Hippo Resilience Report: Best States for Climate Change

The climate is shifting, and homeowners are feeling the impact. According to our 2024 Housepower Report, 28% of homeowners ranked extreme weather preparedness as a top concern—up from 25% in 2023. This year-over-year increase reflects growing anxiety around climate-related risks, and homeowners have good reason to be wary.

In 2024, nearly half of U.S. homes (45%) faced at least one type of severe climate risk. Not only do these events pose a real threat to homeowners, but they also drive up insurance costs and put pressure on home values and maintenance budgets.

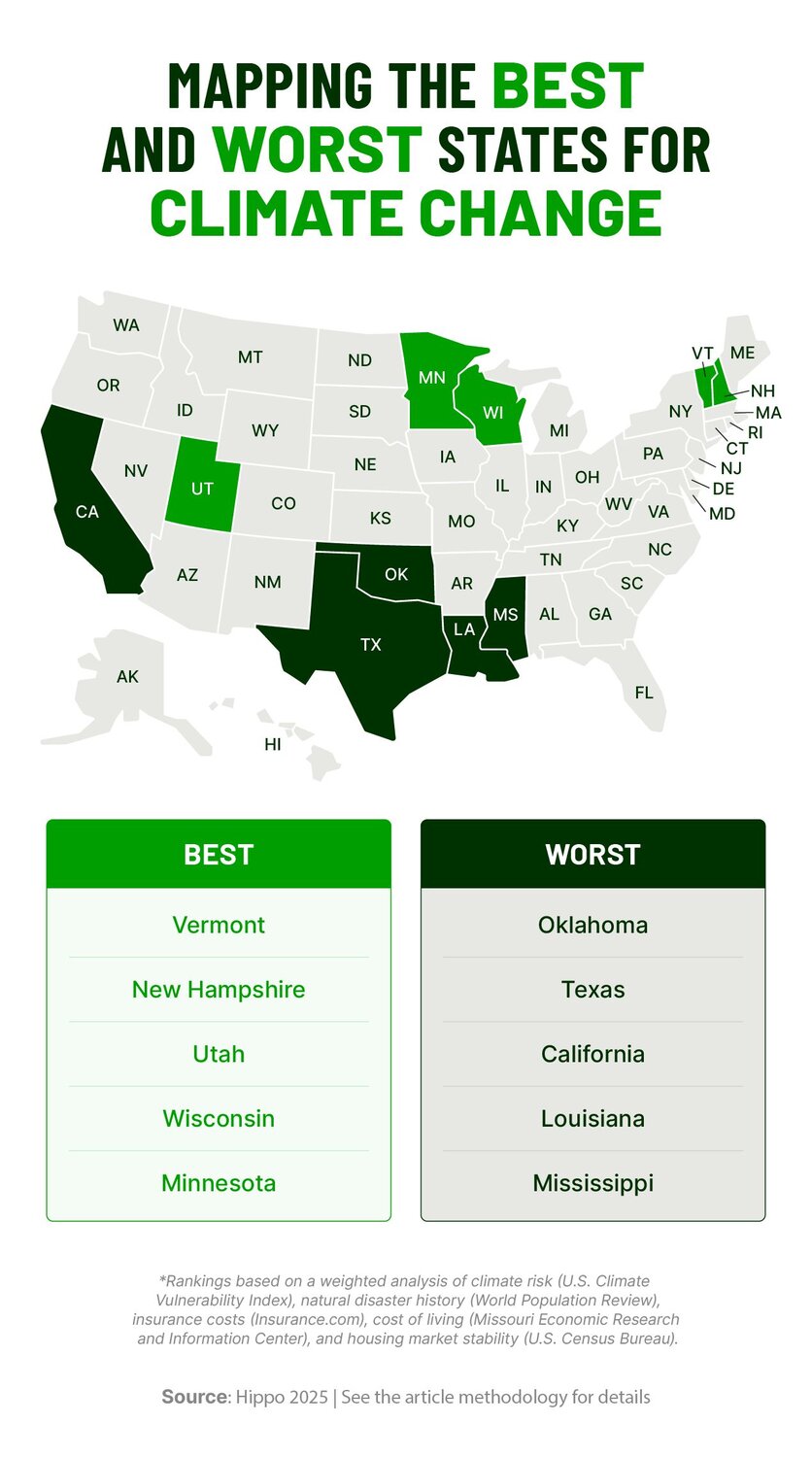

Given these increasing risks, some homeowners are considering relocation. To help with this decision, we identified the best and worst states for climate change, where homeowners generally experience more or less exposure to climate-related threats like hurricanes, wildfires, and more.

See our full methodology below for source links and a detailed breakdown of how we evaluated insurance costs, disaster risk scores, and other key factors.

The rising costs of climate risk for homeowners

"In 2024, when faced with unexpected repairs, many homeowners shelled out high out-of-pocket costs to manage their homes. We understand the importance of preventative care and are here to help homeowners confidently protect their homes, and in turn, their primary financial investment." — Rick McCathron, President and CEO of Hippo

