Guide to Earthquake Insurance [Quake-Proof Your Home]

Even well-built structures and furnishings can suffer significant damage during an earthquake. Without insurance, the financial impact can be substantial. You may assume you're covered with your homeowners' insurance, but typically, standard policies don't protect against earthquake damage.

Therefore, it's essential to take extra steps to protect your property. Similar to other forms of catastrophe insurance, earthquake insurance can be a crucial safeguard for homeowners, particularly those with older homes or residing in earthquake-prone areas.

Key takeaways

- Standard homeowner insurance doesn't cover damage caused by an earthquake.

- You can buy a separate earthquake policy or extend your current policy by paying an additional amount.

- Insurance policies covering earthquakes frequently include substantial deductibles, which may significantly lower the amount you receive in a claim payout.

What is earthquake insurance?

How does earthquake insurance actually work? When it comes to property insurance, earthquake coverage is a subset that reduces financial risk by shifting the burden of probable earthquake damage expenses onto the insurer. This coverage is essential since insurance helps pay for home repairs or rebuilding, replacing damaged personal goods, and extra living costs if the house is inhabitable because of an earthquake.

In the case of a seismic disaster, policyholders can rest assured that they will not be financially exposed due to the exclusion of earthquake damage from ordinary homeowners' policies. As a safety net, earthquake insurance helps people deal with the financial fallout of a natural disaster that no one can anticipate.

Does homeowners insurance cover earthquakes?

Generally, homeowners insurance does not cover earthquake damage. A standard policy typically protects against risks such as fire, theft, and certain types of water damage. This means that in the event of an earthquake, a typical policy would not cover the costs of repairs, rebuilding, or replacing personal property.

Homeowners need to either obtain a separate policy that specifically covers earthquake damage or add an earthquake insurance rider to their existing home insurance for earthquake coverage. Adding an earthquake insurance rider to your homeowner's policy can provide additional protection for your home in the event of an earthquake. If an earthquake makes your home uninhabitable, this rider may help cover necessary structural repairs, replacement of personal belongings, and additional living expenses.

What does earthquake insurance cover?

Standard earthquake home insurance plans typically cover damage caused by earthquakes, aftershocks, and volcanoes within a certain time frame, often 72 hours. The three primary elements of earthquake insurance are damage to your house, also called a "dwelling" in plans, personal property, and additional living expenses (ALE).

Let's take a deeper look at the covered items.

Dwelling coverage

This covers damage to attached home structures and built-in appliances such as an attached garage or an HVAC system. It does not cover any detached structures like a detached garage, porches, or fences.

Personal belongings coverage

Your earthquake insurance will pay for the cost of repairs or replacements for your personal possessions up to a certain amount. However, these policies frequently impose additional restrictions on valuable items, such as electronics and jewelry.

Temporary living expenses coverage

If an earthquake makes your house inhabitable, your insurance will ensure that you continue living comfortably by covering the costs of lodging, food, and other necessities.

Other coverage

The cost of repairing your home to protect it from residual tremors is covered by earthquake insurance. In addition, making renovations to comply with new construction standards or reinforcing the property may also be covered.

What doesn't earthquake insurance cover?

Earthquake home insurance coverage does not cover sinkholes and floods caused by natural disasters, so it's important to have separate insurance coverage. Similarly, fire insurance is not included in earthquake insurance, although it is most likely included in your homeowner's policy. The same is true for flood insurance. Ensure you have additional fire and flood coverage and your homeowner's insurance is up to date.

Some earthquake house insurance policies may not pay out for repairs to outbuildings like fences, sheds, and garages, so it's essential to check with your policy provider about their coverage. If your house is made of brick, stone, or clay, consider getting more coverage, as these sturdy materials are more vulnerable to earthquake damage.

Additionally, home earthquake insurance won't pay for repairs to things that were already damaged or neglected. To ensure complete coverage in case of a claim, keep your house in excellent condition and repair and fix any existing problems.

Is earthquake insurance worth it?

