5 Costly New Homeowner Maintenance Mistakes (And Fixes)

Owning a home comes with responsibilities that can surprise first-time buyers. Common costly mistakes include skipping regular home maintenance, not knowing what home insurance covers (since coverage varies by policy and insurer), and being unprepared for severe weather.

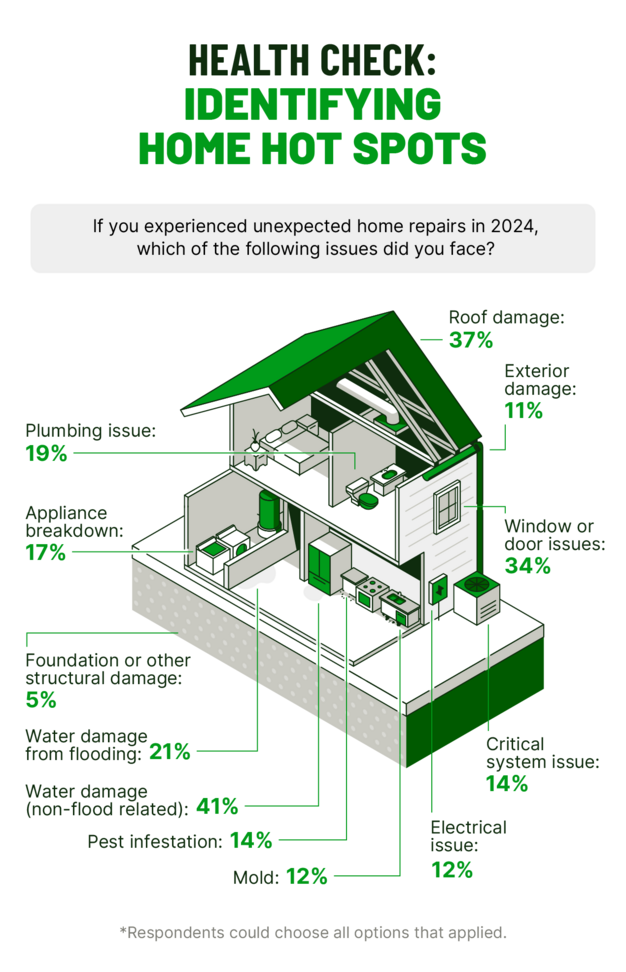

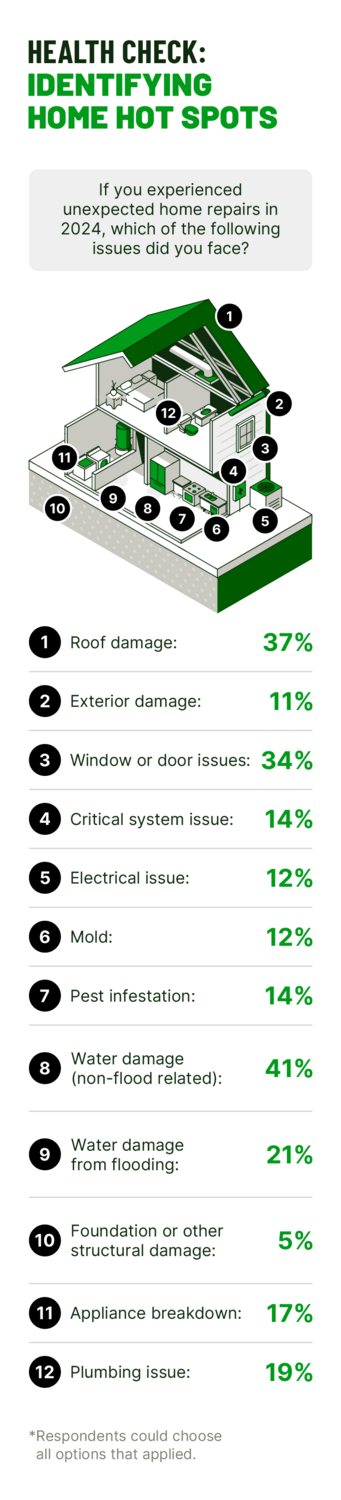

Our 2024 Housepower Report shows the impact of these challenges: 73% of homeowners said they regretted purchasing their home in 2024. This makes sense when nearly half of homeowners (46%) spent more than $5,000 on unexpected repairs in 2024, up from 36% in 2023.

