Unlocking the American Dream: 2024 Financial Goals Report

Many Americans dream of owning a home, but the combined costs of insurance premiums, property taxes, and ongoing home maintenance may come as a surprise. These combined costs can also claim a significant portion of their income. Cost-burdened homeowners (those paying more than 30% of their income on housing) reached a record high in 2022, reaching 19.7 million households according to the most recent U.S. Census Bureau data (2024 Joint Center for Housing Studies of Harvard University).

Although homeownership can take a significant financial investment, we learned that U.S. homeowners are not backing down from creating and maintaining their dream homes. We surveyed U.S.-based homeowners to learn about their financial goals, how much they’ve saved, and what they were willing to compromise on to reach those goals.

Key Takeaways from Responding Homeowners

-

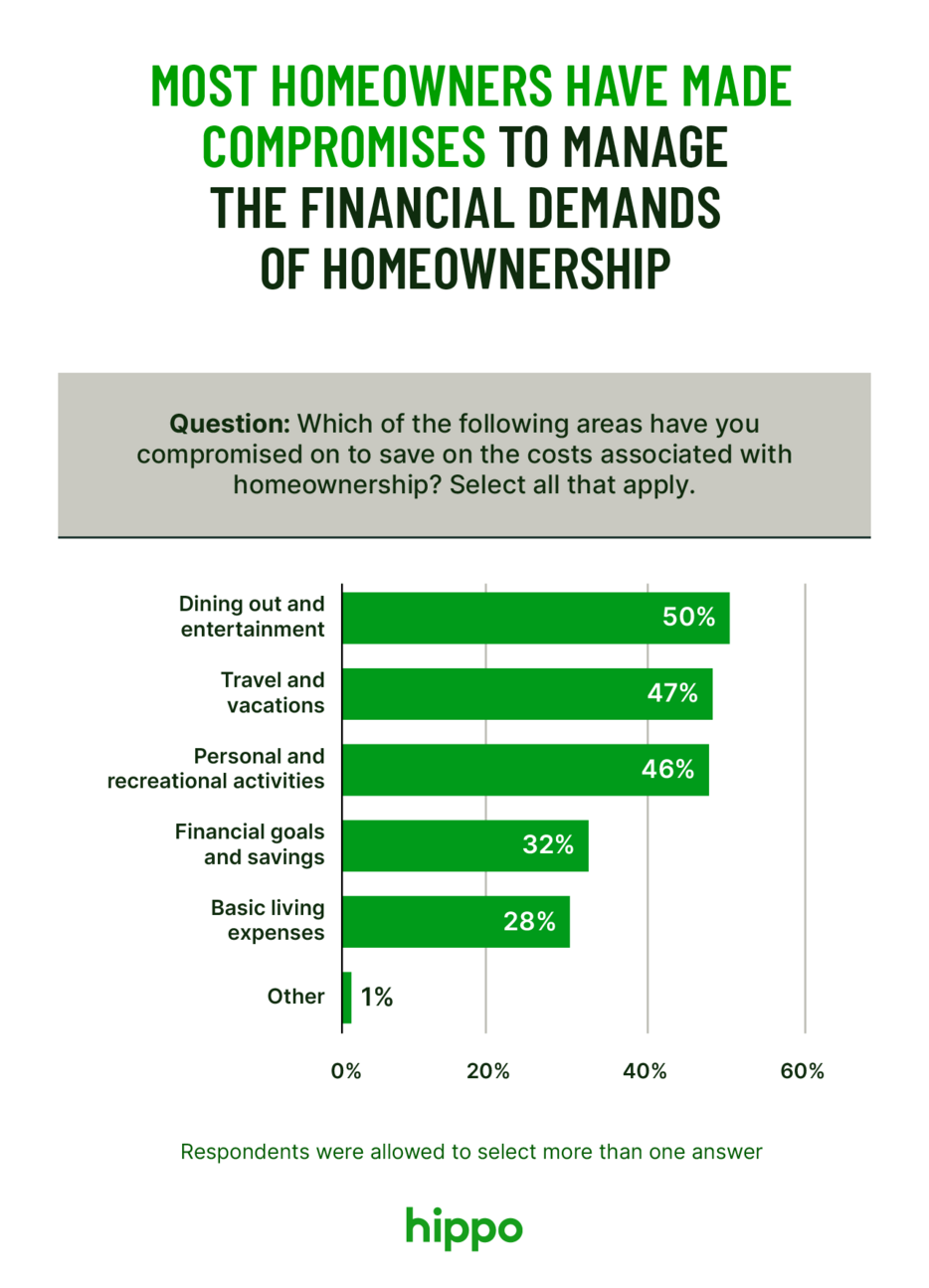

While many Americans dream of owning a home, the unexpected costs of owning one can be jarring. Of those surveyed, 86% have compromised on at least one area of their lives to prioritize homeownership costs.

