Hippo 2023 Homeowner Preparedness Pulse Report

Our 2022 Homeowner Preparedness Report found that nearly three-quarters of responding homeowners paid for upgrades and maintenance projects resulting from a lack of planning. However, we also learned from that report that inflation and price increases kept close to half of surveyed homeowners from doing planned maintenance or improvement.

With the ongoing impacts of inflation and the increasing effect of severe weather, we wanted to see how homeowners approached preparedness in 2023. Being prepared and proactive can range from making home upgrades to protect against extreme weather to completing routine maintenance to get ahead of major issues down the road.

We surveyed U.S.-based homeowners for our 2023 Homeowner Preparedness Pulse report to get an updated look at homeowner obstacles, motivations, and actions homeowners are taking. Below, “homeowners” refers to homeowners who responded to our survey.

Key Survey Takeaways

-

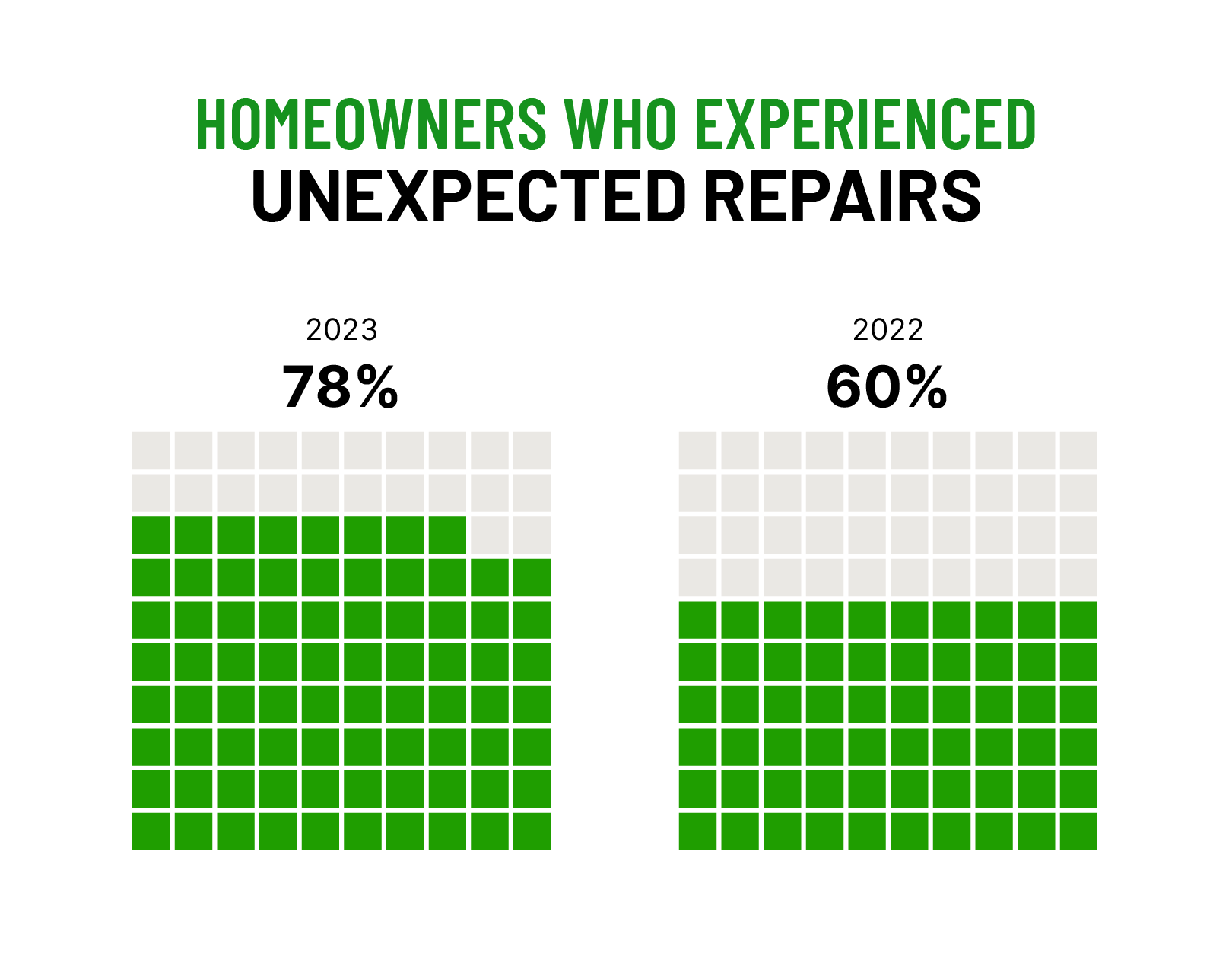

78% of homeowners experienced unexpected repairs this year.

