Future of American Suburbs: Redefining Where (and How) We Live

American suburbs are in the midst of a boom, and buyers aren’t settling for cookie-cutter neighborhoods anymore. Today’s homeowners want resilience, community, and convenience in neighborhoods that offer flexible spaces and easy access to local amenities.

Builders who identify and cater to these preferences could lead the market, designing suburban neighborhoods that resonate with today’s buyers and stand the test of time. But delivering this is often easier said than done. That’s why we outlined three key trends shaping the future of suburban development.

Hybrid suburbs and the 20-minute community model

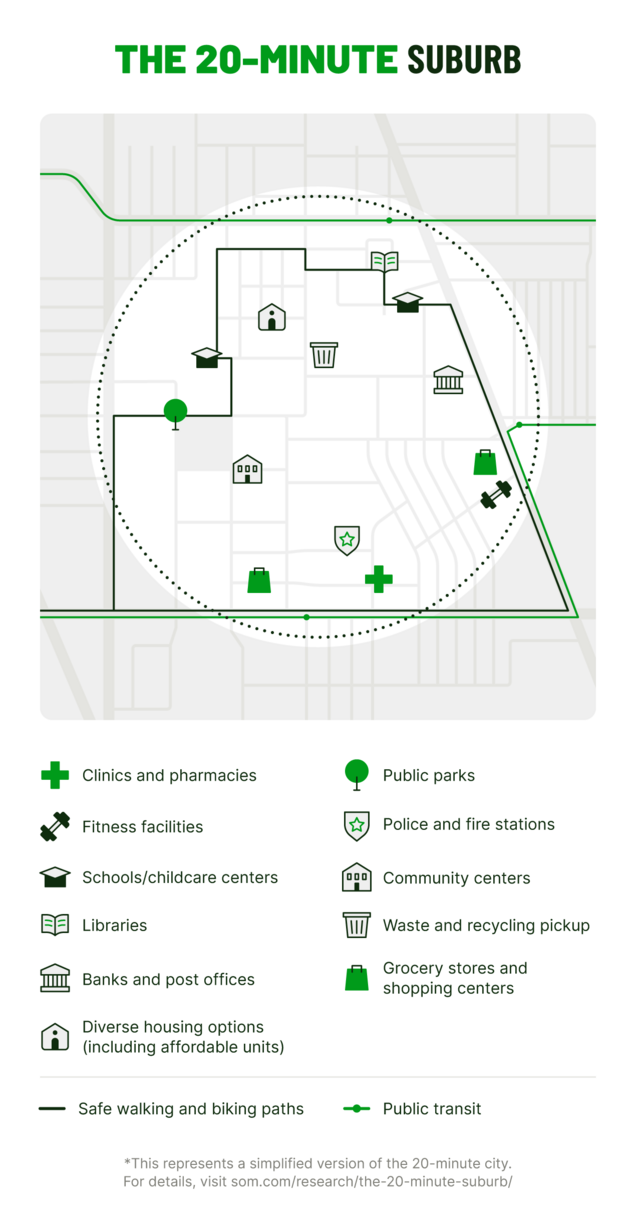

The 15-minute city concept, emphasizing walkability and local access, has inspired a shift in suburban development. The "20-minute suburb" is an emerging concept that promotes neighborhood walkability, mixed-use development, and sustainable transportation.

Unlike traditional car-dependent suburbs, this model encourages residents to access daily necessities (i.e., schools, grocery stores, and healthcare facilities) within a 20-minute walk or bike ride from their homes. By executing this, developers can create neighborhoods that reflect the convenience of city centers while maintaining the safety and charm of suburban life.

- A mix of housing types and price points, such as single-family homes, townhouses, and apartments, that accommodate a range of lifestyles and income levels.

- Grouped essential facilities like parks, schools, shops, and healthcare to make them easily accessible and encourage community interaction.

- Enhanced transportation options to ensure residents can move easily within and beyond the neighborhood.

- Streets that prioritize pedestrian safety and comfort, with features like sidewalks, crosswalks, traffic calming, and public spaces that encourage socializing.

- Local history, traditions, art, and cultural events are incorporated into neighborhood design to foster pride and a sense of belonging among residents.

Smart suburbs: Tech reshapes homebuying

Price pressures shifting suburban demand

Insurance services for forward-thinking communities

Related Articles

Master-Planned Communities: Perks, Costs, and Insurance Coverage

Homebuyers Want Disaster-Resilient Homes and 88% Will Pay More for Them

Cutting-Edge Solutions for Fire-Safe Construction

2025 Dream Home Must-Haves: Practical, Flexible, and Built to Last

6 Homebuilding Trends Shaping 2025 and Beyond