The 20 Best Cities to Buy a Second Home

Buying a second home may seem like a pipe dream, something reserved for only the most well-off. But in reality, that’s far from the truth. Buying a second home is more doable than you might think for homeowners of all income levels who are looking to make a property investment or just have a place to vacation. According to a Redfin study, demand for second homes skyrocketed over the pandemic, growing an astonishing 84% year over year.

Where you purchase your second home can make or break your investment, not to mention how much enjoyment you get from your new pad. To help ensure you make the right decision for your needs, the team at Hippo analyzed data such as median home costs, average home insurance premiums, property value gain, crime rates and much more for the 100 most populous cities across the nation. Below, we break down the top cities in every region of the U.S. that are worth investing in.

Table of Contents:

Top cities for a second home

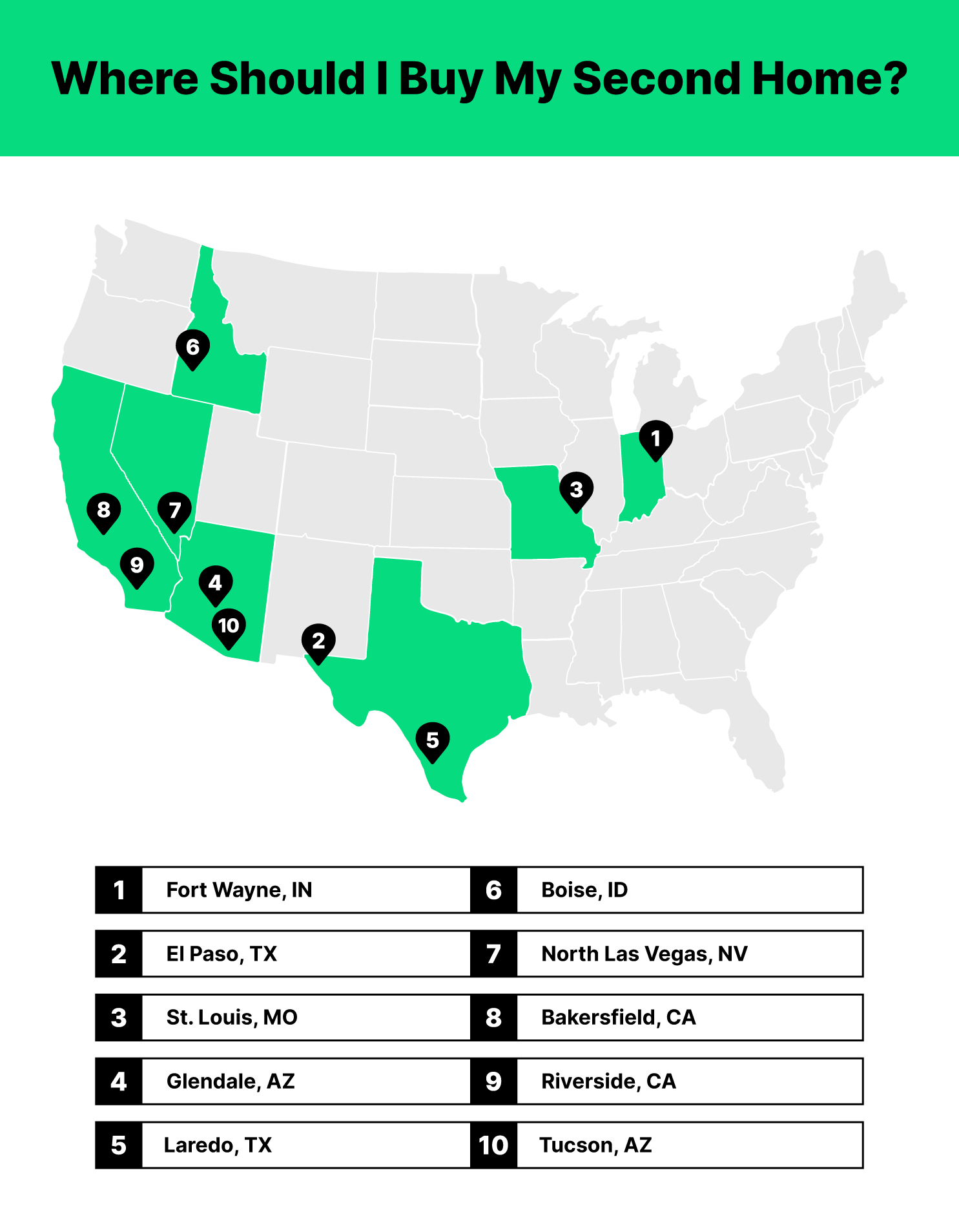

If you don’t have your heart set on living in any particular part of the country but feel you’re financially ready to buy a second home, consider any of the following cities to settle down. With low median housing prices, relatively low property crime rates and high walkability scores and comfort indexes, these cities are perfect for families and young homeowners alike.

- Fort Wayne, Indiana

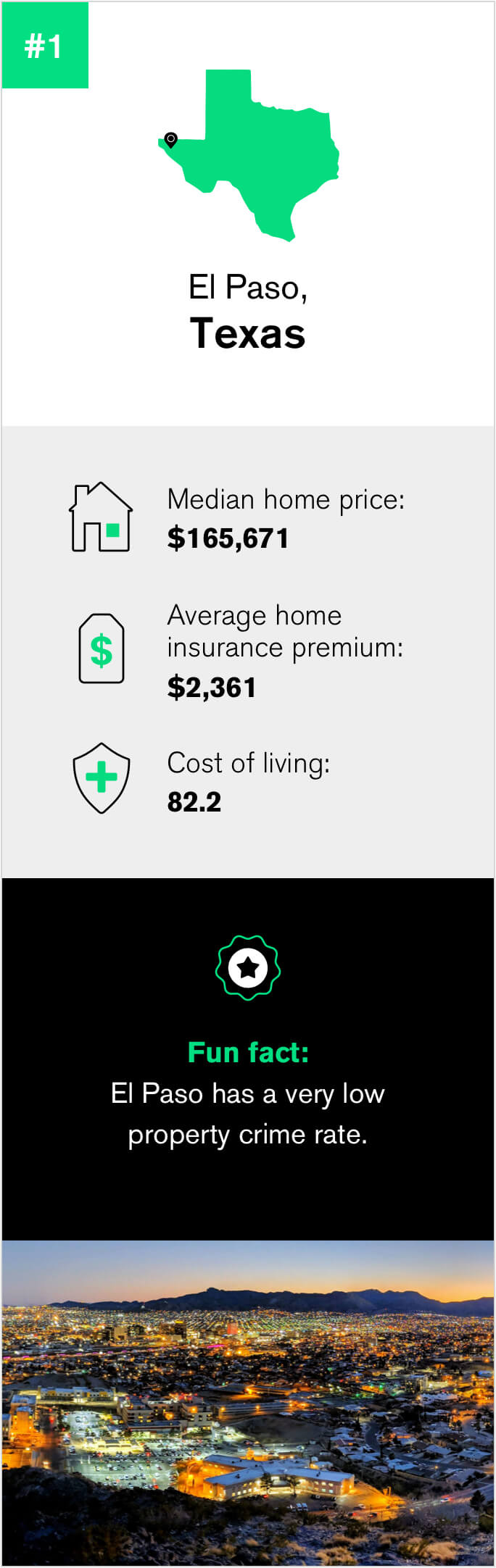

- El Paso, Texas

- St. Louis, Missouri

- Glendale, Arizona

- Laredo, Texas

- Boise, Idaho

- North Las Vegas, Nevada

- Bakersfield, California

- Riverside, California

- Tucson, Arizona

To learn more about what makes these cities so exceptional, keep reading for our regional breakdown.

5 best Southern cities to buy a second home

There’s a lot to love about the South. From good old Southern hospitality to the best BBQ and fried chicken around, it’s no surprise that so many people are moving to this part of the country in recent years. And while places like Austin, Texas, may be all the rage, high housing prices are starting to make cities like this unattainable for the average homeowner.

Below are the top five cities in the Southern portion of the U.S. poised for an Austin-like boom over the next few years, meaning if you get in now, you will likely see a terrific return on your investment. Plus, you can enjoy all the cities have to offer in the best way possible — as a local!

-

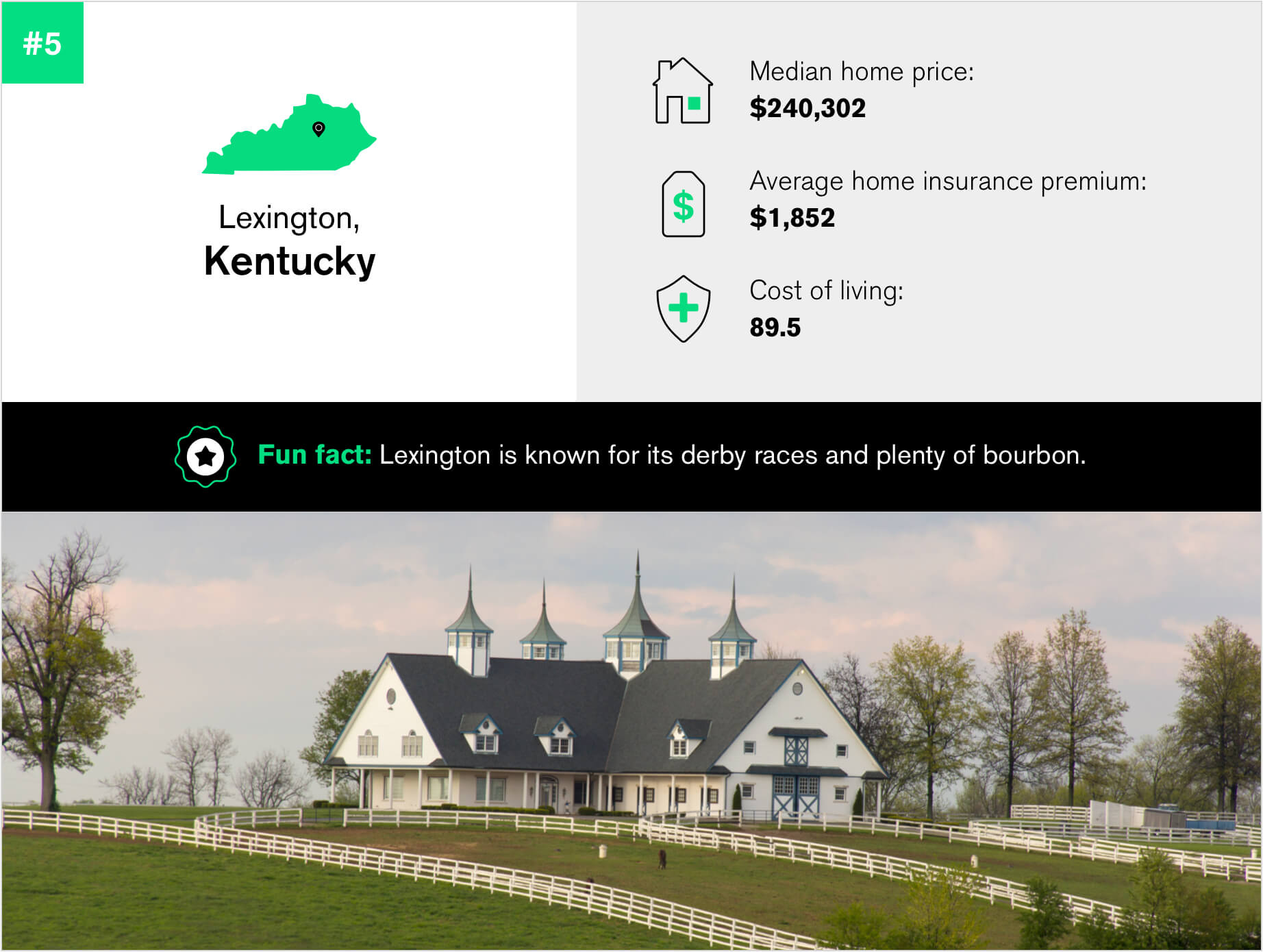

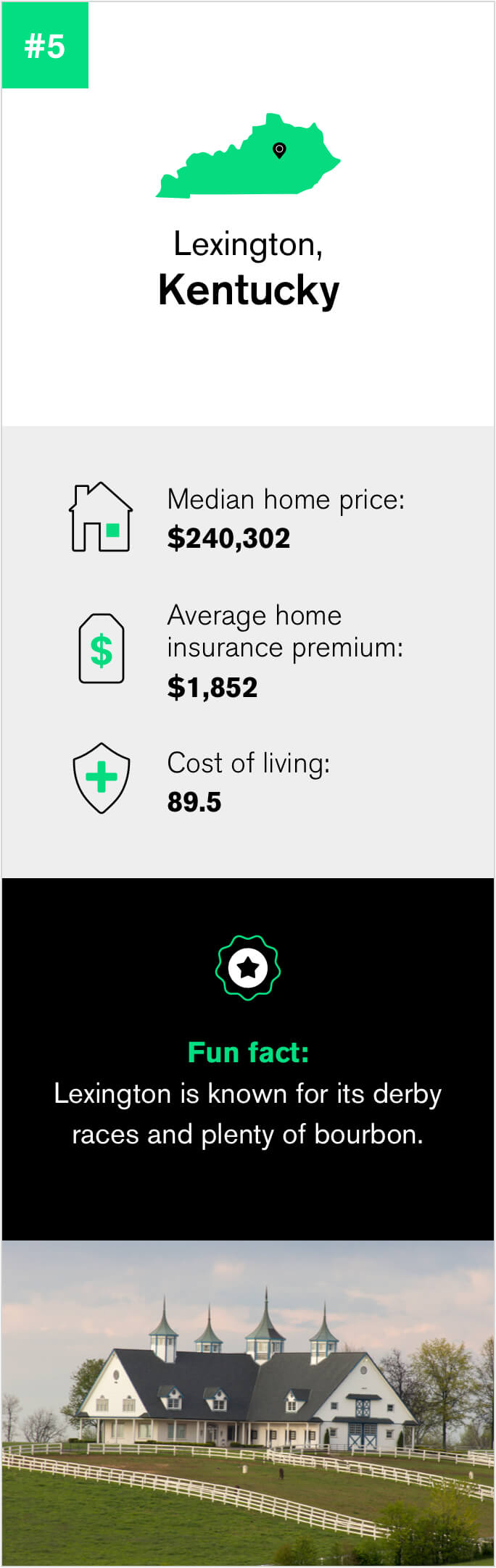

Median home price $240,302 Average home insurance premium $1,852 Property value gain over the last 10 years 53.05% Comfort index 7.3 Cost of living 89.5 Percentage of those who own their home 54% Property crime rate 471.4 (U.S average is 500.1) Walkability score 34 Nestled in the heart of Kentucky is Lexington, a town known for its horses, bourbon and festivals that draw in sizable crowds from across the country every year. With a lower property crime rate and cost of living than the nationwide average, Lexington is a smart move for those wanting to soak in the city’s rich history, art and culture (or just watch a derby or two). The city is even home to some of the nation’s best hospitals and colleges, making it a tremendous place to settle down no matter where you’re at in life.

