How To Navigate the Home Buying Process as a Transgender Person

Owning a home is a worthwhile goal for many, including transgender people. While the process might seem as easy as falling in love with your dream home, signing the papers and booking the U-Haul, discrimination or confusion may seep into the homebuying process for transgender homebuyers.

In honor of Trans Visibility Day on March 31, we here at Hippo wanted to provide trans homebuyers with confidence by readying them for some of the unique challenges they may face. To help navigate the homebuying process so you can start packing your boxes, we’ve put together this guide to considerations for trans homebuyers, including protections that are available and steps to take.

Table of Contents:

Homeownership statistics for LGBTQIA+ and trans people

Mortgage provider Freddie Mac did a survey to gauge the LGBTQIA+ community’s experiences and attitudes toward homebuying, including housing discrimination statistics and interest in purchasing. We’ve rounded up some insightful findings from their report.

- 49% of LGBTQIA+ people ages 22 to 72 own a home.

- 90% of gender-expansive people report feeling worried about gender identity discrimination while purchasing a home.

- 76% of LGBTQIA+ homeowners said they didn’t feel discriminated against while purchasing their home.

- 50% of LGBTQIA+ prospective homebuyers do not believe they’ll have the necessary down payment in the next three years.

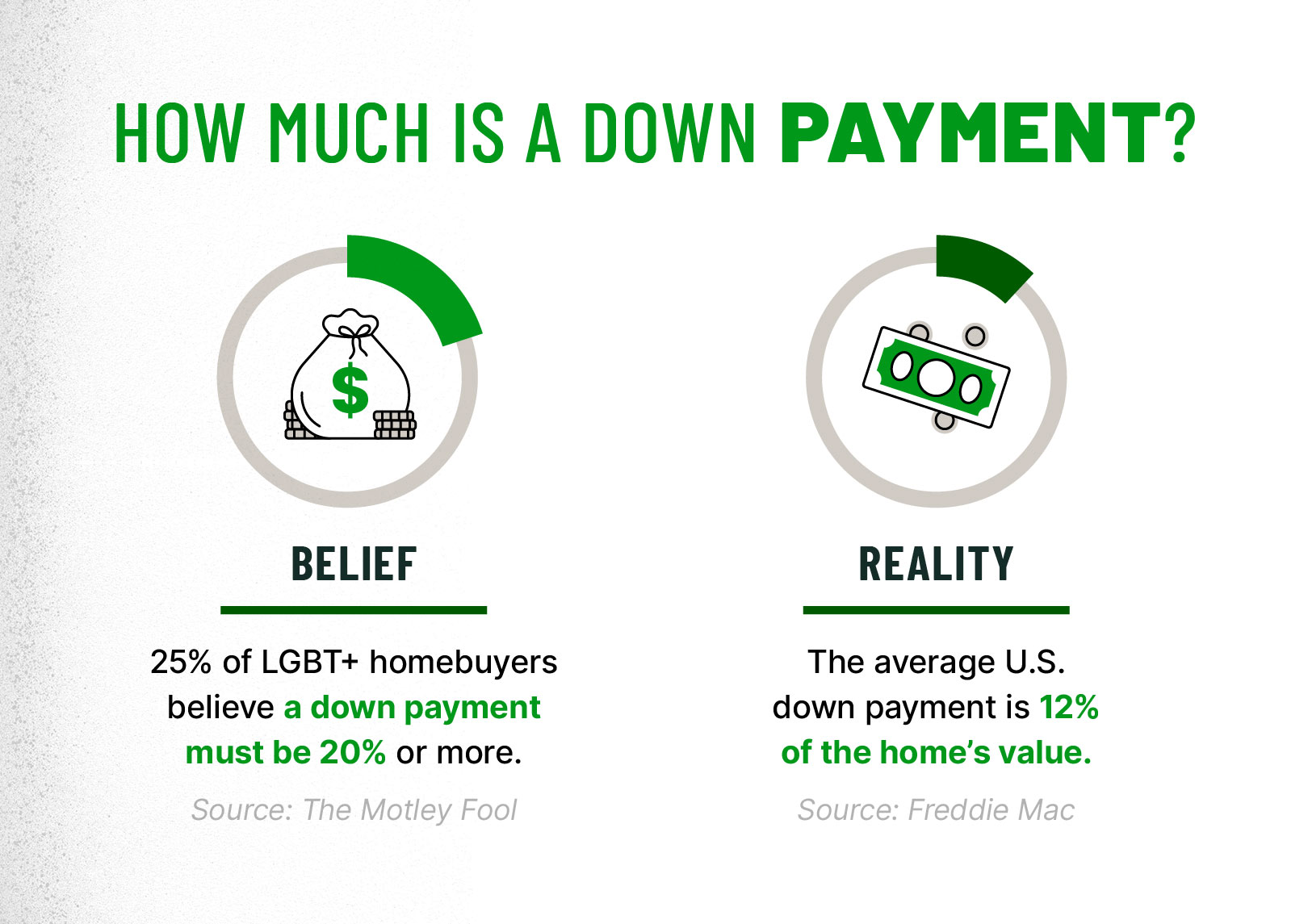

- 25% of LGBTQIA+ prospective homebuyers believe a down payment must be 20% or more.

- 41% of gender-expansive people said they want to own a home in the future.

- 72% of LGBTQIA+ renters want to own their homes in the future.

- 67% of LGBTQIA+ homebuyers financed their purchase with a 30-year fixed loan from a financial institution.

