6 Homebuilding Trends Shaping 2025 and Beyond

The homebuilding industry is in a state of rapid transformation. As affordability concerns push buyers toward innovative housing solutions, staying ahead of homebuilding trends is critical.

This report dives into the key homebuilding trends shaping the market today and explores their long-term impact. From embedded insurance solutions to building to withstand climate emergencies, understanding these shifts is essential for anyone looking to confidently navigate the future of home construction.

1. Downsizing and the shift to smaller single-family homes

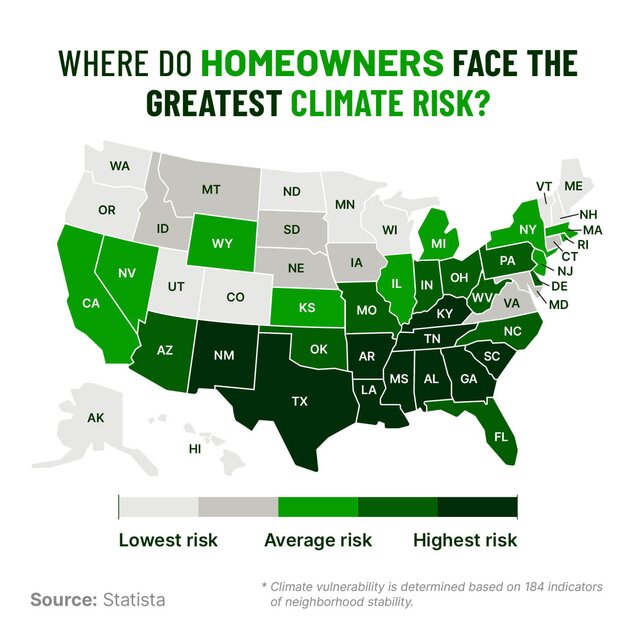

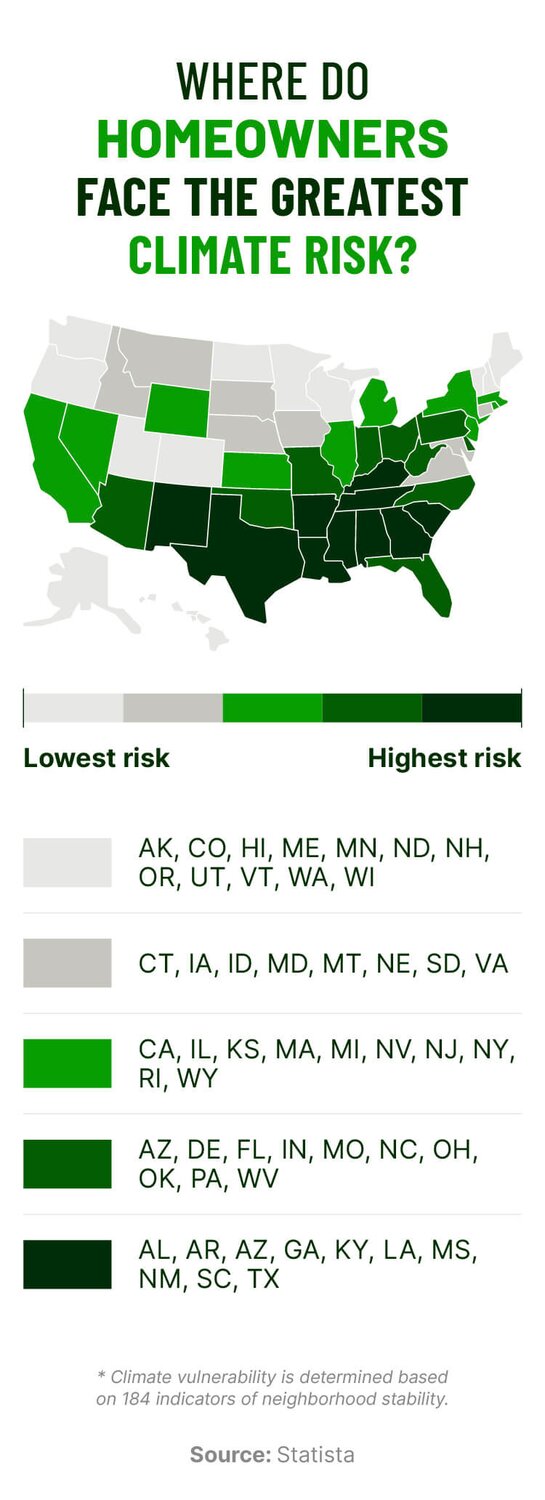

2. Building to withstand extreme weather and natural disasters

- Materials: Fire-resistant siding, non-combustible roofing, and reinforced concrete or steel framing help reduce vulnerability to disasters.