-

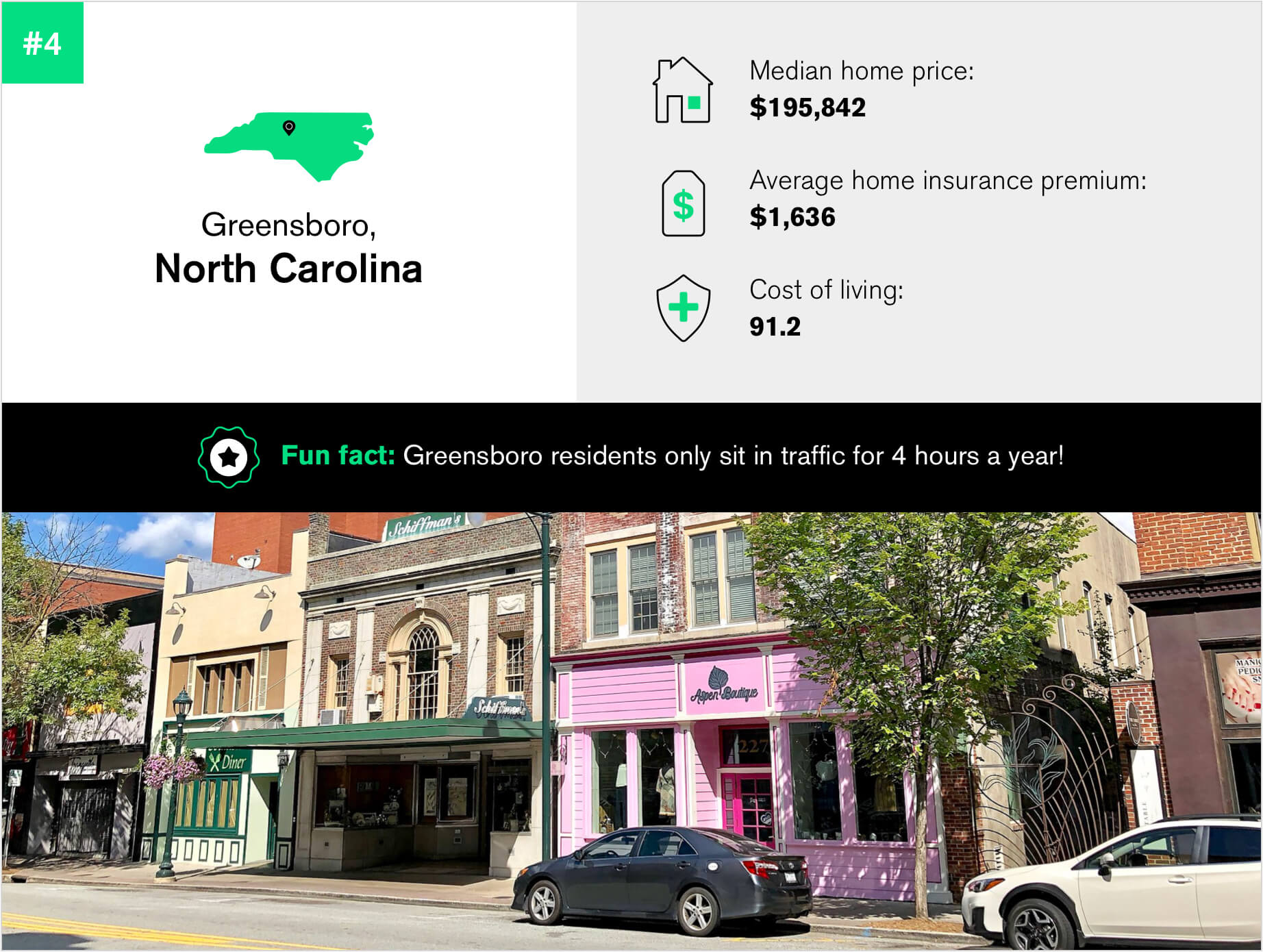

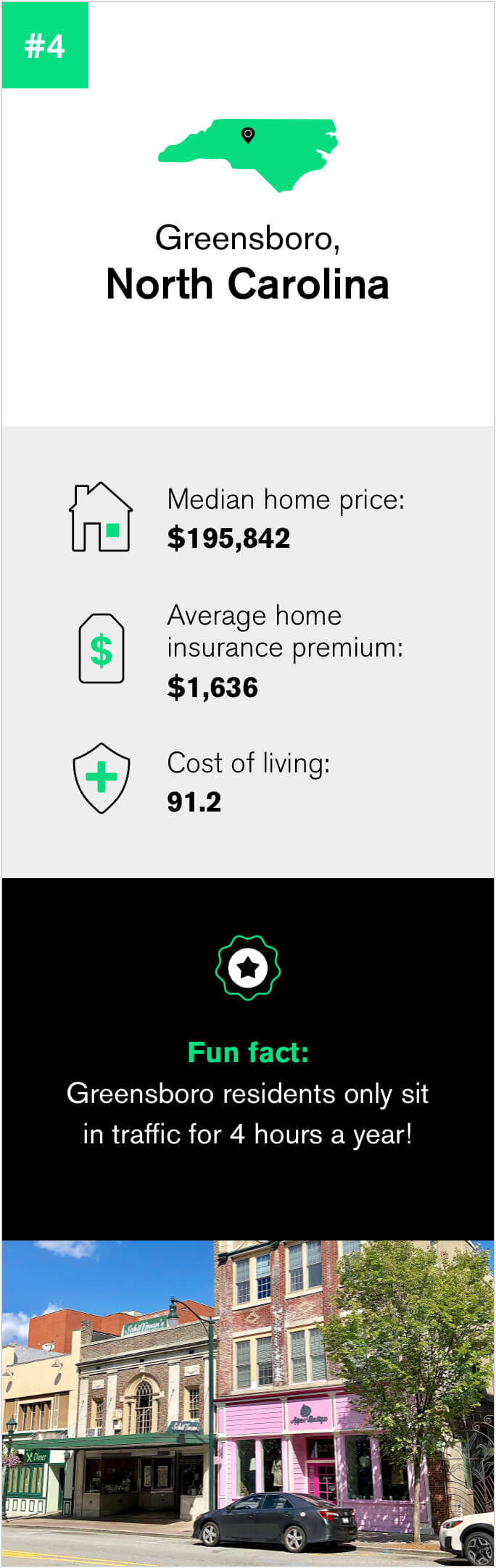

Median home price $195,842 Average home insurance premium $1,636 Property value gain over the last 10 years 53% Comfort index 7.6 Cost of living 91.2 Percentage of those who own their home 50% Property crime rate 743.2 (U.S. average is 500.1) Walkability score 29 If you’re looking to buy a home where you can not only experience all four seasons but where both mountains and beaches are just a short drive away, look no further than Greensboro, North Carolina. Nicknamed “Tournament Town” for its vast array of college sports, Greensboro is a wonderful place to settle down if you want to get behind a great team and feel the comradery throughout the community. Add to that a low median home price, little to no traffic and a 53% increase in property value over the last 10 years, and it’s not hard to see why Greensboro made it to the fourth spot on our list.

-

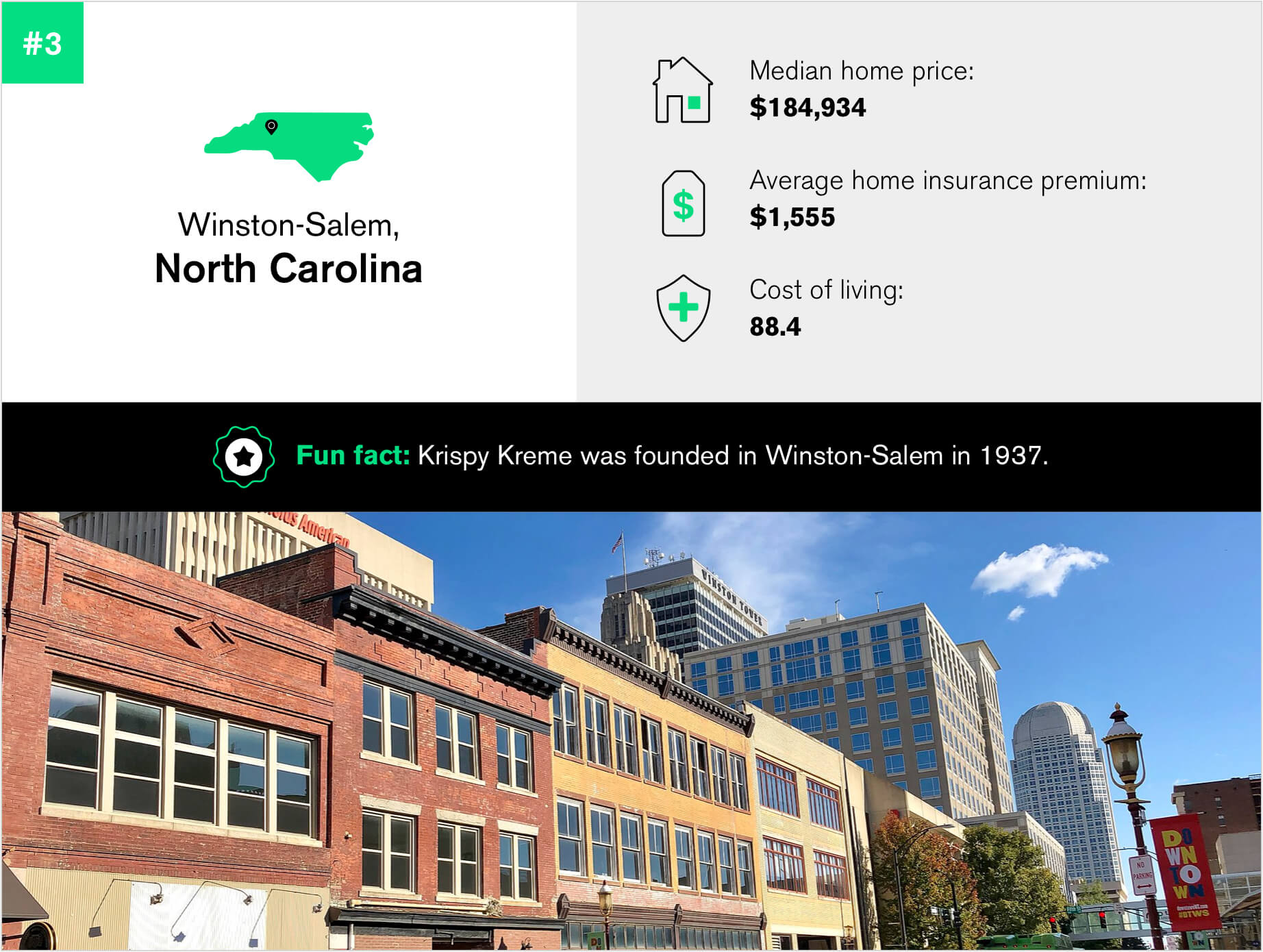

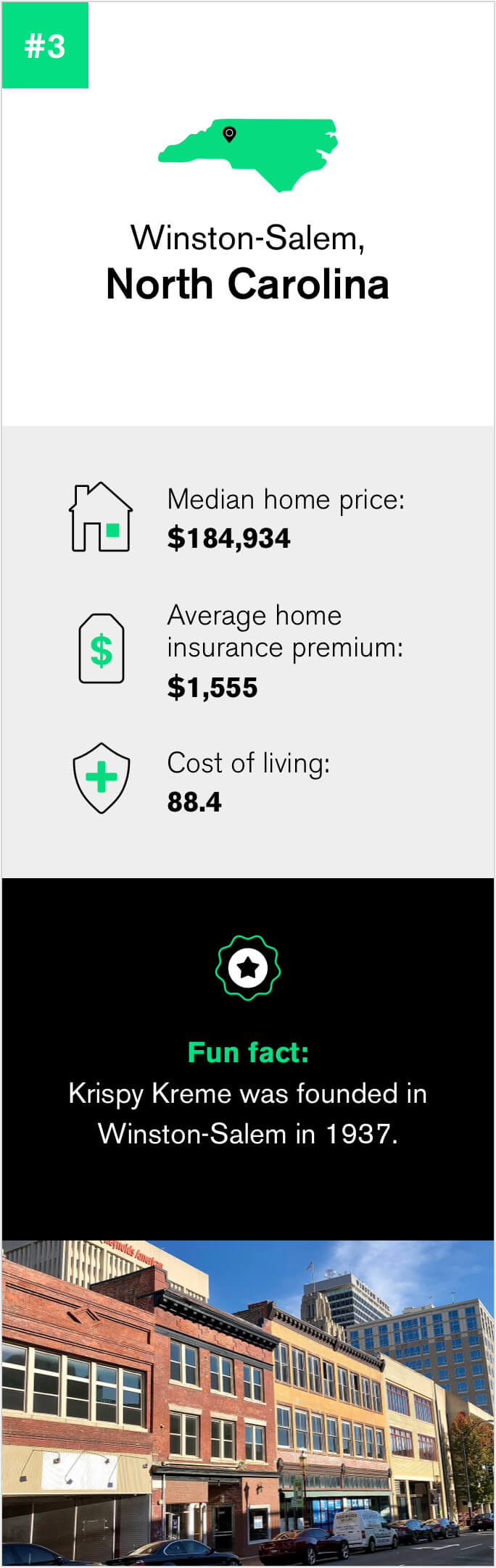

Median home price $184,934 Average home insurance premium $1,555 Property value gain over the last 10 years 52.83% Comfort index 7.6 Cost of living 88.4 Percentage of those who own their home 53% Property crime rate 1,564.2 (U.S. average is 500.1) Walkability score 23 Who wouldn’t want to live in the town where Krispy Kreme was invented? Though it’s worth noting that Winston-Salem has much more to offer than just donuts. This hip and historic town boasts an extensive roster of attractions, exceptional restaurants and year-round entertainment made for families and bar crawlers alike. And with low housing and insurance premium averages, you’ll have plenty of cash left over to get in on all the fun.

-

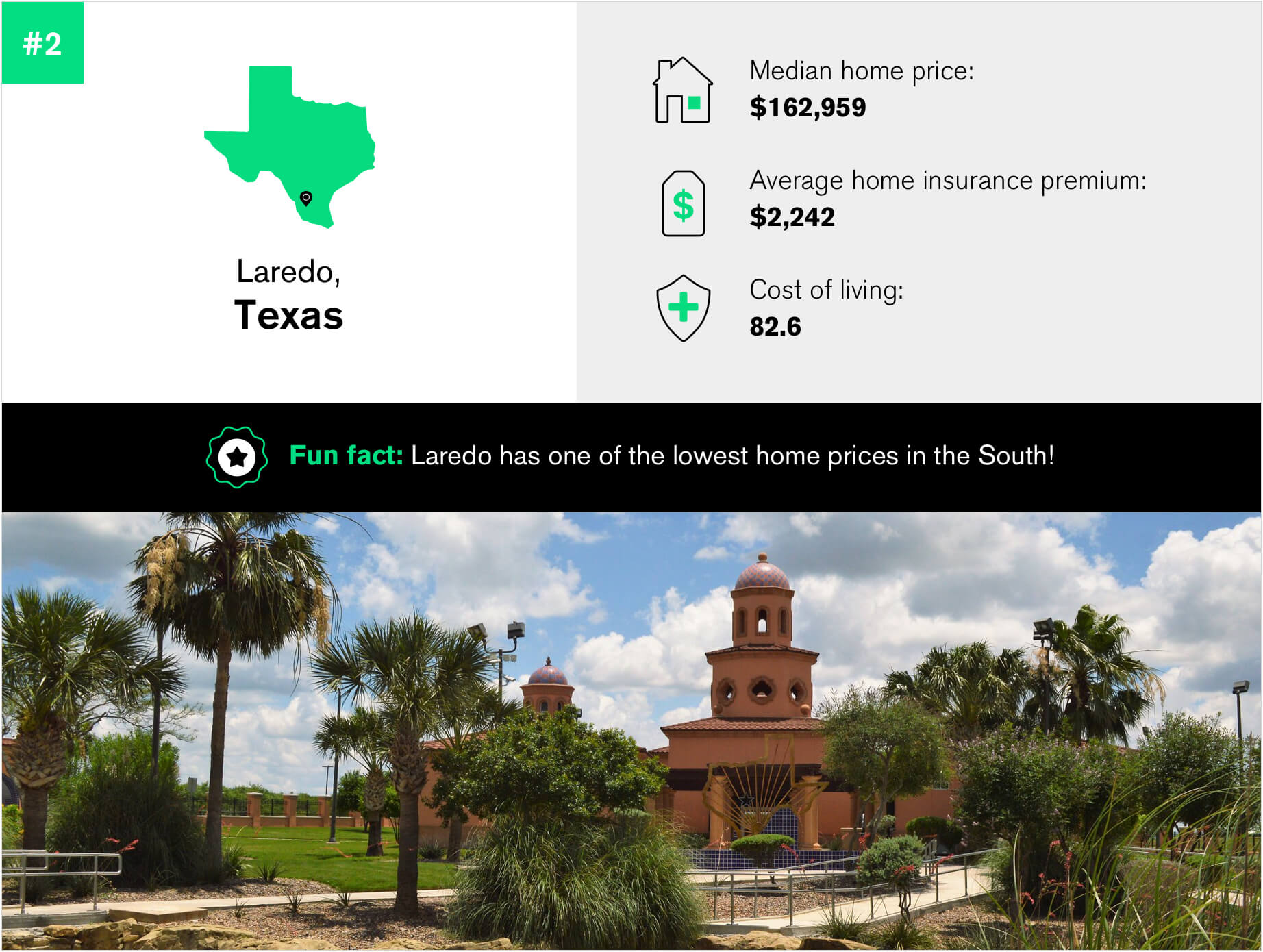

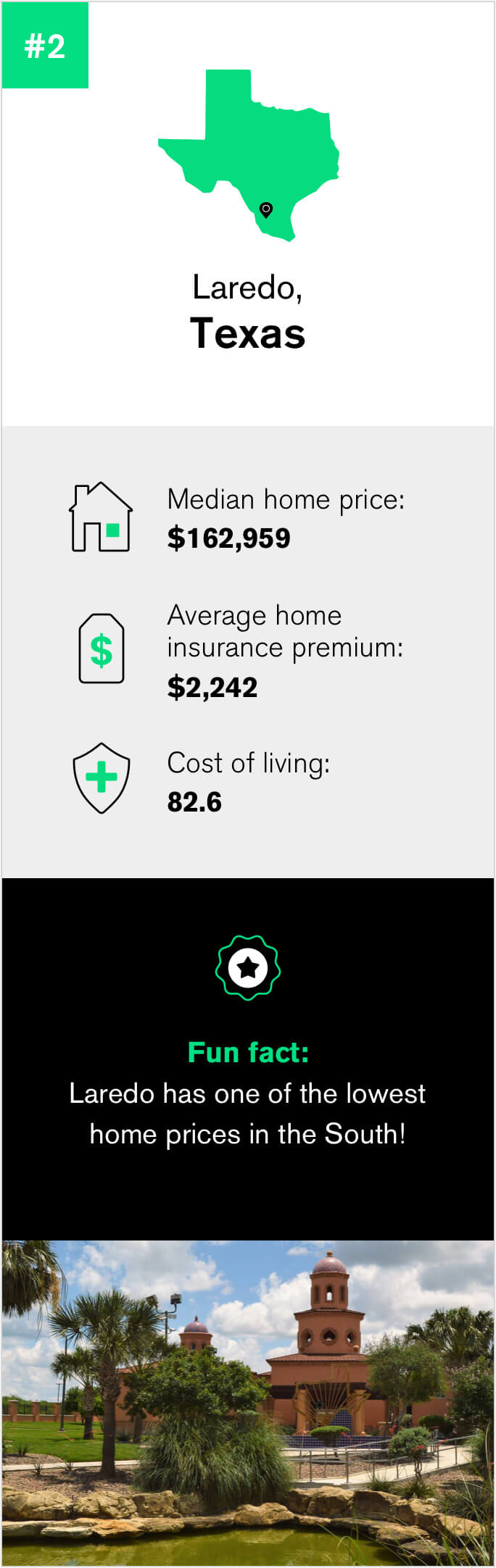

Median home price $162,959 Average home insurance premium $2,242 Property value gain over the last 10 years 15.57% Comfort index 6.4 Cost of living 82.6 Percentage of those who own their home 62% Property crime rate 267.3 (U.S. average is 500.1) Walkability score 41 Lean into the blend of Mexican-American culture and purchase your second home in Laredo, Texas, one of the southernmost cities in the U.S. With the lowest home price and highest walkability score of our top Southern cities, Laredo is a no-brainer for young homeowners who don’t have a lot of savings built up (and love exploring on foot). Plus, most of your neighbors will be homeowners too, a good sign for overall curb appeal and increasing property value. So what are you waiting for? Get ready for the most authentic Mexican food you’ve ever had and plenty of river access in the border town of Laredo.