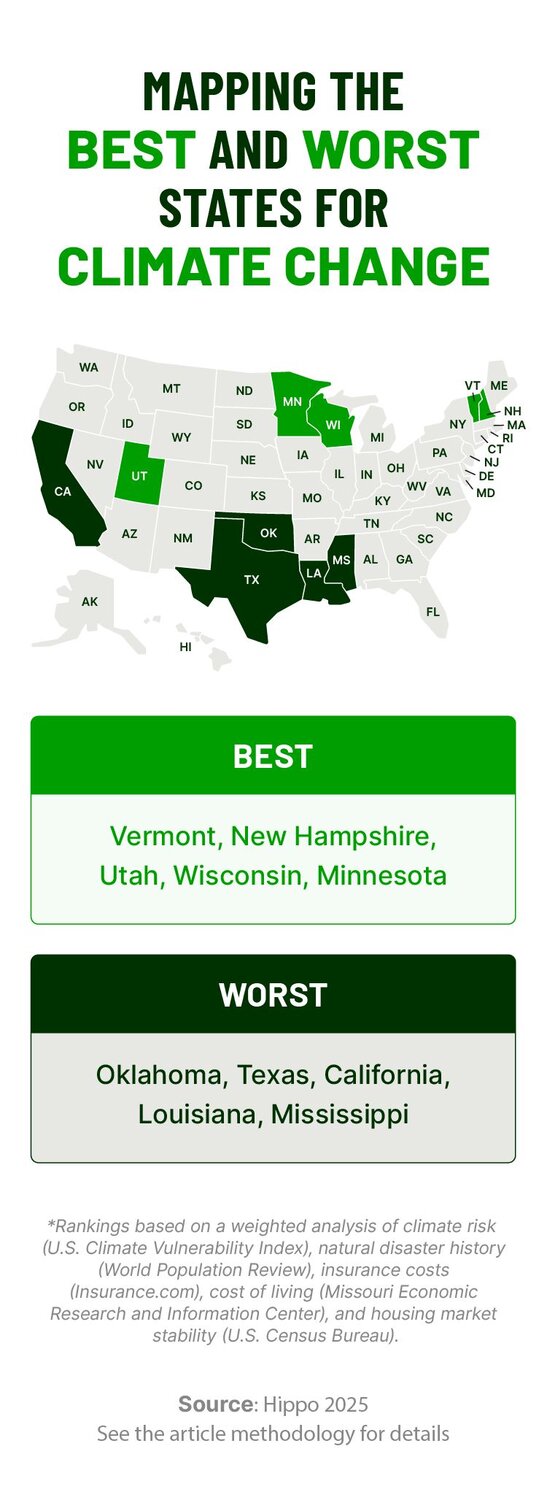

The top 5 best states to live in for climate change

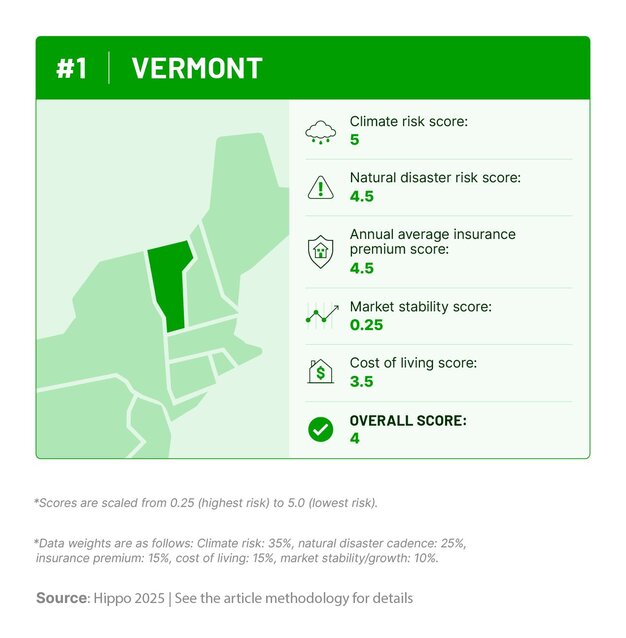

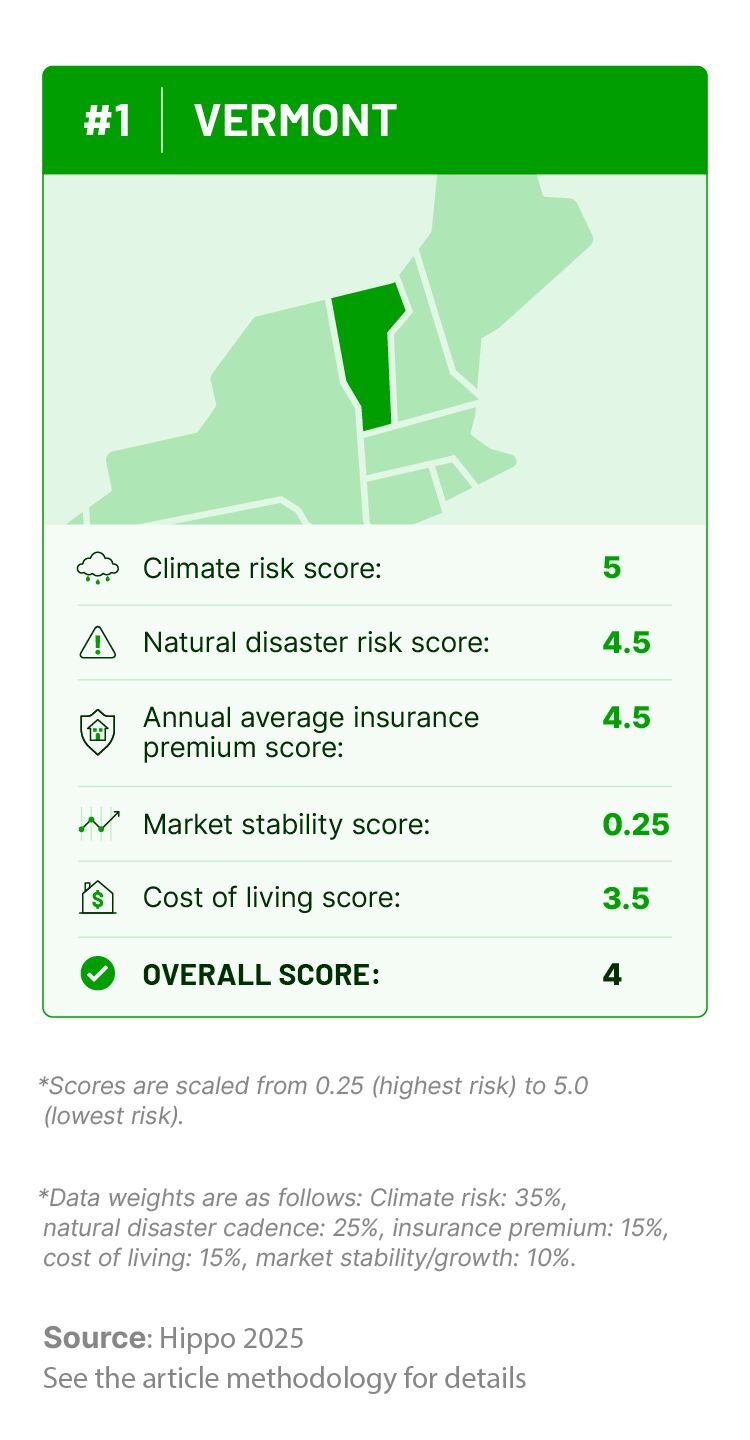

1. Vermont: Leading the way on renewable energy and net-zero homes

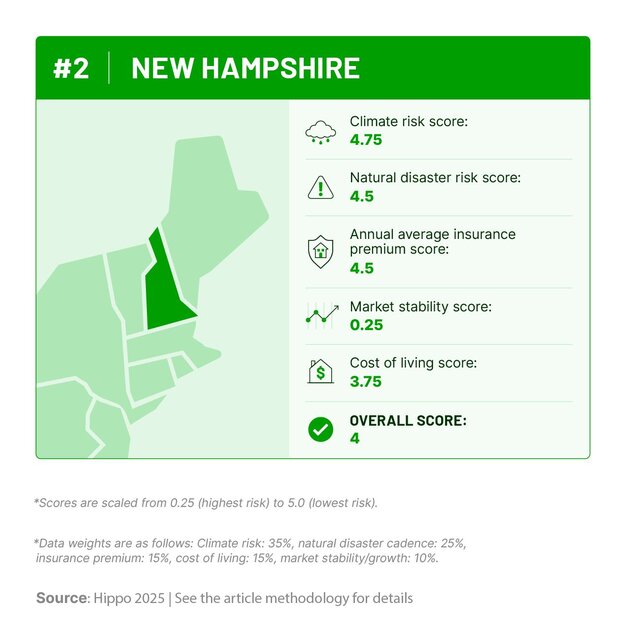

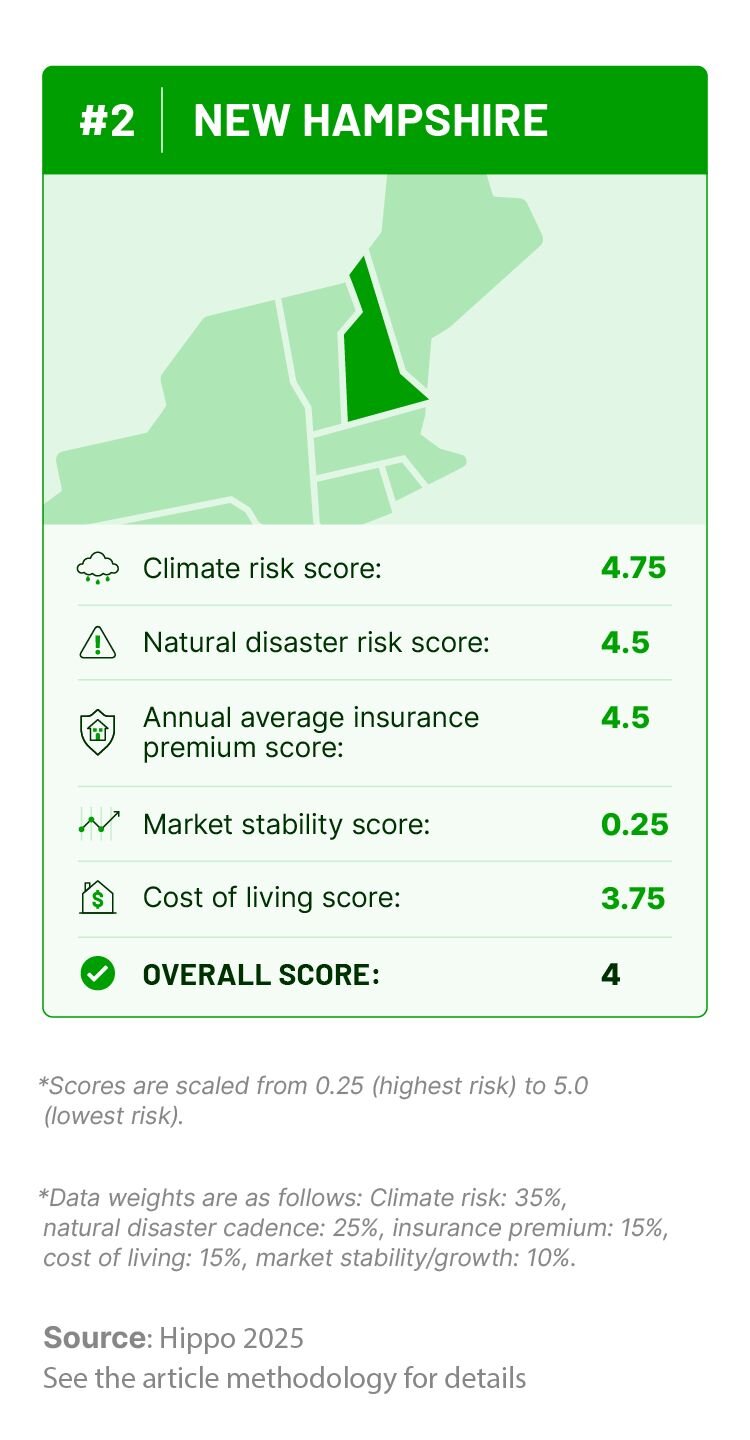

2. New Hampshire: Forest cover and forward-thinking coastal planning

