Backyard Safety Gap: 66% Overlook Insurance When Installing Outdoor Amenities

According to our 2024 Housepower Report, nearly half of U.S. homeowners (46%) named home insurance and protection plans as a top priority going into 2025. But how does that urgency translate to outdoor spaces?

We surveyed over 2,000 U.S. homeowners this year to understand the prevalence of outdoor amenities like swimming pools, trampolines, fire pits, decks, and swing sets on their properties. This allows us to assess how frequently homeowners consider safety features, including appropriate insurance coverage, for these amenities.

Our new data surfaces the most common trends and concerns relating to common outdoor amenities, bringing attention to an often-overlooked area of home protection. This knowledge can help homeowners potentially reduce risks and have greater peace of mind.

Key takeaways

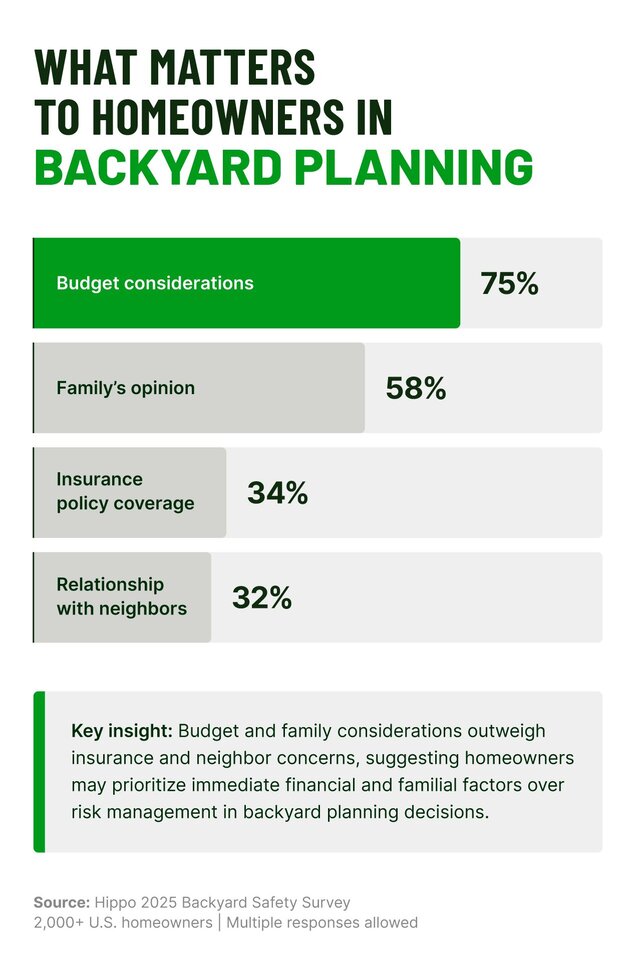

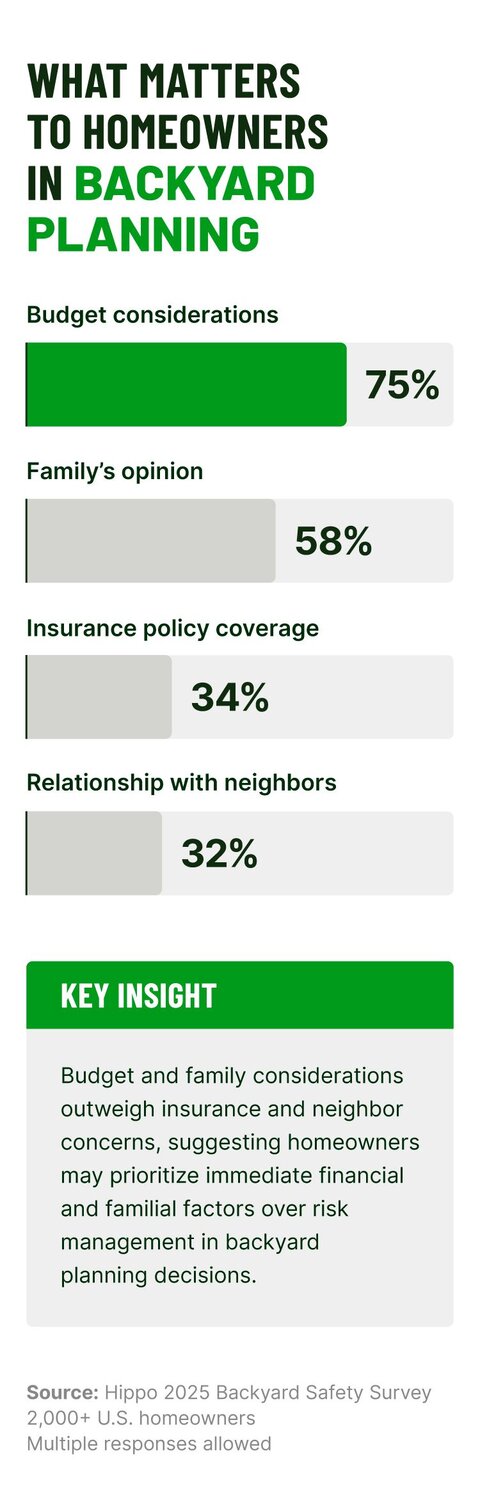

- Most homeowners consider their budget when upgrading their backyard, but their insurance coverage? Not so much. While 75% of homeowners say that budget influenced their decision to add outdoor amenities, only 34% considered insurance coverage.