-

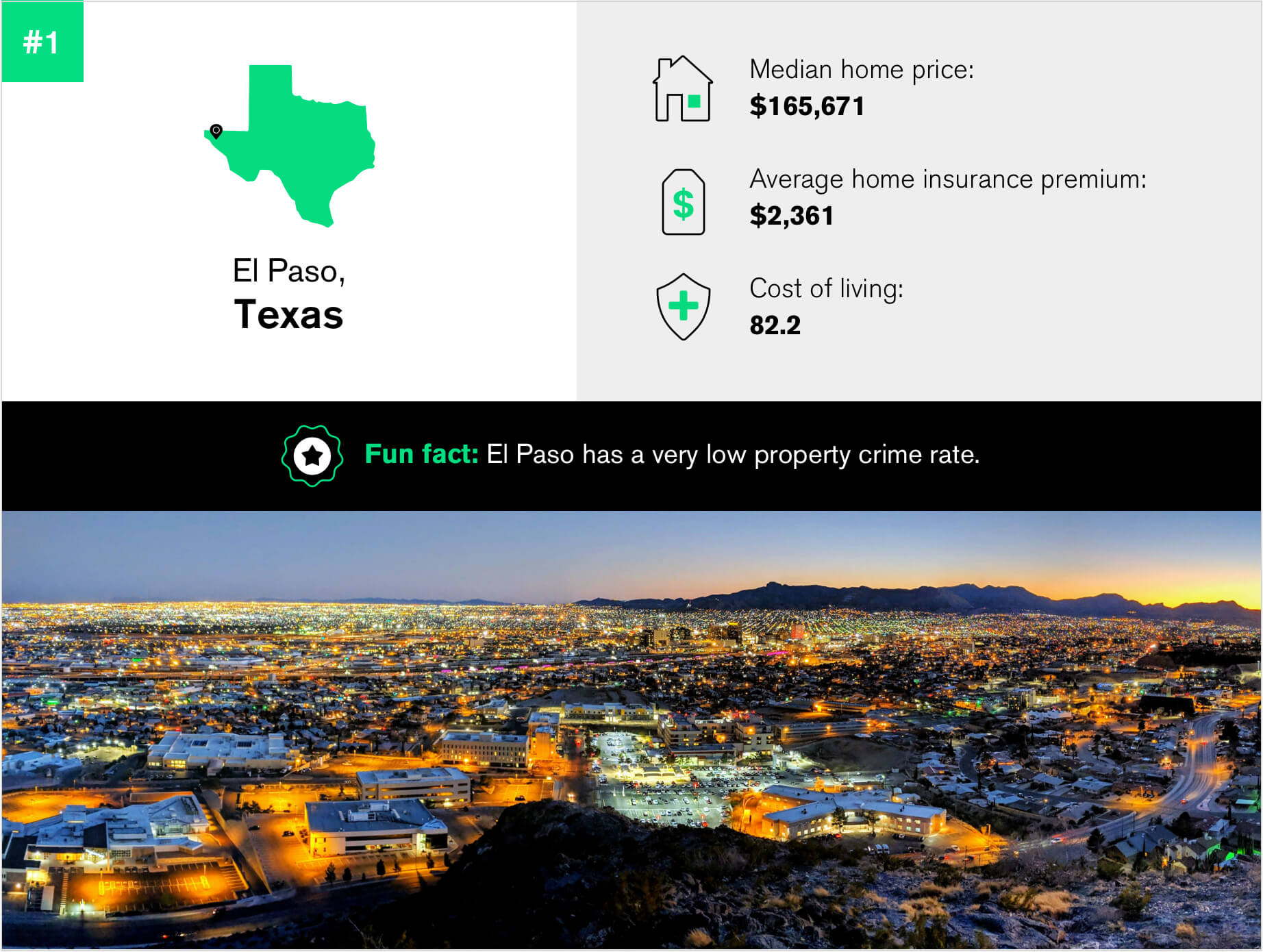

Median home price $165,671 Average home insurance premium $2,361 Property value gain over the last 10 years 32.53% Comfort index 8 Cost of living 82.2 Percentage of those who own their home 59% Property crime rate 152.6 (U.S. average is 500.1) Walkability score 41 Another Texas gem secures a top spot on our list of the best cities to buy a second home in the Southern region of the U.S. El Paso scores high on our list due to a low average home price, high ROI, high comfort index (it's known as “Sun City,” after all) and one of the lowest property crime rates seen in all 100 cities we studied. Other reasons to call El Paso your second home include a rich culture, burgeoning culinary scene and easy access to the Franklin Mountains and the Rio Grande river.

5 best Midwestern cities to buy a second home

The Midwest may not be top of mind when you think of popular tourist destinations or vacation spots. But don’t count out this portion of the U.S. just yet, as the Midwest is home to a lot more than meets the eye. With an abundance of natural wonders to explore and several unique foods only found in this area of the country — anyone up for cheese curds and Chicago-style hot dogs? — the following Midwest cities have plenty to offer those looking for a new place to purchase real estate.

-

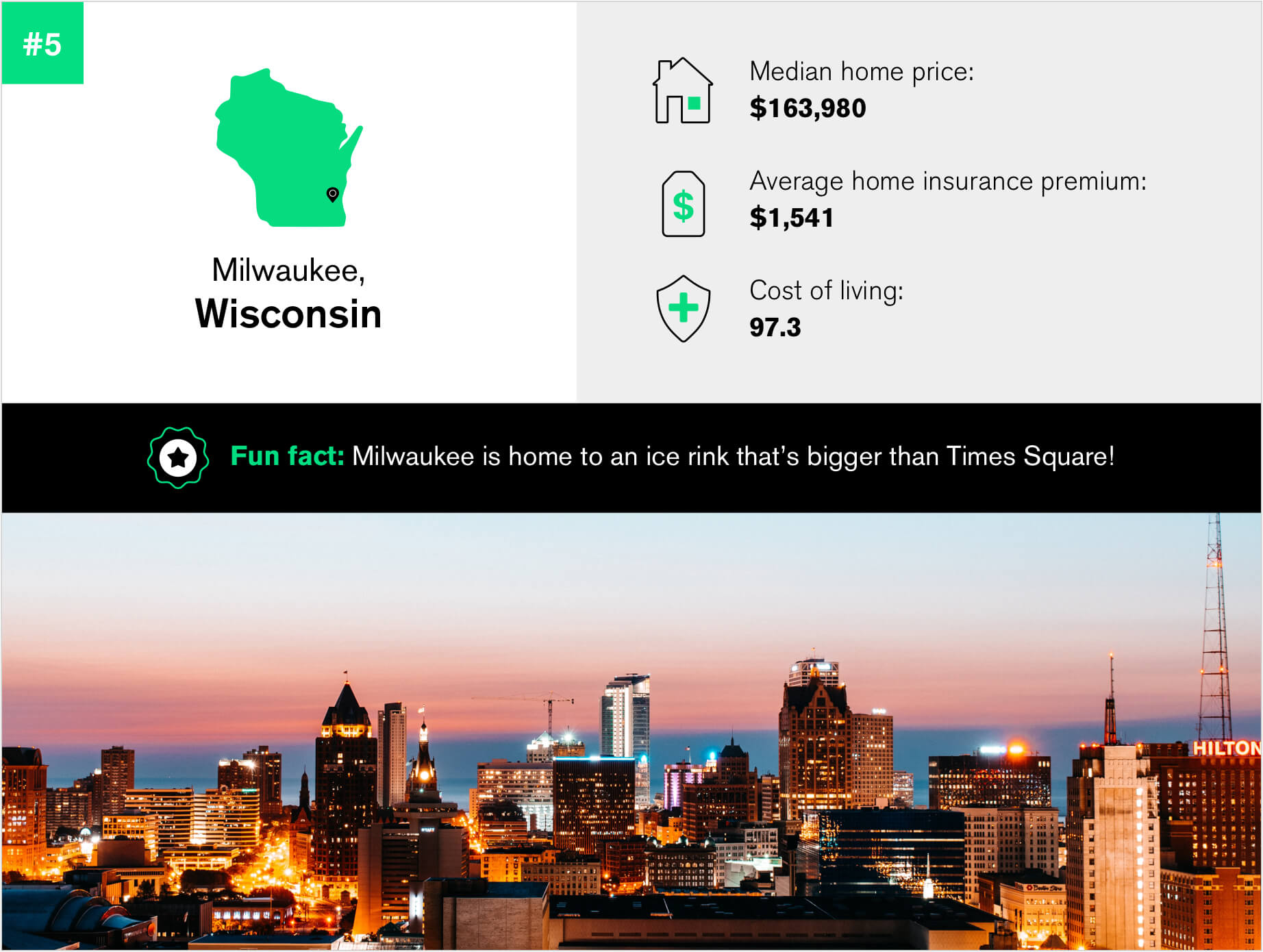

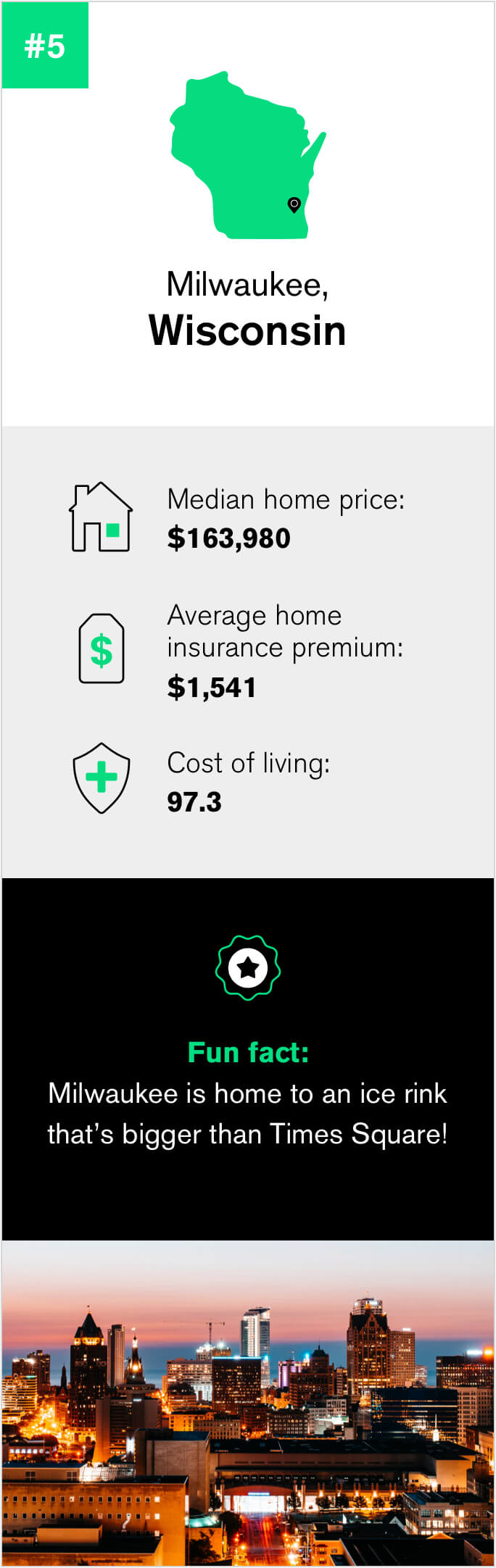

Median home price $163,980 Average home insurance premium $1,541 Property value gain over the last 10 years 77.42% Comfort index 6.8 Cost of living 97.3 Percentage of those who own their home 41% Property crime rate 608.2 (U.S average is 500.1) Walkability score 63 Set on the western shore of Lake Michigan, Milwaukee, Wisconsin, takes the fifth spot for the best city to buy a second home in the Midwest. What exactly makes this city so fab? It’s seen a huge property value increase over the last decade, has a lower cost of living than the nationwide average and is a pretty walkable city. There’s also plenty of fun things to do inside Milwaukee’s city limits, from skating on an ice rink that’s bigger than Times Square to seeing the largest T-Rex skull in the world at the Milwaukee Public Museum.

-

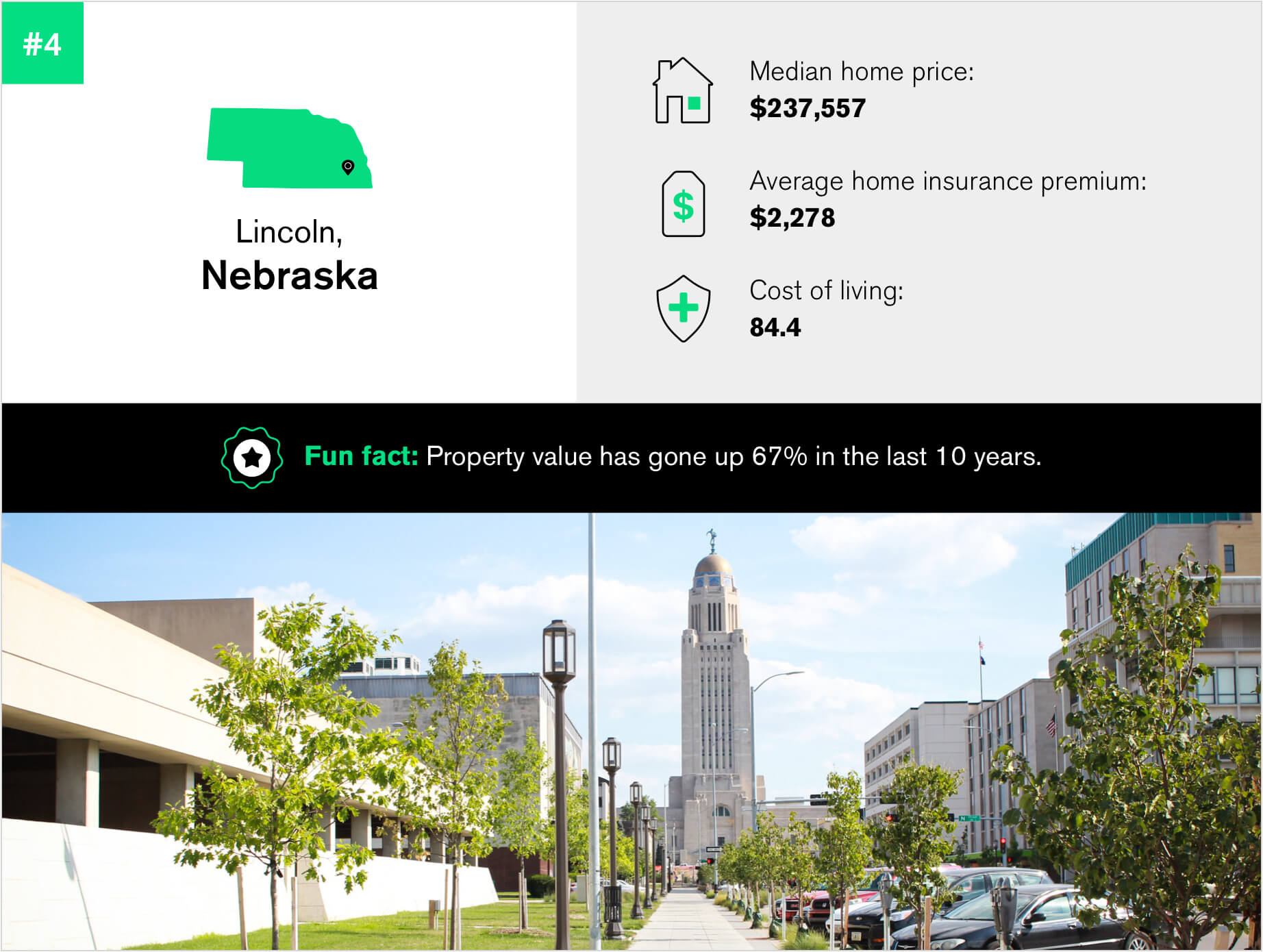

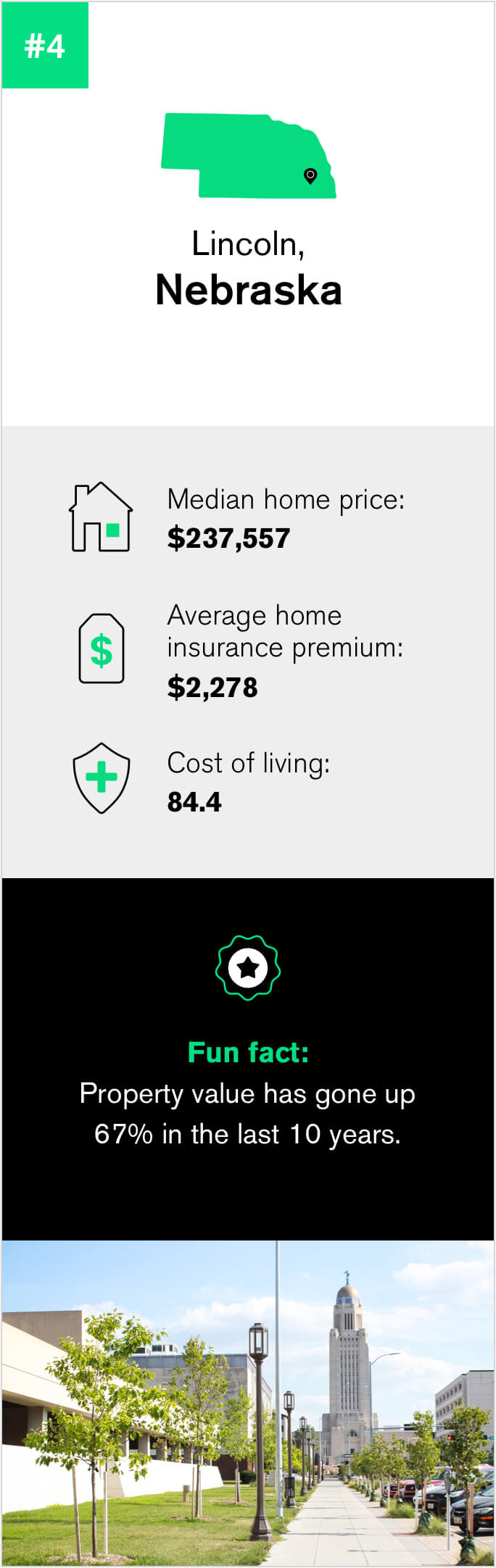

Median home price $237,557 Average home insurance premium $2,278 Property value gain over the last 10 years 67.29% Comfort index 7.2 Cost of living 84.4 Percentage of those who own their home 57% Property crime rate 339.4 (U.S. average is 500.1) Walkability score 43 The state capital of Nebraska, Lincoln, is another outstanding place to scoop up property and see a positive ROI. (Property value has gone up 67% there in the past 10 years.) Named after former President Abraham Lincoln, this city is chock-full of historic places and museums. It also boasts a low property crime rate for a college town, meaning it’s a good choice if you’re looking to lease out your second home throughout the majority of the year.