"Preventive maintenance is critical to avoiding bigger, more expensive issues down the line. For example, if you ignore a small leak, you could end up with mold and structural damage to your walls and flooring. By staying proactive with home maintenance, homeowners can help avoid costly, unexpected damage in the first place." — Peter Piotrowski, Chief Claims Officer, Hippo Insurance Services

1. Skipping the home inspection before closing

Typically covered in general home inspections[1] | Typically covered in specialized home inspections[1] |

|---|---|

Roofing: materials, drainage, flashing, skylights, and chimneys | Antennas, hidden vents, and roof accessories |

Exterior: walls, doors, decks, porches, steps, grading, and walkways | Fences, outbuildings, pools, docks, and soil conditions |

Structure: foundation, framing, floors, walls, ceilings, and attic/crawlspace (visible areas) | Engineering analysis, hidden areas, small crawlspaces, and attic insulation hidden by material |

Plumbing: pipes, fixtures, drains, water heater, and sump pumps | Wells, septic systems, water quality, irrigation, and solar water heating |

Electrical: service panels, wiring, outlets, light fixtures, and GFCI/AFCI | Security systems, low-voltage wiring, solar/wind systems, and testing voltage or amperage |

Heating & cooling: central heating/cooling, vents, ducts, and energy source | Portable units, humidifiers, air cleaners, renewable HVAC, and balance or efficiency checks |

- Get a home inspection before purchasing. This could help you catch hidden issues like foundation problems or HVAC failures that might otherwise become your responsibility.

- Consider specialized inspections, especially for older homes or when there are known risks, such as mold or pest activity.

- Schedule your inspection during the contingency period—the window in a real estate purchase where certain conditions must be met before proceeding with the sale. Doing so can help prevent delays in the process and may even influence insurance costs.

2. Ignoring routine maintenance until something breaks

- 65% said they complete seasonal maintenance tasks to help prevent unexpected repairs

- 45% completed maintenance as a way to protect their home’s overall condition

- 46% reported they completed maintenance to maintain or increase return on investment.

- Follow season-specific maintenance checklists to help stay on top of tasks. For a complete seasonal maintenance guide, check out our home maintenance checklist.

- Focus your efforts on the core systems—such as your roof, foundation, or plumbing systems—of your home that could cause costly damage if they fail.

- For every major maintenance task you complete, keep receipts and make a note of the date. If you ever need to file an insurance claim, having detailed records could make the process smoother.

3. Underestimating insurance needs and coverage gaps

"Many first-time homeowners may assume their policy covers everything, but if you add on certain home features like pools and detached structures, you generally need to get additional coverage for those items. Flooding also isn’t covered in a standard policy. Homeowners should regularly review their policy and consult their insurance provider for any coverage questions or recommendations.” — Peter Piotrowski, Chief Claims Officer, Hippo Insurance Services

- Know your area’s most common risks—like hurricanes, wildfires, or windstorms—and see if you’re covered.

- Ask your licensed insurance representative to explain what’s not covered in your policy, since that’s often where surprises happen.

- At a minimum, review your homeowners insurance policy annually, keeping in mind any home upgrades or changes in extreme weather patterns.

