How Much To Budget for Home Maintenance

Many sources advise saving 1% of your home’s value for home maintenance, but the amount you choose to save may also depend on factors like your home’s age, current condition, climate, and financial situation.

For some homeowners, their homeownership savings may not be enough to cover major expenses like roof repairs or appliance replacements. Our recent 2024 Financial Goals Report revealed that nearly half of responding homeowners have only $1,000 or less saved for home improvements and maintenance costs.

Stubborn inflation and continued high costs make it a good time to evaluate your homeownership budget to help strategically plan for home maintenance and make every dollar count (U.S. Bureau of Labor Statistics).

Our guide will go over steps you can take to help you determine how much to budget for home maintenance. We also include a downloadable budgeting checklist and tips to help you on your journey.

Download our home maintenance budget checklist

To help you organize your finances, you can download this simple home maintenance budgeting checklist below that summarizes all of our tips

4 steps to determine your home maintenance budget

With some time and research, you can get information that can help you more realistically estimate how much you may need to set aside.

Step 1: Evaluate your home’s condition

To get a more specific understanding of your home’s needs and associated costs, you’ll need to determine your home’s current condition and the lifetime left for appliances and critical systems.

For example, water heaters typically last between six and 10 years, according to the International Association of Certified Home Inspectors (InterNACHI). For a better idea of how much it costs to maintain it, take note of:

-

The purchase date and the manufacturer’s predicted life expectancy

-

How often you use it

-

How often you do maintenance and how closely you follow the manufacturer’s recommendations

-

Any current issues and how long it had those issues

While evaluating your appliances and individual components and systems, consider factors that may wholistically impact your home:

-

Home age: Is your home up to code? Are there outdated or old areas that need repairs?

-

Materials and finishes: Are the wooden parts of your home starting to decay or get warped? Is there exposed brick that’s starting to crack?

-

Location and climate: Is your home prone to extreme weather or temperatures? If so, is your home reinforced to withstand your area’s climate?

Schedule a formal home maintenance inspection from a licensed home inspector to get a comprehensive overview of what needs to be done and identify issues you may not have noticed on your own. Home maintenance inspections can cost between $200 and $400.

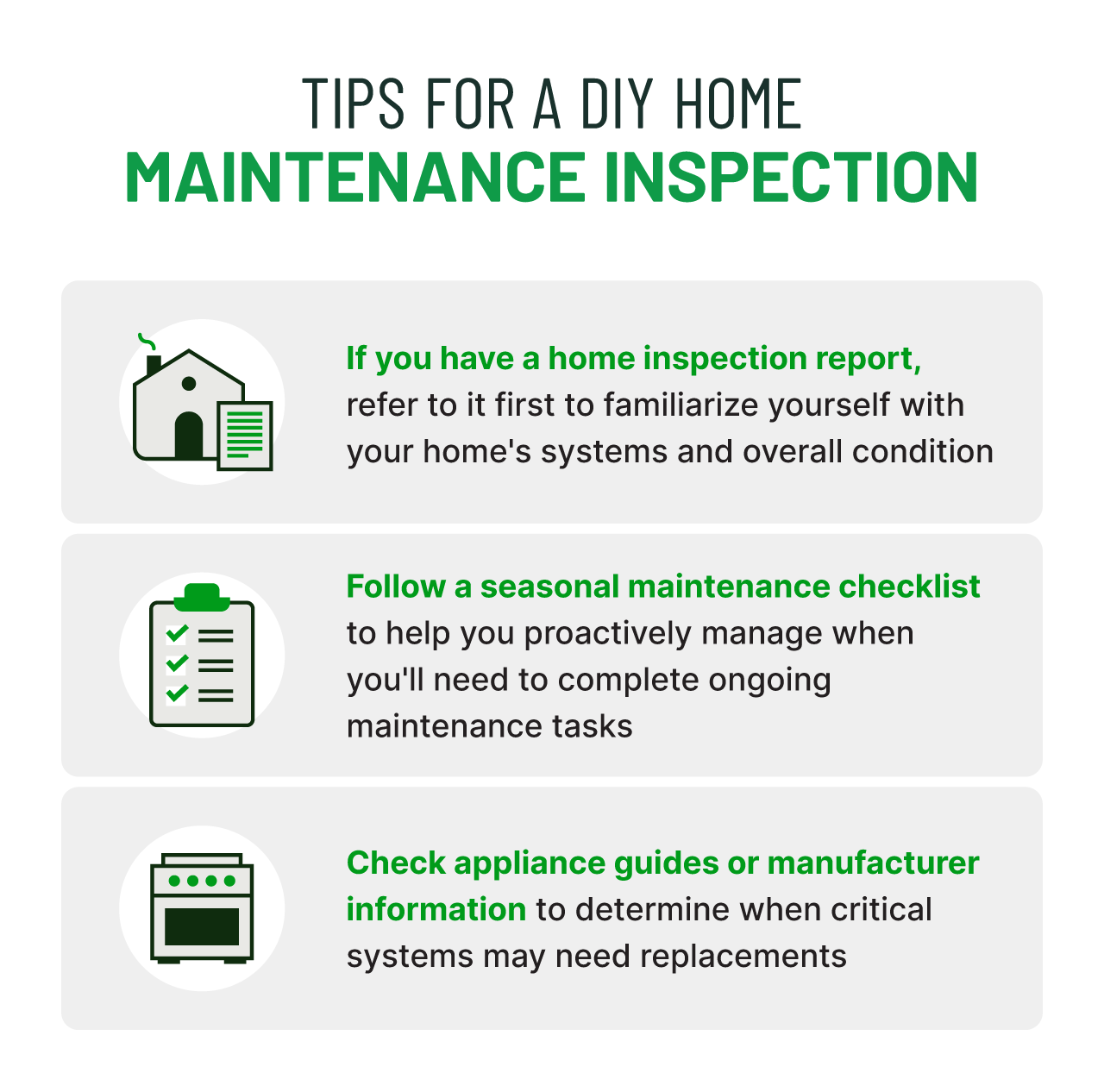

If it’s not possible to schedule a formal inspection, you can follow these tips below to get an idea of your home’s condition.

