Is Your Fixer-Upper a Mistake? 1 in 5 U.S. Homeowners Said Yes

The idea of transforming a bargain fixer-upper has long been a part of American homeownership, but new research suggests that this can come with a costly reality check.

A recent Zillow study highlighted the “nostalgia tax”: remodeled homes now sell for 3.7% more on average than expected, while listings labeled “fixer-upper” are discounted by 7.3% compared to similar properties.1 In short, today’s market increasingly rewards move-in ready homes.

Our survey of more than 2,000 U.S. homeowners explores the trade-offs between buying a fixer-upper vs. a move-in ready home. The findings reveal a strong preference for convenience — and growing regret among fixer-upper buyers — as home costs continue to rise.

Key takeaways

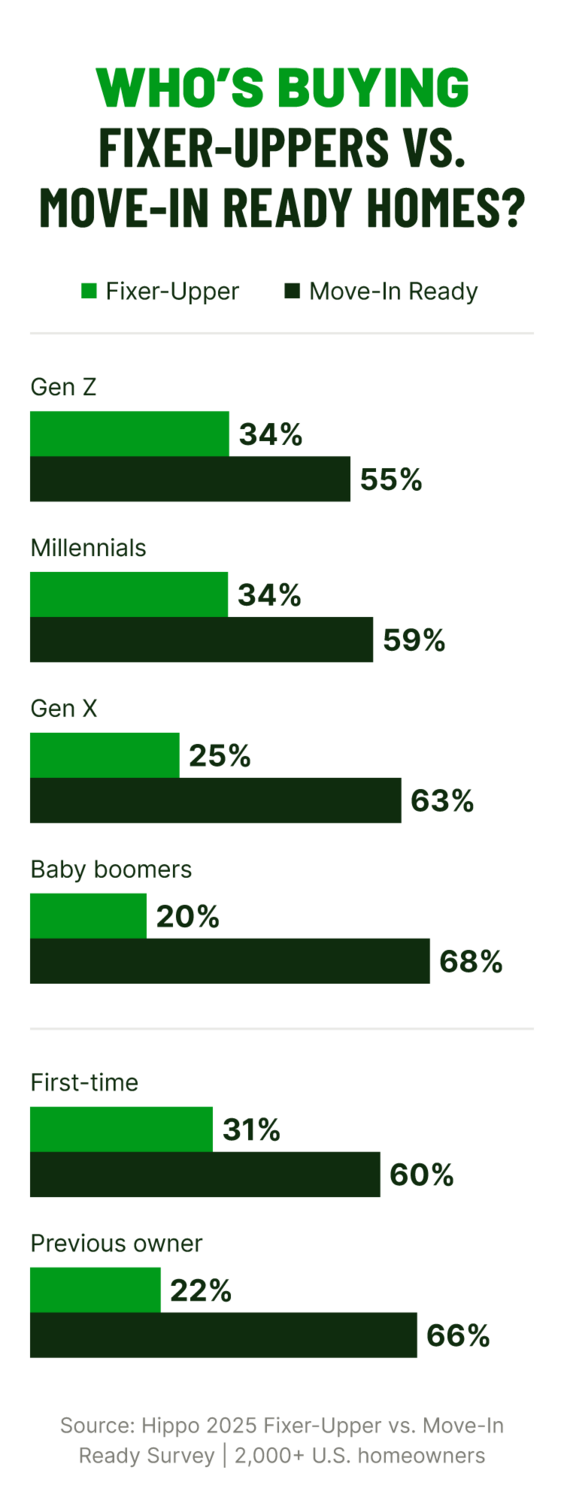

- 62% of homeowners bought a move-in-ready home, while only 28.1% bought fixer-uppers, showing a strong preference for turnkey homes.

- Across all home types, 51% love the area it’s in, suggesting that features like walkability, school districts, and proximity to family or work is more important than the price (50%) and the features of the home itself (44%).

- More than 62% of fixer-upper owners spend upwards of $6,000 per year on renovations, increasing monthly expenses.

