Understanding the Modern Homeowner: New Construction vs. Existing Homes

Rising costs, unpredictable weather, and a growing focus on return on investment (ROI) are shaping homeowner behavior in 2025. These factors influence how homeowners approach property upkeep and maintenance and also provide valuable insights for builders seeking to meet their clients' evolving needs.

We surveyed over *2,000 U.S. homeowners and discovered distinct differences between homeowners who recently purchased a new construction home and homeowners who bought or owned an existing home. These differences include a resurgence of DIY projects and a heightened awareness of extreme weather risks.

These shifts could inform how builders approach future projects—from prioritizing resilience-focused features to helping homebuyers make choices that could prevent costly maintenance down the line.

Key takeaways

- Over half (60%) of new construction homeowners significantly exceeded their maintenance budgets vs. 10% of homeowners of existing homes. This suggests a potential gap in expectations regarding ongoing maintenance costs for homeowners with newly built properties.

- Most new construction homeowners (81%) are "very likely" to take on DIY maintenance in 2025 to help save on costs. This contrasts with owners of existing homes, only 33% of whom reported the same intention.

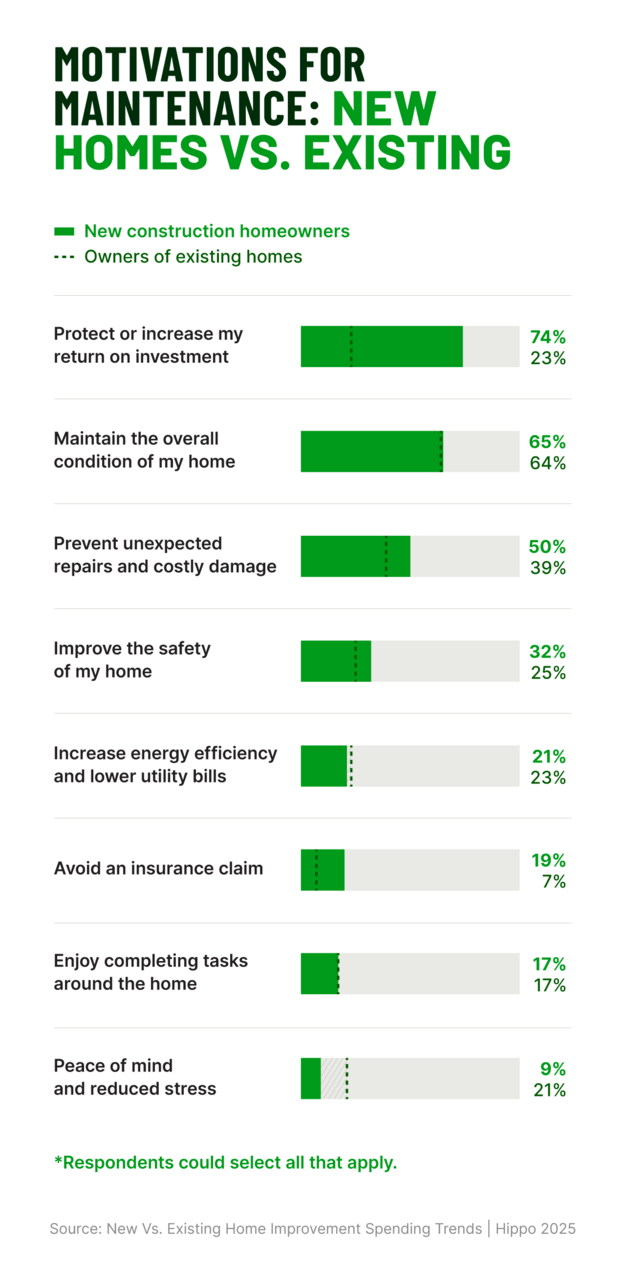

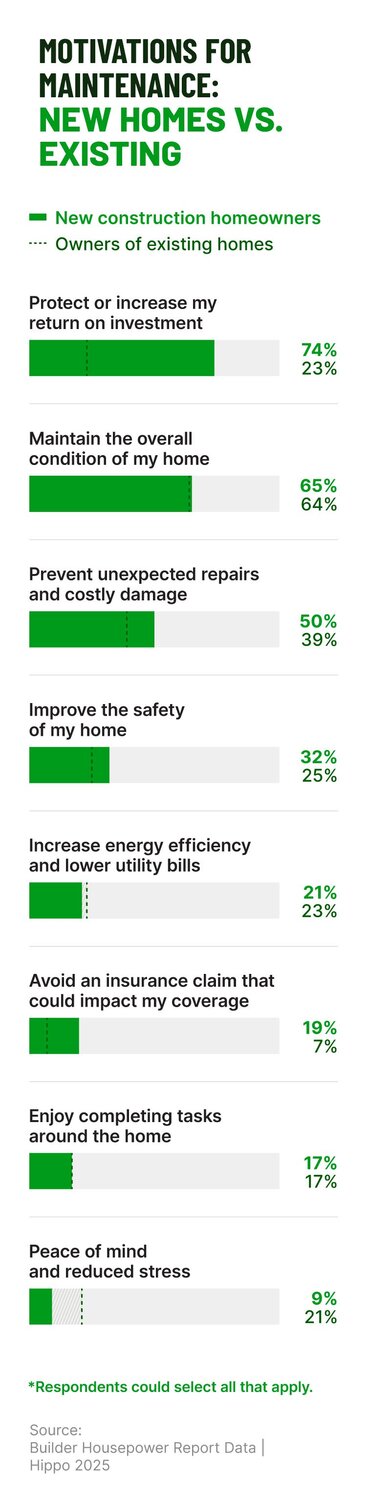

- New construction homeowners heavily prioritize protecting their home's value, with 74% identifying ROI as a primary motivator for maintenance. That’s compared to just 23% of respondents with existing homes.