- Grills, the most popular outdoor amenity, pose significant safety risks, causing millions in property damage and thousands of emergency room visits annually. Homeowners could reduce these risks with simple precautions like hiring someone to perform seasonal gas line checks, posting usage rules, and keeping a fire extinguisher nearby.

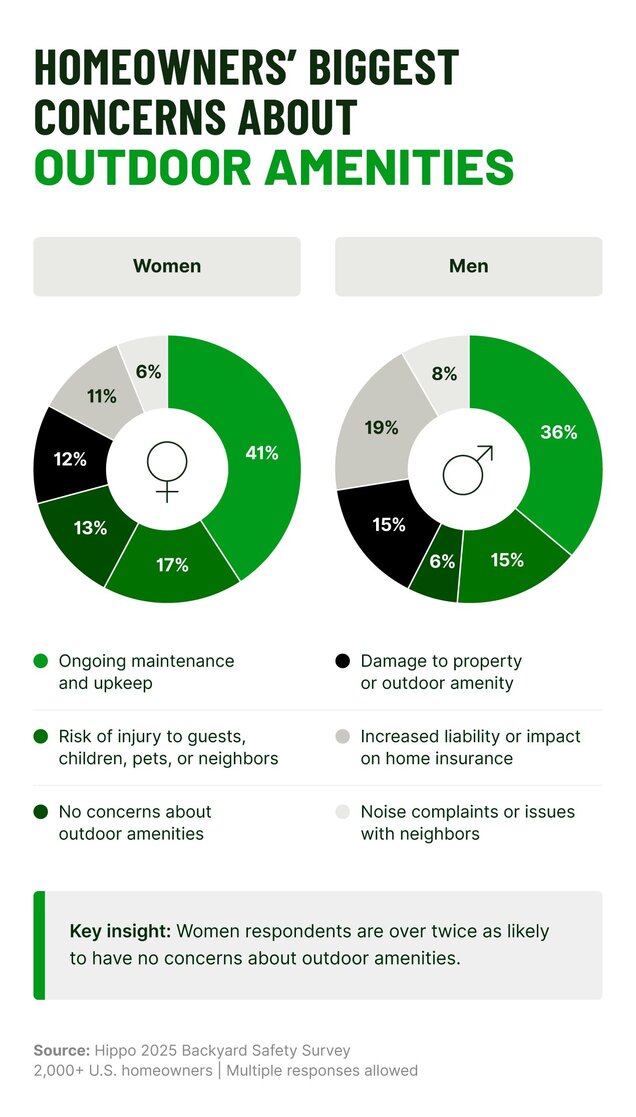

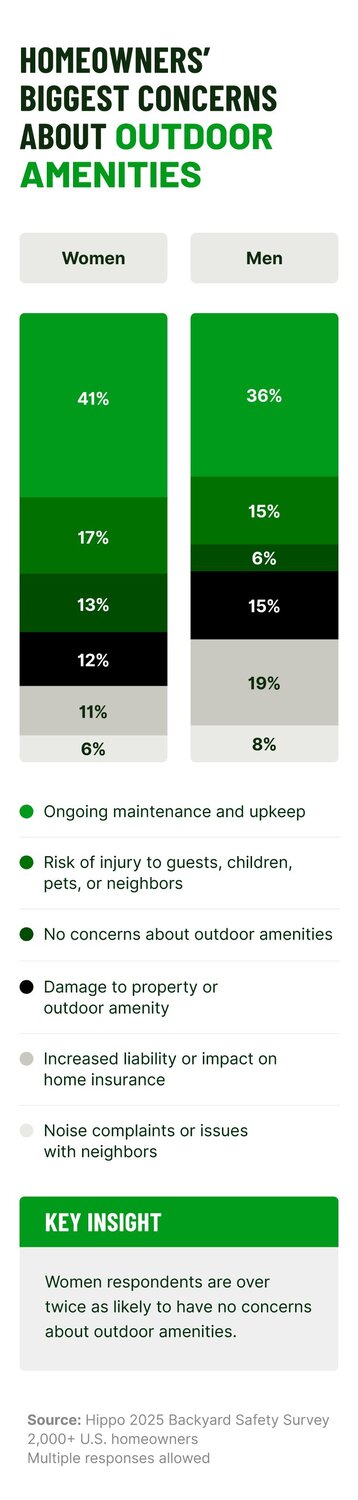

- Most homeowners rank ongoing maintenance and upkeep as their top concern with having outdoor amenities in their yard.