-

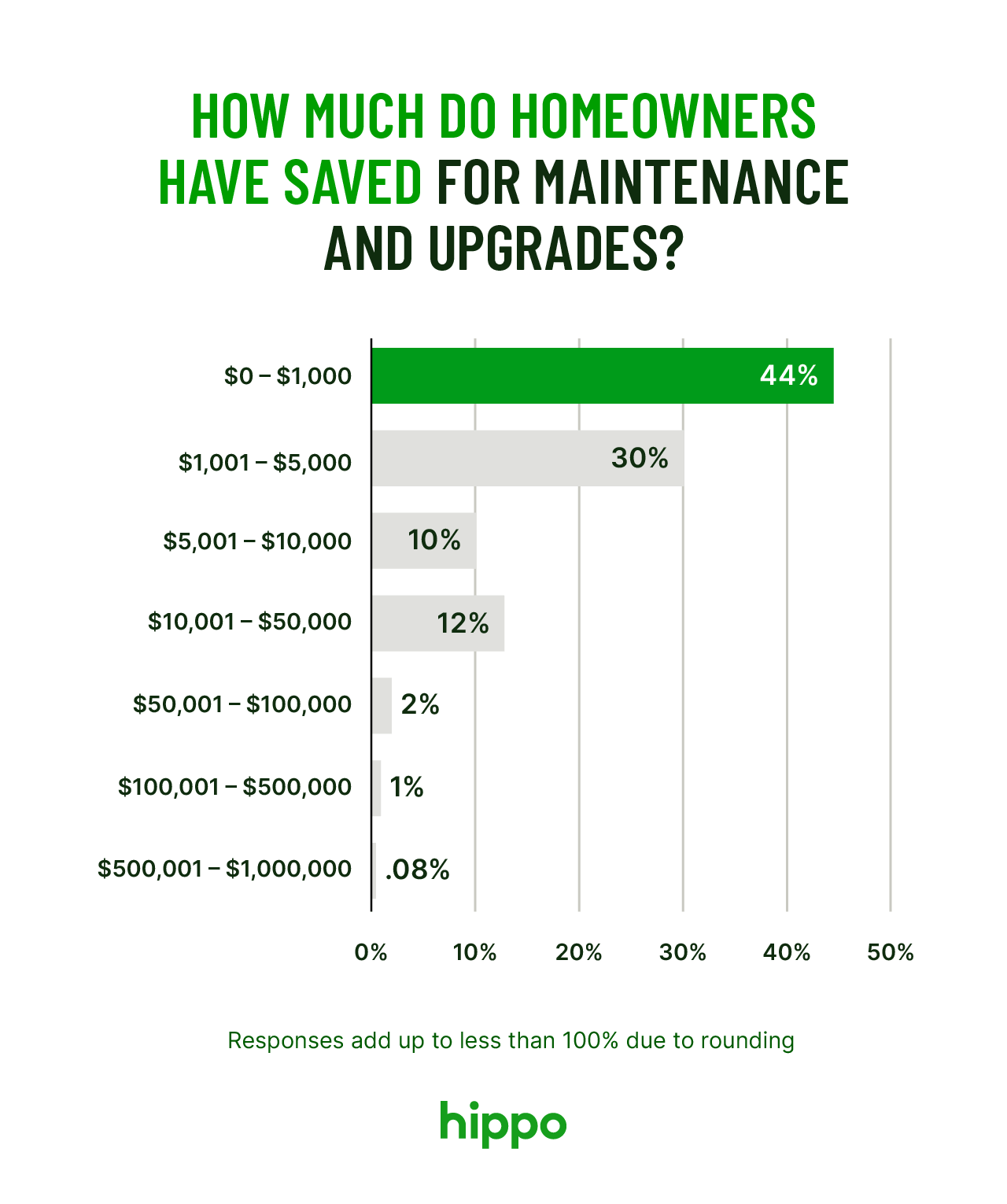

Homeowners are diligently saving for home upgrades and maintenance, with the current median amount saved being $2,000. However, after a year of high inflation rates and price increases, one quarter (25%) of homeowners surveyed say they have saved $500 or less for home upgrades and maintenance costs.