-

45% of homeowners said they experienced damage to their home they could’ve prevented compared to 19% in 2022’s Preparedness Report.

-

49% of homeowners experienced unexpected repairs or upgrades around their homes and had enough money to cover the cost.

-

41% of homeowners say they are primarily DIYing some or all renovation, repairs, and maintenance to manage costs.

-

74% of homeowners said inflation and price increases hindered their planned projects in the past few months compared to only 43% in 2022’s Preparedness Report.

-

50% of homeowners estimated that they’d paid more than $3,000 on repairs in the past year, and 50% predict they’ll also pay more than $3,000 in the upcoming year.

-

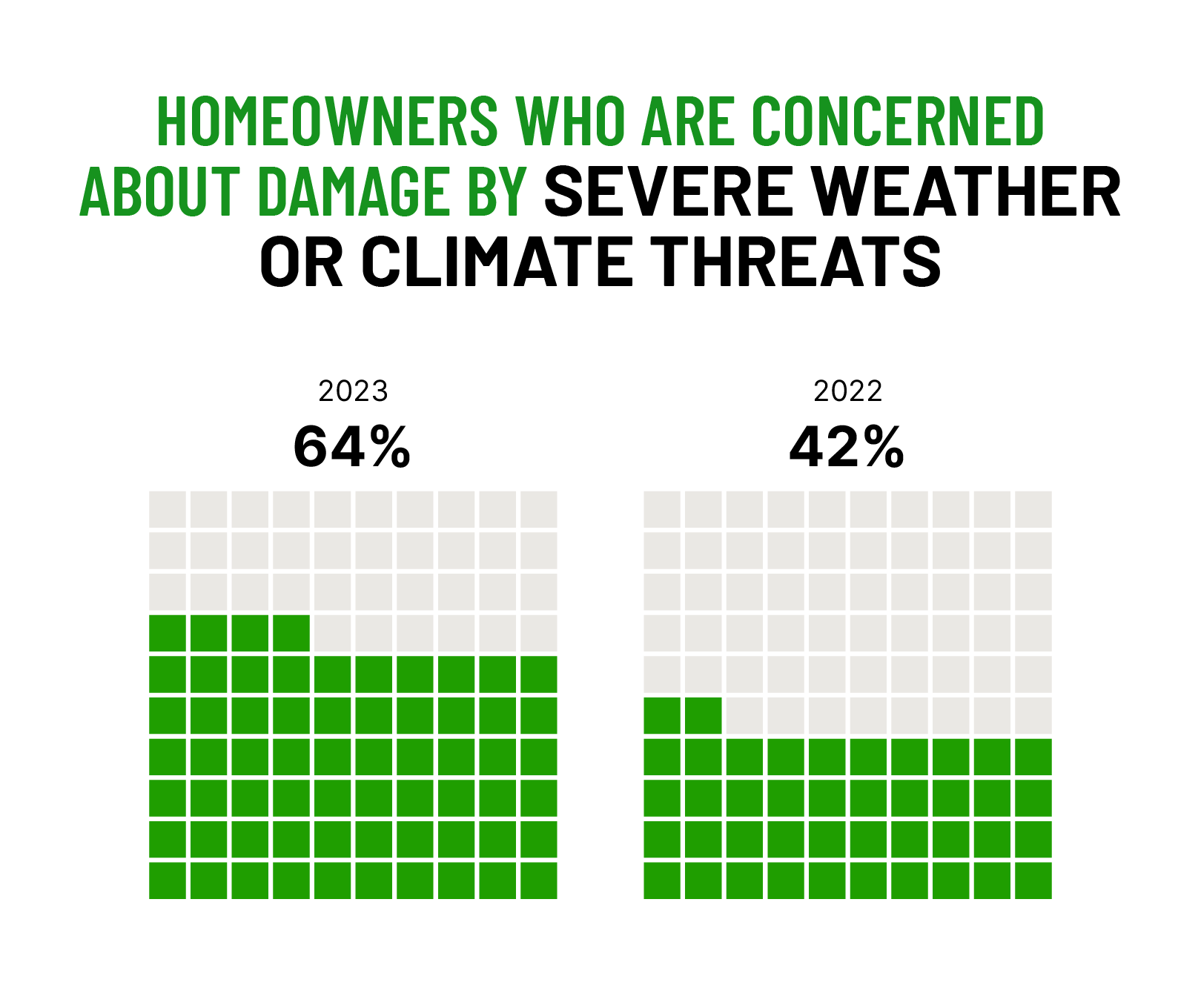

64% of homeowners said they’re concerned about severe weather or climate threats damaging their homes, compared to 42% of homeowners in 2022’s Preparedness Report.

-

56% of homeowners experienced damage to their homes due to climate-related or severe weather issues compared to 31% in 2022’s Preparedness Report.

78% of homeowners are dealing with unexpected repairs in 2023

HVAC leaks. Clogged gutters. Broken windows. Unexpected issues can come in many shapes and forms for homeowners—and now, more frequently based on our survey results.

According to our 2023 Preparedness Pulse Report, nearly 8 in 10 homeowners paid for unexpected repairs. This high number is potentially why 78% are also concerned with staying on top of regular home maintenance (compared to 52% in 2022’s Preparedness Report).

The top three reasons for unexpected repairs were:

-

Gradual wear and tear over time (28%)

-

Aging home infrastructure (20%)

-

Severe weather or climate-related issues (15%)

Fortunately, homeowners have the power to get ahead of issues with wear and tear or older parts of the home.

Although we can’t directly control severe weather, homeowners can install storm shutters or create a defensible space around their homes. Going through your home maintenance checklist for each season can also help ensure small issues don’t lead to big repairs.

More homeowners acknowledge this as well. 45% of homeowners from this year’s report said they experienced damage to their home they could’ve prevented compared to 19% of homeowners in 2022’s Preparedness Report.

DIY, budgeting, and prioritizing help homeowners manage repairs

The Joint Center for Housing Studies of Harvard University found that spending for home improvements and repairs has declined since Q4 2022 and is predicted to decline well into 2024.

Although spending is down, we found that homeowners are still doing what they can to protect their homes. According to our 2023 Homeowner Preparedness Pulse Report, 62% of homeowners are most motivated to work on maintenance and repairs to fix something that’s broken or needs replacing. This motivation surpasses other areas like improving their home’s value (45%) and improving their home’s safety (38%).

