Is Your Home Haunted … Or Just Hiding Serious Repairs?

With Halloween creeping closer, every bump in the night feels a little more chilling. According to our Homeowners Preparedness Report, 78% of homeowners experienced unexpected repairs just last year.

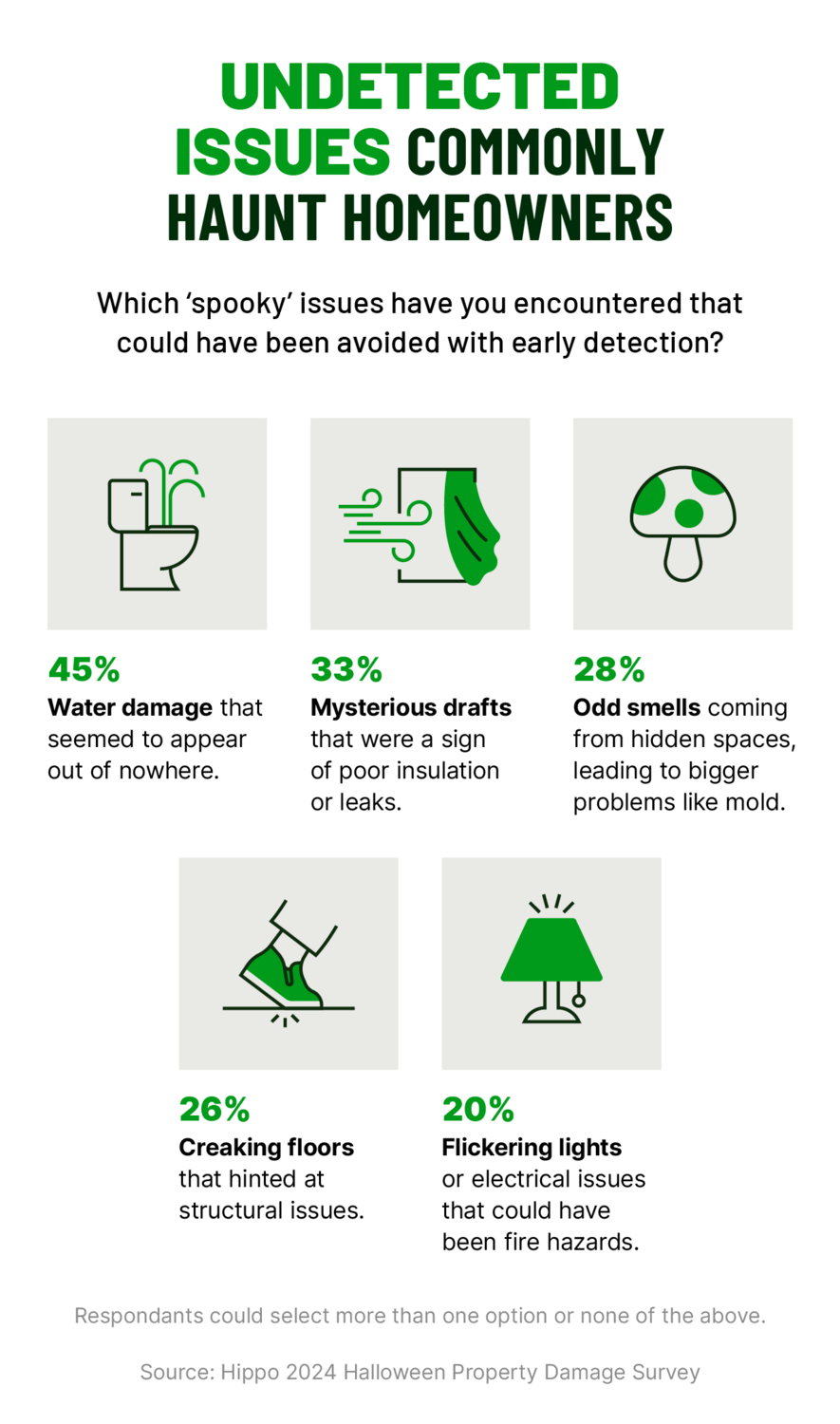

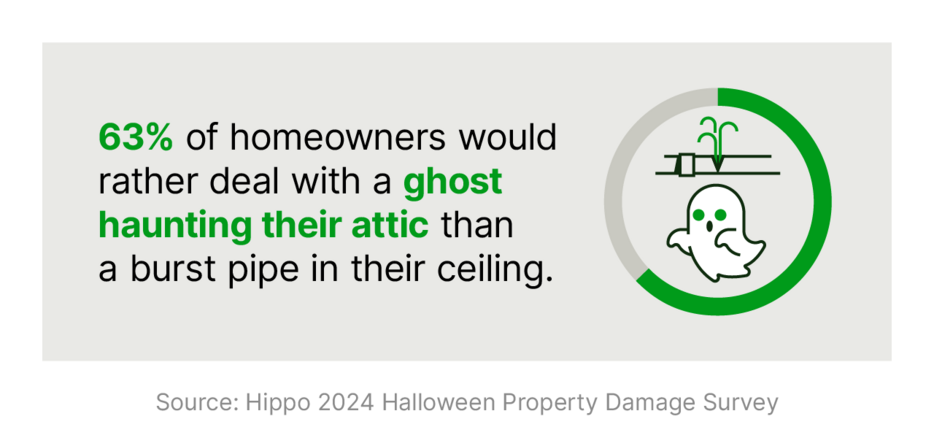

With the spooky season in full swing, we took a closer look at the things that scare homeowners. Our new study surveyed over 2,000 U.S. homeowners to find out how often eerie house settling noises or weird smells in the home turn out to be something more sinister—like a burst pipe or mold infestation.