- 57% of LGBTQIA+ homebuyers said their real estate agent’s status as a member of the queer community or an ally influenced their decision to work with them.

- 95% of LGBTQIA+ homebuyers said a safe neighborhood is a must.

Roadblocks for transgender homebuyers

LGBTQIA+, and specifically transgender, homebuyers can face additional obstacles throughout the home buying process.

Securing a down payment

Trans homebuyers might experience hardship securing a down payment for their home, which is usually 6% of the home’s cost for first-time buyers and 12% for all buyers. That means if you’re wanting to purchase a $300,000 home, your down payment will most likely be somewhere between $18,000 and $36,000.

Meanwhile, hormones or gender-affirming surgeries can cost thousands of dollars, especially for those without health insurance. Paying for both a home’s down payment and the cost of health care can put a large financial burden on a trans homebuyer.

Being outed

During the home buying process, you’ll come into contact with realtors, real estate agents, mortgage lenders and the seller you’re buying from. If you’re not publicly out or interested in discussing your identity with strangers, this string of meetings and discussing personal details with new people could feel uncomfortable.

Being deadnamed

If you haven’t formally changed your name on all of your important documents, home buying might be a little harder. Mismatched names on identification documents, proof of employment, credit history, bank information, etc. could cause confusion for your lender or realtor and make it harder or slower for you to secure your home.

In addition, you might encounter your deadname while speaking with a lender or bank employee, which could cause discomfort.