-

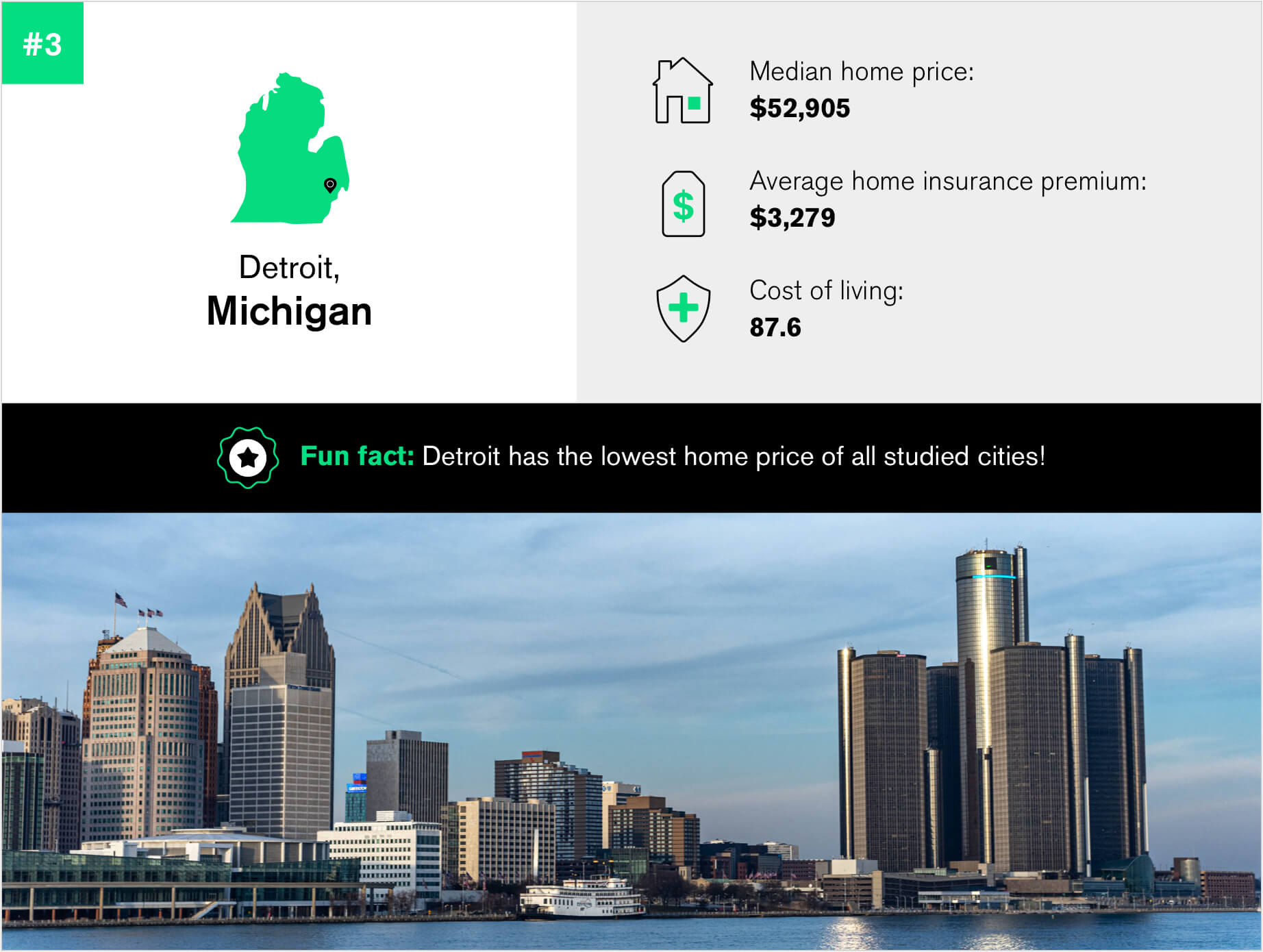

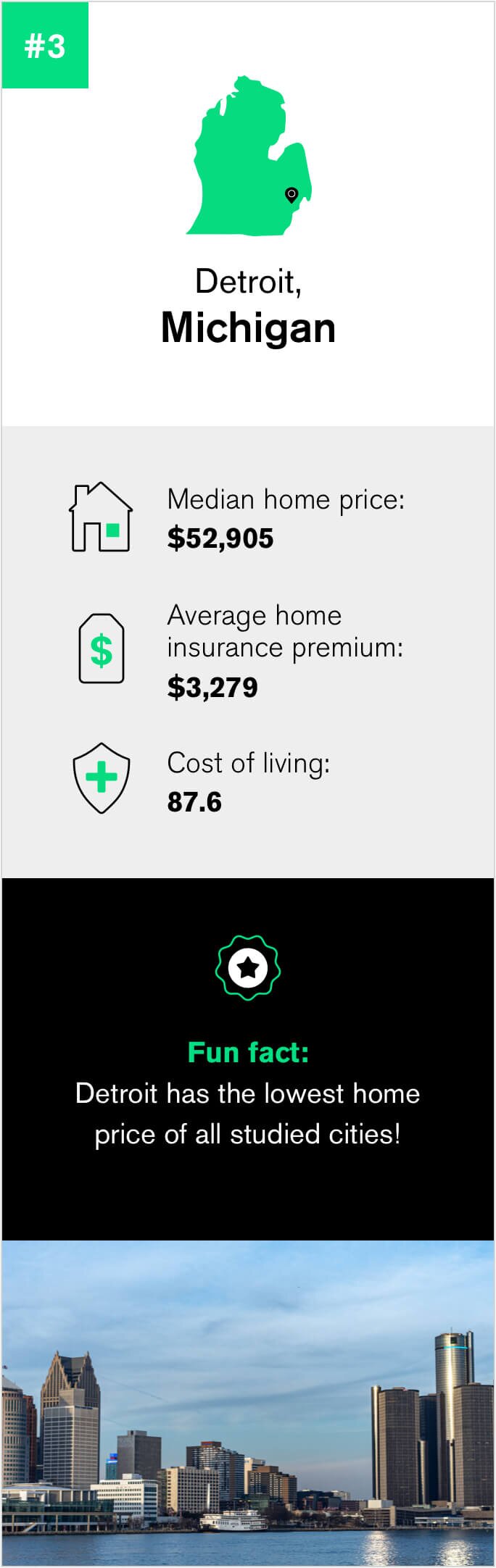

Median home price $52,905 Average home insurance premium $3,279 Property value gain over the last 10 years 234.48% Comfort index 6.9 Cost of living 87.6 Percentage of those who own their home 47% Property crime rate 1,027.9 (U.S. average is 500.1) Walkability score 53 If you’ve got a hankering for Detroit-style pizza and love to jam out to Motown music, Detroit, Michigan, is the city for you. Hallmarked for its extensive theatre district, booming auto industry and emerging art scene, Detroit is a fine place to buy if you want a solid deal on a house (the lowest out of all the cities we studied) and plenty of things to do. But if the high crime rate has you concerned, don’t fret. Detroit is looking up, with significant drops in property crime and an extensive rise in property value over the last 10 years.

-

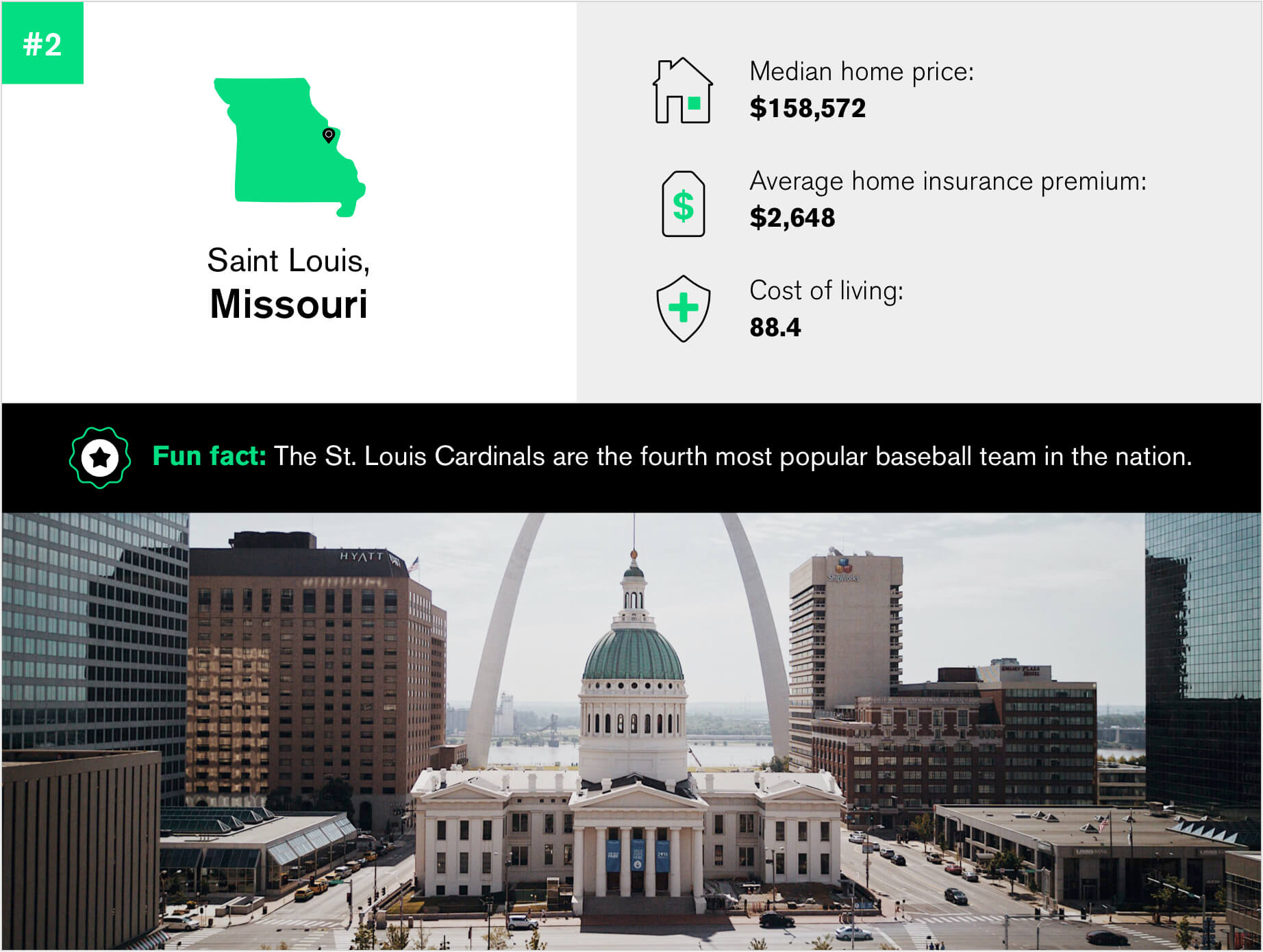

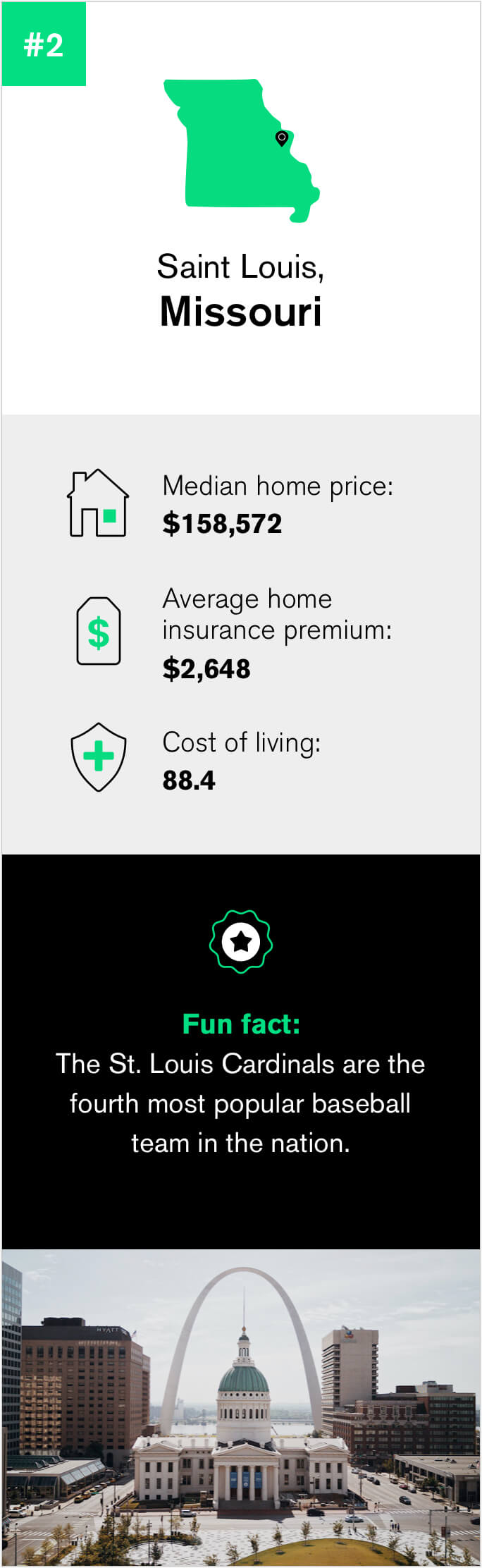

Median home price $158,572 Average home insurance premium $2,648 Property value gain over the last 10 years 46.82% Comfort index 7.2 Cost of living 88.4 Percentage of those who own their home 69% Property crime rate 363.9 (U.S. average is 500.1) Walkability score 65 With the highest walkability score of our top five Midwestern cities, St. Louis, Missouri scores high on our list due to a low cost of living and property crime rate, as well as a relatively low median house price. While you may be most aware of the St. Louis Cardinals and the famous Gateway Arch, you might be surprised to learn that the city is also well-loved for its plethora of beautiful parks and its own unique style of BBQ. Not only that, but the barbeque capital of the world is not too far in Kansas City. It’s also a terrific place to bring the kids for vacations, as the city is home to The Magic House, one of the best children’s museums in the U.S.

