How To File A Home Insurance Claim in Eight Steps

Fallen tree limbs, break-ins, severe weather and electrical mishaps...Many things can happen to a home throughout its life. While we all hope these things will never happen, dealing with them promptly is an important part of homeownership. But you aren’t on your own when it comes to repairing the damage or replacing what’s beyond repair. That’s where home insurance can help.

From filing a police report to working with an insurance adjuster and settling your claim, below, we’ve broken down how to file a home insurance claim in just eight easy steps.

You can file a home insurance claim by following these eight steps:

- File an official report

- Call your home insurance

- Document the damage

- Mitigate the existing damage

- Fill out all the forms

- Meet with an insurance adjuster

- Get an estimate

- Settle the claim and schedule repairs

1. File an official report

If someone broke into your home, stole your electronics, damaging your property in the process, you’d need to call the police and file a report. Make sure to get a copy of the information to give to your insurance provider, as they’ll need to see an official document that breaks down what damage occurred and any other relevant details.

If the damage is unrelated to criminal activity, you won’t need to get a police report before calling your provider and filing a claim.

2. Give your home insurance provider a call

Let your provider know about the damage sooner rather than later to avoid any potential issues down the line. To begin the claim process, contact both your home insurance provider and your mortgage lender — if you have one, that is — to let them know about the damage and how it occurred.

Your insurance agent will be able to give you a rundown on coverage levels, documents needed and how to go about filing your claim and getting the help you need.