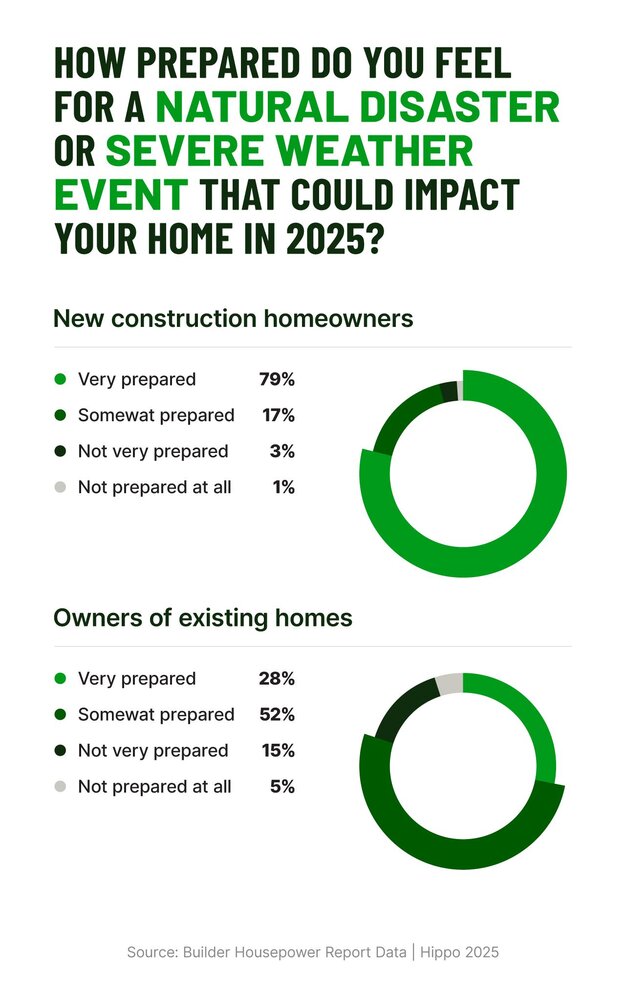

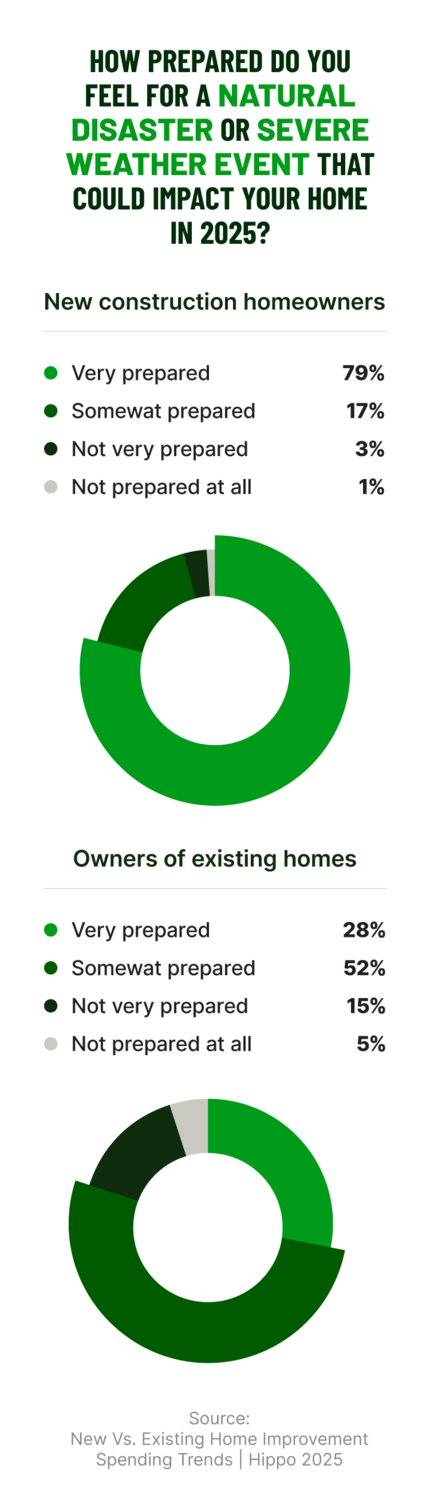

- Many (79%) new construction homeowners feel very prepared for a natural disaster vs. only 28% of homeowners of existing homes.

1. Budgeting: Expectations vs. reality for new builds and existing homes

2. ROI motivates new build homeowners more than homeowners of existing homes

3. New construction homeowners outpace other groups in seasonal maintenance

- Approximately 20% of new-build homeowners completed 6-9 tasks, while only 10% of owners with existing homes did the same.

- While 5% of new construction owners managed 10 or more maintenance tasks, just 3% of owners with existing homes did the same.

4. New construction homeowners prioritize disaster preparedness in 2025

Modern insurance for modern homes

DOWNLOAD ADDITIONAL FINDINGS

Related Articles

The Hippo New Homes Insights Report

Hippo Housepower Report: Home Protection Priorities in 2025

Building for the Future: How Residential Construction is Adapting to Weather and Climate Change

Hippo Expands Home Builder Access to New Homes Program in California, Florida and Texas

Addressing Florida Homeowner Concerns through Insurance and Builder Partnerships