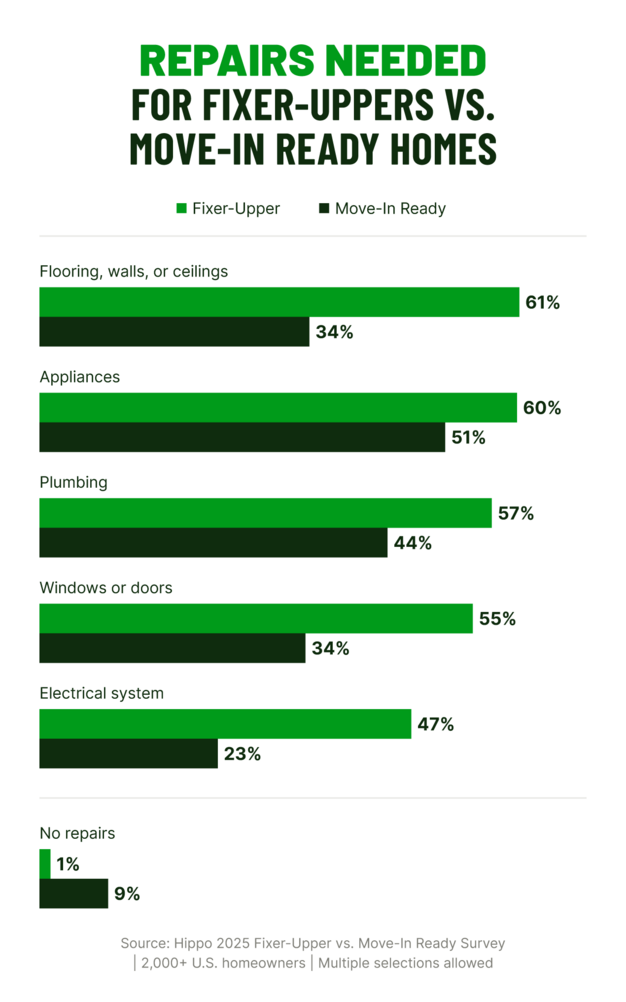

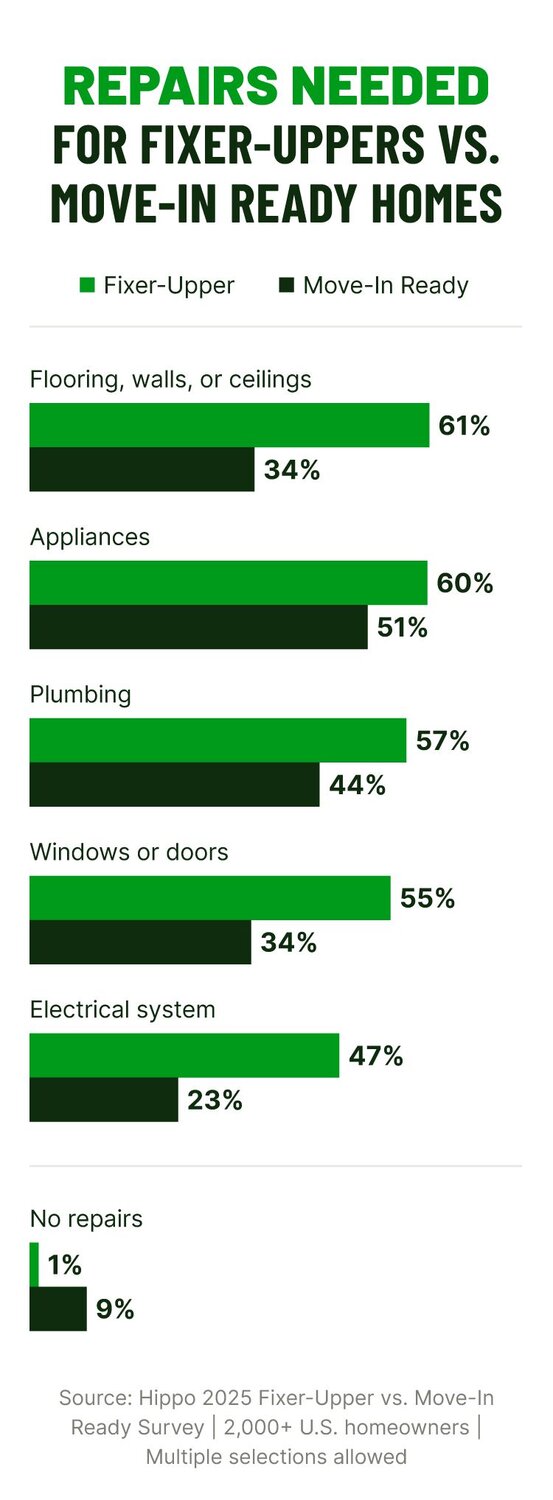

- Nearly all fixer-upper buyers (98%) have made repairs since moving in; more than 48% spend more than $6,000 annually on those repairs.