Your home may not be haunted, but these spooky occurrences are all too real. Here’s how to protect yourself from ‘scary surprises’ commonly found around the house.

Key takeaways

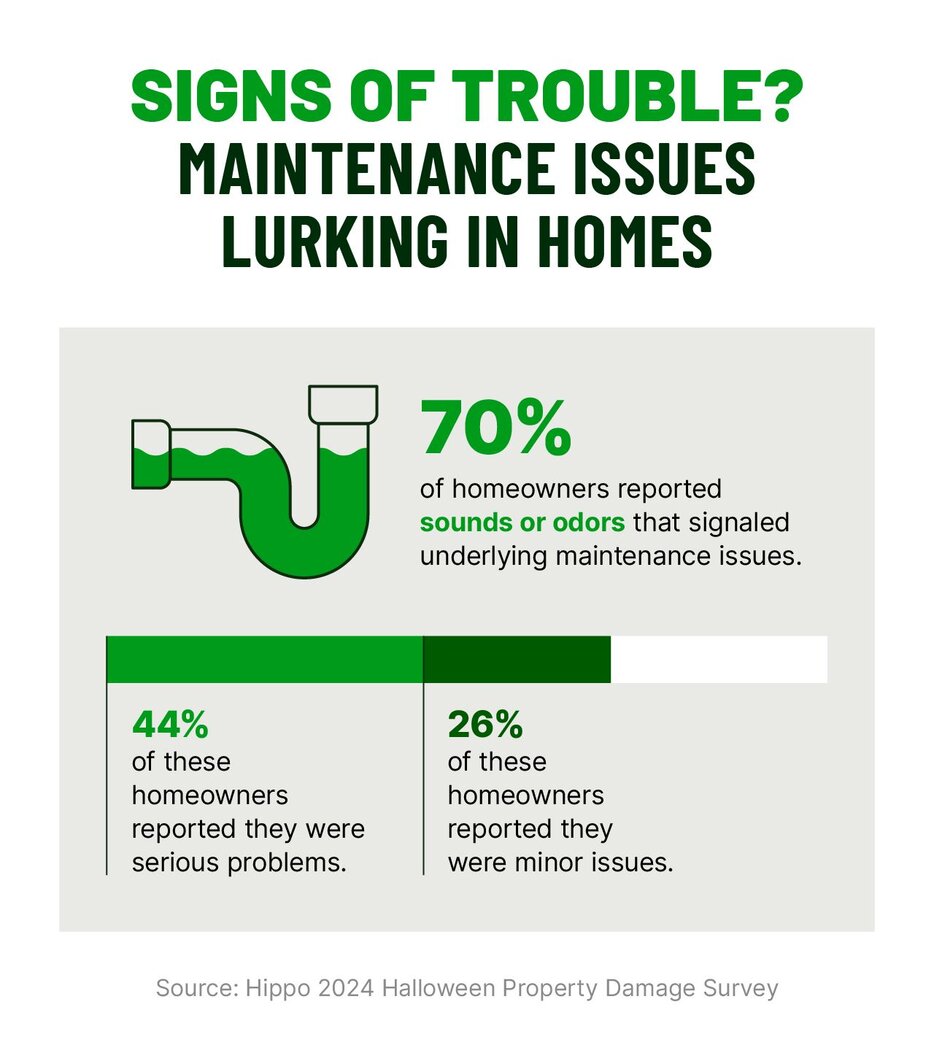

- Spooky signs often indicate real problems. In fact, 70% of homeowners reported hearing eerie sounds or noticing strange smells that turned out to be signs of maintenance issues.

- Homeowners fear unexpected and costly damage. 49% of homeowners are most frightened by the possibility of discovering unexpected property damage that leads to expensive repairs.

- The Halloween season amplifies homeowner concerns. The fear of home damage intensifies around Halloween, with 36% of homeowners worried about liability from accidents and 40% feeling more anxious about theft.

- Prevention is key to avoiding costly repairs. Regular inspections, preventative maintenance, and comprehensive home insurance can help homeowners address problems before they escalate, ensuring peace of mind throughout the year.

The real scare? What unsettling sounds and odors could mean for your home

- Clanking pipes could signal air trapped in the plumbing or failing pipes.

- Unexplained drafts or cold spots might indicate gaps in insulation or leaky windows/doors.

- Scratching sounds in walls could point to rodents or pests invading the home.

- Flickering lights could suggest electrical issues, faulty wiring, or power surges.

- Musty or rotten odors might indicate mold, mildew, or a sewage leak.

- Mysterious water stains on ceilings or walls could be signs of a hidden leak or roof damage.

- Rattling HVAC systems might signal loose components or an impending system failure.

Home horror stories: Top issues haunting homeowners

Liability fears haunt 36% of homeowners: The importance of coverage during Halloween

Creaks and cracks? Help prevent issues from becoming nightmares

- Schedule regular inspections: A professional can help identify potential problems that might be tricky to access, such as behind walls, inside critical systems such as HVAC systems and other harder to reach areas.

- Invest in preventative maintenance: Keeping up with a seasonal maintenance checklist can help prevent costly repairs.

- Consider home security essentials: Installing home security essentials like automated lighting, doorbells and security cameras, window and door sensors, smart locks, and security systems could help deter crime.

- Review your home insurance coverage: Know what’s covered before disaster strikes. Homeowners insurance (aka an HO-3 Policy) typically covers your home, belongings, personal property, other structures, and liability.

Methodology

Related Articles

6 Weird Smells In Your House And How To Prevent Them

The Cracks in the Walls Homeowners Shouldn’t Ignore

14 House-Settling Noises Homeowners Should Know

Fall Home Maintenance Checklist: 23 To-Dos + Downloadable

Report: Where Homeowners Turn for Maintenance Advice in 2024