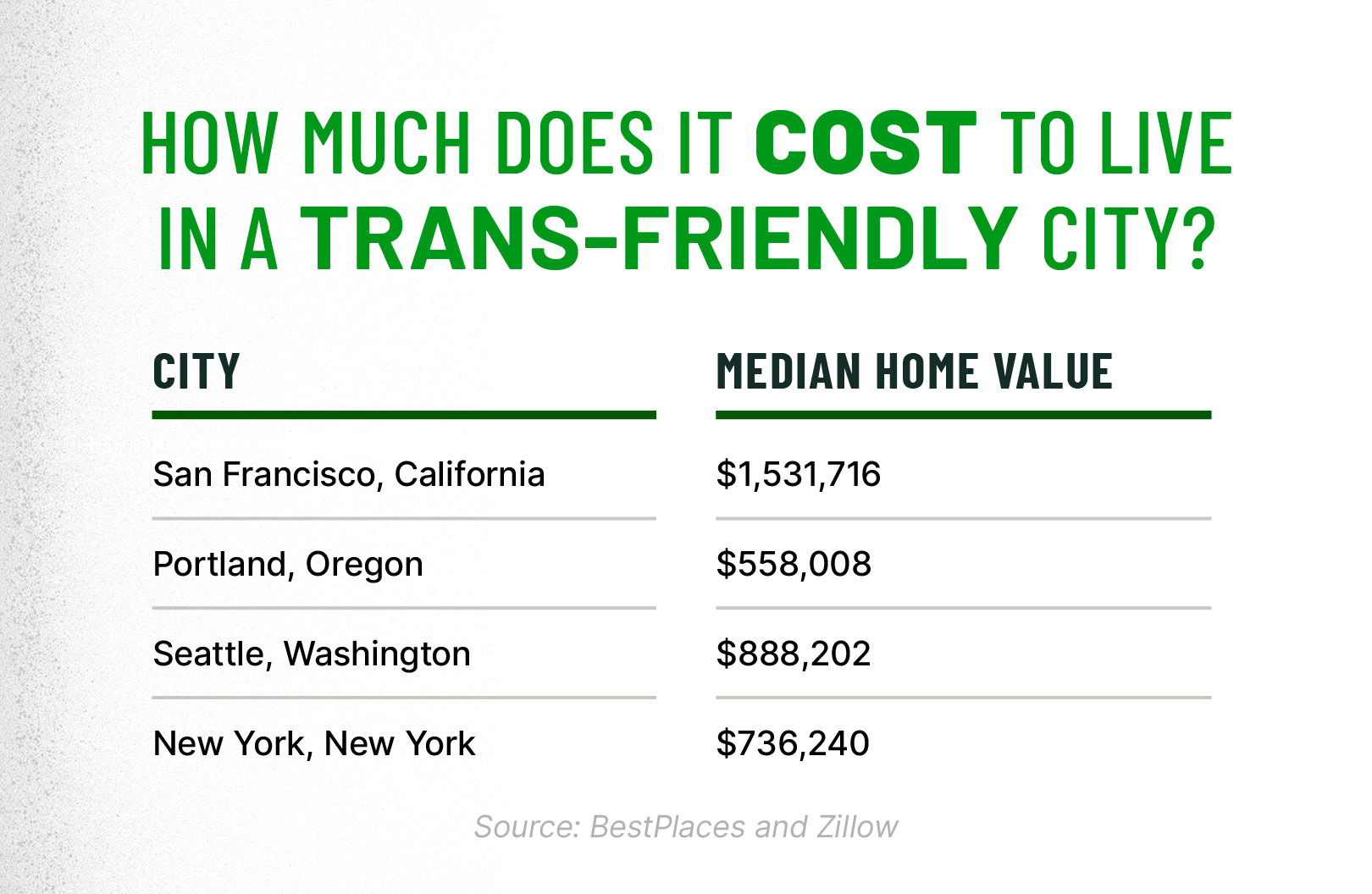

Finding an affordable and inclusive community or neighborhood

Though there are cities and states in the U.S. that have direct protections for LGBTQIA+ homebuyers, high housing costs might make it hard for members of that community to actually live there. For example: California has statewide regulations to protect queer people, but the home values there are about 187% higher than the U.S. average.

Facing discrimination

Though the U.S. has made strides in LGBTQIA+ representation and protection, discrimination may still impact homebuyers, especially considering that more than half of U.S. states don’t offer housing protections to the LGBTQIA+ community. According to the Real Estate Alliance, 10% of LGBTQIA+ homeowners reported experiencing discrimination while looking for housing and 5% reported that a seller refused to sell to them.

Laws or organizations protecting LGBTQIA+ homebuyers

Some federal and state laws offer protections to LGTBQIA+ home buyers. These laws are meant to make sure discrimination doesn’t seep into the home buying process and impact the queer community’s ability to purchase a home.