- If given the chance to start over, 23% of fixer-upper owners would choose a move-in ready home instead, suggesting the labor and cost outweigh the value.

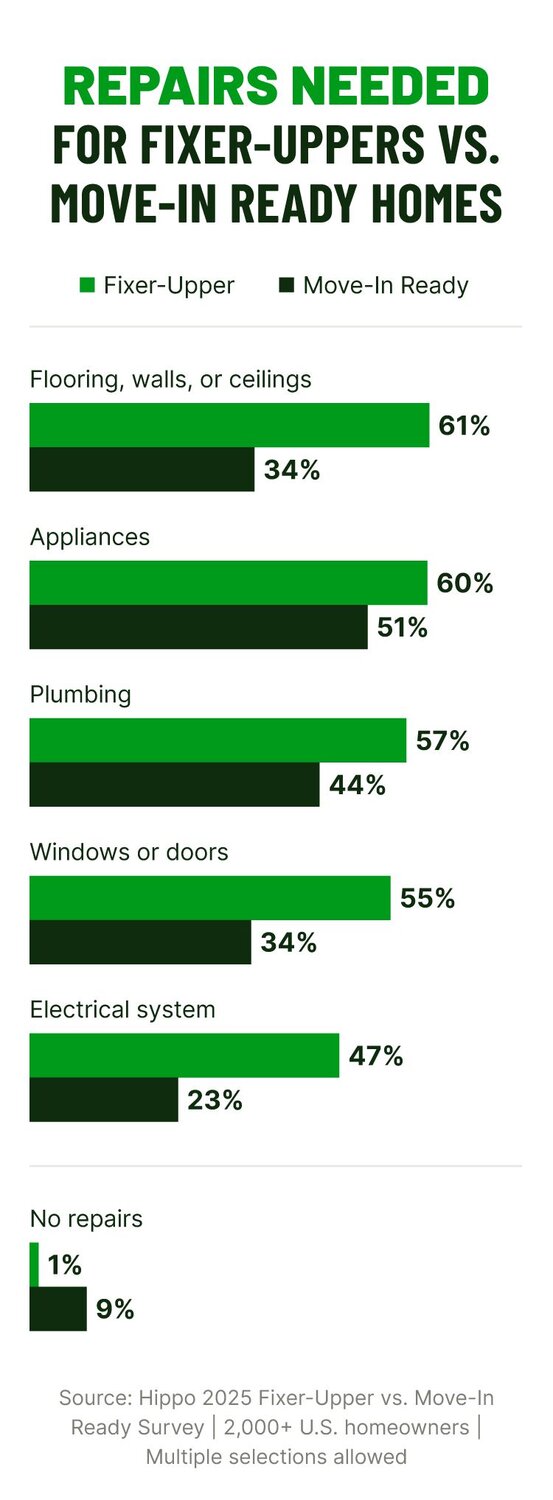

Renovation costs overshadow initial savings from buying a fixer-upper

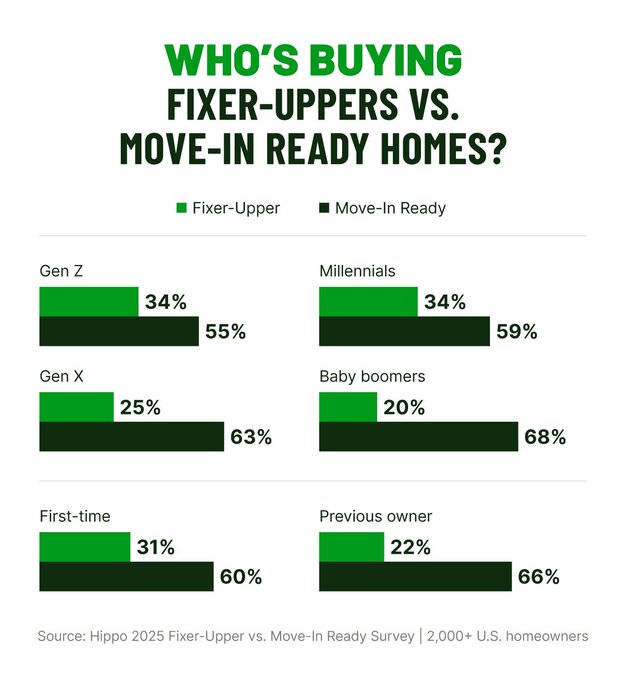

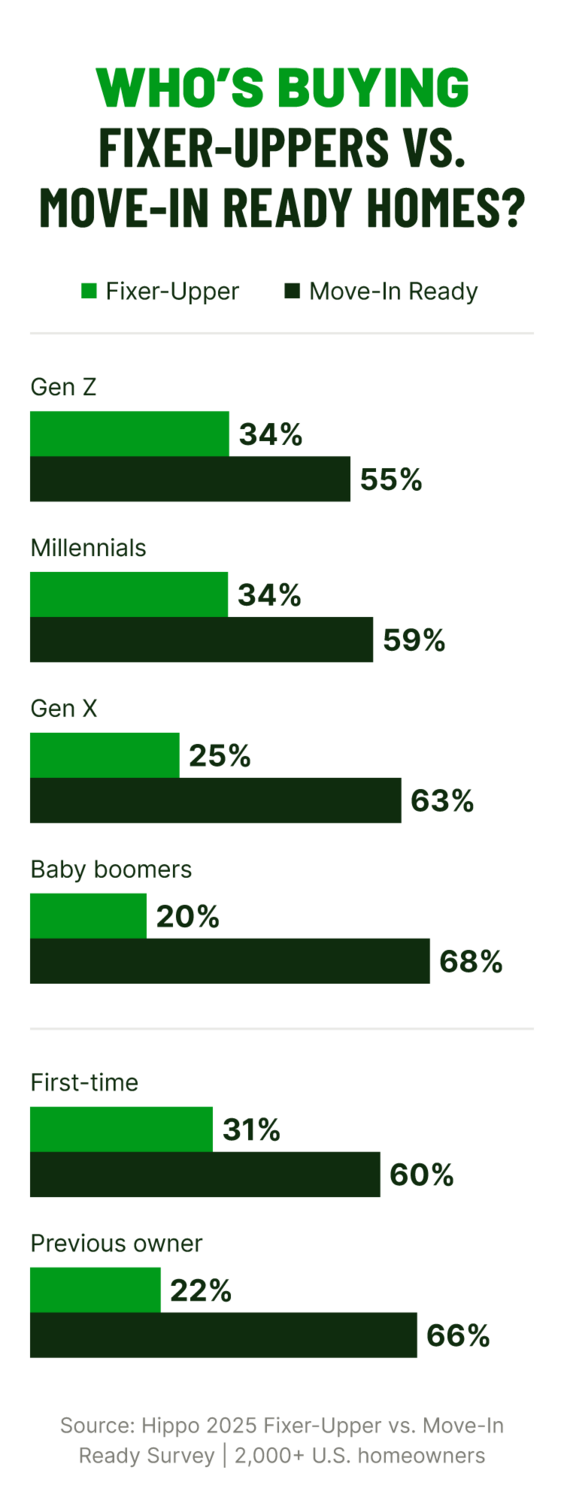

Across generations, buyers prefer move-in ready homes

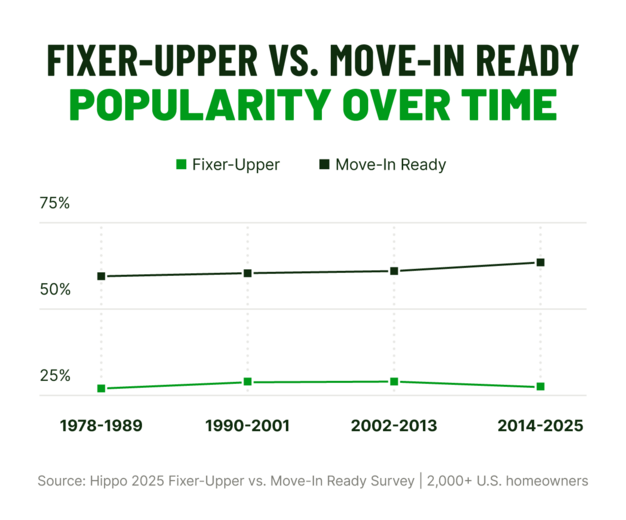

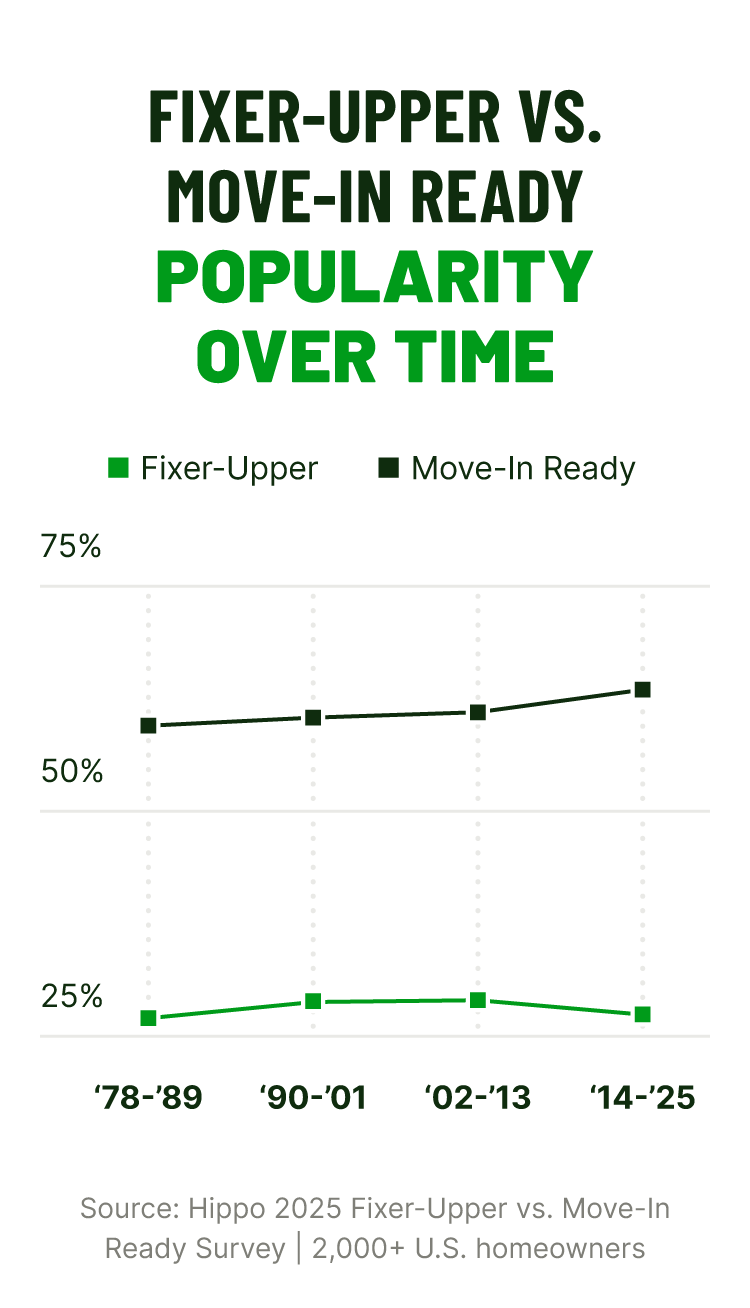