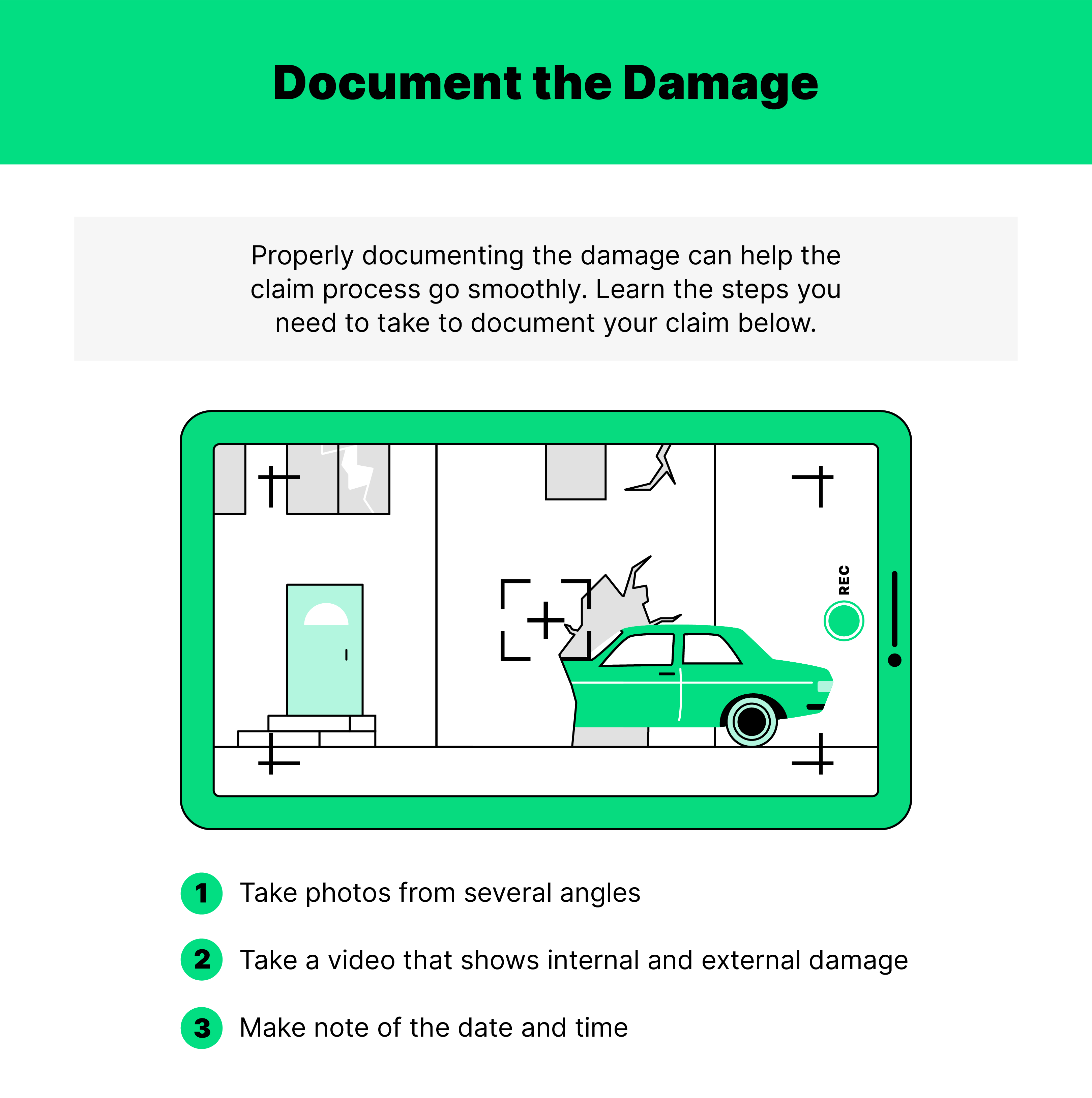

3. Document the damage

Next, you’ll need to document all the damage to send proof to your insurance provider. Take plenty of pictures and videos showing the damage from different angles, use other items to provide scale and write down the approximate date and time the damage occurred.

If you took a home inventory when you first moved in, you can refer to that document (or your home inventory app) to make estimates about how much each damaged item costs. If you don’t have a home inventory, you can do some research online to find approximate costs, though your insurance provider may determine a different price point.

4. Mitigate existing damage

After you’ve documented the damage, you’ll need to take steps to stop the damage from spreading. This could include mopping up standing water to keep mold from forming or covering up wall damage to prevent rain or critters from entering your home.

Stopping the damage from spreading is essential because your insurance provider may not cover additional damage that you could’ve easily prevented. In addition, it’s just a smart move, as protecting the rest of your home and your belongings will prevent any more of your hard-earned money from being wasted.

5. Complete all required forms

Once you’ve contacted your insurance provider, they will begin drawing up the paperwork (like a proof-of-loss form) for you to complete to get the claim process started. Filling out those forms and sending through the police report and any pictures or videos you took quickly is crucial to getting your claim approval process moving and settled within a timely manner.