- When considering new outdoor amenities, female homeowners often have no concerns. If they do, their main worries are maintenance and upkeep. Male homeowners, however, are more influenced by their family and neighbors.

- Age shapes how homeowners prioritize outdoor amenity decisions, shifting from family and budget considerations for those aged 30-44 to a greater emphasis on insurance implications for homeowners aged 45-60.

The top 5 most popular amenities and the overlooked risks

- Grills (57%)

- Fire pits (44%)

- New decks (34%)

- Outdoor kitchens (32%)

- Swimming pools (29%)

Bridging the gap: Maintenance, safety, and insurance for outdoor living

- Conducting regular safety checks or maintenance

- Having a fire extinguisher or hose nearby

- Using safety nets or protective enclosures

- Anchoring equipment to the ground

- Adding padding on hard edges or surfaces

- Using pool or hot tub covers with safety locks

- Posting safety signage or rules

- Review insurance coverage annually: Review homeowner liability details and any endorsements that apply to outdoor features like pools, decks, or built‑in grills. Minor adjustments now could prevent significant out‑of‑pocket costs later, and help homeowners understand what can cause home insurance costs to go up.

- Document backyard upgrades: Keep digital records of permits, contractors, and receipts. Clear documentation may help speed up a potential claim and help validate additions that boost your home’s value.

- Confirm local safety requirements: Many municipalities mandate pool fences, deck rail heights, or spark screens for fire pits. Meeting these codes can help if you ever need to file an insurance claim, since some policies have clauses that require homeowners to maintain their property in a safe condition and comply with local regulations.

- Explore additional coverage options: If homeowners host frequently or have amenities not covered by typical insurance policies, additional coverage options can add another layer of protection.

Survey reveals differing approaches to backyard safety across gender and age

Gender divide: Women prioritize maintenance, men focus on liability

Age analysis: From family-first to insurance-focused

Essential backyard safety checklists for America's most popular amenities

Grills: The popular amenity that causes $37 million in annual home damage

- Store a fire extinguisher close by the grill, so it’s readily available in an emergency.

- Inspect gas connections and hoses before each grilling season.

- Clean grease traps and drip pans regularly to prevent flare-ups.

- Position grills at least 10 feet from structures, overhanging branches, and deck railings.

- Never leave a lit grill unattended.

- Post basic safety rules in visible areas for guests and family members.

- Set up the grill and propane tanks upright, away from other heat sources, and on a flat surface.

- Check local fire restrictions during dry seasons.

Fire pits: Safety habits to help minimize fire risks

- Install spark screens or guards to contain embers.

- Keep a fire extinguisher, a reliable water source, or sandbags within reach.

- Keep flammable materials at least 10 feet away from the fire pit.

- Check local burn bans and fire restrictions before use.

- Never leave fires unattended, even for short periods.

- Fully extinguish fires before going indoors or to bed.

- Establish clear rules for children and pets around open flames.

- Install proper drainage to help prevent water accumulation in permanent pits.

Decks: The "lower-risk" amenity that still needs attention

- Inspect stair railings and guardrails for stability and proper height. That is roughly 34–38 inches for stair railings and 42 inches for deck guardrails.

- Check for loose or warped boards.

- Examine support posts and joists for signs of rot or insect damage.

- Ensure stair handrails are secure and balusters are properly spaced.

- Clear debris from between deck boards to prevent moisture buildup.

- Test deck lighting and replace burnt-out bulbs.

- Remove snow load promptly in winter climates.

- Schedule professional inspections for decks over 10 years old.

Pools and trampolines: Higher-risk amenities need higher safety engagement

- Install and maintain proper fencing (minimum 4 feet high) with self-closing, self-latching gates.

- Use pool covers with safety locks when not in use.

- Keep rescue equipment (reaching pole, life ring) poolside.

- Install proper lighting for evening use.

- Maintain clear sight lines to the pool from the house.

- Post pool rules and emergency contact information.

- Keep first aid supplies and emergency phone numbers accessible.

- Regularly test and maintain pool alarms.

- Schedule annual professional inspections of pool equipment and safety features.

- Ensure all family members and frequent guests know basic water safety.

- Install safety nets and padding on all springs and frame edges.

- Anchor trampolines securely to prevent movement in high winds.

- Position trampolines away from structures, trees, and other hazards.

- Inspect nets, springs, and the jumping surface regularly for wear.

- Supervise children during use.

- Remove ladders when not in use to prevent unsupervised access.

- Post safety rules visibly near the trampoline.

Boosting home protection habits with Hippo

Methodology

Related Articles

11 Pool Safety Tips for a Worry-Free Summer [Free Checklist]

2024 Pre-Summer Check-in Survey: Exploring Homeowner Preparations

Survey: 66% of Homeowners Experience Summer Plumbing Issues

How To Save on Your Electric Bill: 10 DIY-Able Ways To Save This Summer

Burning Issue: 41% of Homeowners Surveyed Experience Heat-related Home Damage Due to Summer Weather