When Do You Start Paying Property Taxes On a New Home?

When you finally close on your new home, you’ll most likely feel excitement and maybe even a bit of relief. Then comes the paperwork and payments, including your annual property taxes. You’ll owe some property taxes as soon as you close, though exactly how much will be decided by your lender and an agreement between you and the seller.

To help navigate the property tax process and payment structure, we’ve put together a guide to this often asked about tax and when exactly you start paying property taxes on your new home.

What are property taxes?

Property taxes are a levy charged on a household based on the value of the home and property. These are local taxes that are then used to fund municipal services, community projects and local infrastructure like schools, parks and community safety.

How are property taxes paid?

There are a couple of ways to pay property taxes: through an online portal or check every six months, or via an escrow account. More information on both of these methods can be found below:

- Via mail or online portal: Once a year or every six months you can pay your property tax bill directly to the taxing agency. This will either be done by writing and mailing a physical check or logging on to an online portal to make a payment.

- Via an escrow account: When you pay your mortgage each month, you can also put money into an escrow account that will then be used to pay your property taxes. The lender will make a tax payment on your behalf using the money in the escrow account. Find out more about changing your homeowners insurance with an escrow account here.

Do you pay property taxes monthly or yearly?

Typically, property tax payments are due twice yearly, in the spring and fall. However, that might not necessarily mean you pay them twice per year. If you take on your own property tax payments, you can opt to pay when they’re due or pay in advance. Some people pay for the entire year at once and only pay once per year.

If your mortgage lender is paying your property taxes on your behalf, you may pay into an escrow account each month when you pay your mortgage payments. In this case, you most likely won’t actively notice you’re paying this tax as there will be no further action required from you.

Is property tax included in my mortgage?

No, your property tax payments won’t help pay down your mortgage. But they might be rolled into the same account. If your mortgage lender is making your property tax payments from an escrow account, you’ll usually set aside money with each mortgage payment that they will then apply to your taxes. These will be two separate payments — mortgage, and then property taxes — that are withdrawn from your account at the same time.

Who pays property taxes?

Just like closing costs, there may be some variation in who pays property taxes depending on each individual transaction. As a general rule: Both the buyer and seller will pay property taxes at closing. The seller will typically pay a prorated amount for the period of time they’ve spent in the home that year, and the buyer will pick up where they left off.

However, this may vary based on the market. For example, a seller wanting to sell their home fast may offer to cover property taxes for the rest of the year to incentivize a buyer to act quickly. On the other hand, a buyer up against competition with other offers might offer to pay the seller’s portion of the taxes for the year.

Keep in mind that the current year’s property taxes will be due at closing. It’s usually up to the lender to determine the amount that will be due, and the seller and buyer to make an agreement about who is going to pay what.

Property tax on a new home vs. old home

Property taxes are correlated to home value. As new builds and newer homes are typically more valuable than older ones, people moving into a home shortly after the foundation dries are most likely going to owe more in taxes.

Home age is just one factor that makes up the assessed value of the home. Older homes in less populated areas won’t be appraised as highly as newer homes in communities that are still being built. So for those looking to get in on the literal ground floor, you can expect a higher home value and the higher property tax that comes along with it.

How much are my property taxes?

There is no universal rate for property taxes, as they’re calculated based on home value and the area where you live. Different zip codes will have different property tax rates, then factors like your home’s age,size and condition will affect its assessed value.

To determine how much you’ll end up paying in property taxes, you’ll simply multiply your home’s assessed value by the tax rate in your area, also called a levy.

Assessed value x your area’s property tax rate = annual property taxes.

For example: The average home value in San Francisco, California, is about $1,500,000. Meanwhile, the property tax rate in the city is 1.18%. That means a San Francisco resident can expect to pay about $18,000 in annual property taxes.