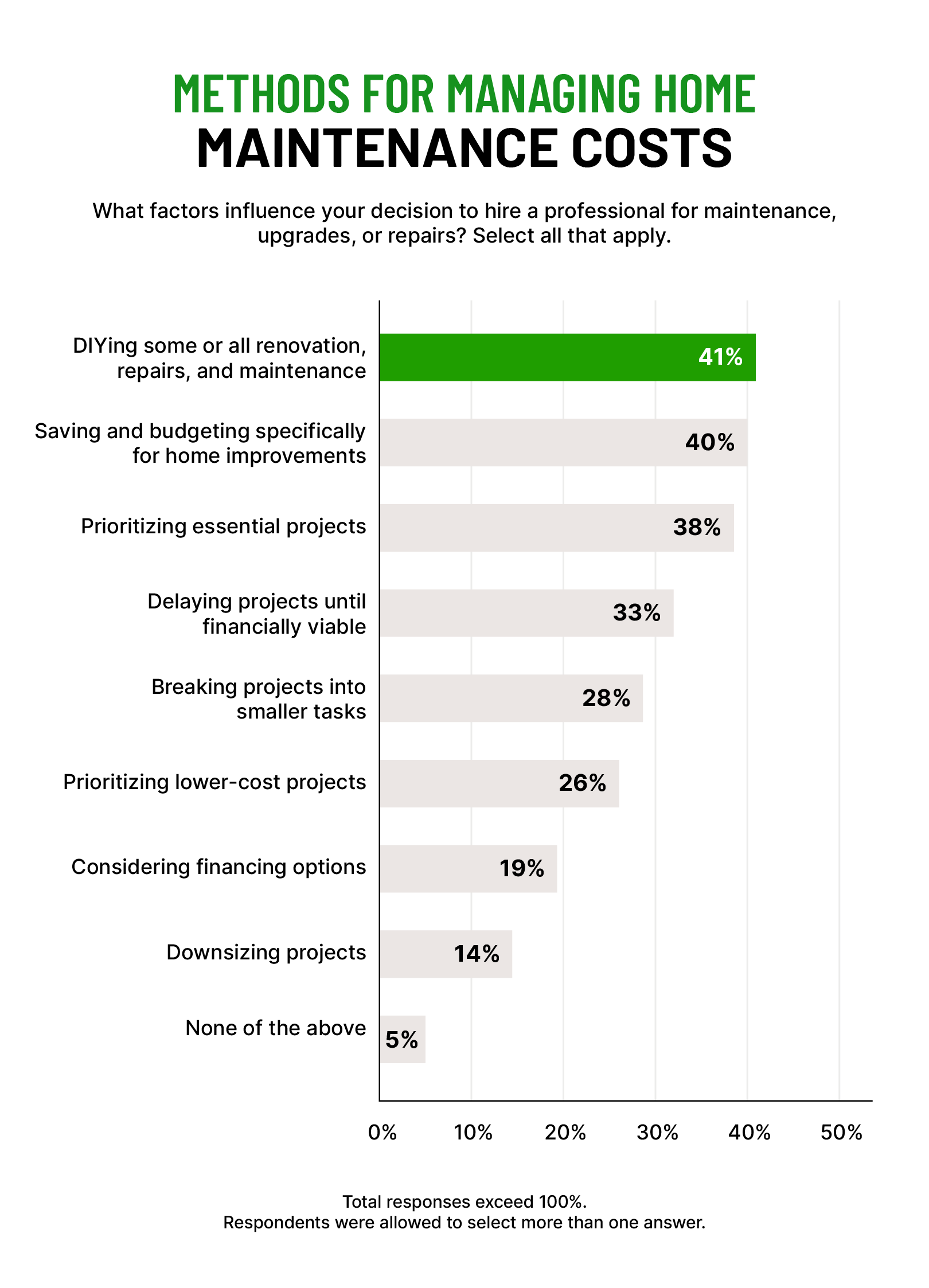

To manage costs this year, 41% of homeowners are primarily turning to DIYing some or all renovation, repairs, and maintenance to manage costs. Other strategies include the following (note that survey respondents were able to select more than one answer):

-

Saving and budgeting specifically for home improvement (40%)

-

Prioritizing essential projects (38%)

-

Delaying until projects are financially viable (33%)

-

Breaking projects into smaller tasks (28%)

-

Prioritizing lower-cost projects (26%)

-

Considering financing options (19%)

-

Downsizing projects (14%)

Despite prioritizing DIY to save money, we found that home professionals still play an important role in helping homeowners tackle repairs.

42% of homeowners said they’re moderately confident in identifying and fixing common household issues and tackling simple tasks. 54% said they’ll hire a professional if they lack the necessary skills, and 54% also said they would if the task is too complex. Homeowners are potentially calling in electricians for support since only 27% felt confident in tackling electrical fixes themselves.

We also saw that more homeowners are saving in 2023 than 2022. Increasing budgets for home repairs can help homeowners keep up with increasing prices as a result of inflation, supply chain issues, climate change, and other external factors that can impact home repair costs.

-

13% of homeowners make a yearly budget in comparison to only 5% last year.

-

22% set aside money each month or pay period compared to only 15% last year.

-

54% pay for upgrades and maintenance as they come up or have no set plan, compared to 74% last year.

Resourcefulness and preparedness are especially important traits since issues like inflation can bring major hurdles.

Inflation and price increases kept 74% of homeowners from doing planned projects

The Consumer Price Index (CPI) in June 2022 (when we published the 2022 Preparedness report) was 9.1%, while the CPI in June 2023 was 3%. 2022 also saw the largest increase in consumer prices in 40 years.

This increase, combined with continued price growth in 2023, can potentially impact a homeowner’s ability to maintain their home. We saw that inflation and supply chain issues impacted homeowners.