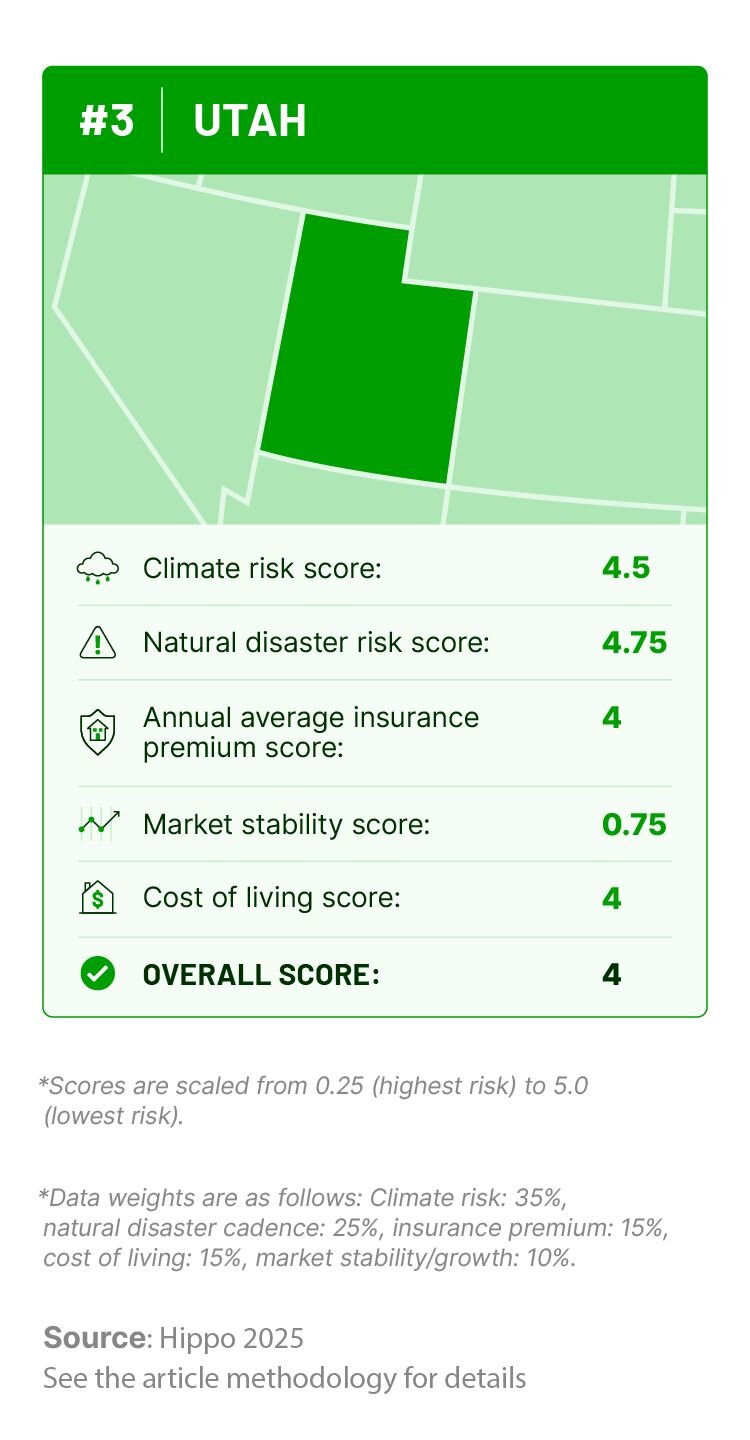

3. Utah: Climate buffers in the high desert

![Graphic outlining Utah’s climate risk, natural disaster history, insurance costs, cost of living, and housing market stability scores.]](https://cdn.builder.io/api/v1/image/assets%2F87a865fc472c4b69863d5e7f8aa60d5c%2F057bf214d1e34c318956c29b2f2a7892?width=626)