-

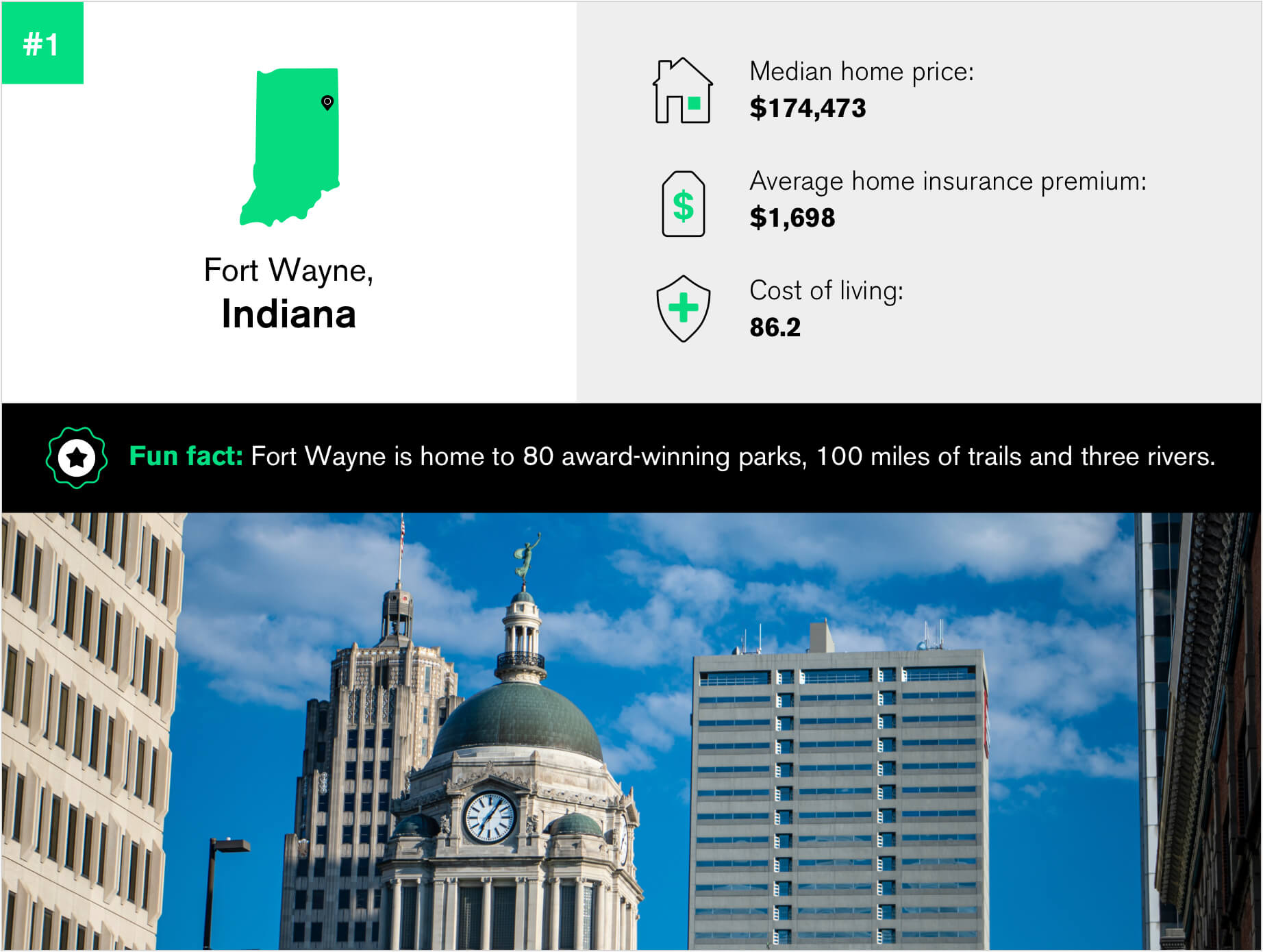

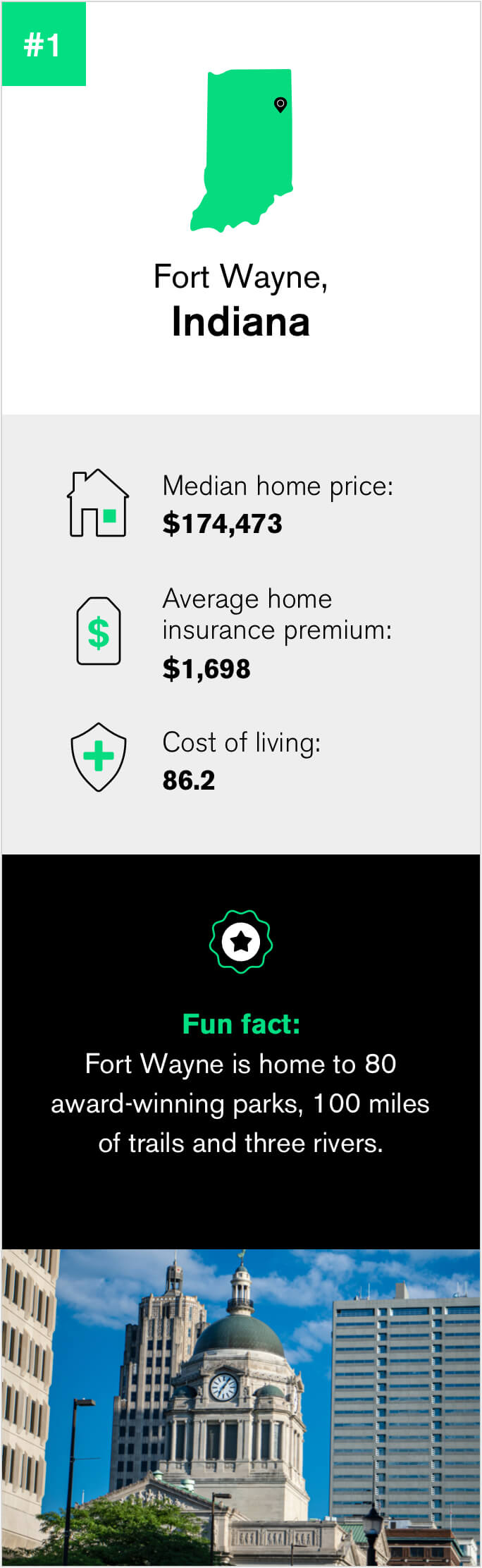

Median home price $174,473 Average home insurance premium $1,698 Property value gain over the last 10 years 72.74% Comfort index 6.9 Cost of living 82.6 Percentage of those who own their home 62% Property crime rate 367.5 (U.S. average is 500.1) Walkability score 30 Rounding out our list of best cities to buy a second home in the Midwest is Fort Wayne, Indiana, a big city with a small-town feel. This charm is a prominent part of what keeps people around — that, and a lower cost of living than the national average. If you’re looking for a noteworthy place to visit and enjoy the snow or escape the brutal summer heat seen in most other portions of the country, Fort Wayne is your best bet.

5 best Western cities to buy a second home

The biggest region in the United States, the Western portion of our country is a melting pot of landscapes, cultures and activities. This means if you aren’t quite sure where you want to buy your second home yet, but you know what you want to be nearby, it's safe to assume you’ll find what you’re looking for in this portion of the country. From the bright lights and casinos of Las Vegas to the perfect temps and beaches of sunny California, there is something for everyone in the Western half of the U.S.

Unfortunately, many states on the West Coast are known for their high cost of living and sky-high home prices. But that doesn’t mean there aren’t great places to purchase property. You just might be surprised at the affordability of some of the smaller cities peppered throughout the region. Take a look at the top five cities for a second home in the West below.

-

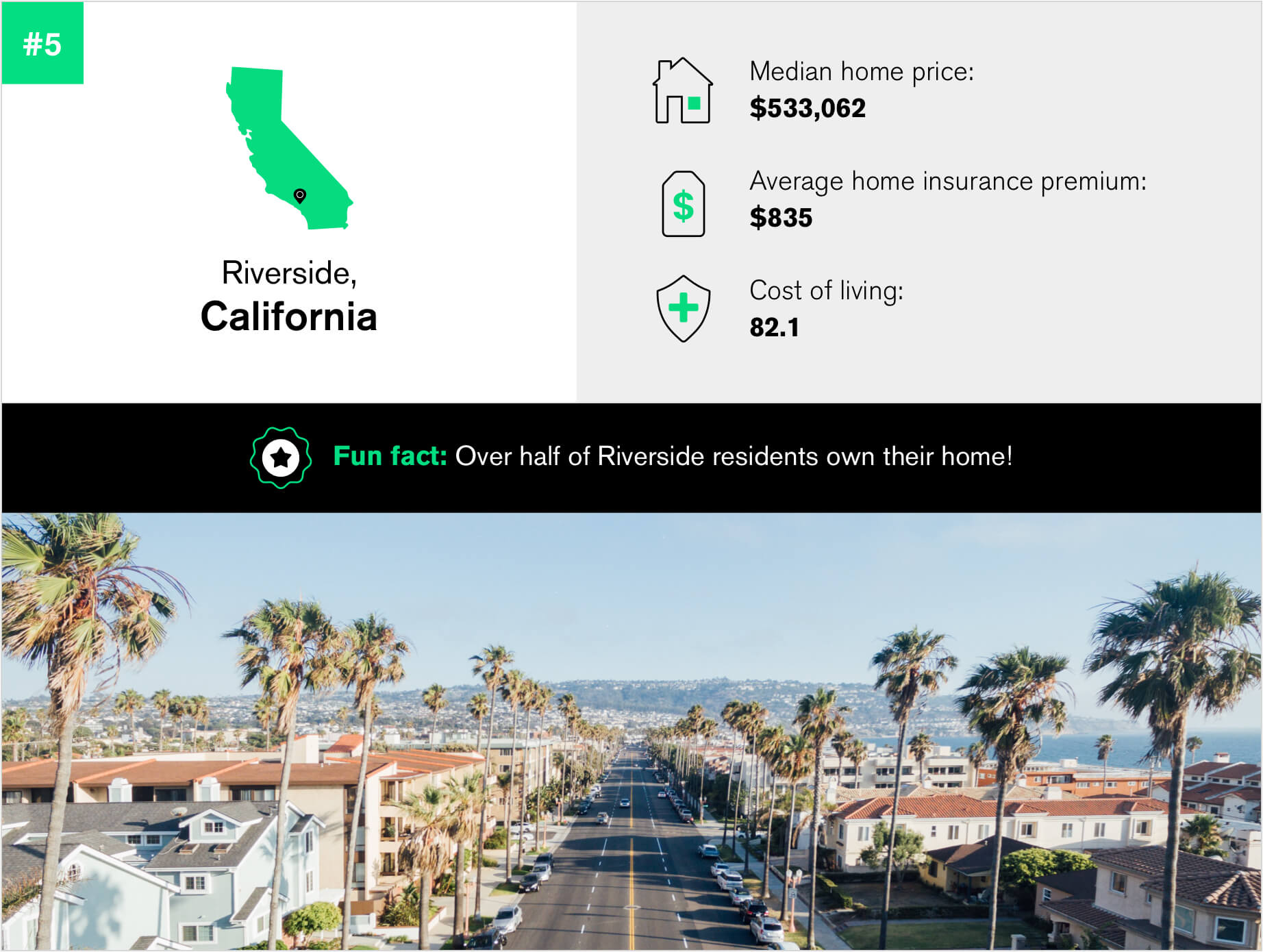

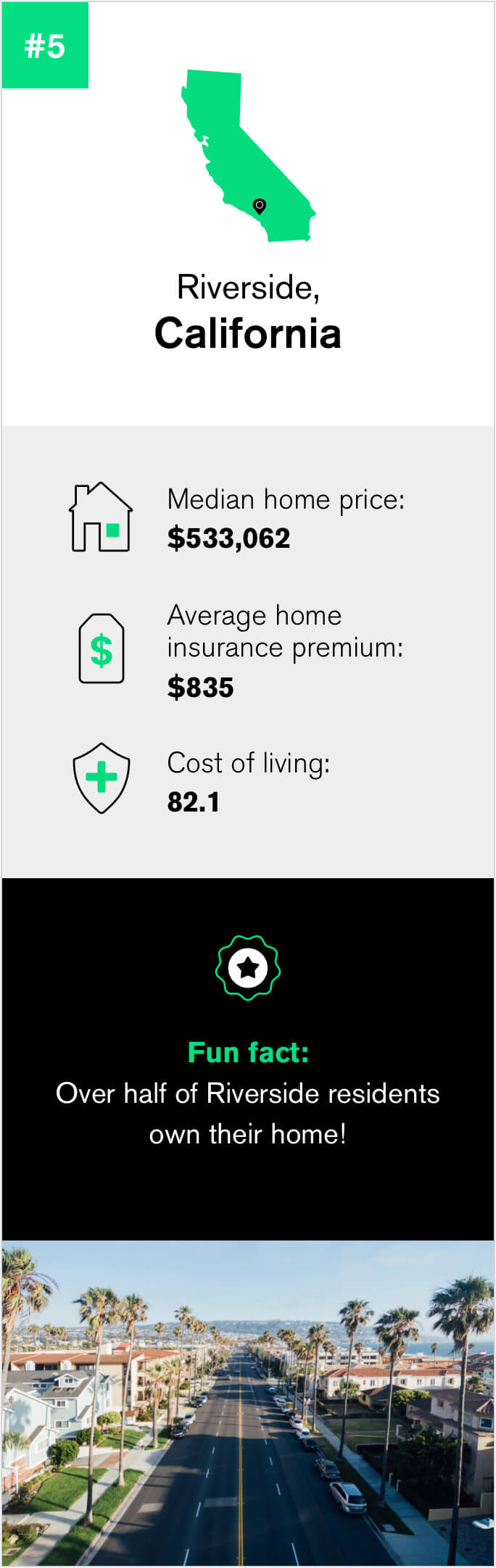

Median home price $533,062 Average home insurance premium $835 Property value gain over the last 10 years 142.3% Comfort index 8.7 Cost of living 82.1 Percentage of those who own their home 54% Property crime rate 390.7 (U.S average is 500.1) Walkability score 42 Are you surprised to see a California city on our list? Don’t be! While housing prices may be relatively high (although extremely low when compared to its neighbor Los Angeles), the city's affordable home insurance premiums, cost of living, comfort index and continually rising property value make investing in Riverside a no-brainer. Riverside also boasts one of the lowest costs of living and highest comfort indexes in all the cities we studied, making California dreamin’ no longer just a dream for many homeowners.

-

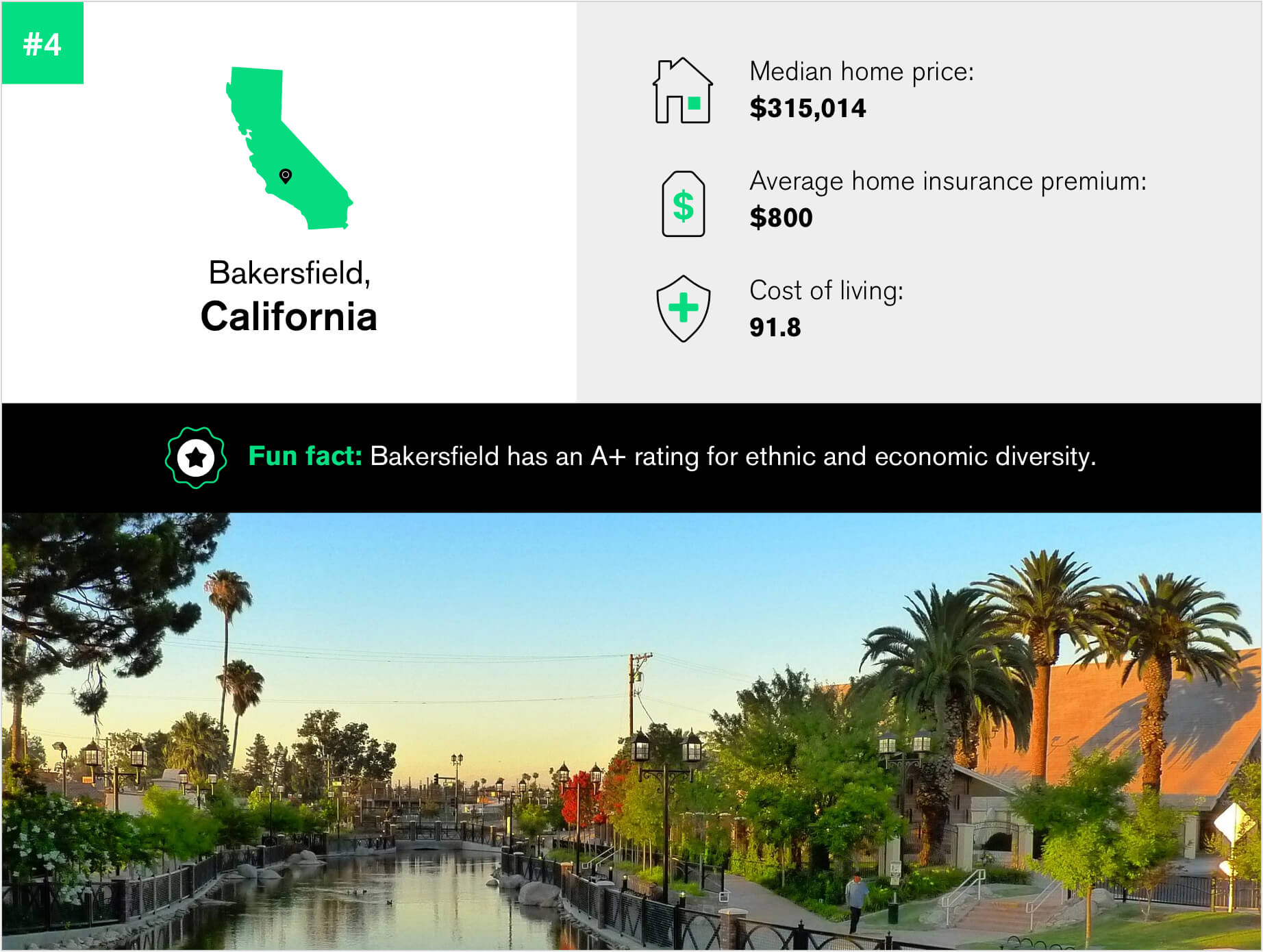

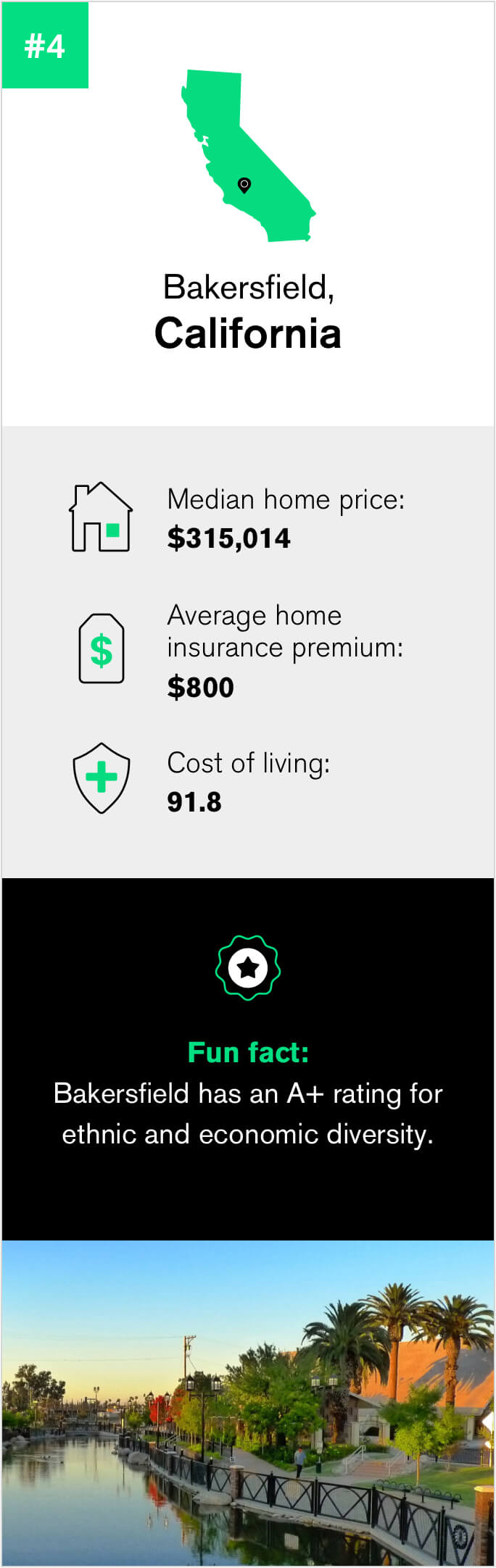

Median home price $315,014 Average home insurance premium $800 Property value gain over the last 10 years 115.76% Comfort index 8.1 Cost of living 91.8 Percentage of those who own their home 59% Property crime rate 1001.9 (U.S. average is 500.1) Walkability score 34 With even lower home and home insurance prices than Riverside, Bakersfield, California, takes the fourth spot on our list of best cities for a second home in the West. Bakersfield earned an A+ rating for ethnic and economic diversity, making it a strong choice for young professionals looking to expand their real estate portfolio. Plus, the proximity to mountains, beaches and major cities combined with a low cost of living solidifies Bakersfield as a little-known gem of the Golden State.

