As billion-dollar storms, floods, and wildfires become a staple of every season, extreme weather is no longer an outlier—it’s a defining challenge of modern homeownership. And yet, despite the mounting risks, many homeowners aren’t taking steps to prepare.

Our 2025 Extreme Weather Survey reveals a critical gap between rising climate threats and stagnant preparedness behaviors. By comparing year-over-year data with our 2024 Severe Weather Prep Report, we uncover key insights into how homeowners are adapting in the face of growing environmental volatility.

Key takeaways

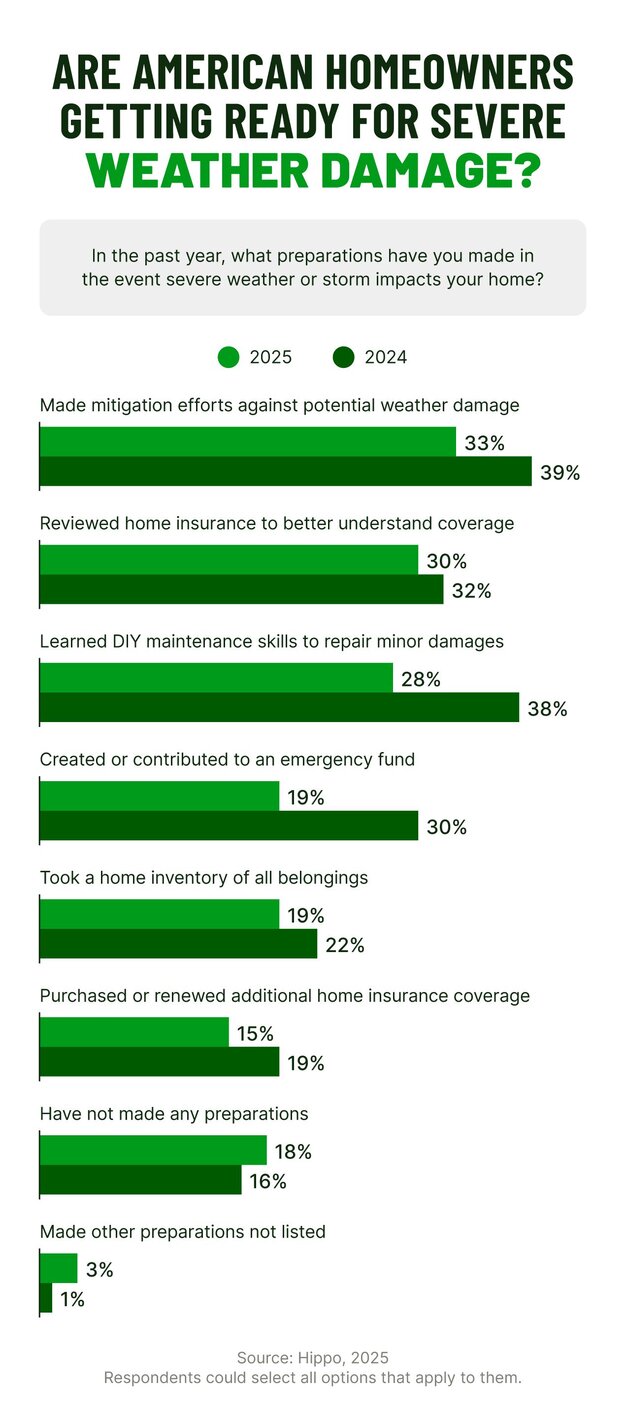

- Preventative upgrades are slipping: Just 33% of homeowners made home improvements to reduce severe weather risks, down from 39% in 2024.