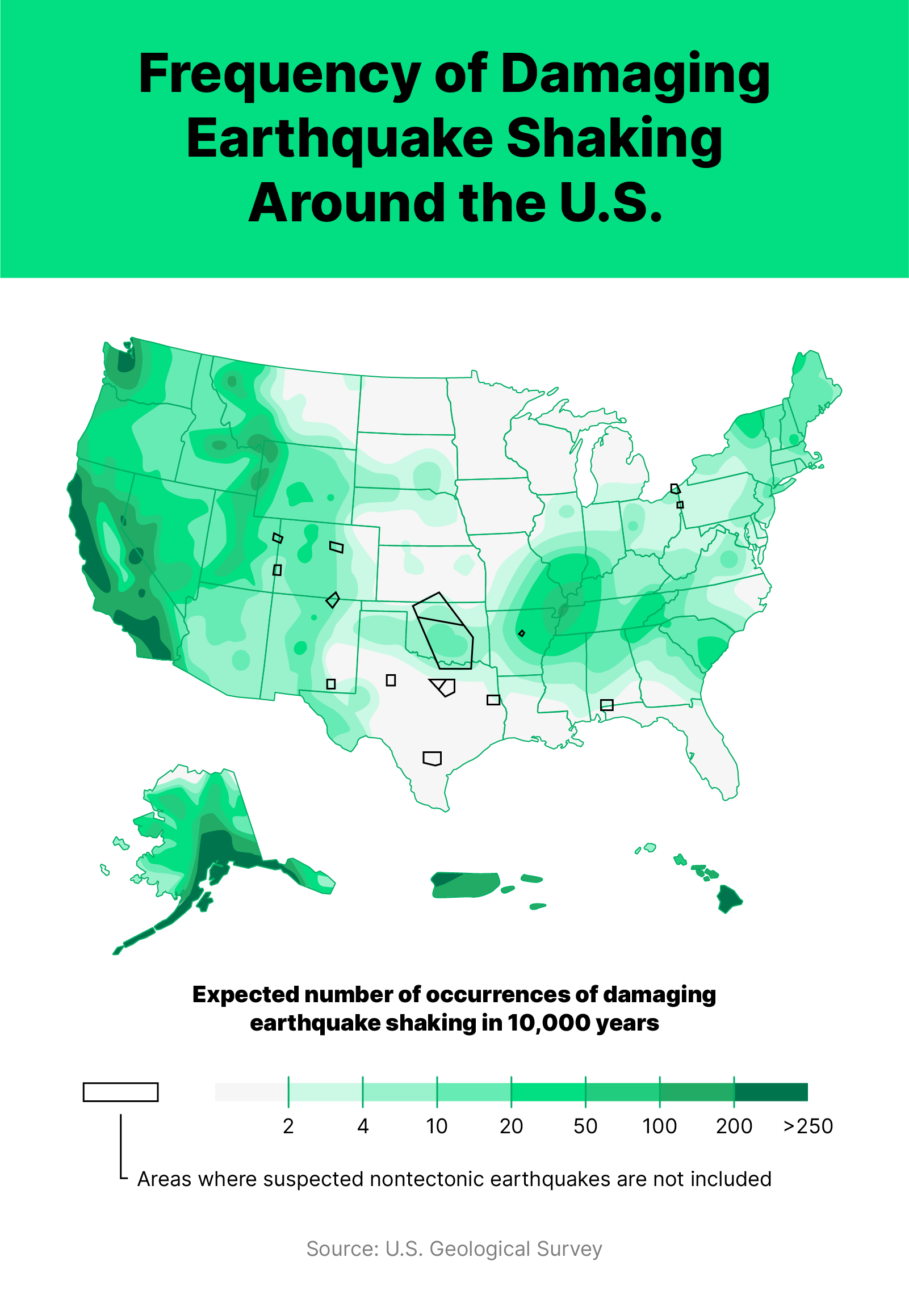

Purchasing earthquake insurance coverage is a preventative measure for people living in high-risk areas to protect their homes and financial security. It is a wise investment, especially for those living near fault lines or in areas with a higher frequency of earthquakes, such as California, Nevada, Washington, Alaska, Hawaii, and Oregon. This coverage would also be beneficial in areas affected by human-induced earthquakes, such as Texas and Oklahoma, due to fracking.

Older buildings are particularly vulnerable to severe earthquakes. Therefore, those living in earthquake-prone areas should look into insurance options that cover earthquakes.

Assess your financial situation and determine whether your home or belongings need repairs or replacement. Also, consider whether you could cover temporary living expenses on your own. If not, earthquake insurance is essential.

Additionally, ensure that you have earthquake insurance before an earthquake occurs. Insurance companies often stop issuing new policies for a few months after a major earthquake. Waiting until after an earthquake could leave you without coverage and protection.

How much earthquake insurance do I need?

The safety of your house and money depends on your ability to accurately assess the amount of earthquake insurance you need. Make a rough estimate of how much it will cost to reconstruct your house. Multiply the current rebuilding cost per square foot by the total square footage of your property. Be sure to include any premium materials or special features in the price.

Then, you need to determine the worth of your possessions. Make a list of everything in your home and calculate the cost of replacing everything, including furniture, gadgets, and clothes. You can use this information to determine the amount of insurance coverage you need for your personal belongings.