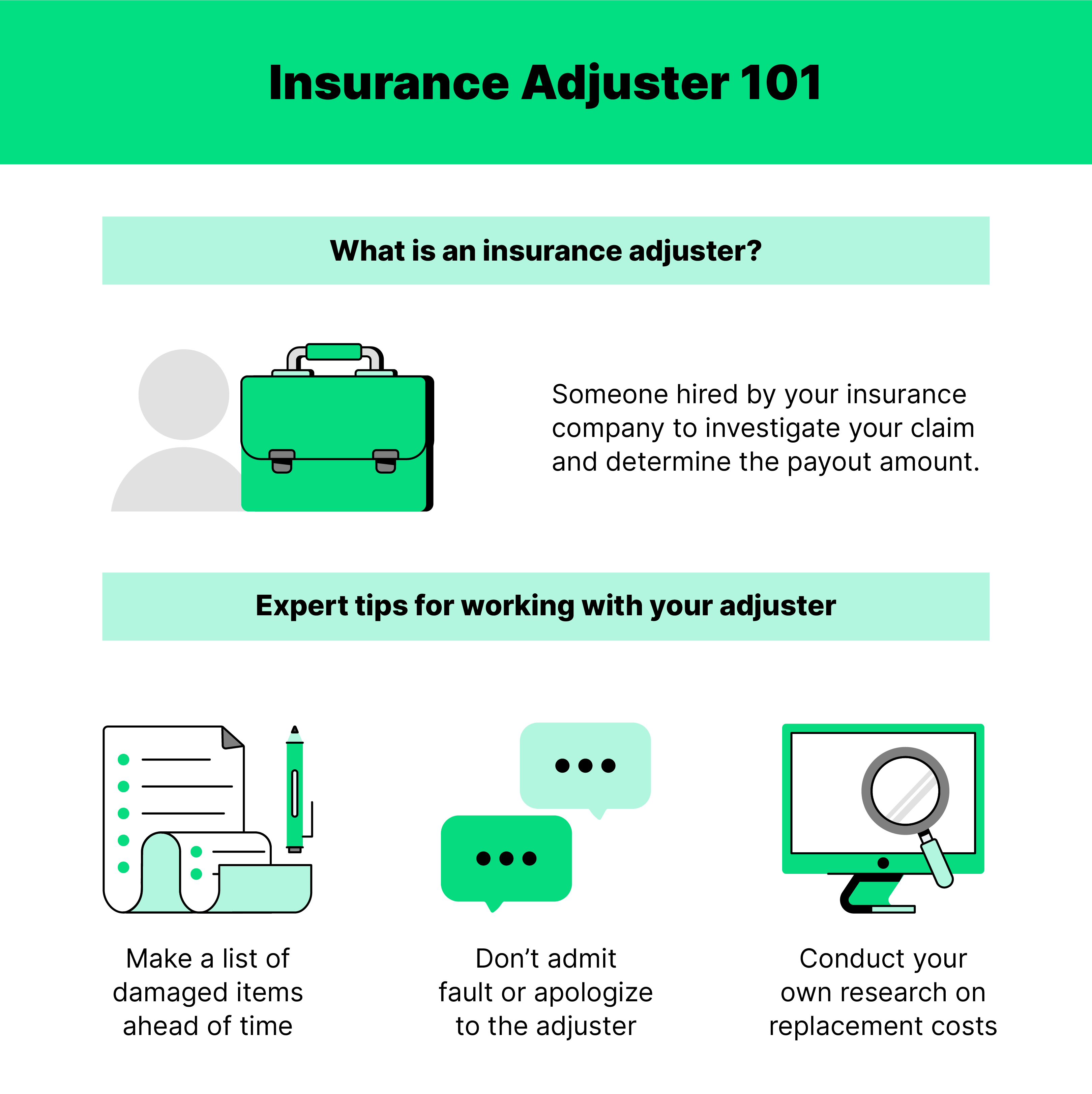

6. Meet with an insurance adjuster

The next step in the claims process is meeting with an insurance adjuster. An adjuster is someone hired by your insurance company to investigate the damage and determine how much it will cost to settle the claim. The insurance adjuster will assess the damage, pore over all the documents and interview the homeowners and any witnesses if need be. This process helps the adjuster determine what (or who) is at fault and if there is coverage for the damage under your policy.

You can prepare for your meeting with the adjuster by gathering all the necessary documents beforehand and notifying any witnesses about the meeting so they can be there and provide a third-party opinion.

7. Get an estimate for repairs

Though your insurance provider will conduct their own research into how much it will cost to repair any damage or replace your belongings, it’s also a good idea to get your own estimates as well. This will ensure you receive enough money to cover the costs and that you are working with a decent contractor.

Before settling your claim, consider getting several quotes from licensed contractors or appraisal experts and give these estimates to your insurance provider as proof of cost.

8. Settle your claim and schedule repairs

The final step in your claim process is to settle the claim. Settling refers to an official closing on the claim, when both parties have agreed to the payout amount. Once the claim is settled, you’ll receive a check from your insurance company to complete the repairs within a specified amount of time. Once you receive the check, get your repairs scheduled soon to avoid any issues with the payment.