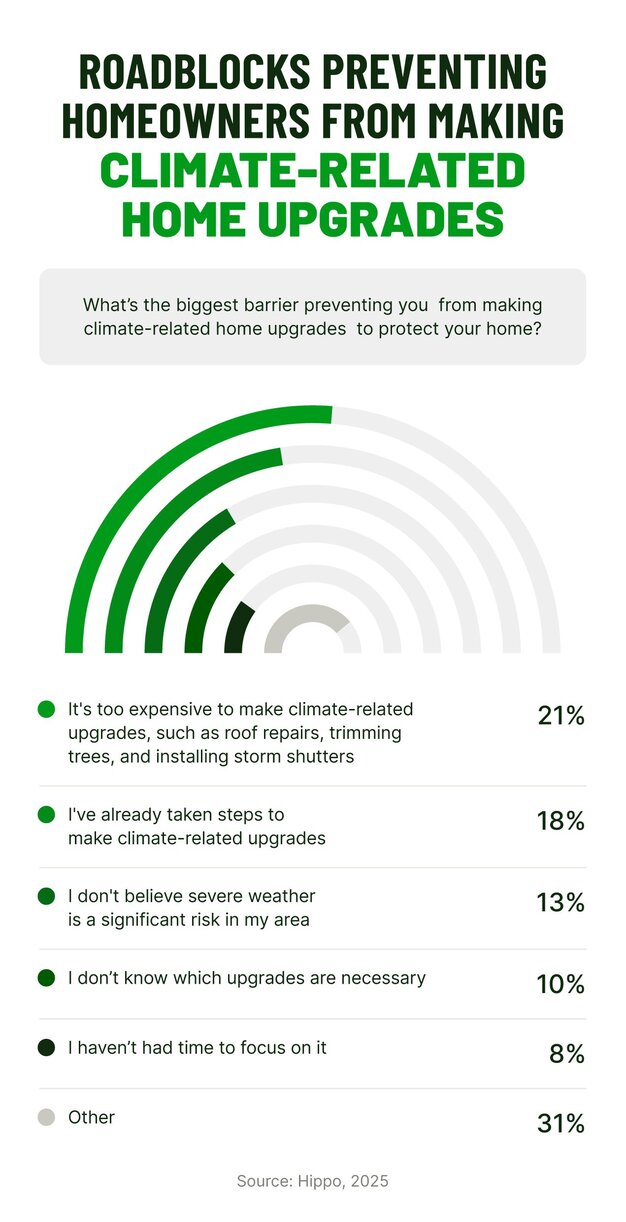

- Cost is a major roadblock: 21% of homeowners say cost is the main reason they haven’t made climate-related upgrades. Meanwhile, urgent repairs are taking priority: 46% spent over $5,000 on unexpected fixes in 2024, up from 36% the year prior.

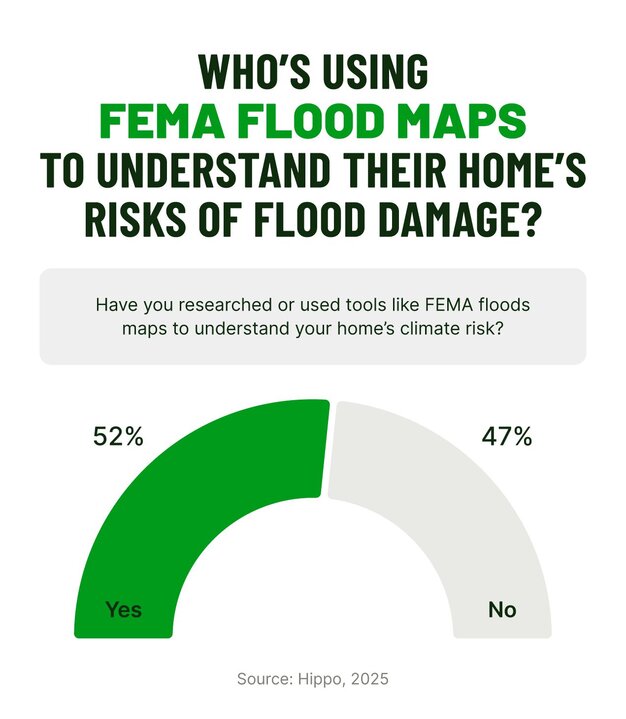

- Flood risk awareness is low: Nearly half (47%) of homeowners haven’t explored tools like FEMA flood maps, and 21% are unaware they even exist. This is alarming, given that over 53 million Americans live in flood-risk zones.

- Climate concerns are reshaping home buying: While 73% of homeowners had regrets about their home purchase in 2024—often tied to surprise maintenance costs—more than half (54%) now list climate risk as a top factor when shopping for a home.