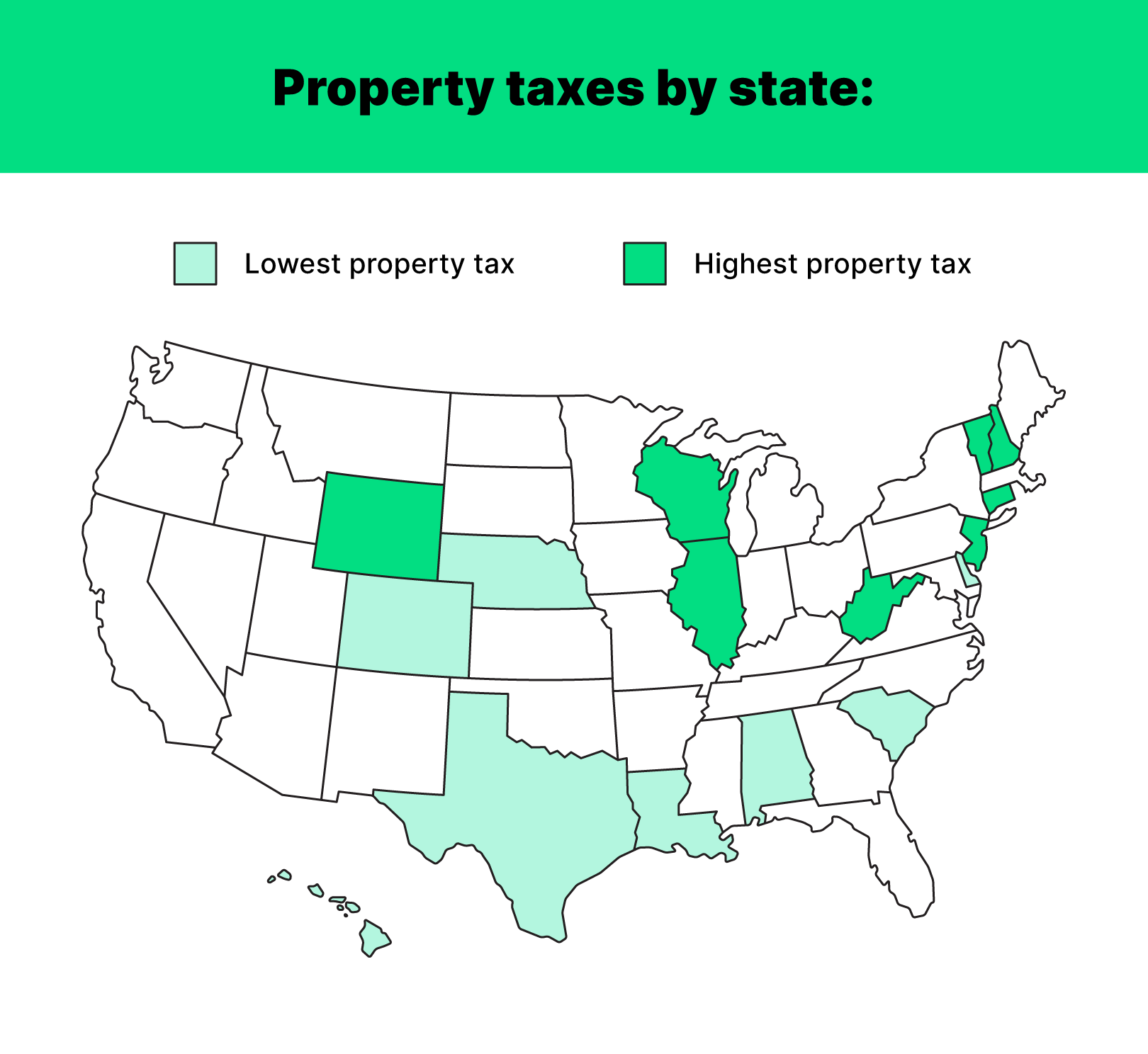

States with the highest and lowest property taxes

Doing your research can help you pick a new locale that doesn’t come with a high price tag. To get you started, we’ve rounded up a list of the eight states with the highest and lowest property tax rates in the United States.

- Lowest: Hawaii, Alabama, Colorado, Louisiana, South Carolina, Delaware, Nebraska, Texas

- Highest: New Jersey, Illinois, New Hampshire, Connecticut, Vermont, Wisconsin, Wyoming, West Virginia

Do you have to pay property taxes forever?

The short answer: Yes. While a mortgage payment will be used to pay off the home and make it fully yours, a property tax payment pays for community projects, municipal services, law enforcement and other area needs. As long as you live in your community, you’ll continue to owe these taxes to your local government.

Some states, however, will allow you to stop paying your property taxes once you turn 65. Check with your local laws to determine if you’ll be eligible for a senior freeze on your property tax.