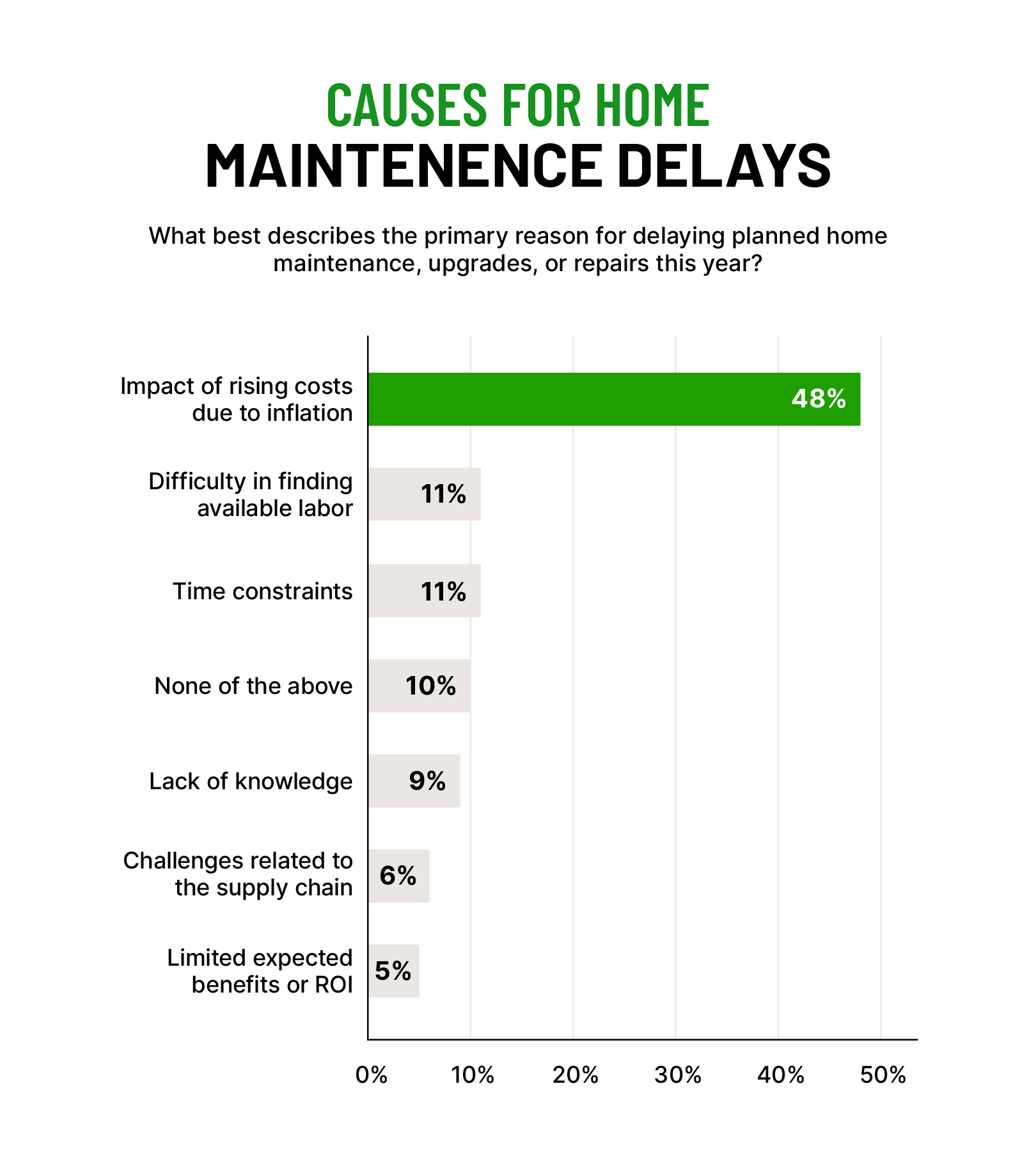

74% of homeowners in our 2023 Preparedness Pulse Report said that inflation and price increases hindered their planned projects compared to 43% in 2022’s Preparedness Report. Additionally, 59% of homeowners in our 2023 Report said that supply chain issues and shortages prevented them from doing planned projects compared to 39% in 2022’s Report.