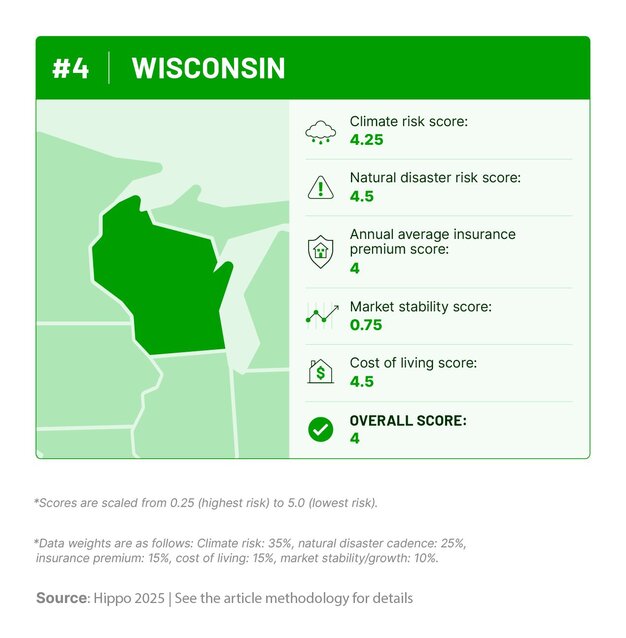

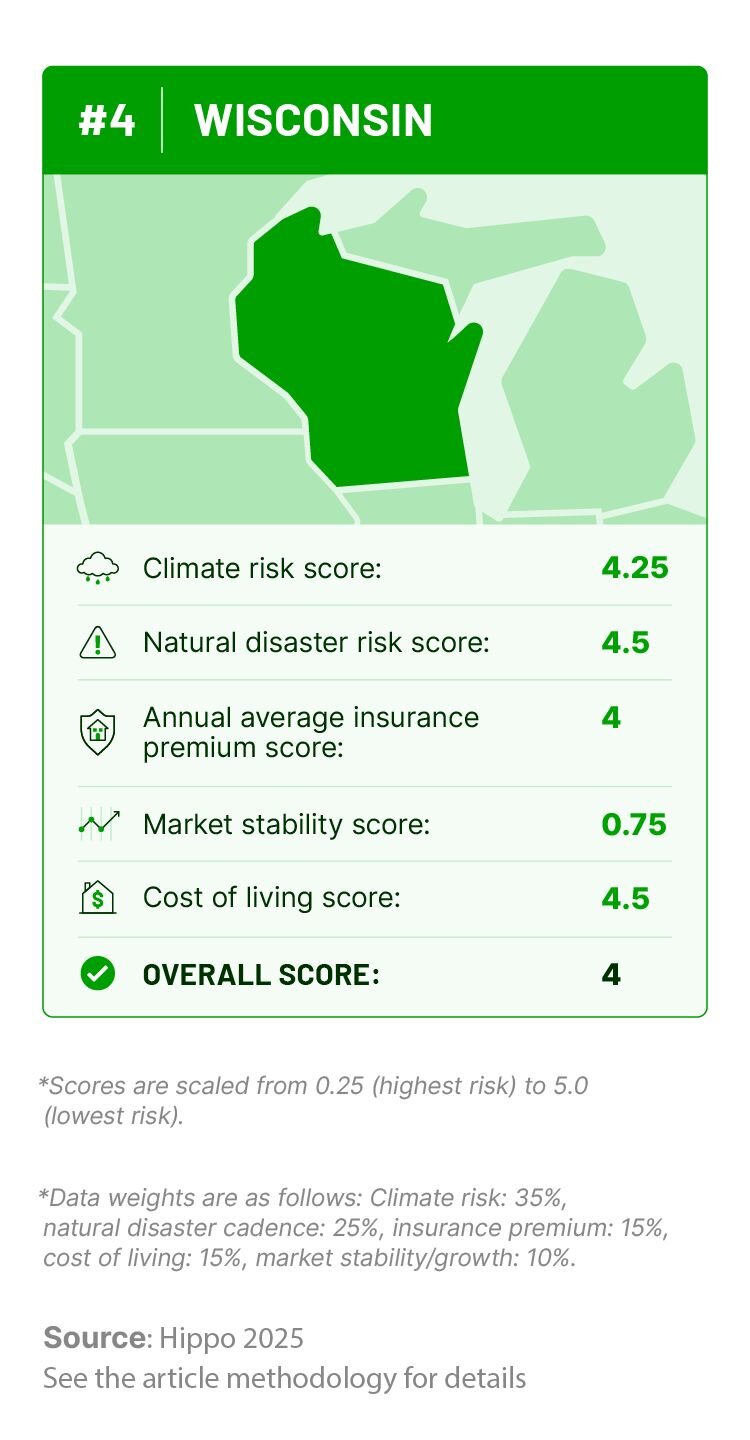

4. Wisconsin: Urban flood resilience meets affordable insurance costs

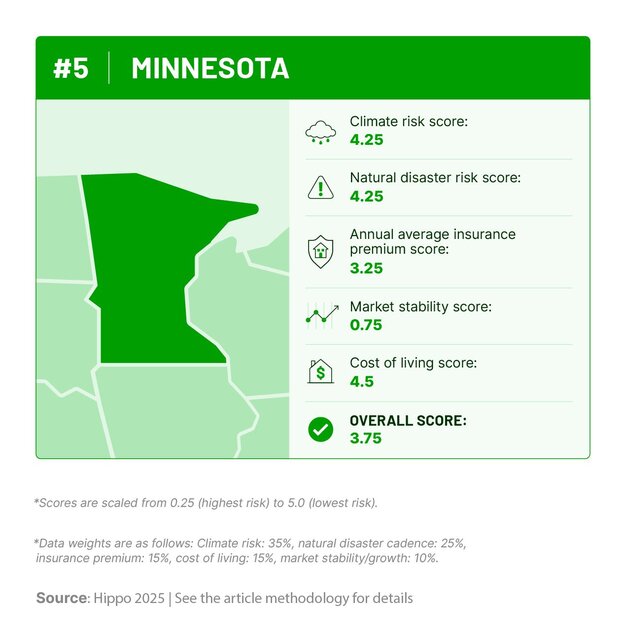

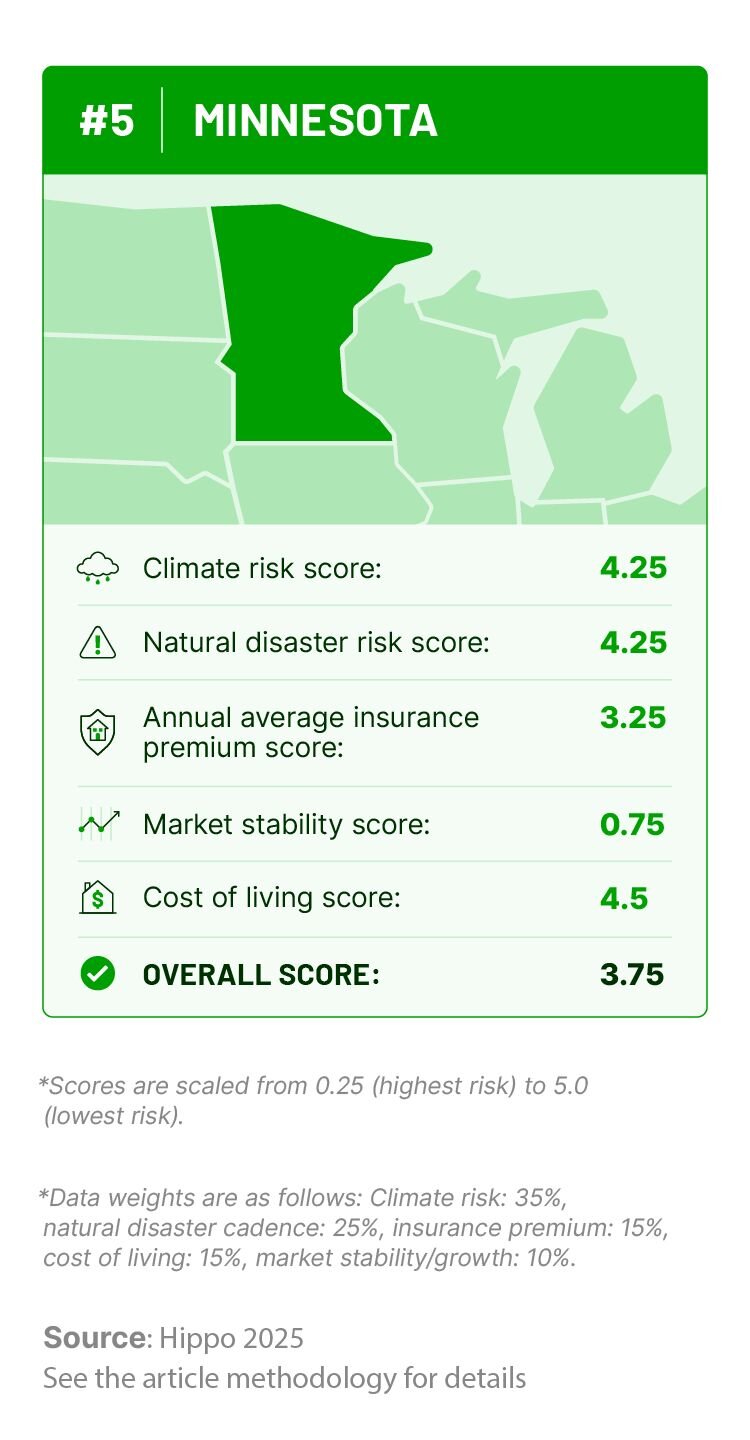

5. Minnesota: Freshwater access and cold-weather infrastructure