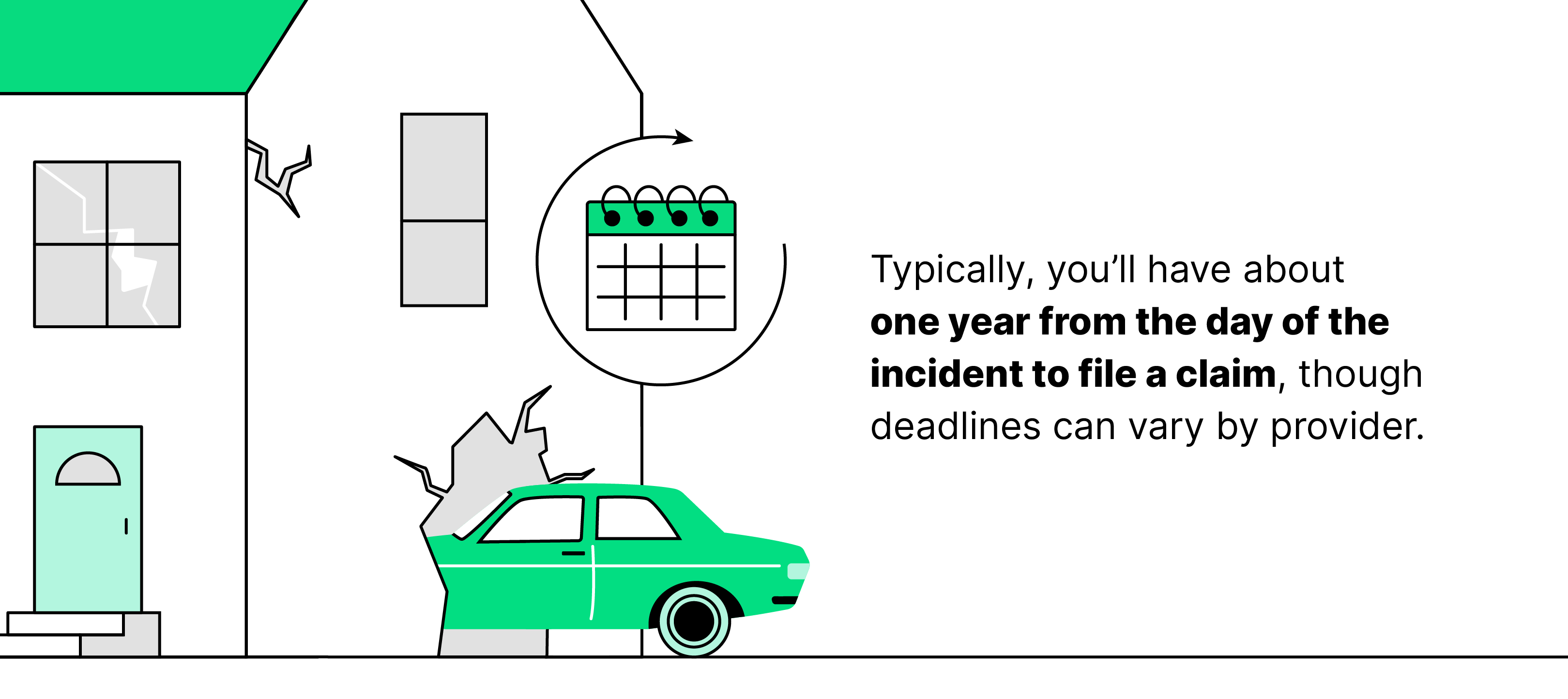

How long do you have to file a home insurance claim?

Typically, you can expect to have one year from the day of the event to file a home insurance claim, including property damage, theft and liability issues. However, not every insurance provider is the same, meaning you’ll need to read your policy carefully to determine your exact requirements.

For example, most insurance providers will use the term “prompt” when explaining how quickly their customers need to file a claim. But if you read the fine print, “prompt” could mean anything from a few months to an entire year.

Understanding this deadline is crucial to making sure you actually receive the coverage and assistance you need. If you wait too long to file, your provider may not cover the incident (or they may only cover a small portion). This is due to the fact that waiting to file may have caused extraneous damage that was preventable if you had filed immediately after the incident.