-

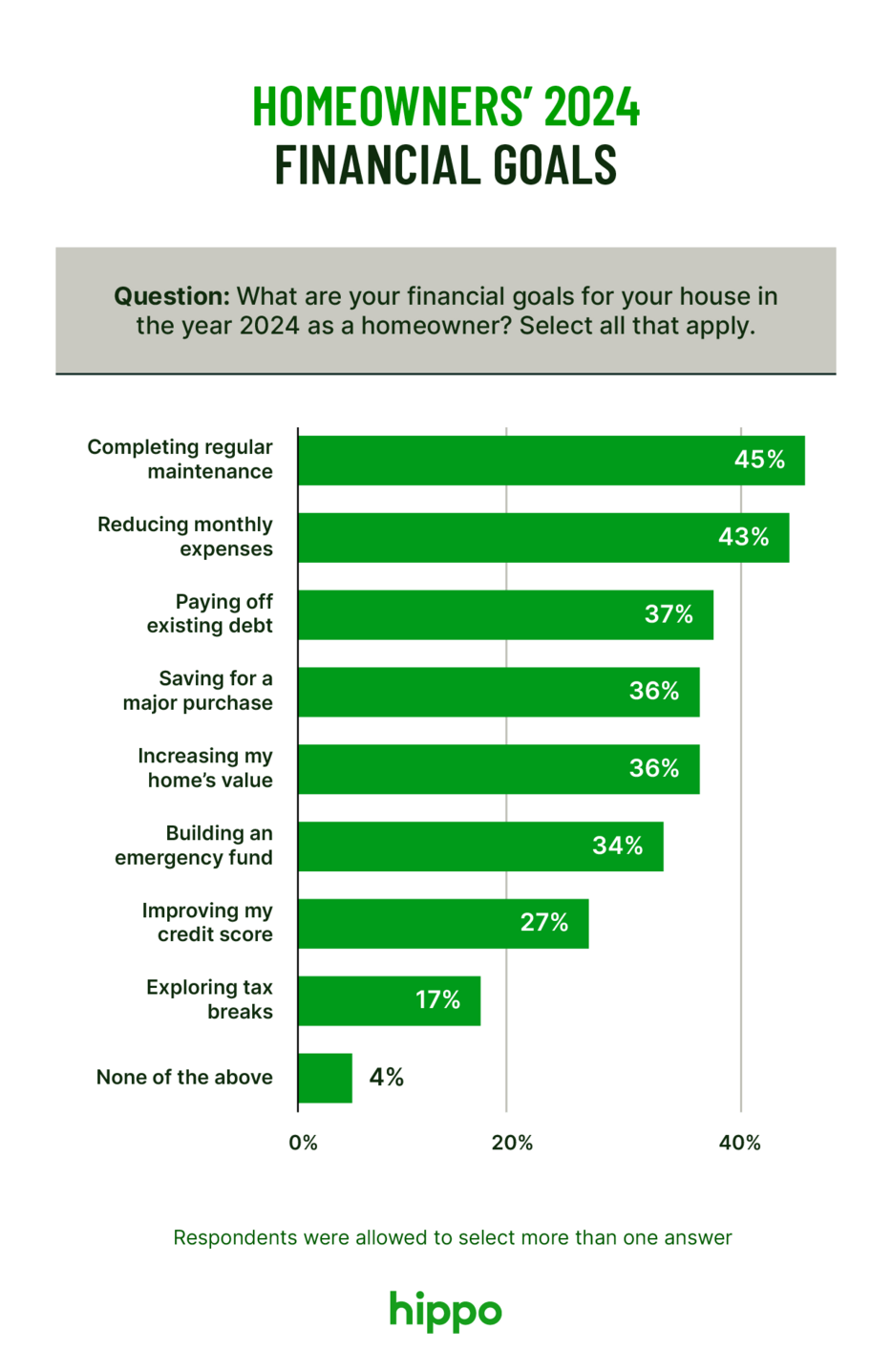

This year, homeowners have distinct financial goals for their houses: completing regular maintenance to prevent repair issues (45%), reducing monthly expenses (43%), and paying off existing debt (37%).