Step 2: Estimate costs and timelines for maintenance

Using the information you gathered in the last step, you can start estimating the costs of potential repairs, replacement times, and other associated costs.

We can use the information we gathered to help predict:

-

Whether an appliance, system, or component may need a repair

-

How much that repair or routine maintenance may cost (including labor and materials)

-

When it may need a replacement

This can also help you decide what you should prioritize first and if there’s anything you may need to start aggressively saving for.

For example, let’s say your dishwasher has some years left and is well-maintained, but your water heater is near the end of its life. Since your water heater is needed for many tasks ranging from showering to cooking, you can prioritize saving toward a new water heater rather than toward potential dishwasher repairs.

Step 3: Assess your home’s value

You can also use your home’s worth to help you estimate your home maintenance budget. If you can’t complete a thorough home inspection, you can start creating your budget based on a percentage of your home’s value.

Here are a few methods to find your home’s estimated value:

-

Look up your home’s estimated market value. Use sites like Zillow or Realtor.com to find market value estimates based on a mix of information sources, like public data, user-submitted data, and sales of similar homes.

-

Check your home’s assessed value that determines property taxes. You can either find it online on your local tax assessor’s website or by contacting them directly.

-

Use real estate comps to see the value of similar homes in your neighborhood. Dig into publicly available information from real estate sites and public property records.

-

Hire a professional appraiser for a thorough evaluation. This will give you a more accurate estimate and is typically required if you’re planning on applying for financing (like a home equity line of credit (HELOC) or a home equity loan).

Step 4: Create a savings plan for home maintenance

Once you have an idea of the value and current state of your home, you can factor it into your home maintenance savings plan.

Below are a few saving strategies you can consider based on the available information:

-

Save based on your home’s upcoming repairs: This route will more accurately predict your expenses and is best to predict after you’ve completed a home inspection.

-

Save based on a percentage of your home’s value: You can use your home’s value and condition to determine a percentage to save toward. For example, saving 1% of your home’s value may be feasible with a newer home with relatively new appliances and components.

-

Save $1 per square foot: This is the least accurate estimate, but it can give you an amount to begin saving toward while gathering information about your home’s condition.

Plan to review your expenses as well to find more savings opportunities. If you have the means, increase your insurance deductible to pay less annually on insurance.

Home maintenance budgeting tips

It’s easy to feel overwhelmed once you start digging into your home’s needs and how much upkeep can cost. Small things, like automating your savings or learning how to do home renovations, can help make budgeting feel more manageable.

These tips can help you manage your home maintenance budget and be more strategic with your finances:

-

Learn how to DIY simple repairs, like fixing leaky faucets or patching small holes, to help stay on top of what needs to be done and prevent unexpected home repair costs. You can also look into strategic DIY home upgrades that can increase the value of your home and help it run more efficiently.

-

Set up a separate account for your home maintenance budget. Then, activate recurring automated transfers to set aside money for maintenance. Include contributions toward your home maintenance budget in your overall financial planning for the year.

-

See if you qualify for home renovation programs that can help cover the costs of specific types of home maintenance and upgrades like the 203(k) Rehabilitation Mortgage Insurance Program.

-

Consider financing options, like home equity loans or a HELOC, if you’re anticipating an urgent repair or replacement that you can’t cover. Addressing a repair sooner than later could help prevent major (and expensive) repairs.

-

Look into additional home insurance riders, like equipment breakdown coverage, or service line coverage, that can expand your coverage.

Now that you have a plan for your finances, the next step is to keep up with home maintenance throughout the year to stay within your budget. Minor repairs can be easy to tackle on your own, but some warning signs and repairs may not be easy to spot.

With the free Hippo Home app, you can get a comprehensive, personalized checklist that can help you improve your home’s health. The app also includes DIY guides to help you tackle issues on your own.

Download the Hippo Home app today from the Google Play Store or the App Store.

Disclaimer:

YourHaus, Inc. ("Hippo Home") is an affiliate of Hippo Insurance Services. Services (including all repair or maintenance services) provided to customers through affiliated and unaffiliated third-party contractors. Your use of Hippo Home is subject to Hippo Home's terms and conditions and privacy policies. Use of unaffiliated third-party vendors is subject to the terms of service provided by such third party. Hippo Insurance Services is not responsible for your use/non-use of Hippo Home or any service vendor. @ YourHaus, Inc. 2024

Hippo Insurance Services ("Hippo") is a general agent for affiliated and non-affiliated insurance companies. Hippo is licensed as a property casualty insurance agency in all states in which products are offered. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy. Coverage and coverage amounts selected are the decision of the buyer.

This guidance and advice is not error-proof and not applicable to every home. You are responsible for determining the proper course of action for your property and neither Hippo nor Hippo Home is responsible for any damages that occur as a result of any advice or guidance.