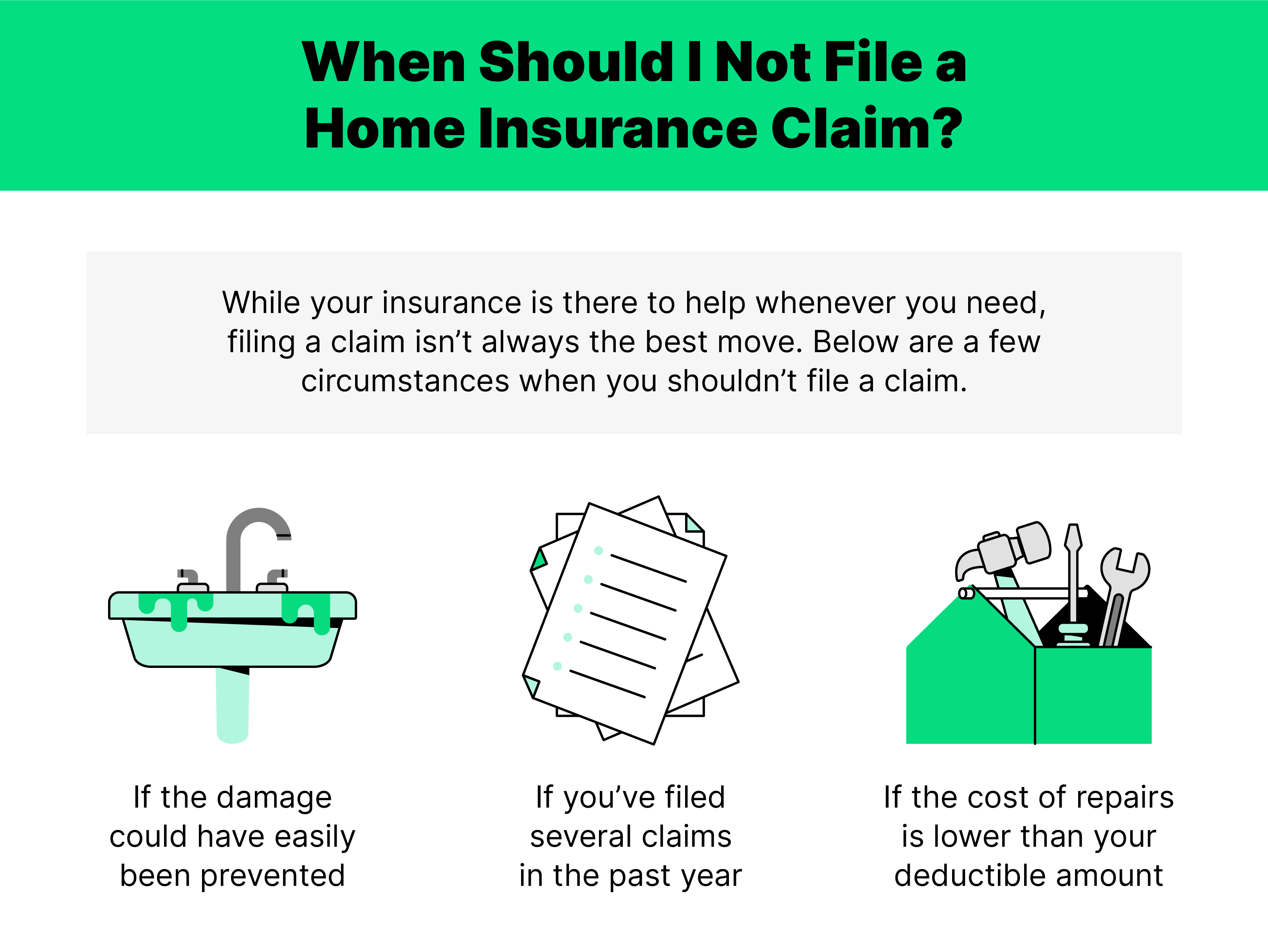

Is there a downside to filing a homeowners insurance claim?

Since you pay your home insurance provider to provide assistance in the event of damage or theft, there can’t be a downside to filing a claim, right? Well, the answer is complicated. While you should, of course, lean on your provider when you need help, you could risk your rate going up if you file too many claims within a short period of time.

If you file a claim on an issue that could’ve been easily prevented, such as a water backup in your kitchen or theft after you left the door unlocked, you can expect your premiums to rise. Claims filed for issues outside of your control (like natural disasters) usually won’t cause a spike. Your claim history will also play a factor here, so make sure to check out your CLUE report to determine if filing would be worth it.

Home Insurance Claim FAQs

We know the claim process can be confusing, filled with insurance jargon, deadlines, and plenty of paperwork. To help lift the curtain on home insurance claims, we’ve broken down the most frequently asked questions so you can feel confident every step of the way.

- What are the leading home insurance claim types?

- According to home insurance statistics, the main home insurance claim types are wind, water, hail, and theft.

- How long should a home insurance claim take?

- To receive a payout from your home insurance company, it can take anywhere from several weeks to several months. How long your exact situation will take depends on state laws, your contract and the type of claim.

- Can you withdraw a homeowners insurance claim?

- After filing, you can still withdraw a home insurance claim by contacting your insurance provider. However, it’s worth noting that a canceled claim will stay on your CLUE record for the same amount of time as an approved claim.

- Is it worth claiming on home insurance?

- Submitting a claim with your home insurance is worth it when the cost of repairs is higher than your deductible amount. Otherwise, you’re better off paying for the repairs yourself.

- What should you not say to an insurance adjuster?

- When working with an insurance adjuster during the claims process, make sure never to admit fault or take the blame for the incident. In addition, you should avoid making statements about your health or saying anything on the record that could be used to deny your claim.

We may be named after an animal, but we pride ourselves on the human touch we provide to the typically stuffy claims process. That’s why we created our 24/7 claims concierge, to be there for you anytime you need us.

In the market for a new provider after a recent claim process gone wrong? Give us a call to learn about our modern policies.