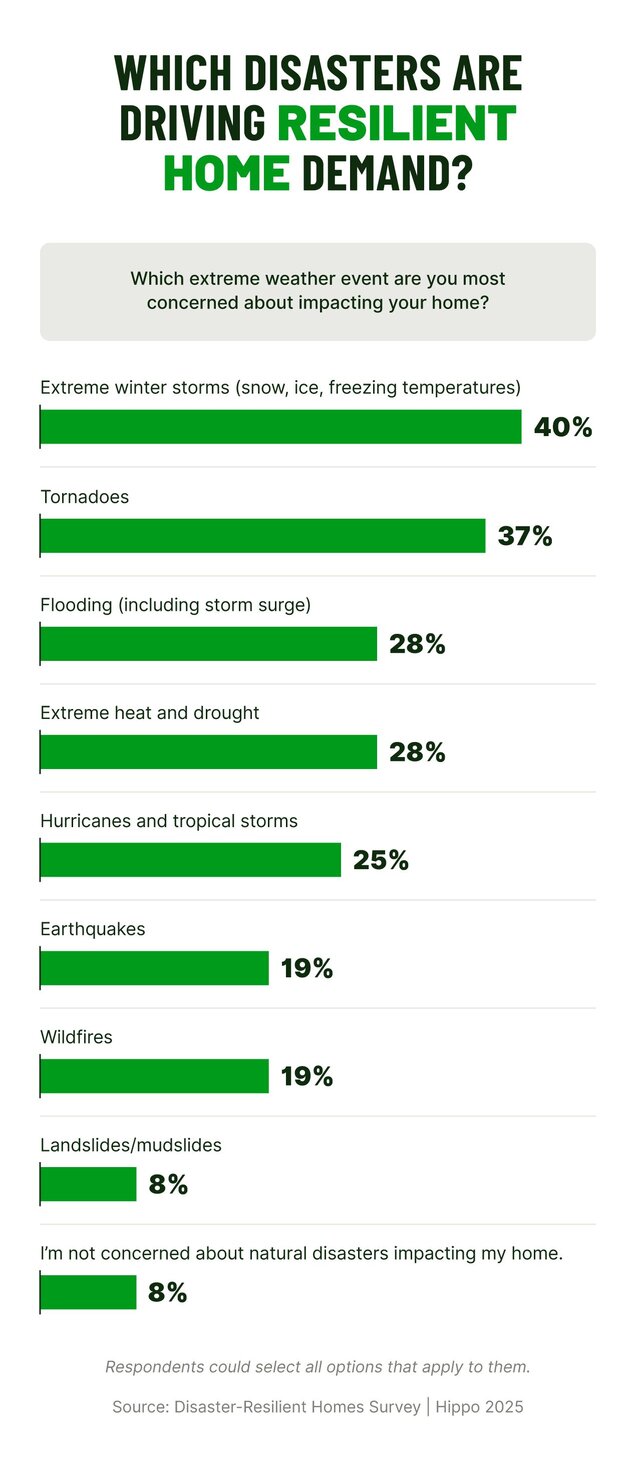

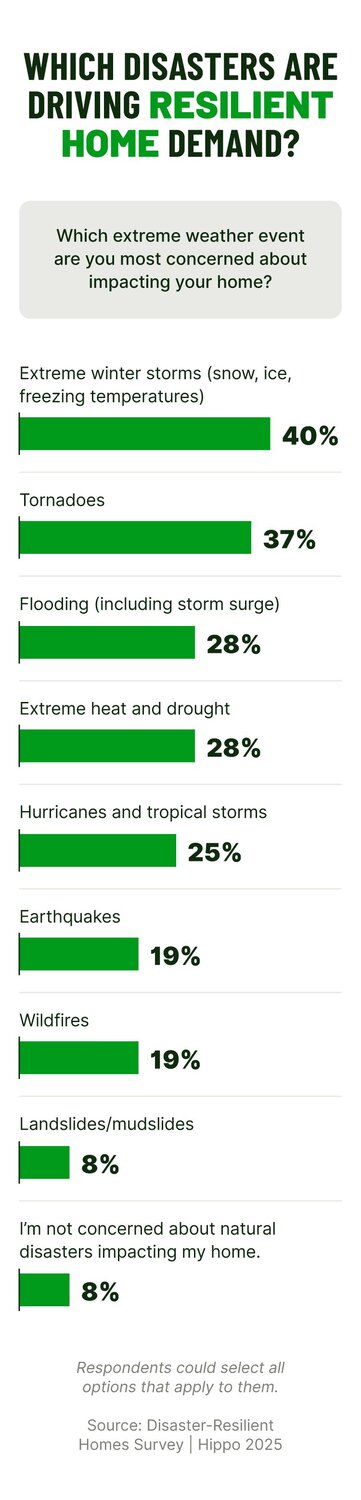

The risk of extreme weather is a critical consideration for buyers of newly built homes. Our recent survey found that 92% of nearly 2,000 U.S. homeowners were concerned about at least one type of natural disaster impacting their property. And this fear of extreme weather isn’t just shaping opinions—it’s shaping budgets.