-

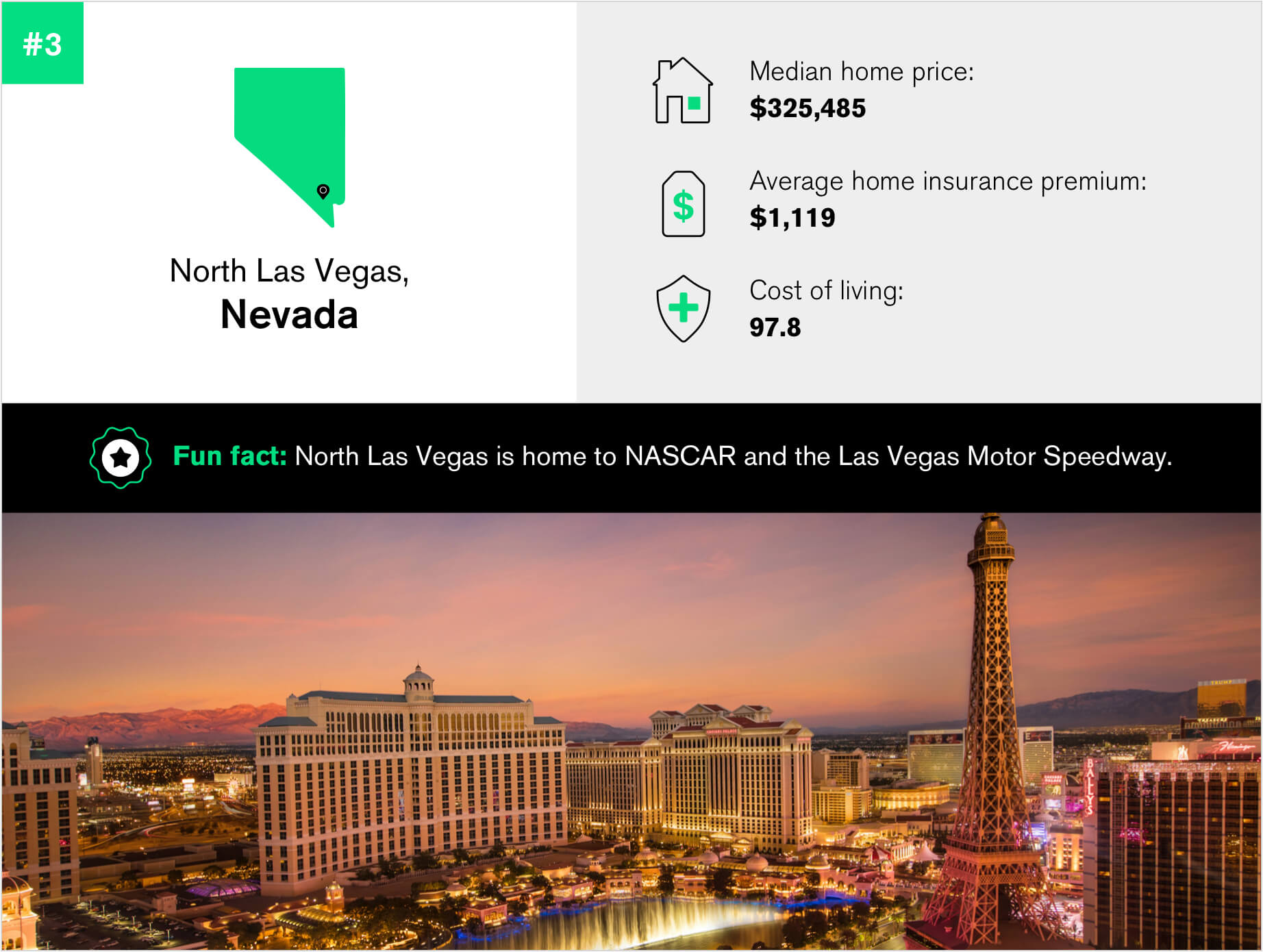

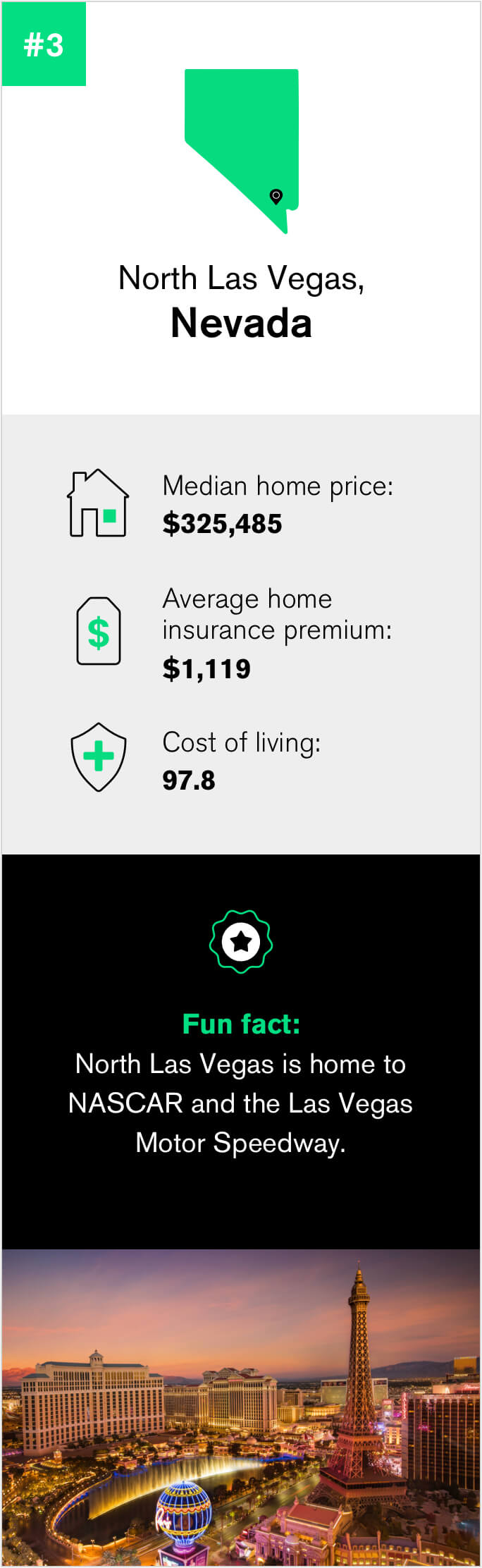

Median home price $325,485 Average home insurance premium $1,119 Property value gain over the last 10 years 195.89% Comfort index 7.4 Cost of living 97.8 Percentage of those who own their home 58% Property crime rate 480.3 (U.S. average is 500.1) Walkability score 33 A stone's throw away from the hustle and bustle of the Las Vegas Strip, buying a second home in North Las Vegas, Nevada, is an awesome idea for younger homeowners. Whether you want to live close to the action or you’re just planning on leasing out the property to tourists to make some cash, this suburb of Vegas can be a perfect fit. And if you’re a NASCAR fan, you’ll love the proximity to the Las Vegas Motor Speedway, which also hosts various dirt and drag racing events.

-

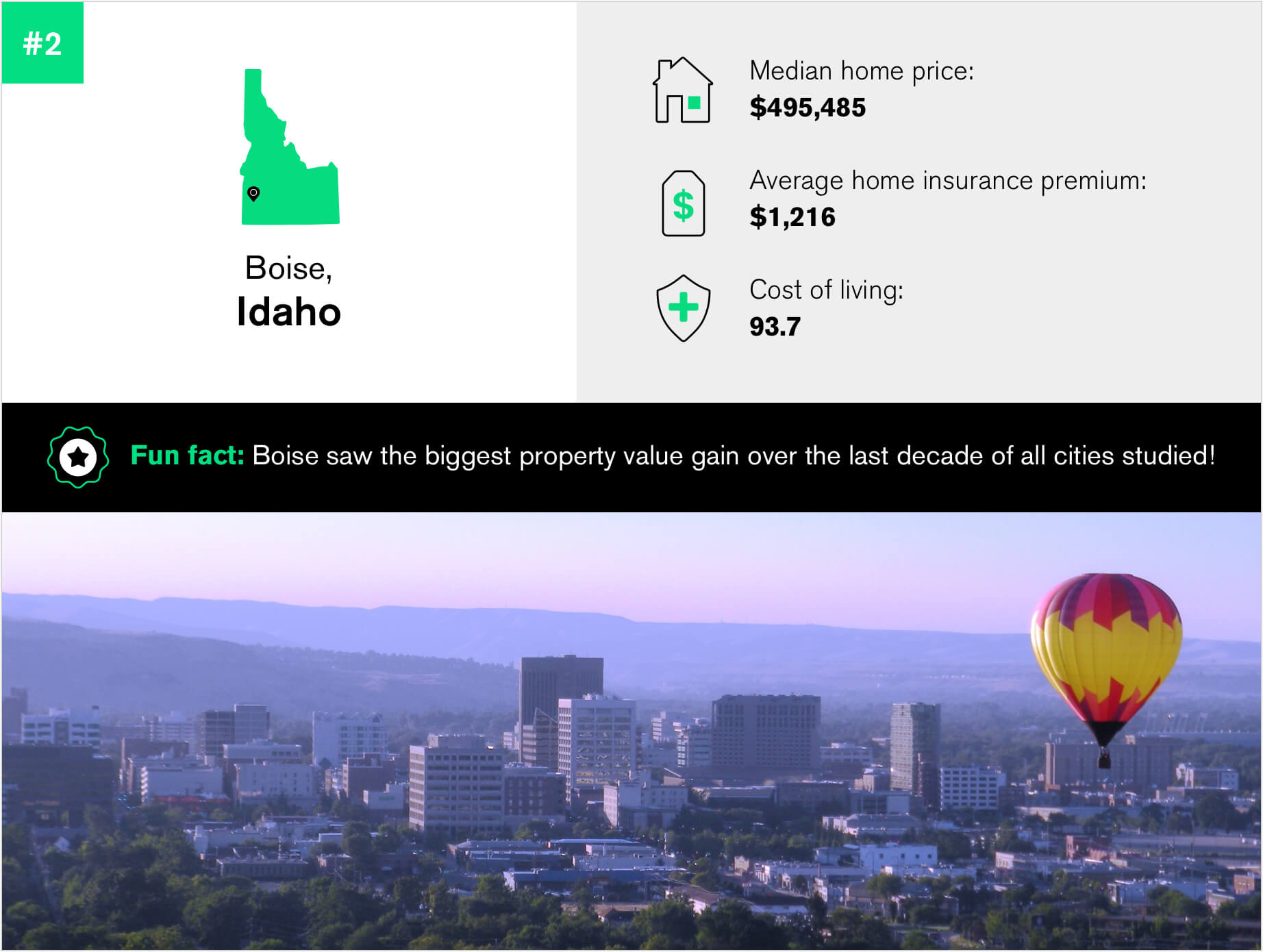

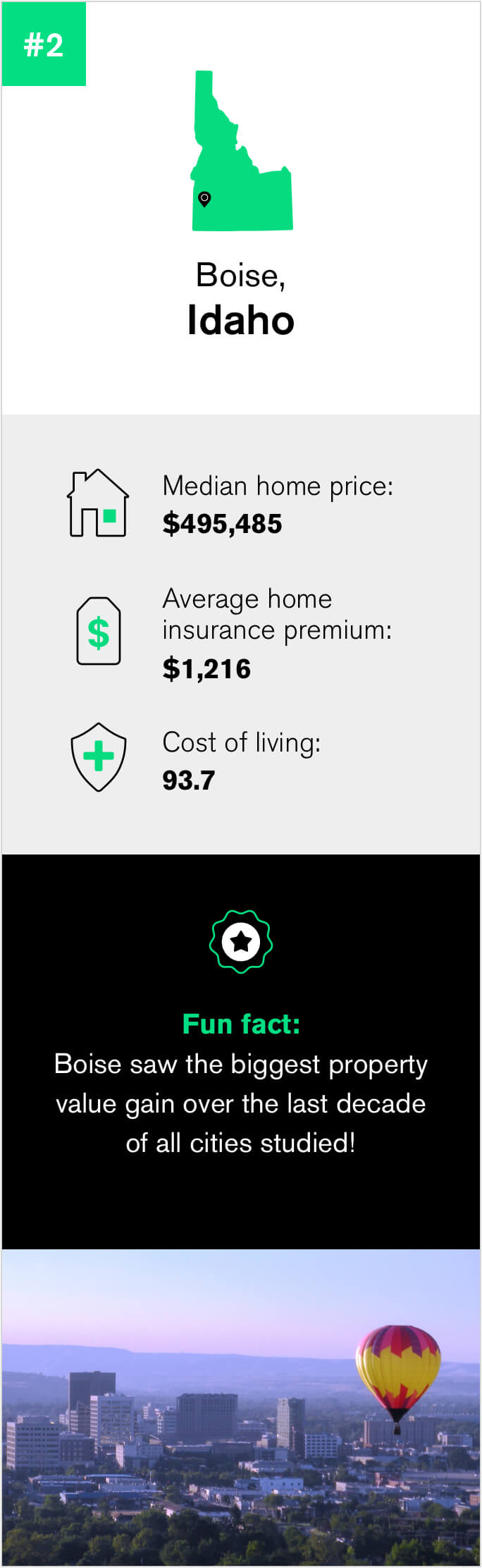

Median home price $495,485 Average home insurance premium $1,216 Property value gain over the last 10 years 234.78% Comfort index 7.3 Cost of living 93.7 Percentage of those who own their home 61% Property crime rate 203.2 (U.S. average is 500.1) Walkability score 39 Want to own a home in a city where you can go to a jazz festival, watch minor league sports teams and go skiing and hiking all within city limits? Then head on over to Boise, Idaho, a city perfect for families due to its low crime rate, highly regarded schools and huge property ROI. In fact, Boise saw the most considerable property value increase over the last 10 years out of all 100 cities we studied.