The top 5 riskiest states to live in for climate change

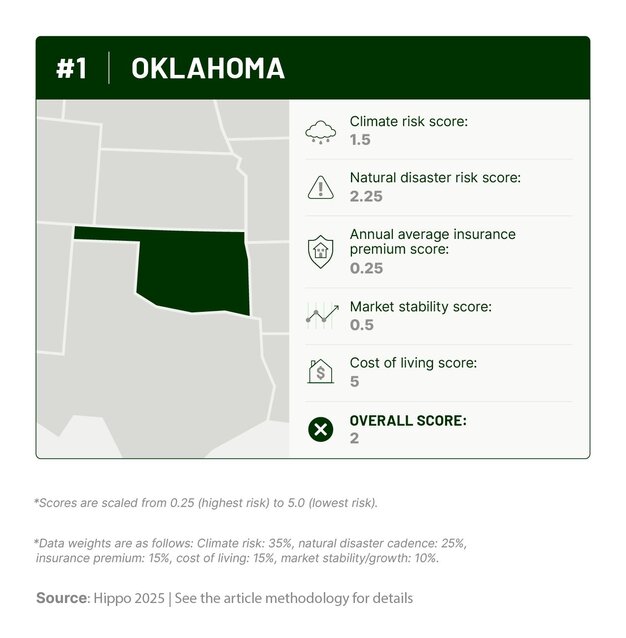

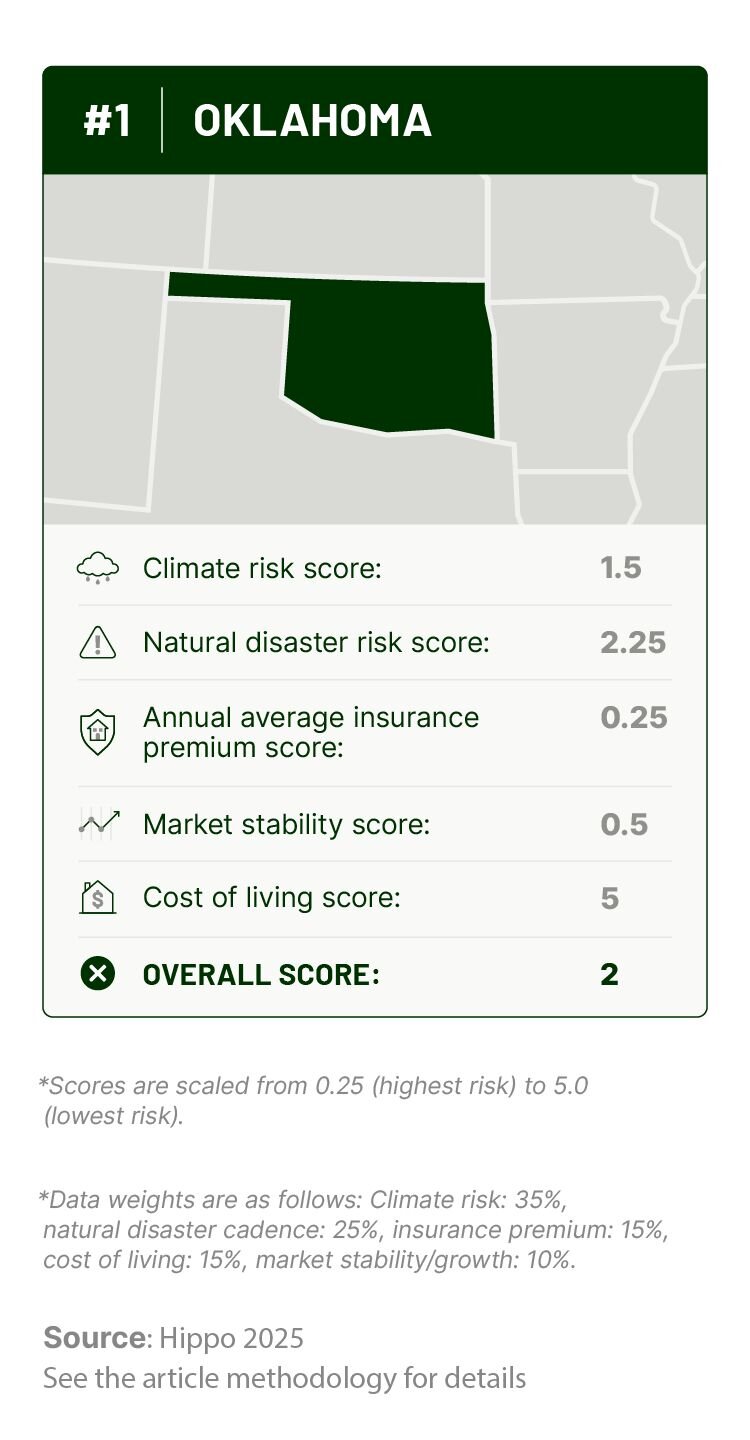

1. Oklahoma: Tornado risk and limited emergency infrastructure

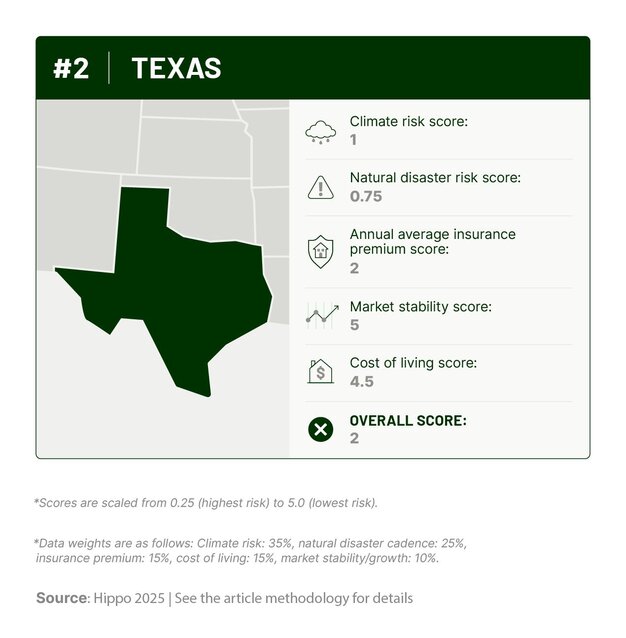