Homeowner preparedness stalls despite rising weather threats

Cost remains a major barrier to climate preparedness

Bridging the awareness gap for effective preparedness

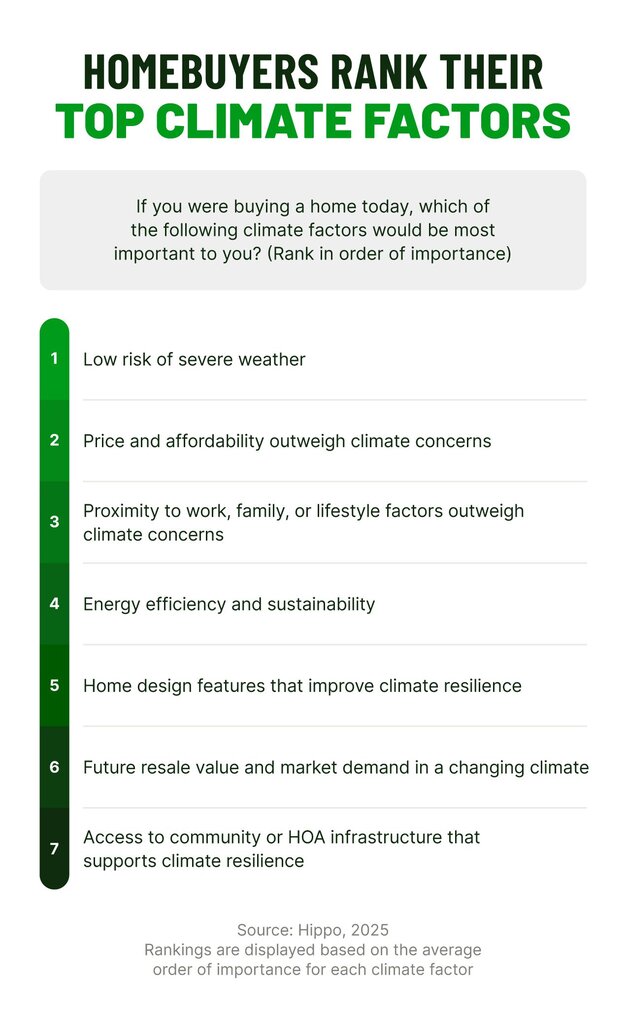

Homebuyers weigh climate risk against affordability

- Low risk of severe weather events: 21%

- Energy efficiency and sustainability features: 14%

- Climate-resilient home design: 12%

- Access to a climate-resilient community or Homeowners Association: 7%

Insurance plays a critical role in climate resilience

As climate risks grow, homeowners recognize the critical role of insurance as a frontline financial defense against severe weather.

Our 2025 survey found that 30% of homeowners reviewed their insurance policies within the past year, specifically to assess coverage for severe weather events. Additionally, 15% reviewed or purchased additional insurance coverage, and 18% contributed to their emergency funds, pointing to a broader trend of financial preparedness.

These shifts signal that insurance is top of mind for homeowners as a financial safety net. In an era of rising flood zones, stronger storms, and unpredictable seasons, working with an insurance agency or provider that offers personalized coverage is more important than ever.

Equally essential is access to expert guidance on preventative measures that can reduce potential damage before a storm hits. Finding the right insurance provider can provide peace of mind and serve as a partner when it matters most. Our team at Hippo is here to help.

Steps to help protect your home from extreme weather

You don’t need a massive budget to boost your home’s resilience. With climate risks on the rise, even small, proactive steps can help prevent costly surprises and keep your property protected.

Start with the basics:

- Regularly clear gutters and downspouts to prevent water damage.

- Seal windows and doors to block drafts and leaks.

- Schedule a professional roof inspection to catch issues early.

Manage water wisely:

- Improve drainage by regrading your yard.

- Extend downspouts away from the foundation to prevent water leaks.

Make smart landscaping choices:

- Plant native, drought-resistant vegetation.

- Trim trees and shrubs to help minimize fire and storm damage.

Invest in financial planning:

- Invest in an emergency fund for unexpected repair costs.

- Review your homeowners insurance coverage for severe weather events annually.

- Consider flood insurance if you live in or near a high-risk area.

Be informed and prepared:

- Learn about local hazards in your area using tools from FEMA, the Red Cross, and your local government.

- Stay ahead of seasonal weather by completing seasonal maintenance.

Proactive protection starts with a plan—and the right tools. The Hippo Home app gives you personalized checklists, helpful reminders, and DIY guides to stay ahead of the storm.

Methodology

This survey was conducted by SurveyMonkey Audience for Hippo Insurance Services. The survey was fielded between February 20, 2025, and February 21, 2025. The results are based on 2,015 completed surveys. In order to qualify, respondents were screened to be residents of the United States, over 18 years of age, and own a home. Data is unweighted, and the margin of error is approximately +/-2% for the overall sample with a 95% confidence level.

This article is for informational purposes only and was compiled from sources not affiliated with Hippo. While we believe this information to be reliable, we do not guarantee its accuracy or completeness. The maintenance tips provided reflect general homeowner guidelines and are not professional advice. For any insurance-related decision, please consult your licensed insurance producer.

Related Articles

Severe Weather Prep Report: How Homeowners Are Bracing for Costs

52% of Homeowners Ignored Extreme Weather Risks Before Buying—Now Emergency Funds Are at the Forefront

Homebuyers Want Disaster-Resilient Homes and 88% Will Pay More for Them

How to Help Climate Change at Home

How To Fireproof Your Home + Fire Safety Checklist