When comparing reasons for delaying projects, significantly more homeowners cited the impact of rising costs due to inflation (48%) in comparison to other reasons, like labor shortages (11%) or time constraints (11%).

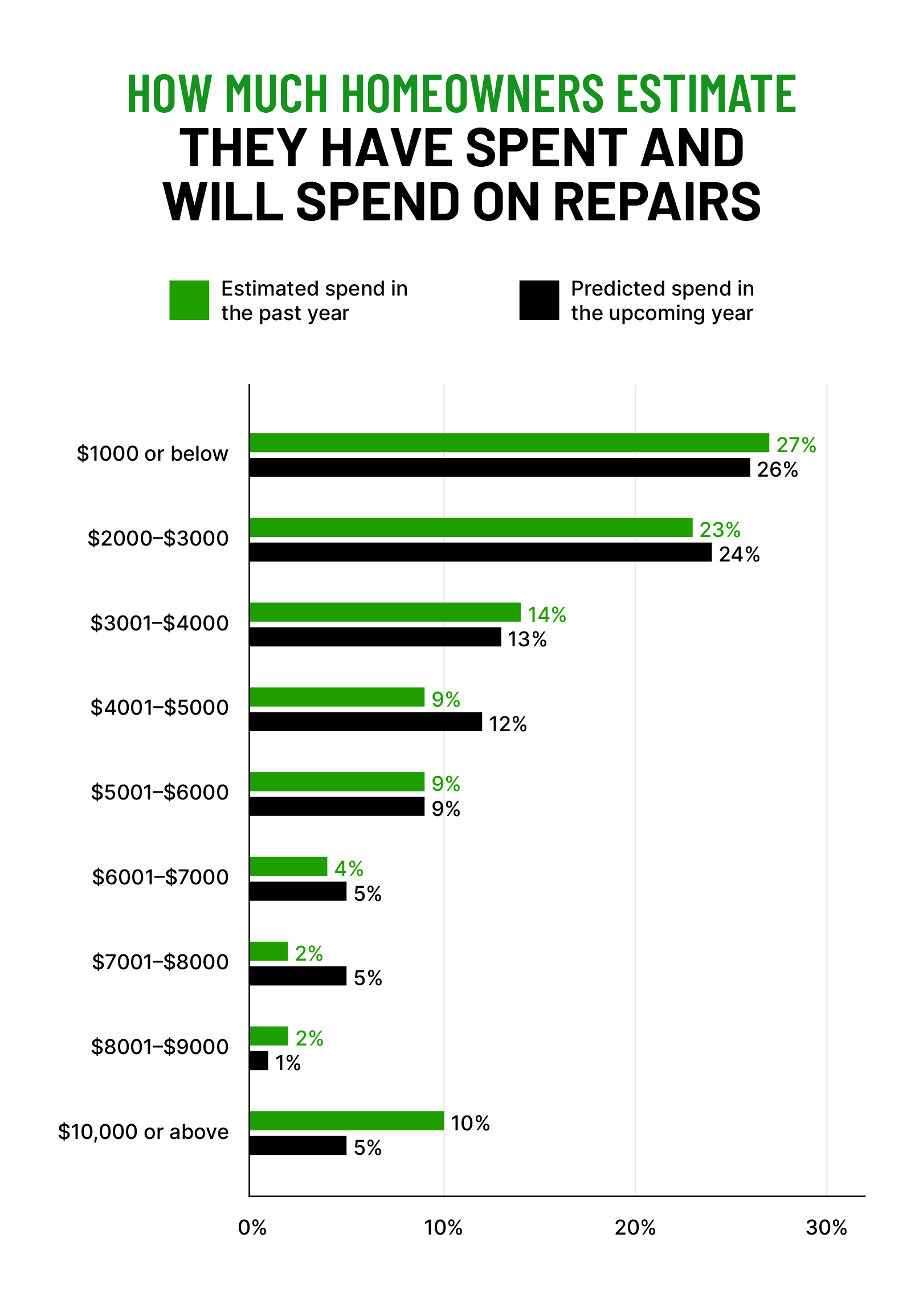

So, how much are homeowners paying?

50% of homeowners this year estimated they’d paid more than $3,000 on repairs in the past year. When asked to predict repair expenses for the upcoming year, 50% also predicted they’d pay more than $3,000.