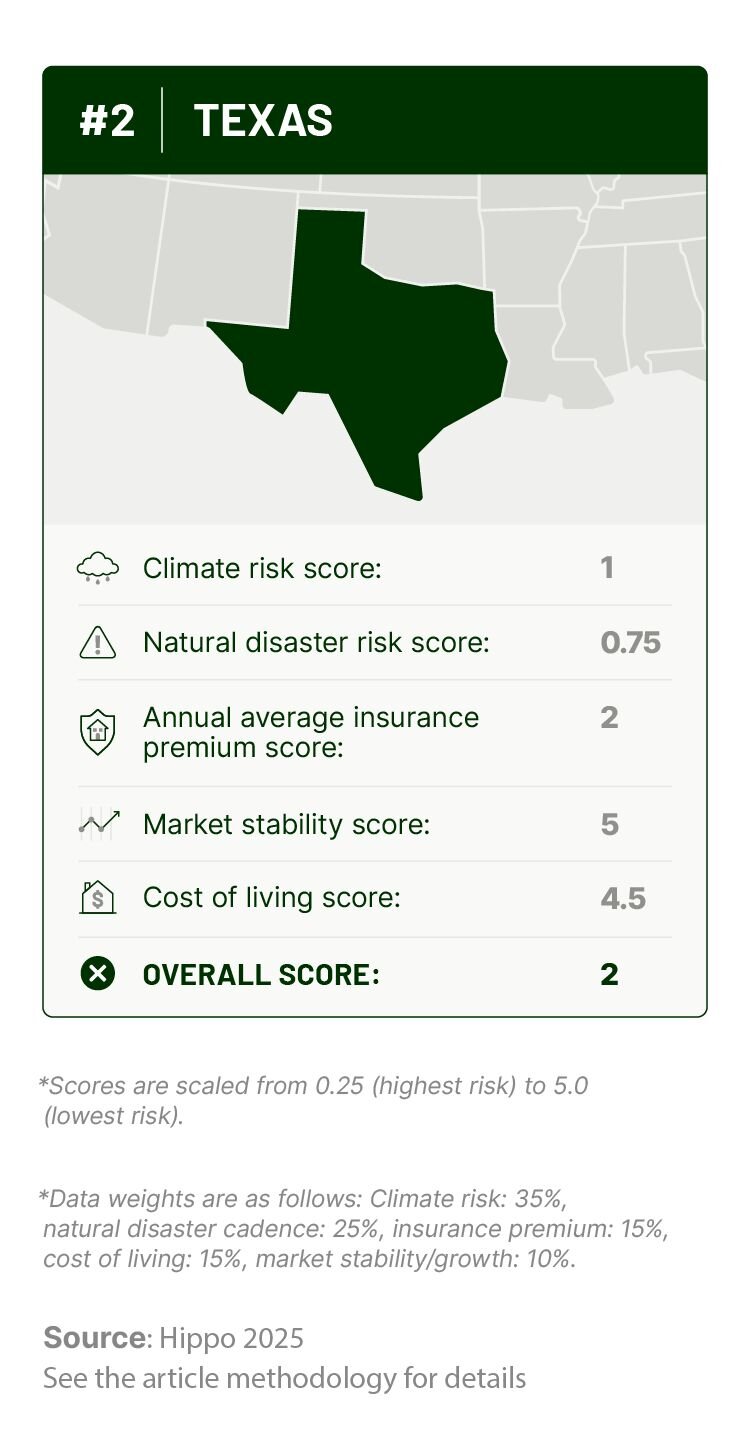

2. Texas: Sinking cities and rising insurance premiums

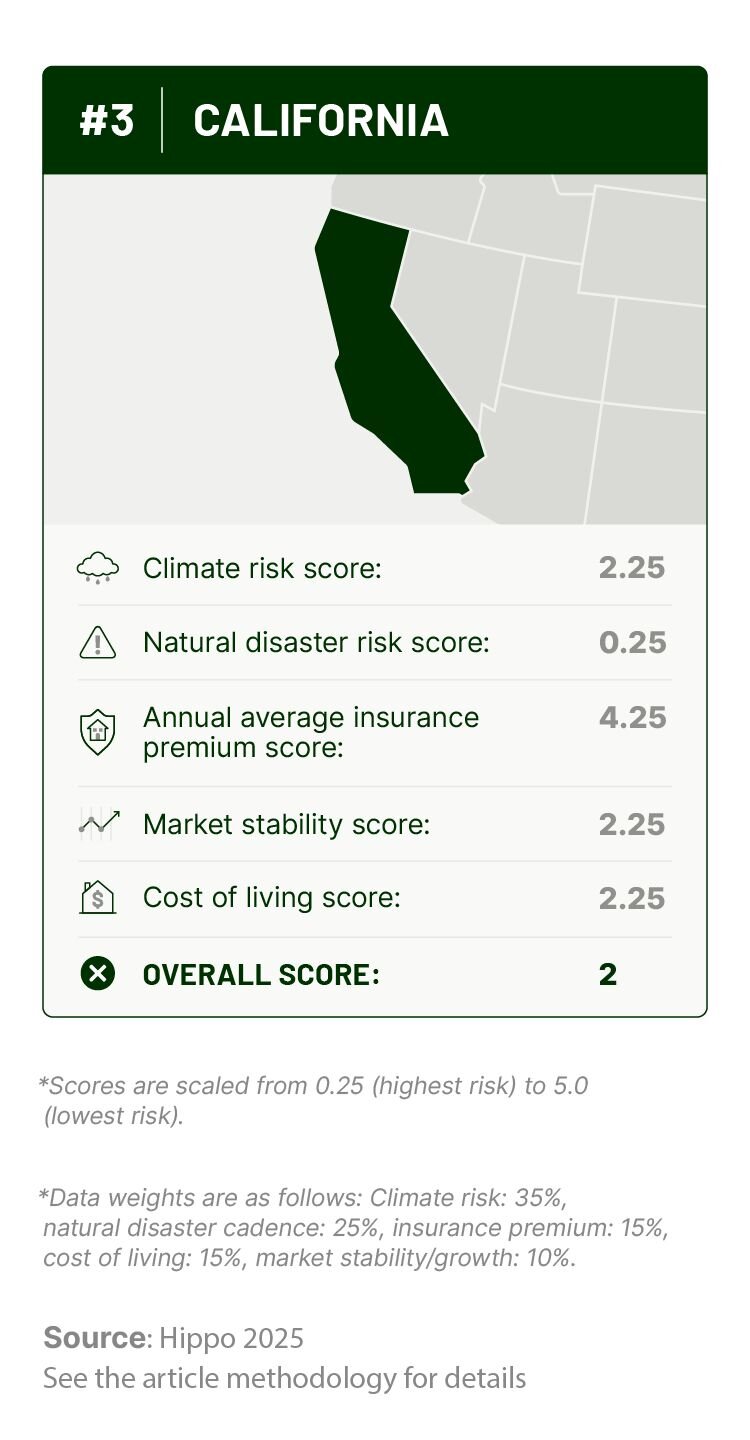

3. California: Wildfire zones pushing the limits of insurability

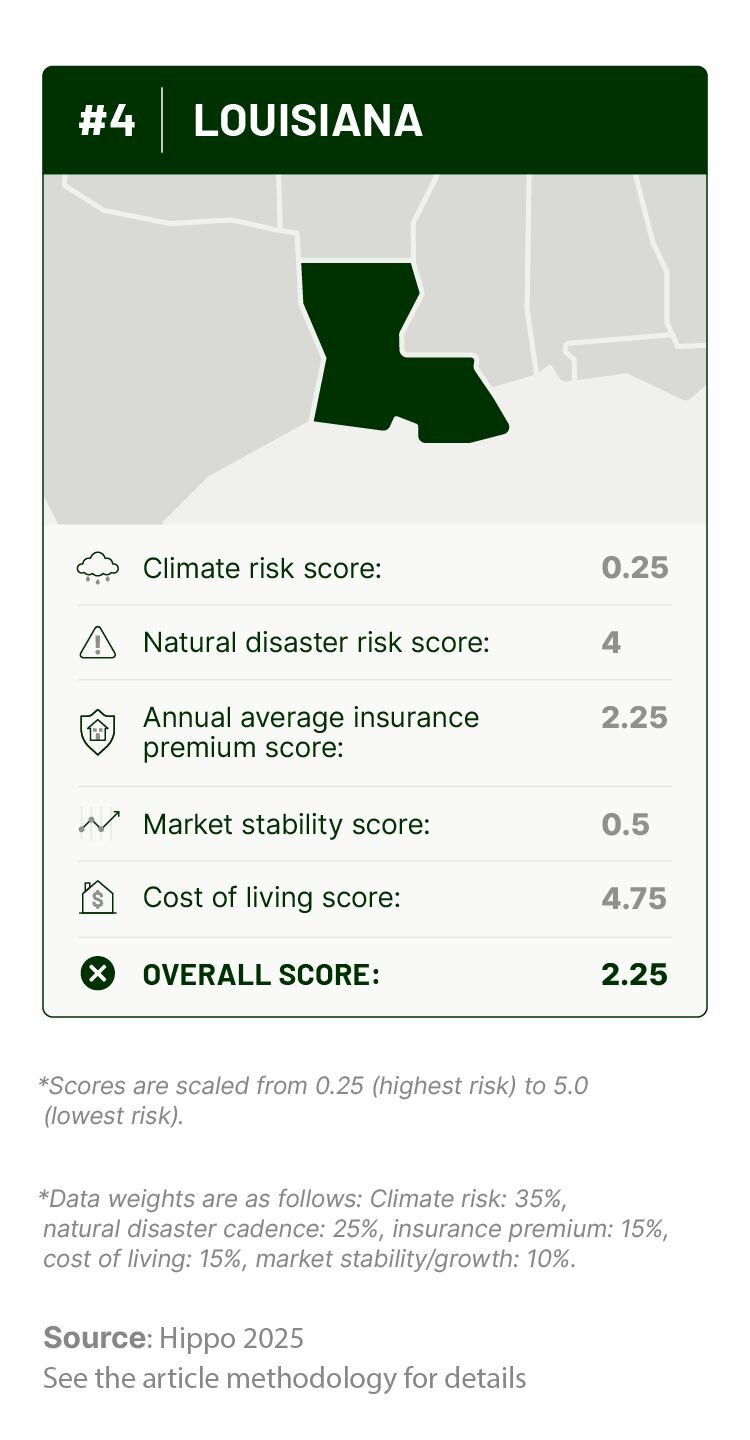

4. Louisiana: Rising seas and the high cost of recovery

![Graphic outlining Louisiana’s climate risk, natural disaster history, insurance costs, cost of living, and housing market stability scores.]](https://cdn.builder.io/api/v1/image/assets%2F87a865fc472c4b69863d5e7f8aa60d5c%2F9fab7405450642e8bc8d45fee1f793b1?width=626)