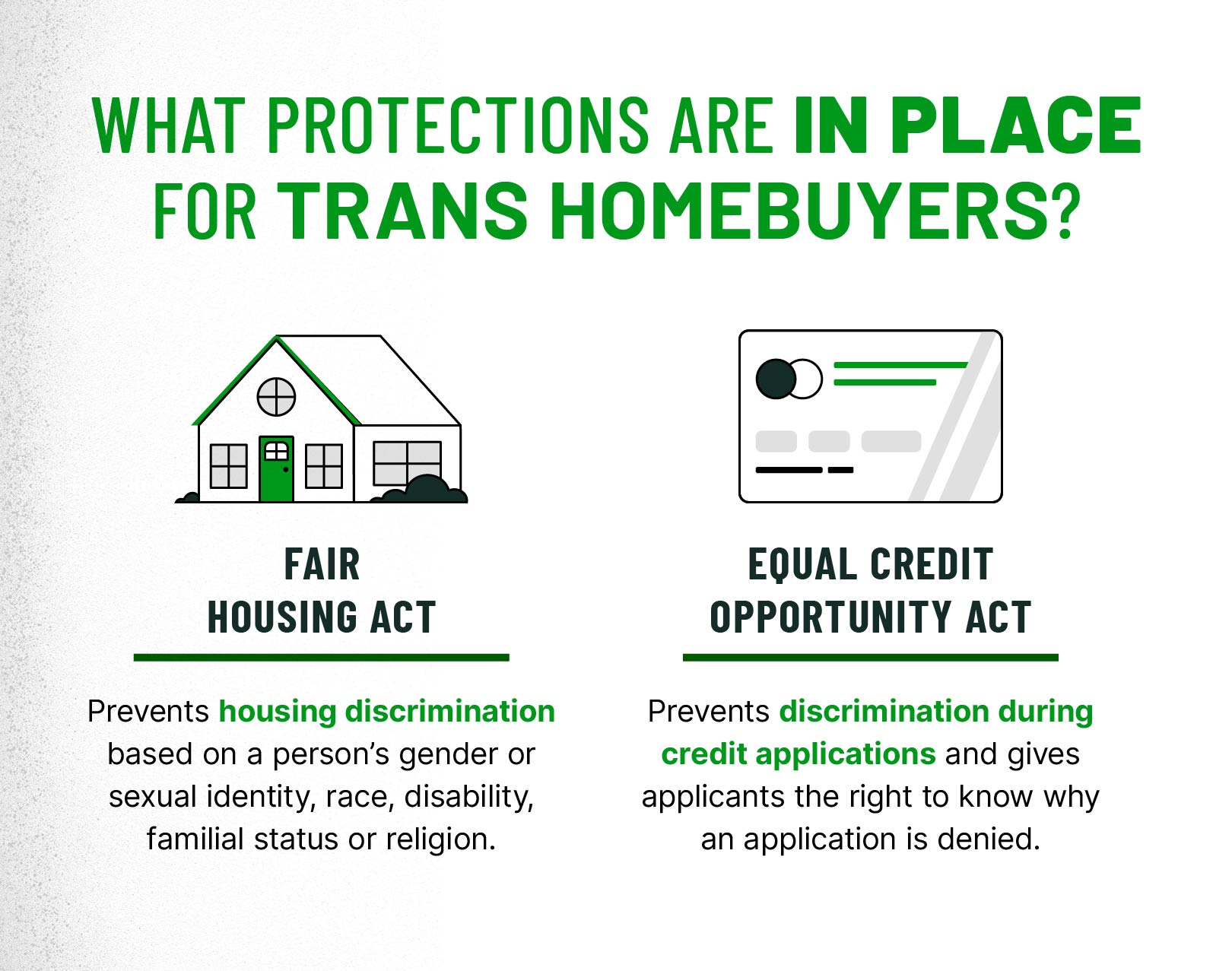

Fair Housing Act

The Fair Housing Act (FHA) was established to block discrimination for many marginalized groups, including not only gender and sexual identity but also race, religion or disability. Under the FHA, it is illegal to refuse to rent or sell to a person because of their identity, set different housing terms based on someone’s identity or try to dissuade the applicant from applying for a home.

For example, the FHA would come into play if a home seller tells a straight couple that they will cover the entire year’s property taxes themselves upon settlement, then tells a same-sex couple that the couple will have to pay the entire year’s taxes.