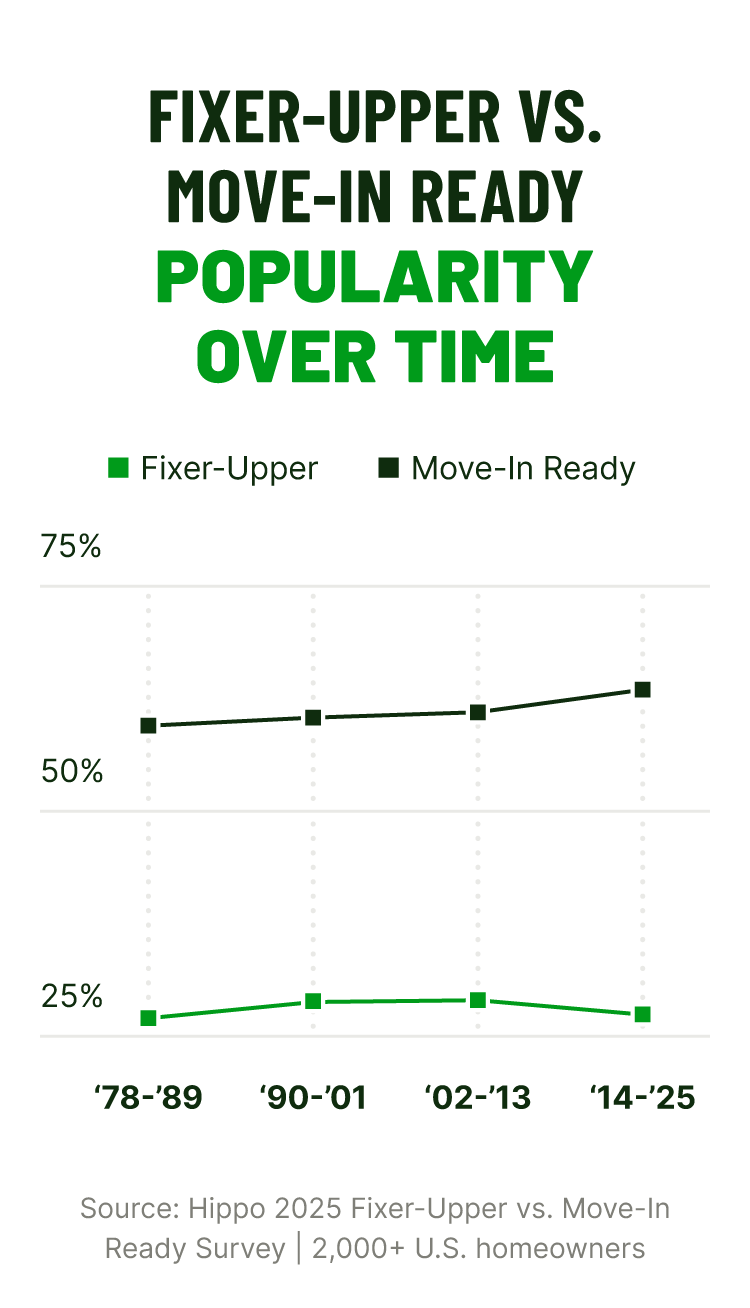

The preference for move-in ready homes is nothing new

General considerations when buying a home

- Closing price: Fixer-uppers tend to list for less, making them potentially more accessible to buyers with less home equity.

- Long-term cost: Lower than average purchase prices could mask unanticipated renovation and repair expenses. Completing a home inspection can help solidify long-term cost projections before completing a sale.

- Time and effort: Not everyone has the bandwidth to manage renovations, including buyers with kids, pets, or demanding careers.

- Risk tolerance: Homeowners with a higher risk tolerance may be open to unanticipated projects that arise from buying a fixer-upper, allowing them to plan and adapt as renovations and repairs arise.

- Emotional cost: Due to the multiple projects that come with the territory, many fixer-upper buyers report wishing they’d done things differently, while move-in ready buyers more often express confidence in their choice.

Fixer-upper | Move-in ready | |

|---|---|---|

Price | 51% | 50% |

Location | 45% | 55% |

Home features (e.g., backyard, patio, etc.) | 44% | 46% |

Household loves the home | 36% | 38% |

Potential | 36% | 23% |

Sentimental value | 29% | 22% |

Get the best protection for your home

FAQ: Fixer-upper vs. move-in ready homes

Is it better to buy a fixer-upper or a move-in ready home?

What is a move-in ready home?

When is it time to walk away from a fixer-upper?