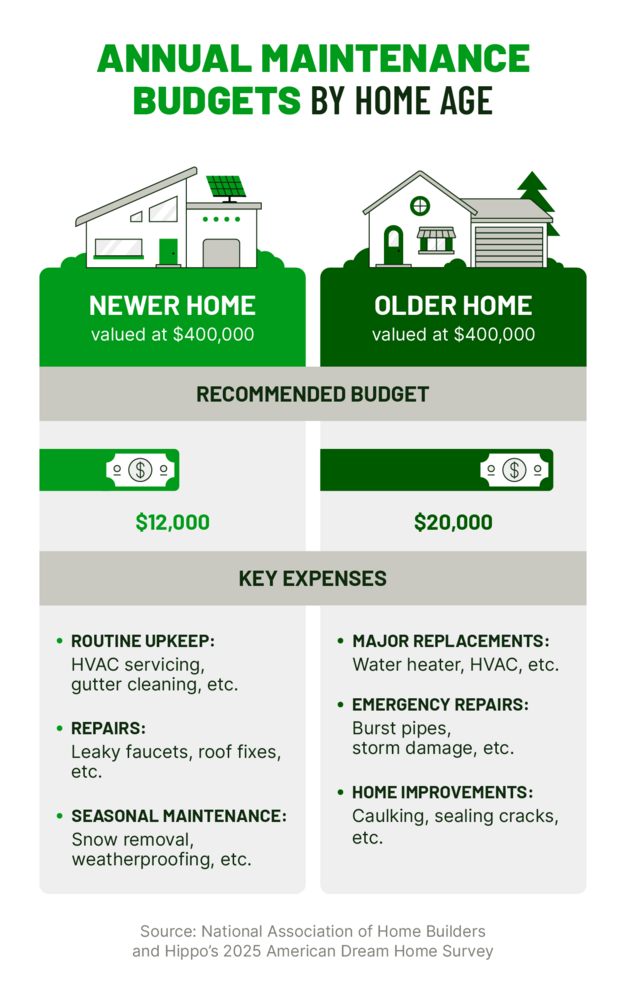

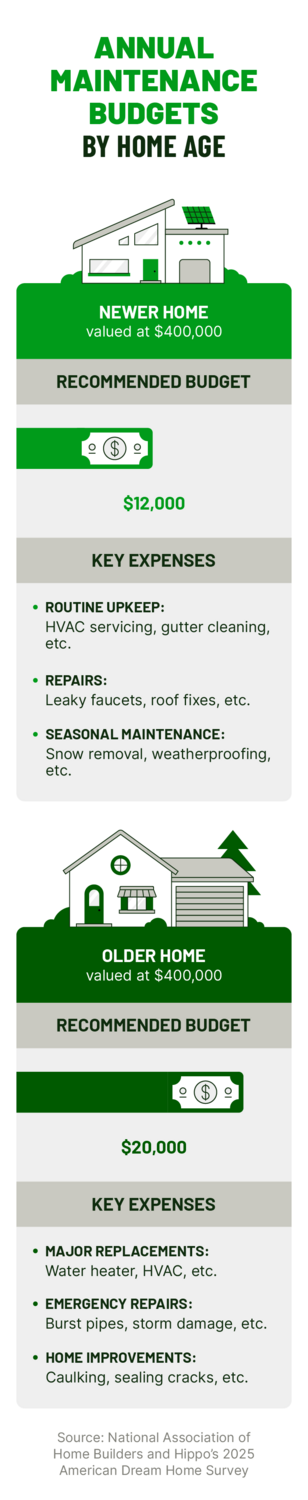

4. Failing to budget for the true cost of home maintenance and protection

- Book seasonal services early (e.g., schedule winter maintenance in the fall, summer maintenance in the spring, etc.) to lock in rates and availability. Peak-season scheduling may mean higher costs and longer wait times.

- Set aside funds in the months before your region's severe weather seasons. This could help ensure you have money available when you need it most.

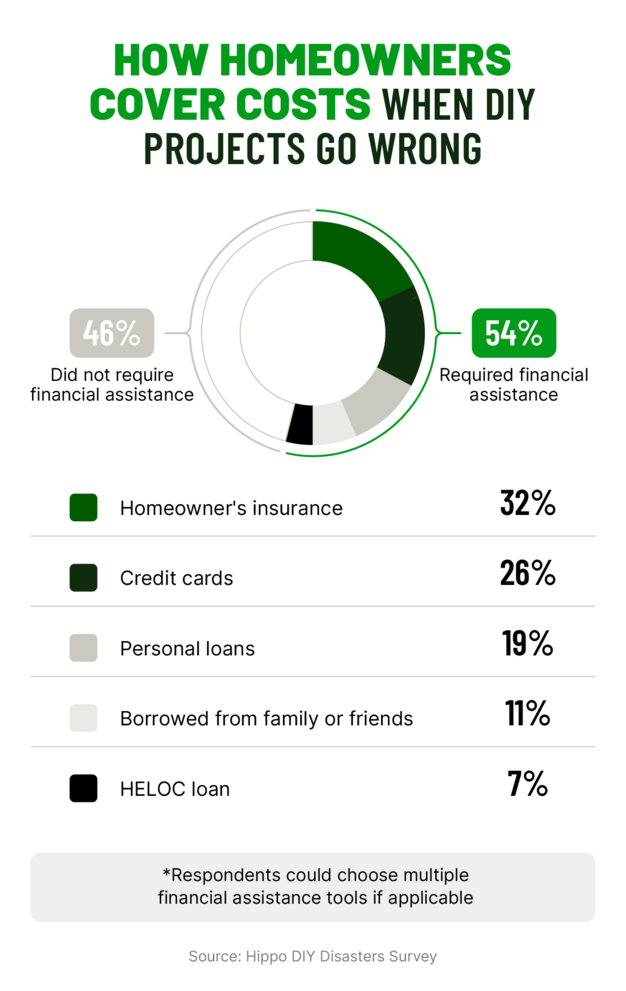

5. DIY-ing maintenance projects beyond their skill level

[3] Typically safe for beginners | [3]Proceed with caution (requires experience or special tools) | [3]Leave to professionals (requires permits and inspections) |

|---|---|---|

Painting | Tile work | Electrical work beyond changing fixtures |

Caulking | Installing crown molding | Structural changes |

Simple hardware installations with no electrical or plumbing connections | Building a deck | Major plumbing repairs |

Step into homeownership with confidence

Sources

- American Society of Home Inspectors. (n.d.). Standard of Practice

- National Association of Home Builders. (2021, January). Operating Costs of Owning a Home

- New Jersey Real Estate Network. (2025, March). Best DIY Home Improvement Projects: Tips For Success & When to Get a Contractor

- All quotes from individuals not affiliated with Hippo are sourced from Featured.com

Related Articles

What to Expect Your First Year After Buying a House

5 Signs You’re Ready to Buy Your First Home

6 Weird Smells In Your House And How To Prevent Them

14 House-Settling Noises Homeowners Should Know

2025 Dream Home Must-Haves: Practical, Flexible, and Built to Last