-

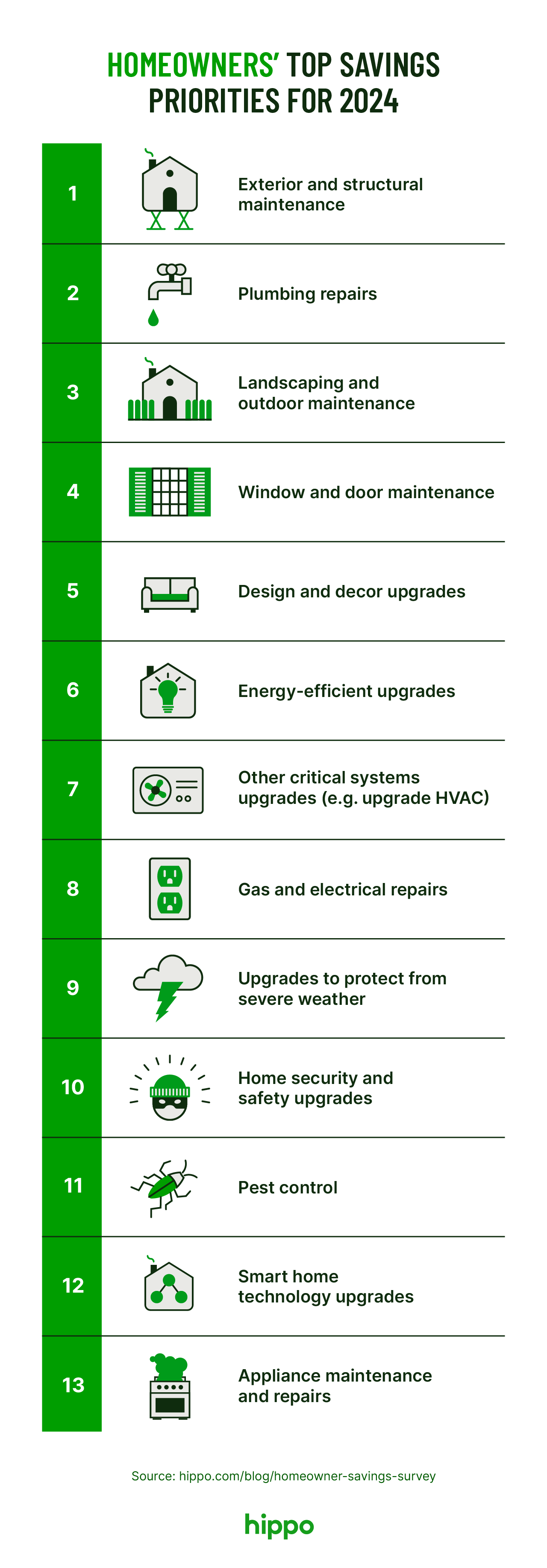

When it comes to planning to spend their savings, many homeowners are channeling their financial resources into projects that can help keep small things from turning into big issues, such as exterior and structure maintenance, plumbing repairs, and landscaping or other outdoor maintenance.

Majority of responding homeowners have compromised on at least one area of their life to cover home costs

According to our survey, 86% of responding homeowners say they have compromised on at least one area of their life to prioritize the costs of homeownership. The top three activities responding homeowners cut back on were dining out and entertainment (50%), travel and vacations (47%), and personal and recreational activities (46%).

This aligns with the trend of declining U.S. household spending growth that started in August 2022 and the prioritization shift to debt repayment.

According to a survey conducted by the Federal Reserve Bank of New York, when asked about how they’d spend with an unexpected 10% income increase, survey respondents said on average that they’d put about 38% of that extra money toward paying down debt and only 16% dedicated to spending (Federal Reserve Bank of New York Survey of Consumer Expectations Survey, December 2023).

Although affording homeownership today may require downsizing in other areas, we learned that responding homeowners are prioritizing financial goals that can help them have more financial freedom in the future.

Responding homeowners' financial goals point to proactivity and improved financial flexibility

For many homeowners, 2023 was a difficult year financially, amidst a challenging economy, cool housing market, and high costs for labor and materials. This year, homeowners are prioritizing cost-cutting goals for their homes that positively impact their financial futures. Responding homeowners’ top three financial goals for their homes in 2024 were completing regular maintenance (45%), reducing monthly expenses (43%), and paying off existing debt (37%).

All three financial goals are necessary to keep costs down while freeing up funds for other priorities, like completing repairs or investing in home upgrades.

Nearly half of homeowners have $1,000 or less saved for home upgrades and maintenance costs

$1,000 may be enough to cover a small project, like proactively installing weatherstripping or paying your insurance deductible for a major repair. However, a larger financial cushion can be a big help when needing to address multiple projects at the same time or more extensive home projects, like repairing rotted wood. Our 2023 Housepower Report revealed that roof damage was among the top issues homeowners experienced. Moderate roof repairs alone can cost between $500 and $1,750.