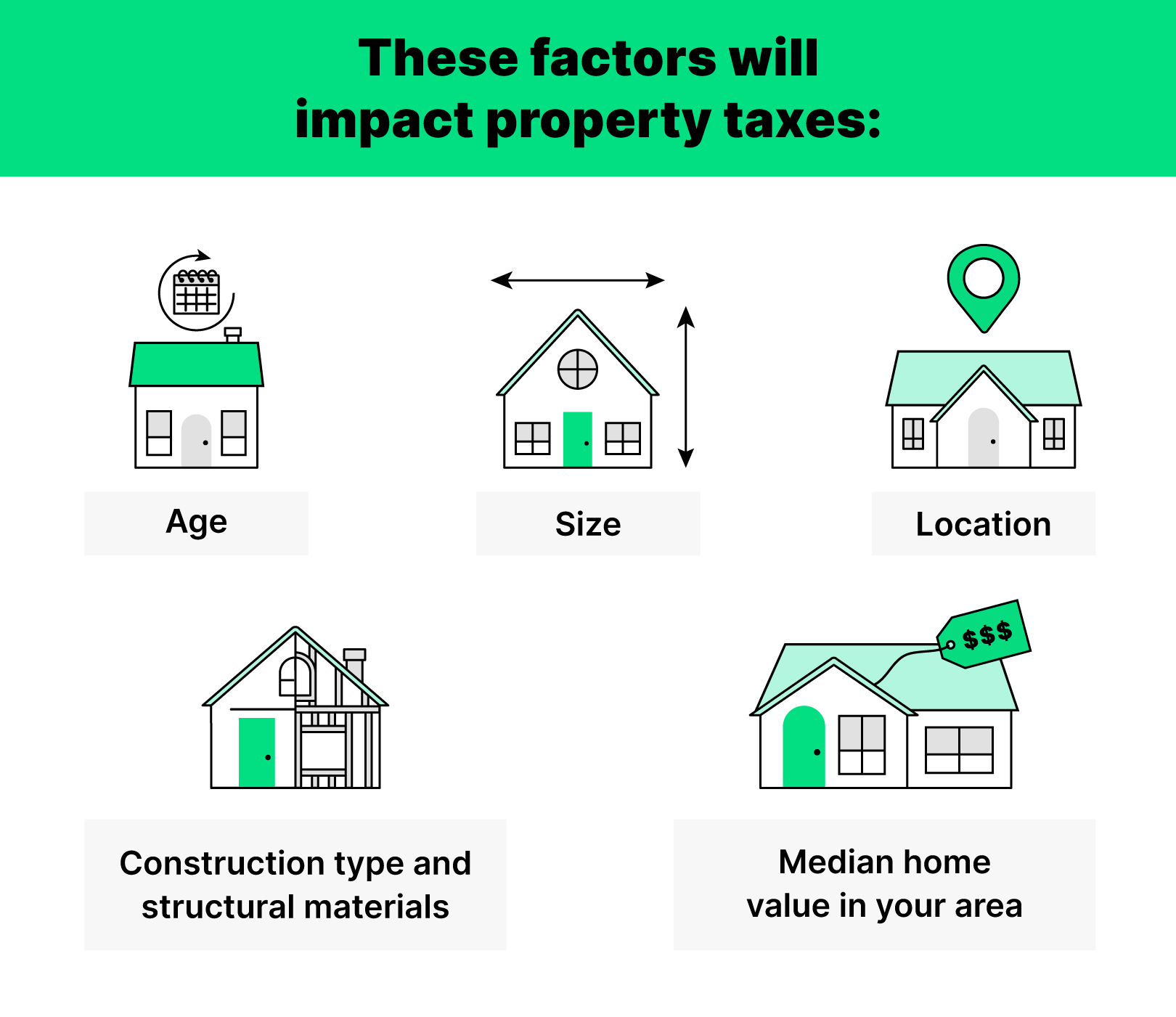

What impacts property taxes?

Property taxes are explicitly tied to home value. What impacts home value? Mainly, the size, location and age of your home. All of these things contribute to how your home is assessed. A few factors to watch out for when thinking about property taxes are the following:

- Age of your home

- Size

- Location

- Construction type

- Median home value in your area

Why do property taxes go up?

Your home value and local tax rate may grow along with you, impacting and potentially raising your rates. If your neighborhood experiences a boom and new moving trucks are speeding down the streets daily, that may translate to higher property taxes as your location becomes more desirable.

You might also see your property values and taxes rise if you take on home improvement projects or increase the size of your home. Big changes to your home or neighborhood might trigger a reassessment of your property value and increase your rates.

Buying a home comes with a lot to think about. While you might be focused on signing papers and moving boxes, costs like property taxes and closing costs are also waiting to be taken care of. One thing you don’t have to worry about? Protection. Getting a quick and easy home insurance quote from Hippo can check one thing off your to-do list so you can get back to the fun part.