Equal Credit Opportunity Act

Similar to the FHA, the Equal Credit Opportunity Act prevents an unfair denial of credit based on someone’s race, religion, gender or sexual identity, national origin or age. When considering a credit application, this act prohibits creditors from being able to ask about the applicant’s spouse or children, consider their identity when making lending decisions or set different terms based on identity.

This act also gives applicants the right to know why a credit application is denied or why they were offered less favorable terms.

Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau is a federal bureau that aims to make sure banks, lenders and other financial entities teach their customers fairly. In addition to offering resources about home buying and paying your mortgage, the bureau also acts as a resource for people who feel they’re being taken advantage of by their lender or bank. While the help from this bureau isn’t specifically for trans people, it can be another resource for anyone facing discrimination.

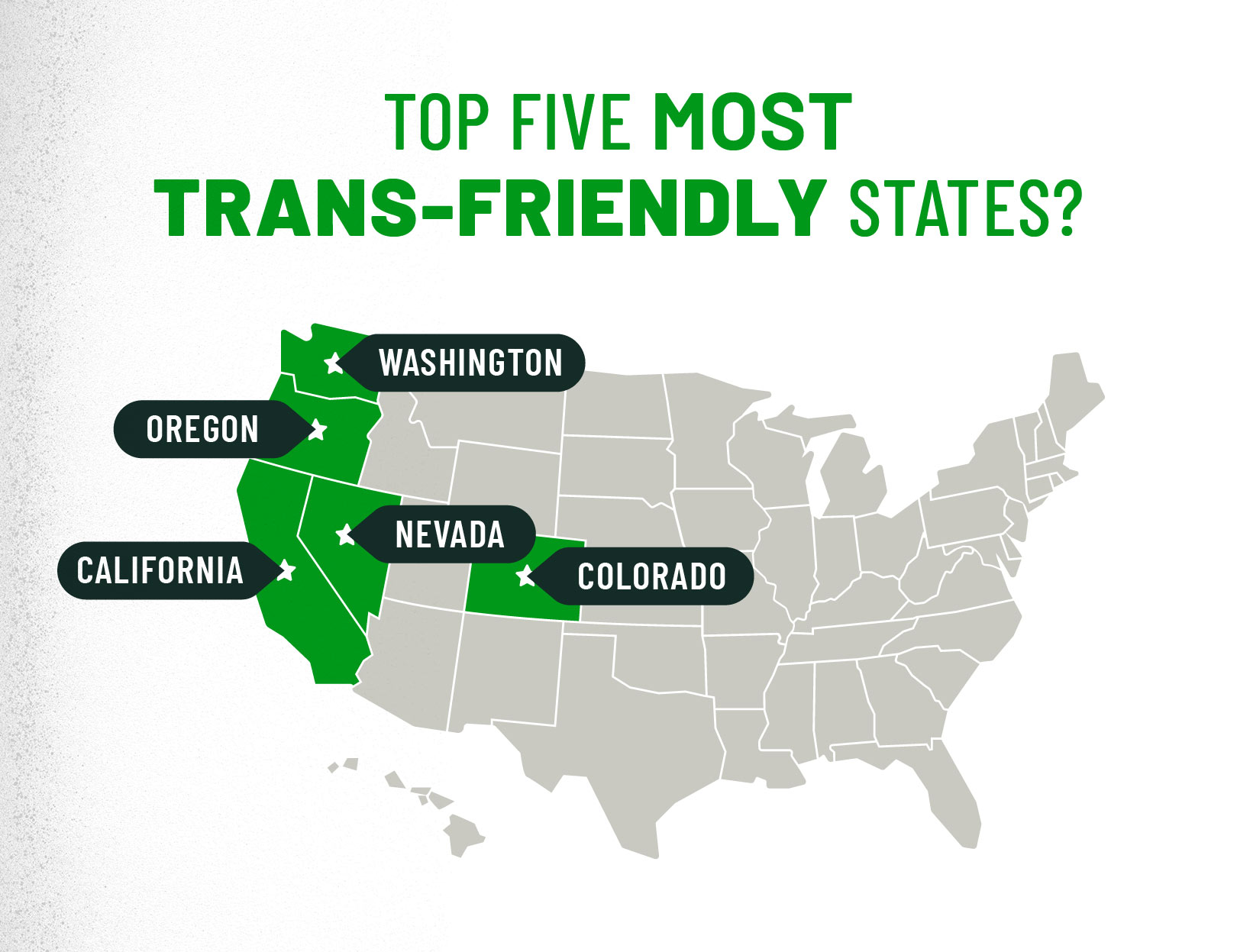

State or Local Laws

Some states or counties have their own laws protecting queer homebuyers. A list of the states that ban housing discrmination based on both gender identity/expression and sexual identity are:

- California

- Connecticut

- Colorado

- Delaware

- District of Columbia

- Hawaii

- Illinois

- Iowa

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New Mexico

- New York

- Oregon

- Rhode Island

- Utah

- Vermont

- Washington

Home buying tips for trans buyers

Finding the right home and putting in an offer can be a confusing experience. We’ve rounded up some tips to help trans homebuyers navigate the process.

Find an LGBTQIA+-friendly real estate agent

You’re going to get a lot of face time with your real estate agent between meetings, showings and ultimately putting in an offer. That means that your chosen agent should be a trusted partner for your home buying needs.

There are resources — such as the Real Estate Alliance — to help you find an agent that either identifies as LGBTQIA+ or is an ally. That way, you can be certain that your home buying experience will be a safe space that makes you feel confident and excited.

Scope out a diverse, inclusive neighborhood

Finding an inclusive, welcoming community can make you excited to move in and get your life started in a new place. And for many, a safe neighborhood is an essential factor: 47% of queer homebuyers said an LGBTQIA+-friendly community was a must.

According to the Transgender Law Center, the states with the highest number of gender identity protection policies in place are: Washington, Oregon, California, Nevada, Colorado, Minnesota, Illinois, New York, Vermont, Maine, Massachusetts, Connecticut, New Jersey, Washington D.C. and Maryland.