Below is a breakdown of all responses:

Although it’s not always easy to cut back and save, prioritizing proactive maintenance and important repairs can be one way to help get ahead of unexpected costly repairs that are out of budget and allow more income to be spent on desired home upgrades.

Preventative maintenance is a top savings priority

According to our survey, homeowners’ No. 1 ranked priority for the home was channeling savings into completing exterior and structural maintenance. This category can include the most important and expensive projects, like repairs for your roof, foundation inspections, and other maintenance that contributes to your home’s structural integrity.

Design and decor upgrades (No. 5) and energy-efficient upgrades (No. 6) weren’t ranked as high, but are still priorities for homeowners as more people stay put and focus on maintaining their current homes. We learned in our 2023 Housepower Report that home upgrades were more important to responding homeowners than selling their homes or buying other properties.

Other cost-saving upgrades were ranked further in the list, including other critical systems upgrades (like upgrading your HVAC) (No. 7) and upgrades to protect from severe weather (No. 9).

Although repairs like roof patches or replacing faulty window hardware are crucial to fix sooner rather than later, prioritizing strategic upgrades can also help you get ahead of unexpected repairs. For example, purchasing a replacement sump pump to help prevent basement flooding may cost several hundred dollars, but one inch of water can lead to $25,000 of damage to your home (Federal Emergency Management Agency).

How homeowners can take action on their financial goals

Making financial compromises in other areas of your life to afford the costs of homeownership doesn’t have to be a daily battle. We learned that responding homeowners are focused on keeping up with regular maintenance and freeing up funds this year. This combination can help you keep a better pulse on your home’s needs while also freeing up funds for valuable upgrades and projects.

Below are ways you can work toward your financial goals while staying in control of your home all year. You can also check out our in-depth guide on budgeting for home maintenance for more recommendations.

Find saving opportunities

Small savings opportunities can add up and help get you closer to your savings goals. Everything from DIYs to improved financial habits can make a difference:

-

Keep up with maintenance to help prevent pricey repairs

-

Improve your credit score to help improve your chances for better lending opportunities

-

Set up sinking funds for upcoming upgrades or maintenance

Cut existing expenses

Reexamining your finances can help you find areas you can cut back on and savings opportunities you may be missing out on:

-

Track spending to help cut down on impulsive and nonessential costs

-

Negotiate bills to potentially get better rates

-

Look into tax breaks that lower your tax burden

Spend strategically

Spending is unavoidable, but you can help make your dollars count by investing in projects that have long-term value and can help prevent future issues:

-

Prioritize repairs that impact your home’s structural integrity

-

Gradually make energy-efficient upgrades to help lower utilities

-

Regularly review your home insurance to ensure it meets your needs

Managing your homeownership expenses can feel tough at times, especially when an unexpected repair suddenly upends your budget. The good news is that proactive maintenance can help you get ahead of many potential issues—and help keep costs down.

Want to discover additional homeownership trends? Check out our new 2024 Housepower Report for the latest financial insights and more. You can also use the free Hippo Home app for personalized checklists to help you improve your home’s health. Our DIY guides can also help you learn how to address issues yourself.

Download the Hippo Home app today from the Google Play Store or the App Store.

Methodology

The survey was conducted by SurveyMonkey Audience for Hippo Insurance Services. The survey was fielded on Jan. 4, 2024. The results are based on 1,221 completed surveys. In order to qualify, respondents were screened to be residents of the United States, over 18 years of age, and own a home. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

Disclaimers

YourHaus, Inc. ("Hippo Home") is an affiliate of Hippo Insurance Services. Services (including all repair or maintenance services) provided to customers through affiliated and unaffiliated third-party contractors. Your use of Hippo Home is subject to Hippo Home's terms and conditions and privacy policies. Use of unaffiliated third-party vendors is subject to the terms of service provided by such third party. Hippo Insurance Services is not responsible for your use/non-use of Hippo Home or any service vendor. @ YourHaus, Inc. 2023

Hippo Insurance Services ("Hippo") is a general agent for affiliated and non-affiliated insurance companies. Hippo is licensed as a property casualty insurance agency in all states in which products are offered. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy. Coverage and coverage amounts selected are the decision of the buyer.

This guidance and advice is not error-proof and not applicable to every home. You are responsible for determining the proper course of action for your property and neither Hippo nor Hippo Home is responsible for any damages that occur as a result of any advice or guidance.