Consider getting ALE insurance, which would cover interim lodging and other expenditures if your house is inaccessible. Determine the amount required to maintain your current level of living for a few months.

Pay close attention to the deductibles on homeowners' earthquake insurance; they are often 10% to 20% of the policy amount. Make sure you have enough money to pay the deductible or look for insurance with a smaller deductible if that's not an option.

Ensure your policy is sufficient by reviewing it regularly and seeking advice from experts like structural engineers or insurance agents on rebuilding prices, house values, and personal situation changes.

How much does earthquake insurance cost?

Several factors come into play when determining earthquake insurance rates. These include the age, size, and construction materials of the building, as well as the soil type and the proximity to seismic activity in your state and ZIP code.

Standard coverage may cost around $300 a year in areas with average risk. However, premiums in high-risk states might range from $1,000 to $2,000 annually. Homes that are older or located closer to fault lines often have higher earthquake insurance quotes due to the increased risks and potential for greater damage.

Houses built with rigid materials, such as brick or masonry, generally have a higher cost of earthquake insurance than those built with pliable materials, such as wood. Additionally, deductibles typically range from 2.5% to 25% of the coverage maximum. Therefore, in the event of an earthquake, out-of-pocket expenses will be greatly influenced by higher-value residences having larger deductibles.

Understanding earthquake deductibles

Earthquake deductibles work differently from regular homeowner's insurance deductibles. Instead of a set financial amount, they are usually calculated as a percentage of the home's insured value. This can have a big impact on out-of-pocket costs following an earthquake.

Typically, earthquake deductibles range from 5% to 25% of the maximum coverage. For example, if your house insurance coverage is $250,000 and your earthquake policy has a 20% deductible, you would be responsible for the first $50,000 in repair of the damage to your home’s structure, and the insurance provider will pay $10,000 afterward.

How can I protect my home from earthquakes?

Retrofitting is crucial for ensuring older homes are safer during an earthquake. This process involves bracing cripple walls, reinforcing chimneys, and strengthening masonry and the home's foundation.

Additionally, ensure that fragile items are placed on lower shelves and secured away from windows and tall furniture. For specific instructions on dealing with different types of emergencies, look at the emergency preparation checklists from your insurance providers. These checklists will help you be prepared for any situation.

Many homeowners may be surprised to learn that standard home insurance plans do not cover earthquakes and floods. Likewise, sewer backups, sinkholes, and mold issues are often not covered. Understanding these coverage gaps is crucial to ensuring your home is protected from all potential hazards.

Still have questions?

Do you have further questions regarding homeowner's earthquake insurance? Read these frequently asked questions to learn more.

Do insurance companies pay out for natural disasters?

Yes, insurance companies do pay out for natural disasters, but it depends on your policy type and coverage. Standard homeowners' insurance covers natural disasters like windstorms, hail, and fires. However, certain disasters, such as earthquakes and floods, are usually excluded and require separate policies. It's essential to review your insurance policy to understand what natural disasters are covered and to consider purchasing additional coverage for those not included.

Does renters insurance cover earthquakes?

No, standard renter's insurance does not cover damage from earthquakes. The renter's earthquake insurance covers personal property, liability, and additional living expenses for fire, theft, and certain water damages. To protect against earthquake damage, renters must purchase a separate earthquake insurance policy or add an earthquake endorsement to their existing renters' insurance.

Does home insurance cover crack renderings?

Cracked renderings on a home's exterior walls may or may not be covered by home insurance, depending on the cause of the damage. The repairs might be covered if the cracks are due to a covered peril, such as a storm or accidental impact. However, if the cracks result from wear and tear, poor maintenance, or ground movement not caused by an insured event, the home insurance policy is unlikely to cover the repairs. It's important to check the specific terms and conditions of your policy.

Does building insurance cover boundary walls?

Building insurance often covers boundary walls if a covered peril, such as a storm, fire, or vandalism, damages them. However, the extent of coverage can vary between policies, and some may have specific exclusions or limitations regarding boundary walls. It is advised to review your building insurance policy to understand the coverage provided for boundary walls and any associated conditions.

What is an uninsurable event?

An uninsurable event is a risk that an insurance company deems too high or unpredictable to provide coverage. Common examples of uninsurable events include:

- Wear and tear or gradual deterioration

- Poor maintenance or neglect

- Pre-existing conditions or damage

- War or nuclear hazards

- Certain types of flooding (without a separate flood insurance policy)

- Earthquake damage (without a separate earthquake insurance policy)

Insurance policies clearly outline which events are covered and excluded, so it's crucial to read and understand your policy details to know what is considered an uninsurable event.