Inflation alone adds complexity to homeownership. An issue like climate change, on the other hand, can bring a separate set of factors to manage.

64% of homeowners in 2023 are concerned about severe weather or climate-related damages

Homeowners’ attitudes toward severe weather, including recent extreme weather events like Hurricane Hilary, may have also impacted the shift we saw toward resourcefulness.

More than 6 in 10 homeowners in our 2023 Preparedness Pulse Report said they’re concerned about severe weather or climate threats damaging their home compared to more than 4 in 10 homeowners in 2022’s Preparedness Report.

When asked about actual damage, 56% of homeowners in the 2023 Report said they experienced damage to their homes due to severe weather or climate-related issues compared to 31% in 2022’s Report.

We also found that 25% of homeowners are motivated to work on home maintenance or repairs to make something more environmentally friendly.

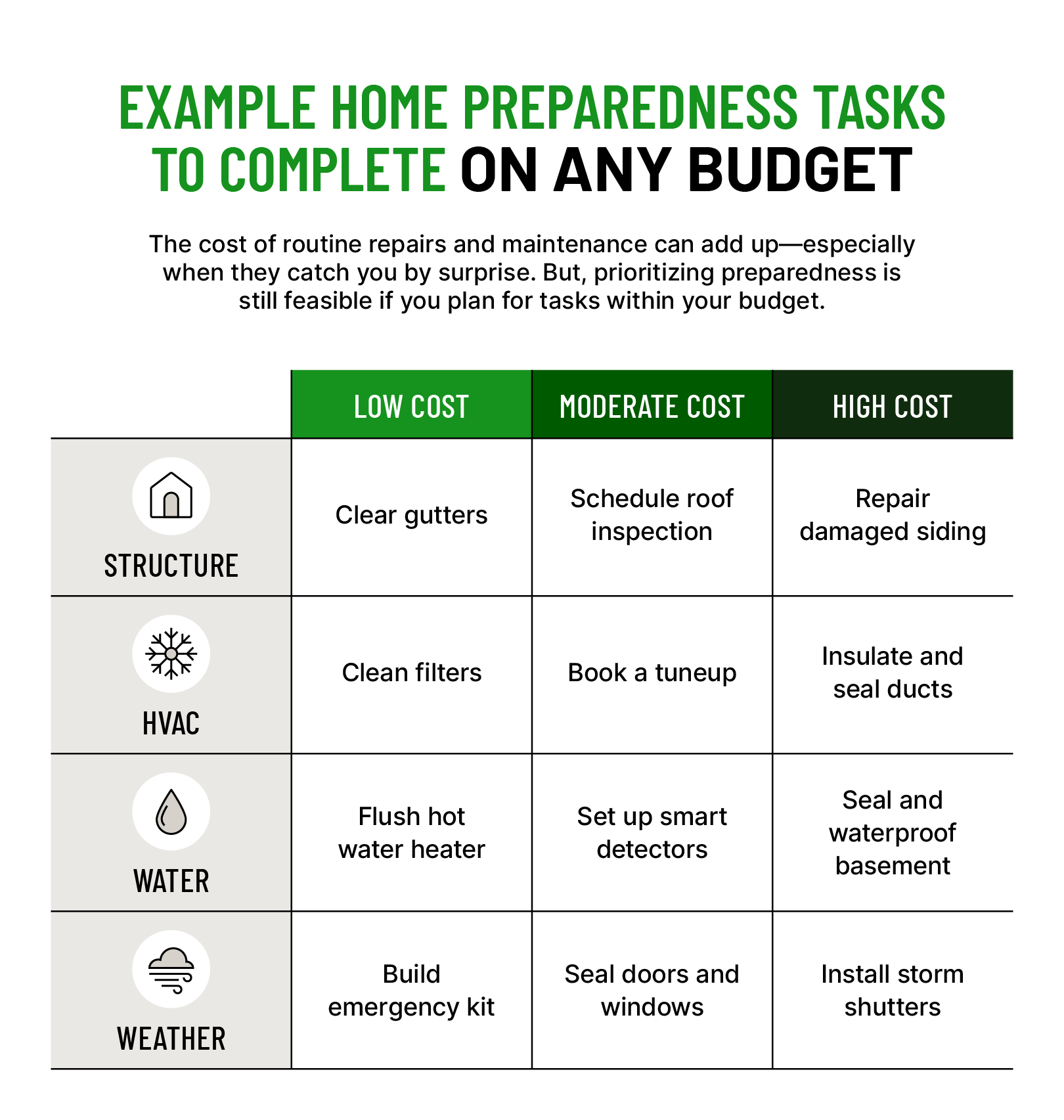

Given that inflation is already concerning a lot of homeowners, the upfront cost of more expensive upgrades (like solar panels) can potentially feel like an out-of-reach expense.