- Construction techniques: Reinforced foundations for earthquake resistance, impact-resistant windows and doors for hurricanes, and ember-resistant vents for wildfire protection.

- Community safety features: Fire-resistant water systems, reduced vegetation in high-risk zones, expanded drainage infrastructure to manage heavy rainfall, and a transition away from gas lines to lower fire hazards.

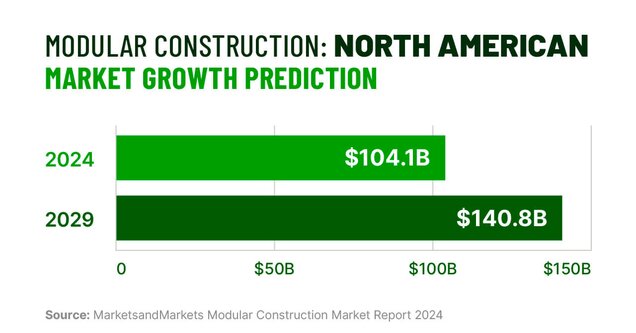

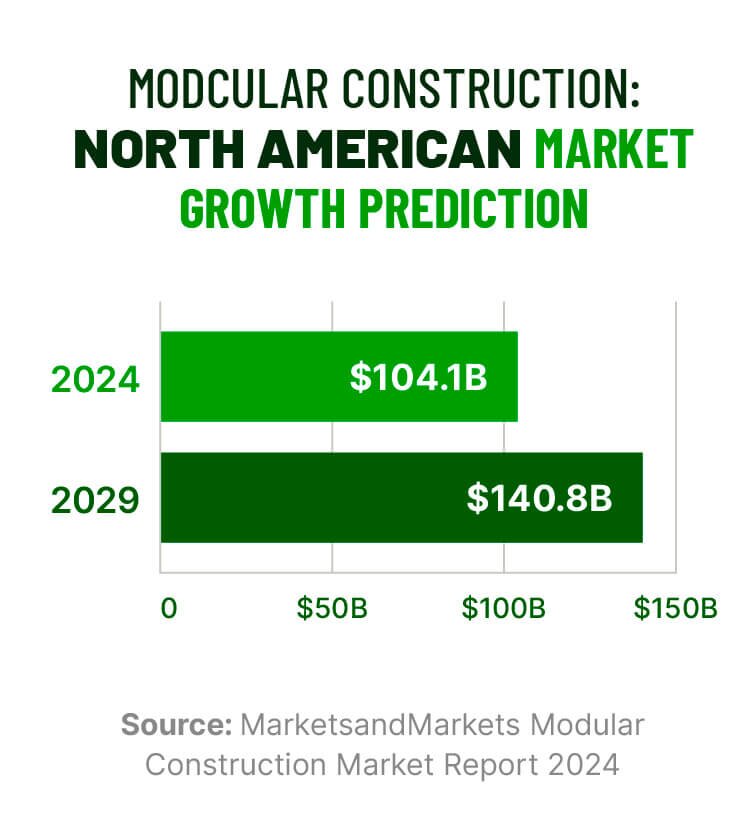

3. The rise of modular and prefabricated construction

- Reduced construction timelines: Modular construction can accelerate build schedules by 20–50% compared to traditional construction.

- Improved quality control: Factory settings allow for better oversight, reducing rework and defects that might surface months or years later.

- Minimized material waste: Offsite manufacturing results in significantly lower material waste, with potential cost reductions of up to 10%.

4. Sustainability at the forefront of homebuilding

5. Increased interest in AI-powered smart homes

6. Embedded insurance streamlines homebuying

“Buying a home is one of the most exciting and overwhelming times in a person’s life. We work closely with our homebuilder partners to deliver tailored policies, customized specifically for each home, at a competitive price.” — Brett Sobol, Director of Partnerships at Hippo.