You can find inclusive neighborhoods by searching for queer-owned businesses, finding local chapters of LGBTQIA+ associations like sports teams, clubs or groups, and reading up on policies in place in that locale to protect its population.

Research the home buying process

Making steps to purchase a home is a huge undertaking. So for any homebuyer, you’ll want to be prepared. You should research the home buying process thoroughly before you begin and familiarize yourself with terms like preapproval, property tax, mortgage, closing costs and, of course, types of home insurance.

Knowing what to expect can keep you feeling confident throughout your home buying experience and prevent you from feeling overwhelmed or taken advantage of. Research can also help prevent home buyer’s remorse by giving you a full picture of what home buying (and ownership) is like.

Get your paperwork together

Purchasing a home comes with a lot of paperwork. To save yourself headaches when you decide on a home, you should make sure your financial documents are in order as soon as possible. This could mean getting proof of employment ready to go and collecting your financial information.

Paperwork you’ll need to purchase your home includes:

- Pay stubs

- Proof of employment

- Tax and bank statements

- Debt information

- Residential history

Most of these documents are available through your bank and employer.

Know your rights and use your resources

Everyone should have access to housing. If during the home buying process you begin to feel that you’re experiencing discrimination, there are resources available (including the Fair Housing Act) that can help you. You should also remember that you’re not obligated to complete your home buying process with the same realtor — if you begin to feel uncomfortable, you can find an agent that better suits your needs.

Additional resources

Need more info about buying a home as a queer person? Visit the following resources.

- Securing A Home Loan: What Transgender People Need To Know

- The Hidden Challenges Facing Transgender Home Sellers and Buyers

- These Gay-Friendly Cities Have Lots to Offer LGBTQ Buyers—Including Affordable Homes

- Mortgage Lending for LGBTQ+ People

- LGBTQ community: Know your rights as a homebuyer

Here at Hippo, we believe in empowerment and confidence throughout home buying and homeownership. That’s why we aim to provide quality insurance at an affordable rate. So once you’ve signed the papers for your dream home and are ready to make sure it’s protected, contact us for a home insurance quote to see how we can serve you.