Many homeowners may also be delaying certain upgrades and tasks to prioritize others. We saw that nearly 4 in 10 surveyed homeowners are prioritizing essential projects to manage costs and more than 3 in 10 are delaying projects until they can afford them.

However, working within your available resources can potentially make a difference. This can be as simple as picking up a few supplies for an emergency kit on a grocery run or cleaning filters regularly to maintain the HVAC system. Prioritizing climate-resistant materials during planned renovations is another way you can help reinforce the home without completely starting a new project.

Why homeowners should prioritize preparedness

Homeowners should prioritize preparedness because it helps keep small issues from becoming large problems.

Start by identifying issues most relevant for the upcoming season. For example, homeowners in the fall can look ahead to repairs that will make a difference in the winter. This can include sealing doors and windows or cleaning out the gutters.

Starting small, whether it’s with repairs or an emergency repair fund, can help homeowners get their homes in better shape over time. We saw that homeowners are especially prioritizing saving and budgeting this year. Taking care of routine home maintenance to-dos each season is another way to help keep costs down.

Here’s how small tasks can pay off in the long run:

-

To help minimize the chance of kitchen fires, clean your range hood filter every 1–3 months.

-

To get ahead of damage during storms, trim overhanging tree limbs near the house and other structures.

-

To deter ice dams in the winter, clean gutters in the fall before temperatures freeze.

-

To help prevent mold growth in your bathroom, regularly clean your bathroom exhaust fan once or twice a year.

Homeownership obstacles are evolving, but homeowners are also stepping up to get ahead of major issues. Hippo can help support your homeownership journey with personalized DIY guides and a personalized checklist of tasks to improve your property’s Home Health.

Check out the Hippo Home app for free from the App Store and Google Play to learn how we can support your homeownership journey.

Home maintenance support would be provided by Hippo Home, an affiliate of Hippo Insurance Services. Hippo Insurance Services is not responsible for your use/non-use of Hippo Home.

Disclaimer:

YourHaus, Inc. ("Hippo Home") is an affiliate of Hippo Insurance Services. Services (including all repair or maintenance services) provided to customers through affiliated and unaffiliated third-party contractors. Your use of Hippo Home is subject to Hippo Home's terms and conditions and privacy policies. Use of unaffiliated third-party vendors is subject to the terms of service provided by such third party. Hippo Insurance Services is not responsible for your use/non-use of Hippo Home or any service vendor. @ YourHaus, Inc. 2023

Hippo Insurance Services ("Hippo") is a general agent for affiliated and non-affiliated insurance companies. Hippo is licensed as a property casualty insurance agency in all states in which products are offered. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy. Coverage and coverage amounts selected are the decision of the buyer.

Methodology

The survey was conducted by SurveyMonkey Audience for Hippo Insurance Services. The survey was fielded on Aug. 22, 2023. The results are based on 1,213 completed surveys. In order to qualify, respondents were screened to be residents of the United States, over 18 years of age, and own a home. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

The following is the methodology for the 2022 report. You can read more about the original report here: Hippo 2022 Homeowner Preparedness Report

This Ipsos poll was conducted April 29 to May 1, 2022, on behalf of Hippo Insurance Services, using the probability-based KnowledgePanel®. This starting sample for this poll is a nationally representative probability sample of 2,104 adults age 18 or older. To qualify for the survey, respondents must own or rent the home they live in (n=1,915).

The study was conducted in English. The data were weighted to adjust for gender by age, race/ethnicity, education, Census region, metropolitan status, household income, and party identification. The demographic benchmarks came from the 2021 Current Population Survey (CPS) from the U.S. Census Bureau.