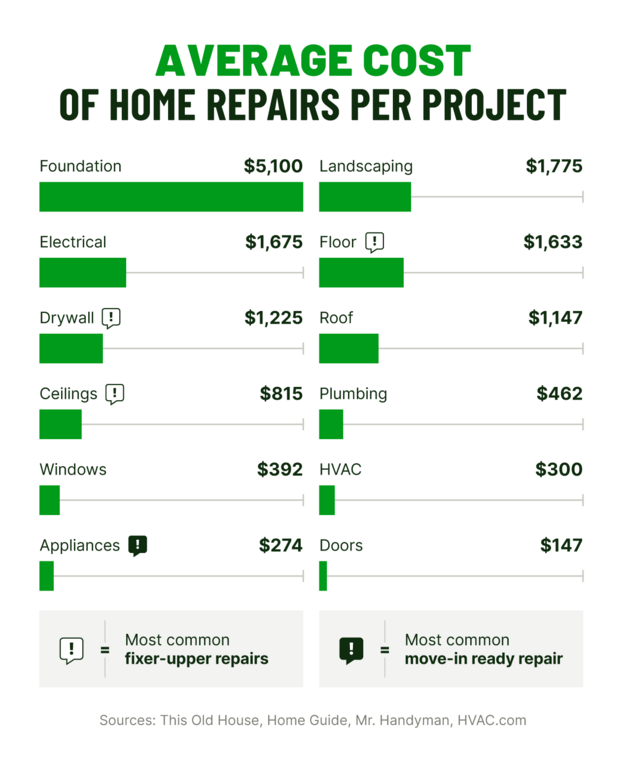

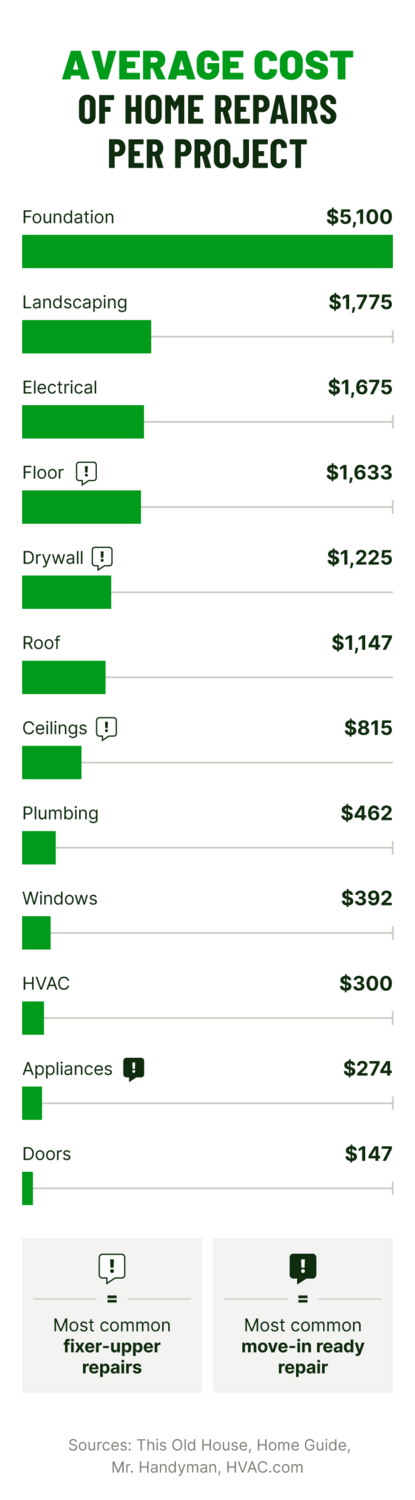

What is the most expensive thing to fix on a house?

Methodology

External sources:

- Zillow. (2025, February). The end of the fixer-upper: Remodeled homes sell for the highest premiums

- Realtor.com. (2025, September) Roll Up Your Sleeves: An In-Depth Look at Fixer-Uppers on the Market

- This Old House. (2025, May) How Much Does Appliance Repair Cost?

- Home Guide. (2025, July). How much does it cost to repair floors?

- Mr. Handyman. (2025, September) How Much Does Drywall Repair Cost?

- This Old House. (2025, May) How Much Does it Cost to Repair Drywall?

- HVAC. (2023, July) HVAC Repair Costs

- U.S. News. (2025, July) 2025-2030 Five-Year Housing Market Predictions

![A graph of average home repair costs, highlighting the most common repairs for fixer-uppers and move-in ready homes.]](https://cdn.builder.io/api/v1/image/assets%2F87a865fc472c4b69863d5e7f8aa60d5c%2F4ce147cbc3634e71bde3d680ffa79686?width=919)

Related Articles

Future of American Suburbs: Redefining Where (and How) We Live

5 Costly New Homeowner Maintenance Mistakes (and How to Fix Them)

The 9 Most Expensive Home Repairs to Watch Out for in 2025

When Is the Best Time To Buy a House? Expert Tips for Homebuyers

Report: Where Homeowners Turn for Maintenance Advice in 2024