Approximately 20% of all surveyed homeowners said they’d pay up to $10,000 more for a home with climate-resilient features. Among new construction homeowners, that number jumps even higher. This indicates a housing market actively rewarding builders with offerings designed to withstand the rise in severe weather events.

A 100% disaster-proof home isn’t realistic, but incorporating strategic building features can help reduce weather-related risks and appeal to most homeowners who are concerned about severe weather damaging their homes.

Key takeaways

- Nearly all surveyed homeowners (92%) expressed concern about at least one type of natural disaster impacting their property, highlighting the growing influence of climate risk on home buying decisions.

- A strong majority of homeowners (88%) said they’d pay more for a home with climate-resilient features, with that number rising to 93% among new construction homeowners.

- Impact-resistant windows and doors and reinforced roofing were the most desired climate-resilient features, topping the list for new construction homeowners and those with pre-owned homes.

- 1 in 5 homeowners are willing to spend up to $10,000 more for homes designed to withstand extreme weather, demonstrating a financial commitment toward resilience.

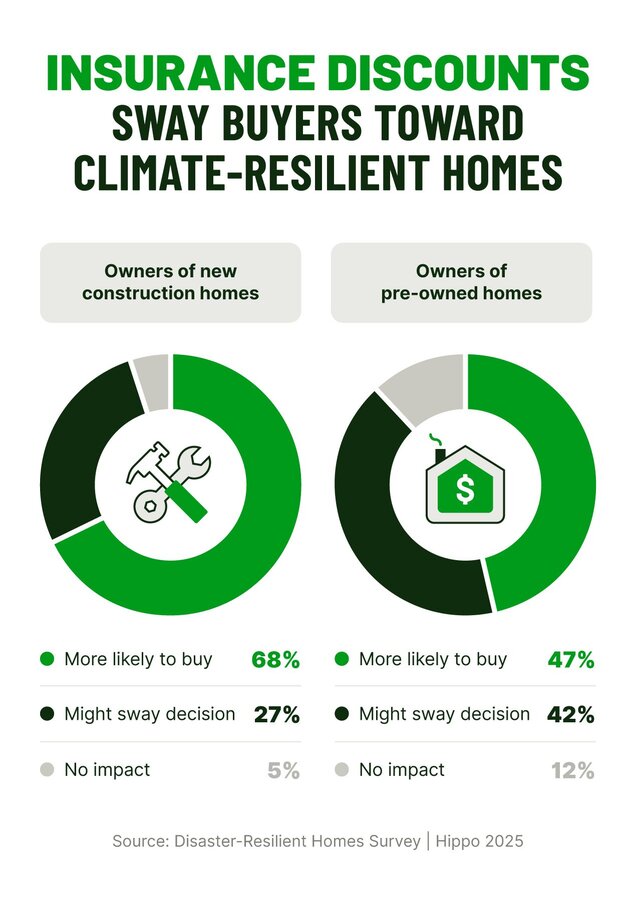

- Over one-half (54%) of homeowners said they’d be more likely to purchase a new construction home with resilient features if it came with reduced insurance premiums, rising to 68% among current new construction homeowners.

Climate fear is widespread, but new construction homes offer a solution

93% of new construction homeowners would pay more for disaster-resilient features

INVESTMENT LEVEL | HOMEOWNERS WILLING TO PAY |

|---|---|

Over $10,000 | 12% |

Up to $10,000 | 20% |

Up to $6,000 | 16% |

Up to $4,000 | 12% |

Less than $4,000 | 17% |

DISASTER-RESILIENT HOME FEATURES RANKED BY IMPORTANCE |

|---|

1. Reinforced roofing materials |

2. Impact-resistant windows and doors |

3. Fire-resistant building materials |

4. Advanced drainage systems |

5. Elevated foundation or flood-resistant design |

6. Earthquake-resistant structural reinforcements |

Insurance discounts sway 54% of buyers toward climate-resilient homes

Methodology

Related Articles

Cutting-Edge Solutions for Fire-Safe Construction

Built to Last: Insights for Designing Fire-Resistant Homes

Understanding the Modern Homeowner: New Construction vs. Existing Homes

Hippo Housepower Report: Home Protection Priorities in 2025

6 Homebuilding Trends Shaping 2025 and Beyond