-

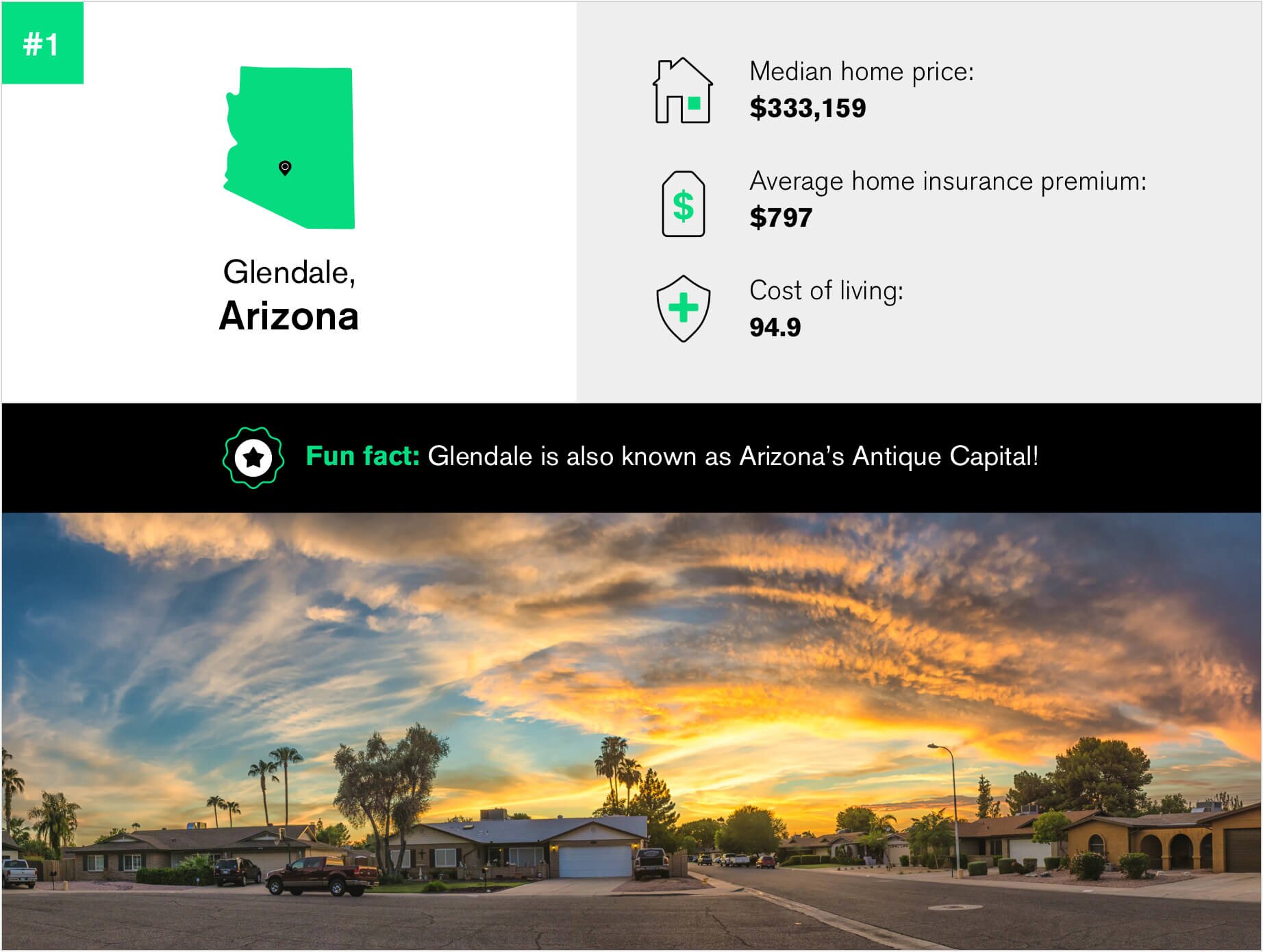

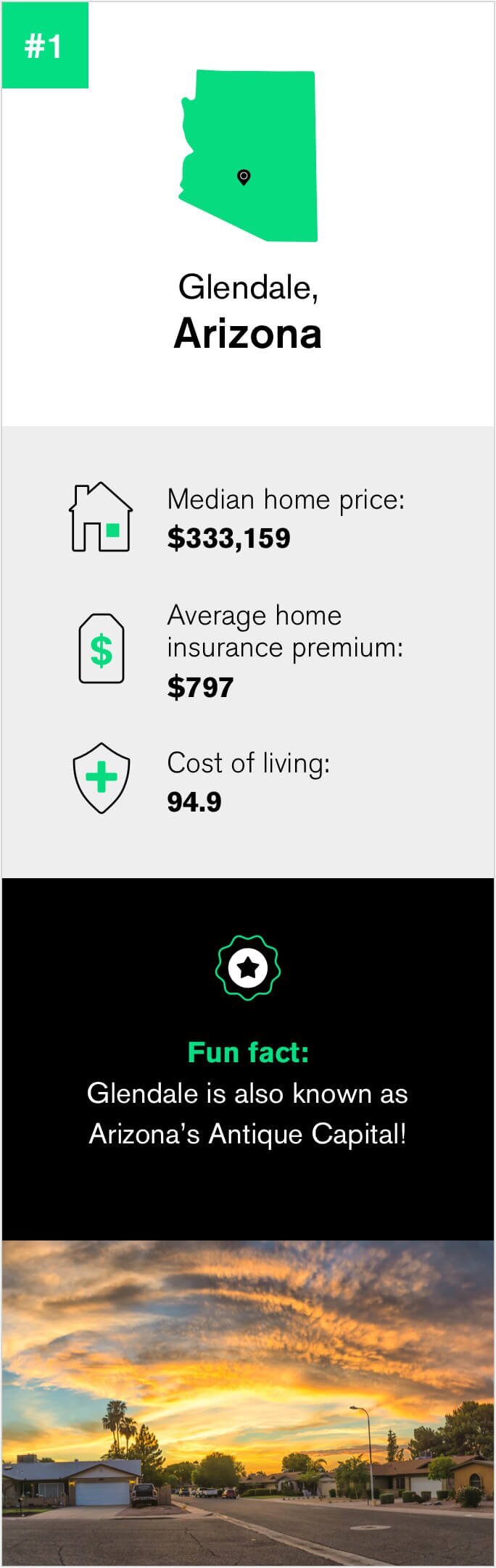

Median home price $333,159 Average home insurance premium $797 Property value gain over the last 10 years 229.86% Comfort index 7.3 Cost of living 94.9 Percentage of those who own their home 55% Property crime rate 557.6 (U.S. average is 500.1) Walkability score 40 A northwestern suburb of Phoenix, Glendale, Arizona, has secured the top spot in the Western region due to its affordable home insurance premiums, high property value growth rate and walkability rating. But outside of the numbers, Glendale draws people in with its fun attractions such as the West Wind Drive-In and a vast array of antique stores that have earned Glendale the nickname “Arizona’s Antique Capital.”

5 best Northeastern cities to buy a second home

While overall, cities in the Northeast region of the U.S. scored lower on our list than any other, there’s still lots to love about the country’s smallest region. Whether you’re looking for a second home in the hustle and bustle of Manhattan or you want to slow things down in Philly, our breakdown of the top five cities in the Northeast will help you decide exactly where to buy your next home. A big bonus? They’re all super walkable!

-

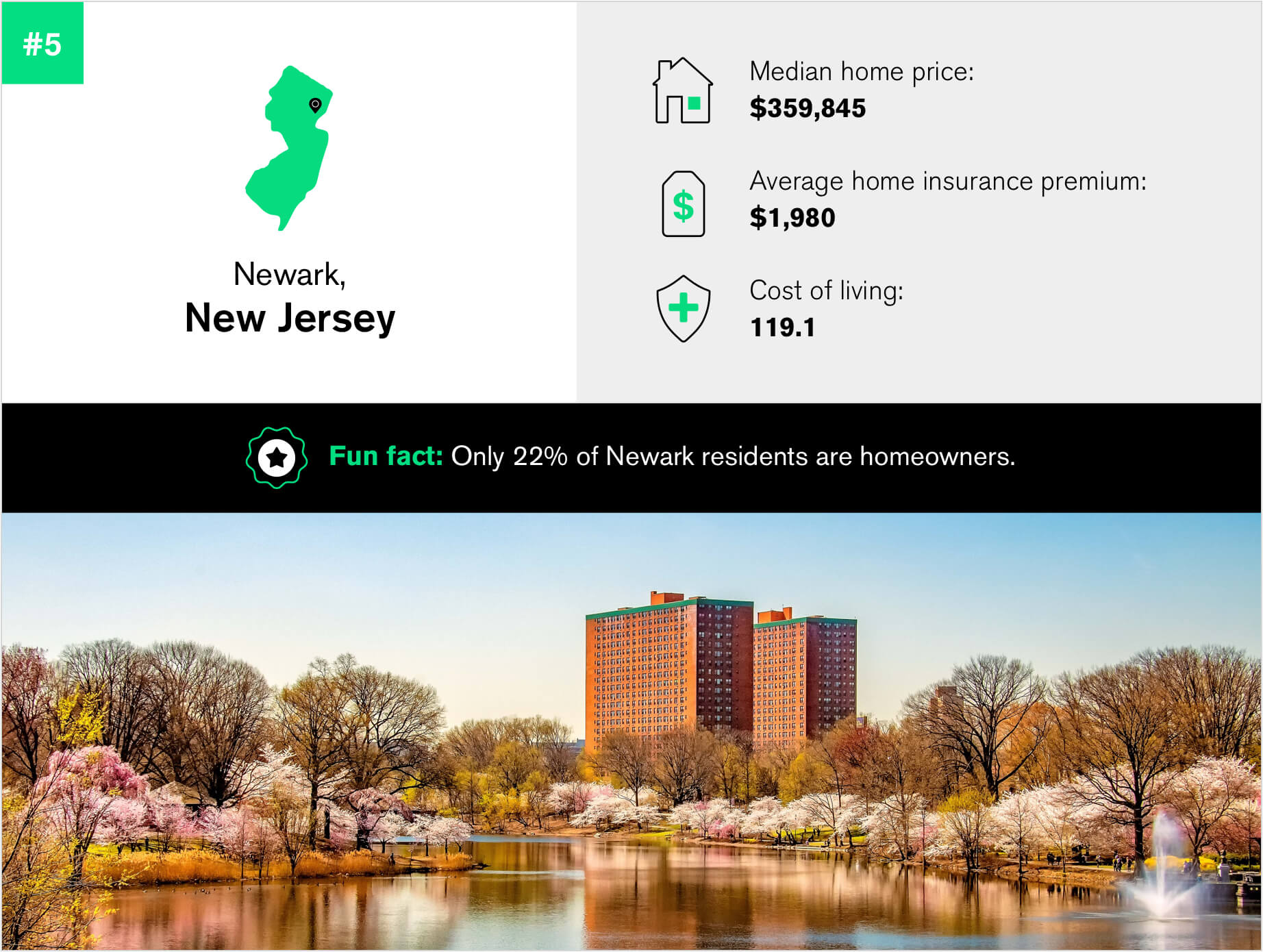

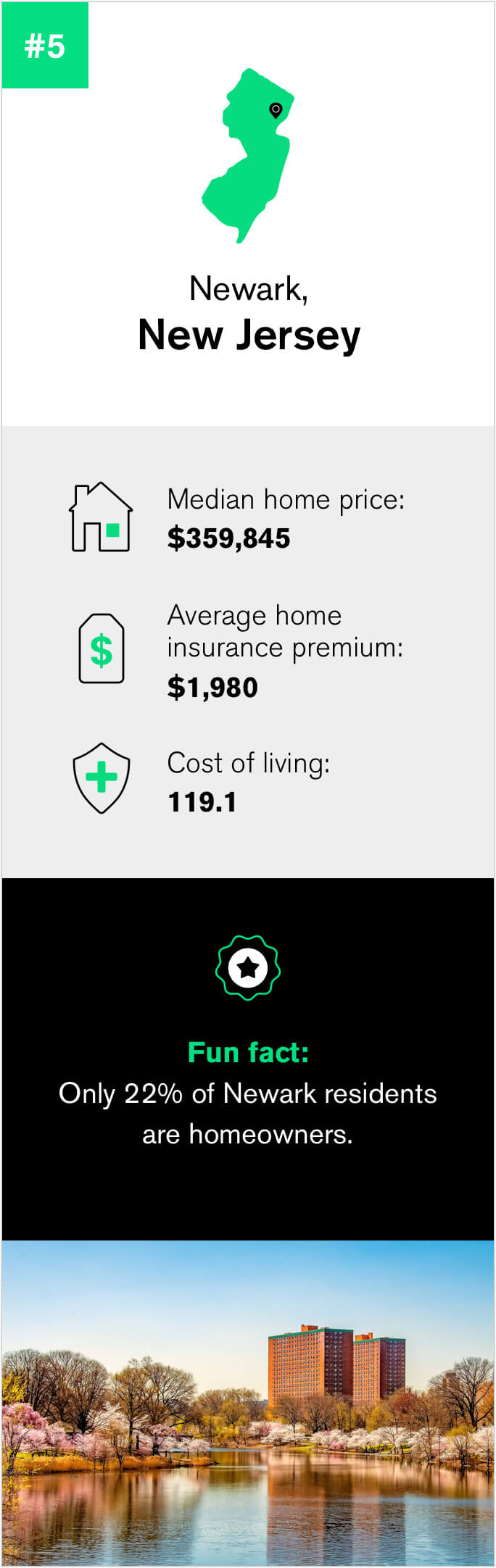

Median home price $359,845 Average home insurance premium $1,980 Property value gain over the last 10 years 69.73% Comfort index 7.2 Cost of living 119.1 Percentage of those who own their home 22% Property crime rate 256.2 (U.S average is 500.1) Walkability score 79 No matter if you’re obsessed with Taylor ham rolls or just want a second home that’s close to New York without all the noise, Newark, New Jersey is the place to be. The second most walkable city on our list, Newark is also known for its famous ice hockey team, the New Jersey Devils, as well as a wide array of colleges. However, only 22% of Newark residents are homeowners, making purchasing in this area a bit of an anomaly.

-

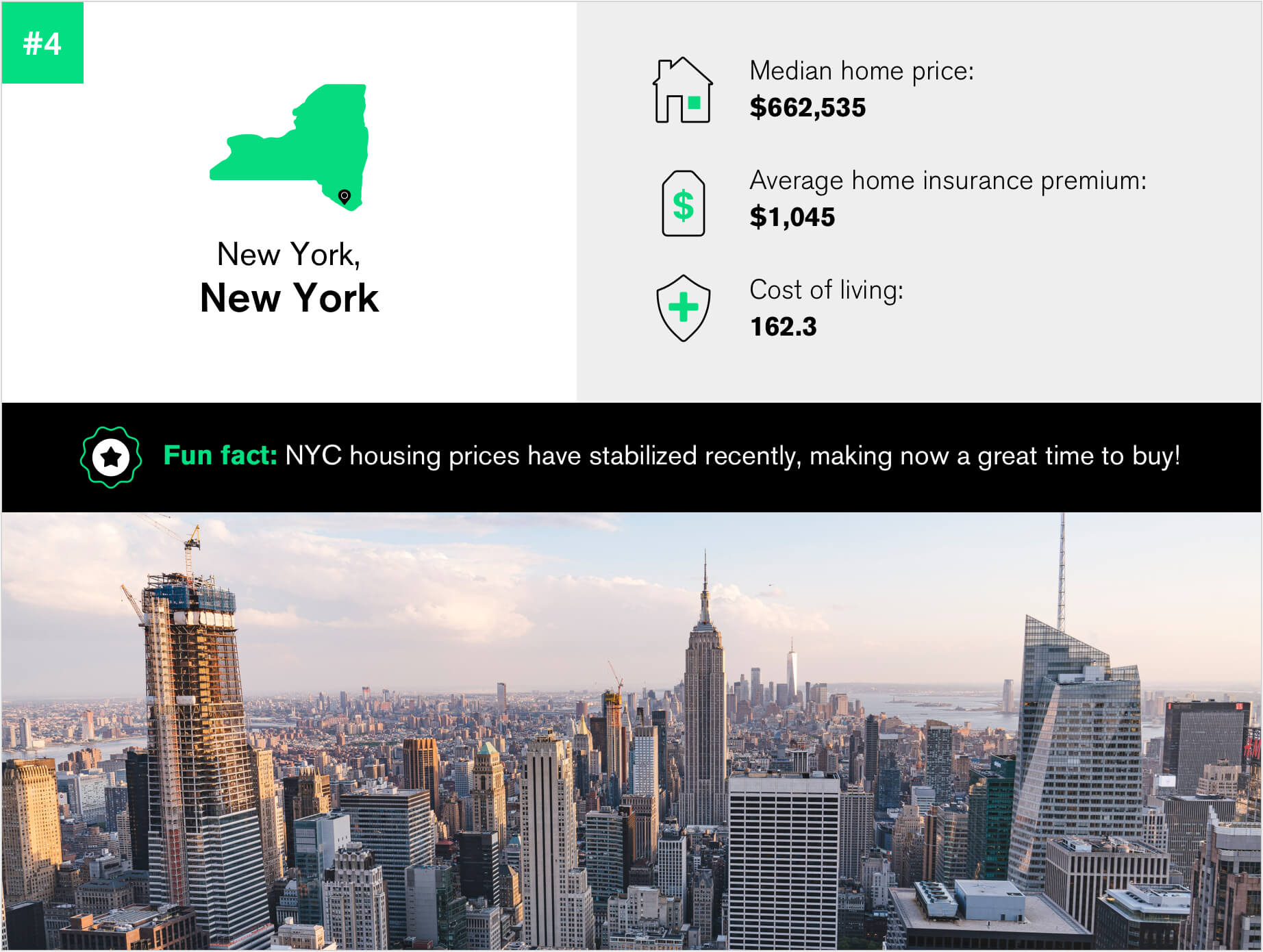

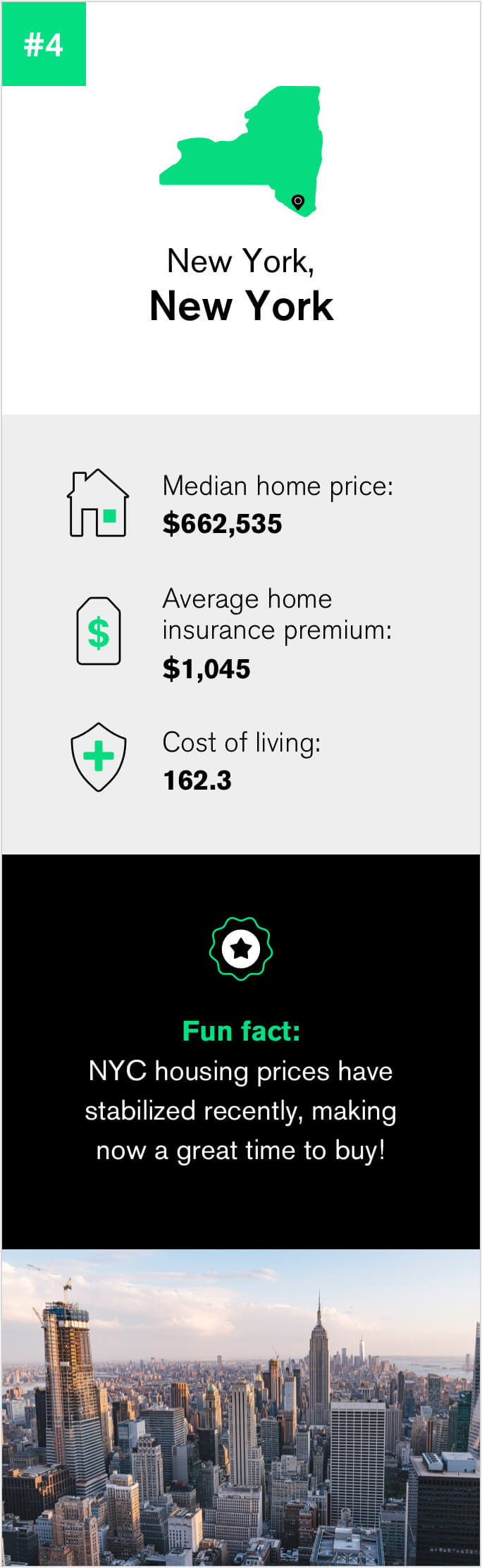

Median home price $662,535 Average home insurance premium $1,045 Property value gain over the last 10 years 53.01% Comfort index 7.3 Cost of living 162.3 Percentage of those who own their home 33% Property crime rate 117.5 (U.S. average is 500.1) Walkability score 88 What is there to say about New York City that hasn’t already been said? There’s a reason thousands of movies, TV shows and books are set there, after all. NYC is pure magic, and it’s a hotspot for young professionals looking to make moves in their careers. (It's also the most walkable city we studied.) And while you may not think of NYC as being relatively affordable — and to live there, you’d be right — but the recent pandemic has caused housing prices to drop dramatically over the past year. This means if you’ve been dreaming of owning property in the City That Never Sleeps, now’s the time.