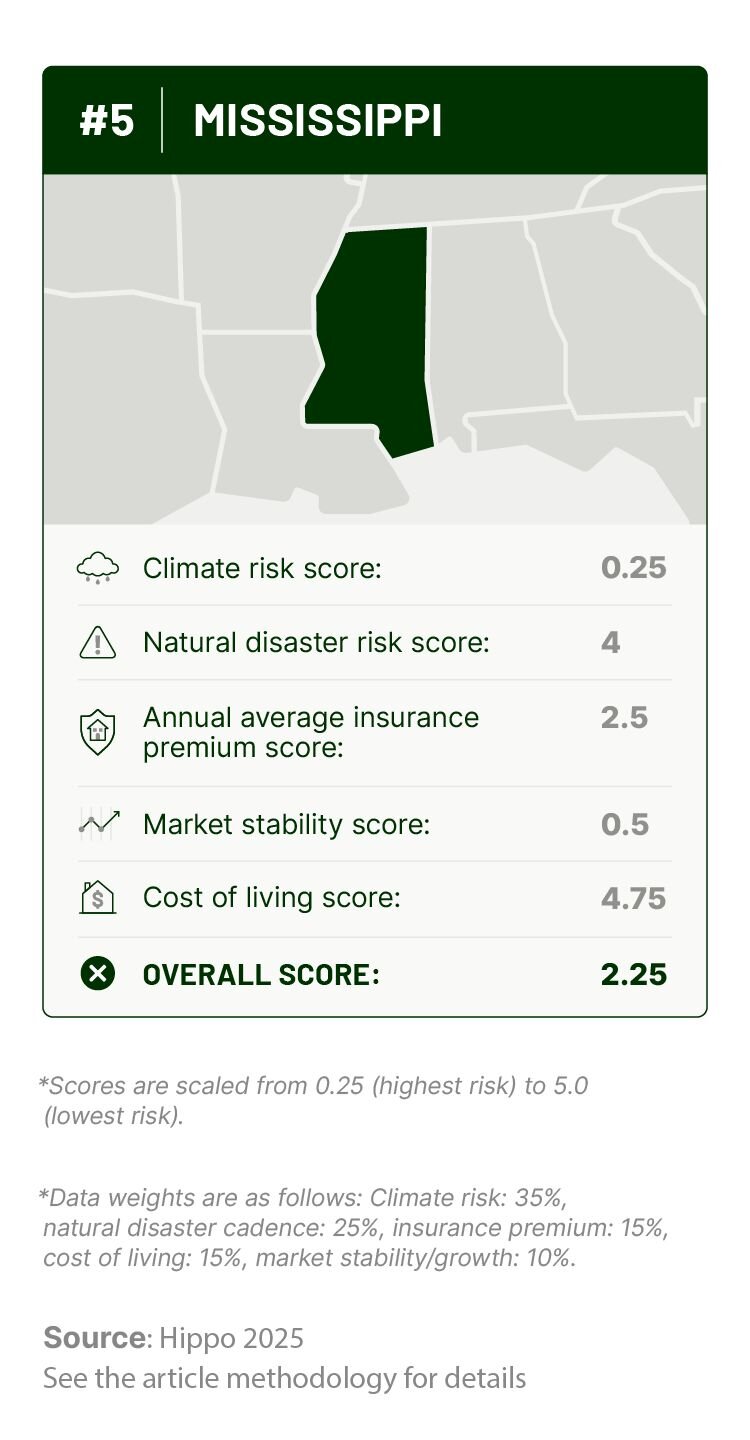

5. Mississippi: Flood-prone homes and economic hurdles

Tips for homeowners in states or cities with higher climate-related risks

- Consider installing hurricane shutters or reinforced windows to safeguard your home in areas prone to high winds (like those experiencing frequent tornadoes or hurricanes). These protective measures can help prevent damage from flying debris.

- To help minimize damage in flood-prone areas, install flood barriers, a sump pump, or even raise your home's foundation.

- To help protect homes in wildfire-prone areas, consider fireproofing measures like installing double-pane windows with tempered glass, regularly cleaning gutters of dry leaves and debris, and pruning trees and shrubs to maintain a distance of at least five feet from the home.

- To prepare for extreme cold or heat, ensure your home is well-insulated, and consider installing energy-efficient windows and HVAC systems. During seasons with extreme temperatures, have a backup heating or cooling plan in case of power outages.

- Make sure your policy covers climate-related events, such as wildfires, flooding, and hurricanes.

- Understand policy exclusions, like flood damage, and consider additional coverage if needed.

- Use Hippo’s Learn Center to stay informed about climate-related coverage options and how to protect your home.

- When buying a home, consider options built with disaster resilience. New construction homes often feature fire-resistant materials, elevated foundations, and better storm-proofing.

- Engage with local governments to learn about climate resilience initiatives and emergency preparedness plans.

- Stay informed about your community’s specific climate protocols and how they impact home safety and value.

Safeguard your home in a changing climate

Methodology: How we identified the best states for climate change

- 1Natural disaster cadence: We considered the number of federally declared natural disasters in each state since 1953, sourced from the World Population Review. A lower number of past disasters is considered more favorable.

- 2Climate risk: We utilized the U.S. Climate Vulnerability Index, where scores range from 1 to 50, with a higher score indicating lower vulnerability to climate change impacts.

- 3Average annual insurance premium: Data on each state's average annual homeowner's insurance premium was obtained from a 2023 to 2024 Insurance.com analysis. A lower premium is considered more favorable.

- 4Housing market stability/growth: We analyzed the number of new privately-owned residential construction permits issued in 2024, based on U.S. Census Bureau data. A higher number of permits indicates greater market stability and growth, which we consider favorable.

- 52024 annual average cost of living: To account for the overall affordability for homeowners, we incorporated the 2024 annual average Cost of Living Index for each state, sourced from the Missouri Economic Research and Information Center. A lower cost of living is considered more favorable.

- Climate risk: 35% weight

- Natural disaster cadence: 25% weight

- Average annual insurance premium: 15% weight

- Annual average cost of living: 15% weight

- Housing market stability/growth: 10% weight

Related Articles

How to Help Climate Change at Home

Homeowners vs. Extreme Weather: Year-Over-Year Trends [2025]

Severe Weather Prep Report: How Homeowners Are Bracing for Costs

52% of Homeowners Ignored Extreme Weather Risks Before Buying—Now Emergency Funds Are at the Forefront

Homebuyers Want Disaster-Resilient Homes and 88% Will Pay More for Them