-

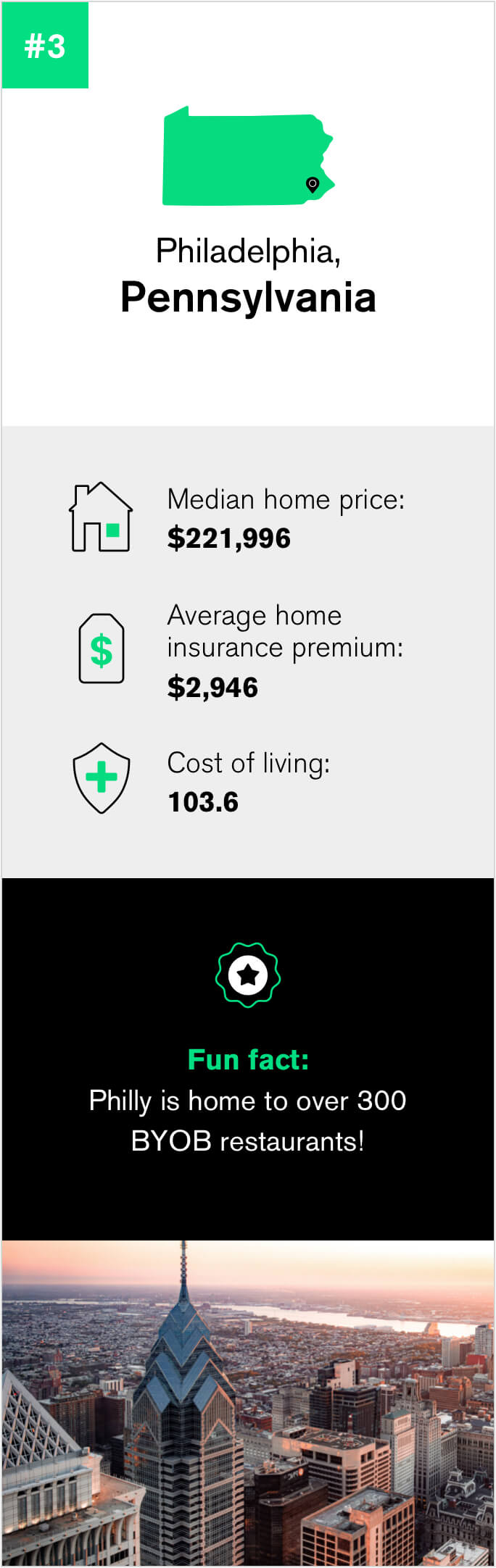

Median home price $221,996 Average home insurance premium $2,946 Property value gain over the last 10 years 63.23% Comfort index 7.3 Cost of living 103.6 Percentage of those who own their home 53% Property crime rate 409.4 (U.S. average is 500.1) Walkability score 79 Often considered the birthplace of the United States, it's safe to say there’s a lot of history packed into the bustling city of Philadelphia, Pennsylvania. Foodies and artists alike will find plenty to do in Philly’s city limits, such as the Manayunk Arts Festival and over 300 BYOB restaurants across the city. Philly scored high on our list of second home cities due to its low housing prices, high percentage of homeownership and first-class walkability score. (Our love for Philly cheesesteaks played no factor — we swear!

-

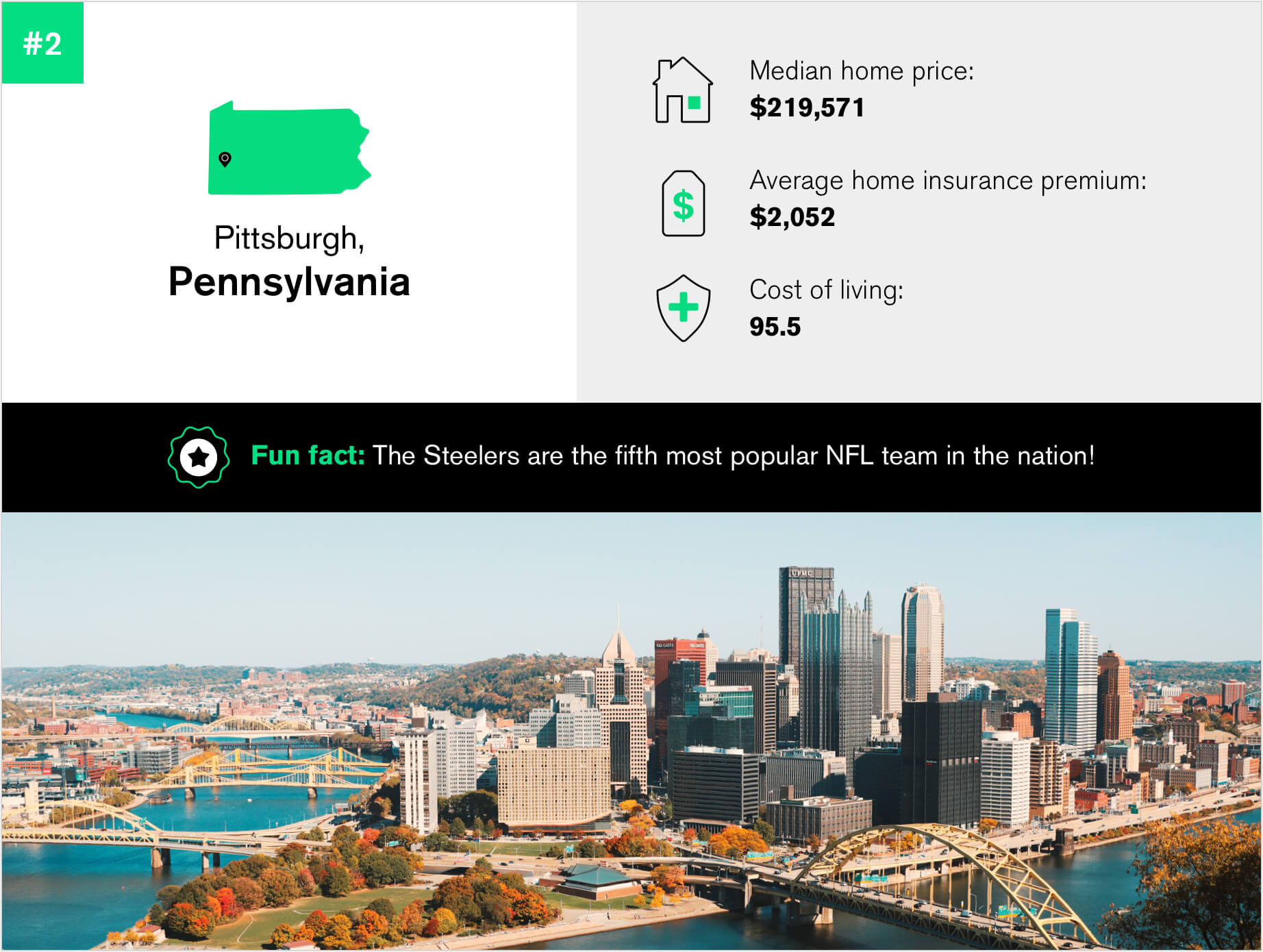

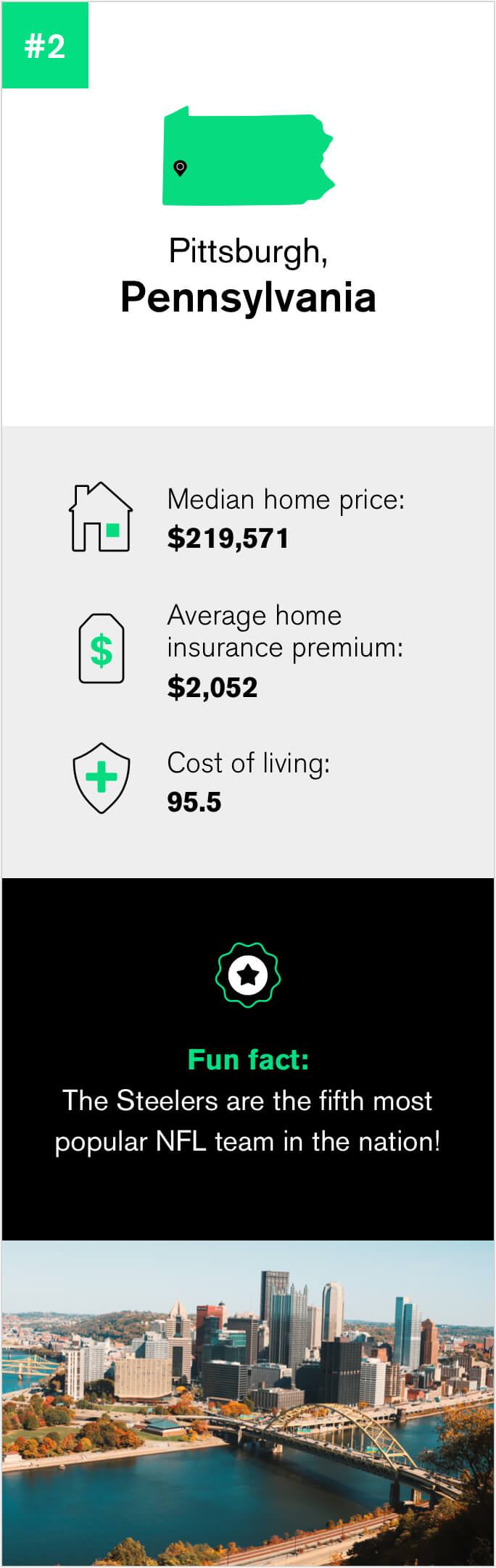

Median home price $219,571 Average home insurance premium $2,052 Property value gain over the last 10 years 97.81% Comfort index 7.1 Cost of living 95.5 Percentage of those who own their home 47% Property crime rate 443.2 (U.S. average is 500.1) Walkability score 63 If you want to move to one of the best cities in the Northeast, but you don’t want to spend an arm and a leg to do it, consider Pittsburgh. With the lowest cost of living of our top Northeastern cities — and low housing costs to boot — Pittsburgh is a smart move for those who want to invest in property for the very first time. Other highlights of life in Pittsburgh include impressive (but hilly) biking trails, the Carnegie Museum of Art and plenty of Steelers games.

-

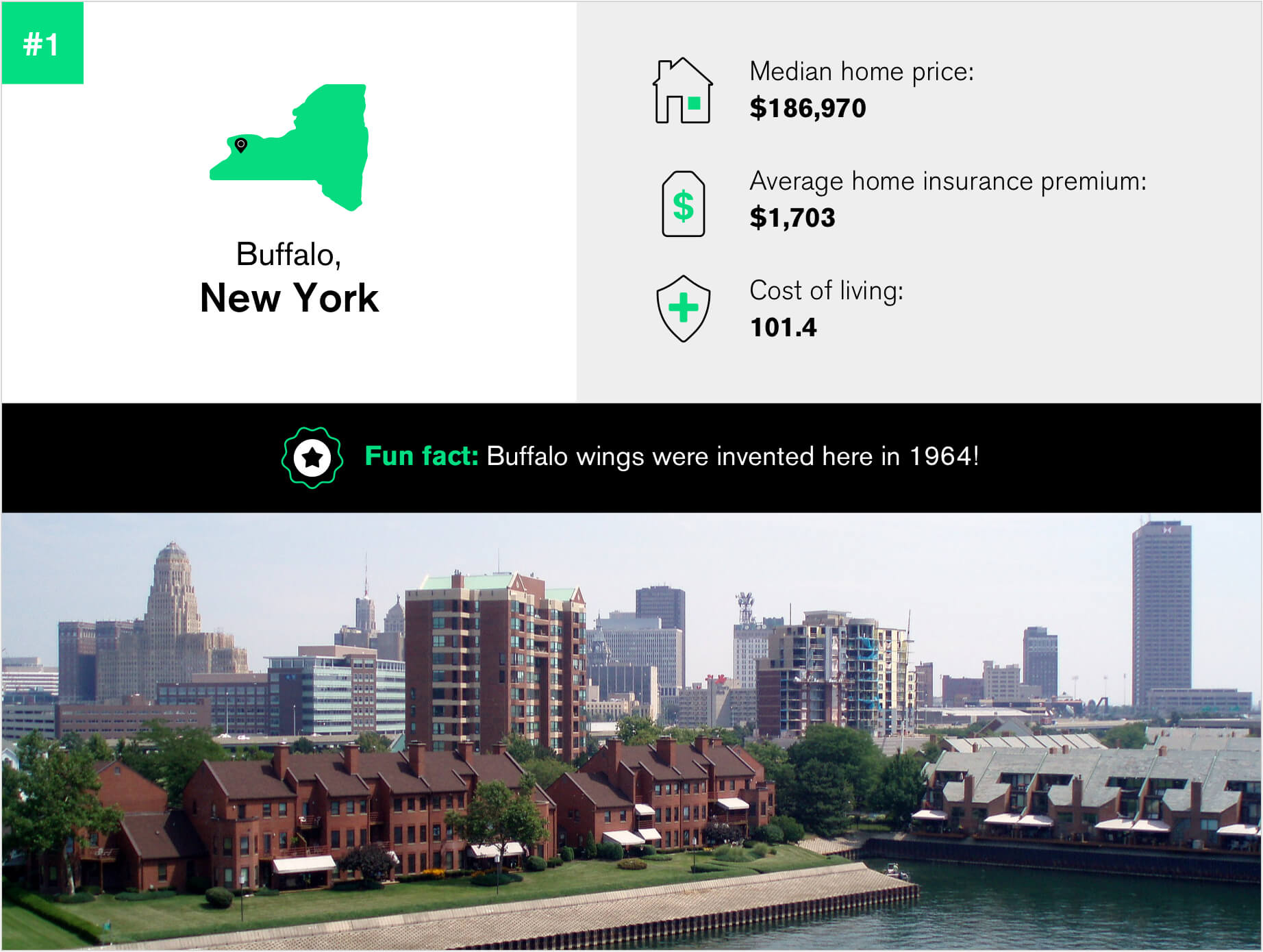

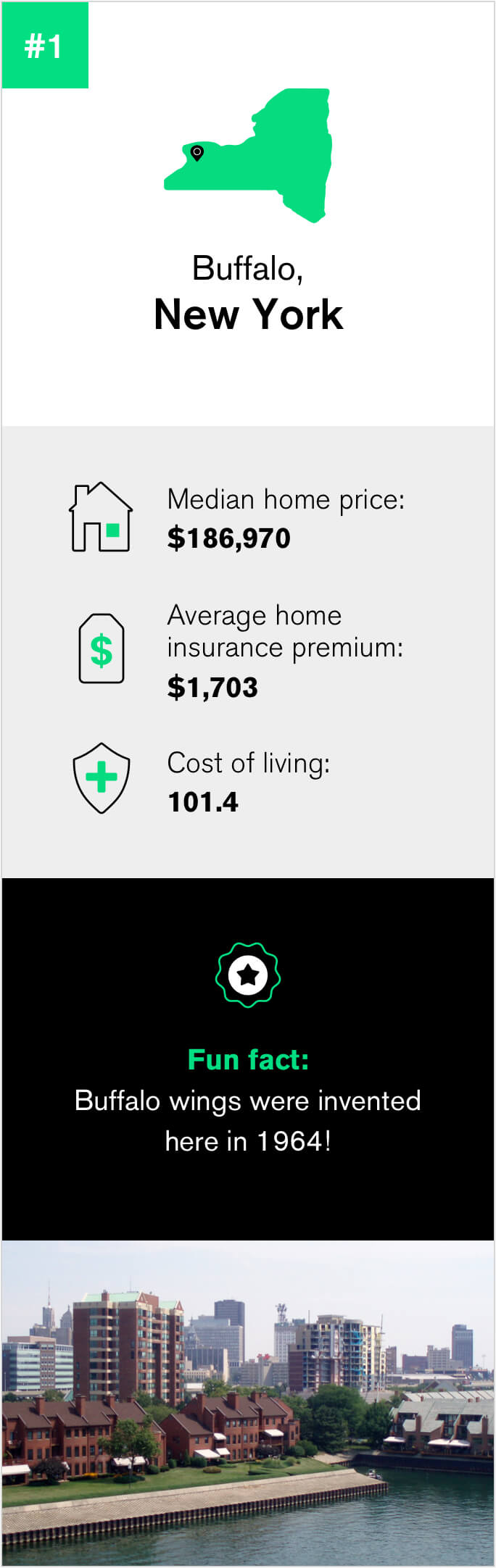

Median home price $186,970 Average home insurance premium $1,703 Property value gain over the last 10 years 133.86% Comfort index 6.4 Cost of living 101.4 Percentage of those who own their home 41% Property crime rate 629.7 (U.S. average is 500.1) Walkability score 68 Seated on the coast of Lake Erie, Buffalo is an excellent second home location for those wanting to enjoy the beauty of upstate New York. The city secured the top spot in the Northeastern region thanks to its super-low housing prices (the lowest out of all the top cities in this region), a cost of living average on par with the rest of the nation and a relatively high walkability score. It’s also the birthplace of Buffalo wings — you know, if you’re into easy access to delicious food.

Getting coverage for your second home

Though you may not spend all your time at your second home, that doesn’t mean it doesn’t deserve protection. Quite the opposite, actually. Since you won’t always be around to keep watch, it’s a smart idea to beef up security and invest in proper insurance for your home. It’s also worth noting that the type of insurance you need will vary based on how often you plan on visiting and if you plan to rent it out to others. You can learn more about protecting your second home with our guide.

No matter where you buy your second home, Hippo’s got you covered with modern, smart home insurance policies that work for you to make sure your investment is properly protected. Have a few questions, or are you ready to get a policy? Give us a call and we’ll help you get what you need. Want to learn more about the best cities to settle down? Check out our NY home buying guide.

Methodology: This study was conducted in August 2021. To identify the top cities to buy a vacation home, the team at Hippo pulled the following data sets for the top 100 most populous cities in the United States:

- Average cost of home insurance (Source: Insurance.com)

- Weight: .21

- Average cost of a home (Source: Zillow)

- Weight: .33

- Property value gain over 10 years (Source: Zillow)

- Weight: .12

- Comfort index (Source: BestPlaces)

- Weight: .05

- Cost of living (Source: City-Data.com)

- Weight: .07

- Percentage of people who own their homes (Source: Niche)

- Weight: .08

- Property crime - burglary (Source: Niche)

- Weight: .11

- Walkability score (Source: Walk Score)

- Weight: .03

We then assigned a weight out of 100 to every data set, based on the most important factors for those shopping for a second home. Each city was then given a score based on these factors and assigned an overall ranking. The cities with the highest scores were deemed the best cities for second home purchases.