The #1 Problem Affecting Homeowners? Water Damage

Every year, American homeowners face new challenges in maintaining and protecting their properties. According to our latest Hippo Housepower Report, water damage is an increasingly common and costly issue.

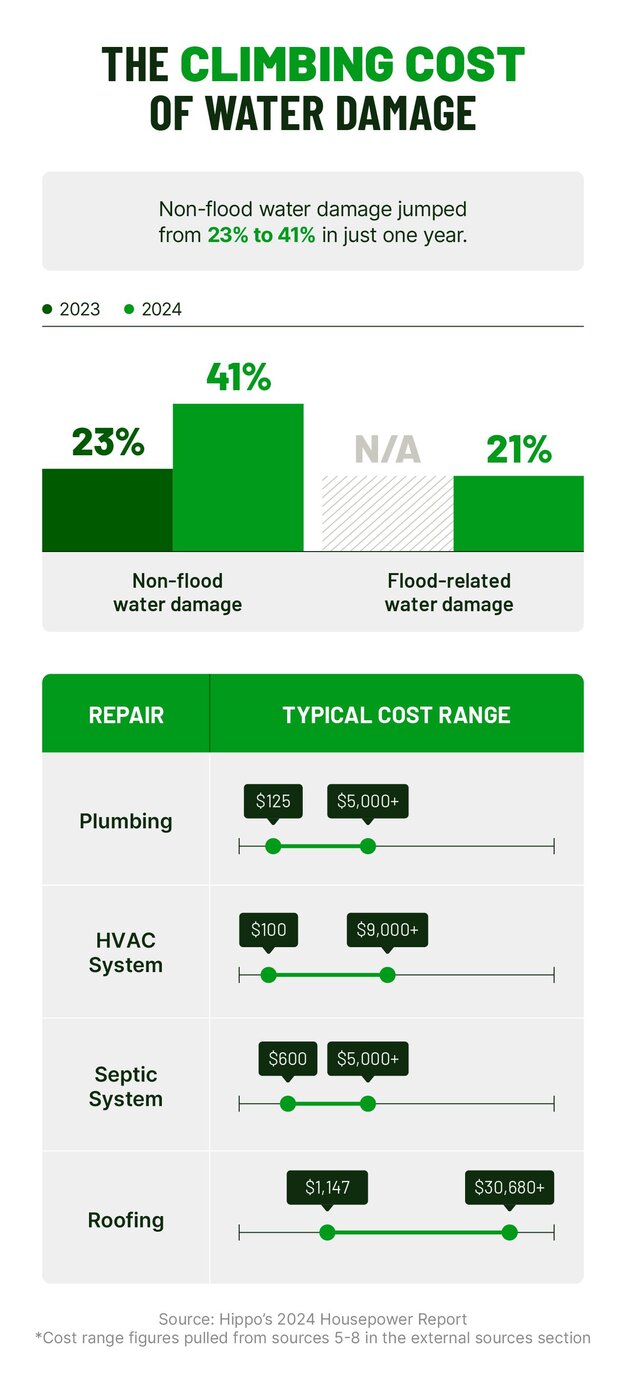

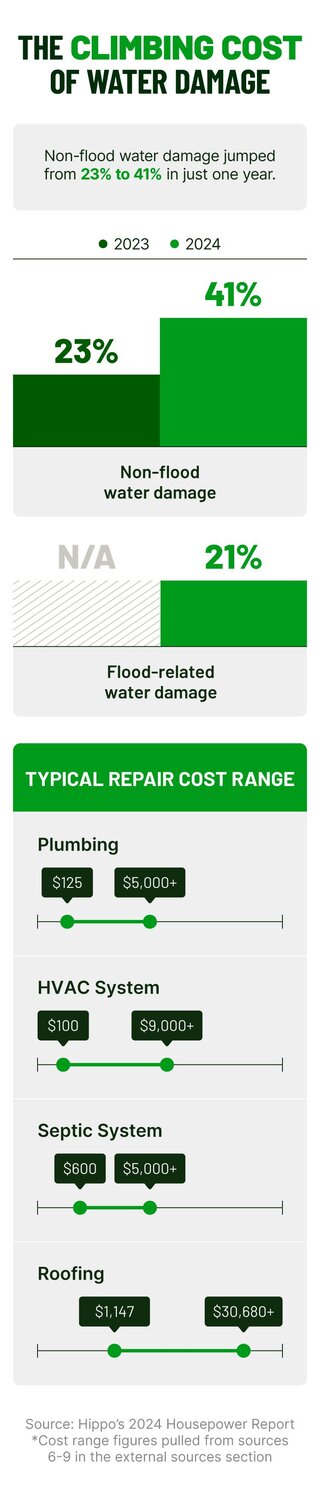

Last year, 41% of homeowners experienced non-flood water damage and 21% reported flood-related damage—up sharply from 23% two years ago.

Winter weather pushed homes to their limits, with freezing pipes and ice dams exposing structural weak spots. As the data shows, even a small leak can escalate into significant damage if ignored. That’s why more homeowners are prioritizing preventive maintenance and professional inspections before problems begin.

In this post, we’ll explore why water damage is on the rise, what it means for homeowners, and how proactive maintenance can help protect homes year-round.

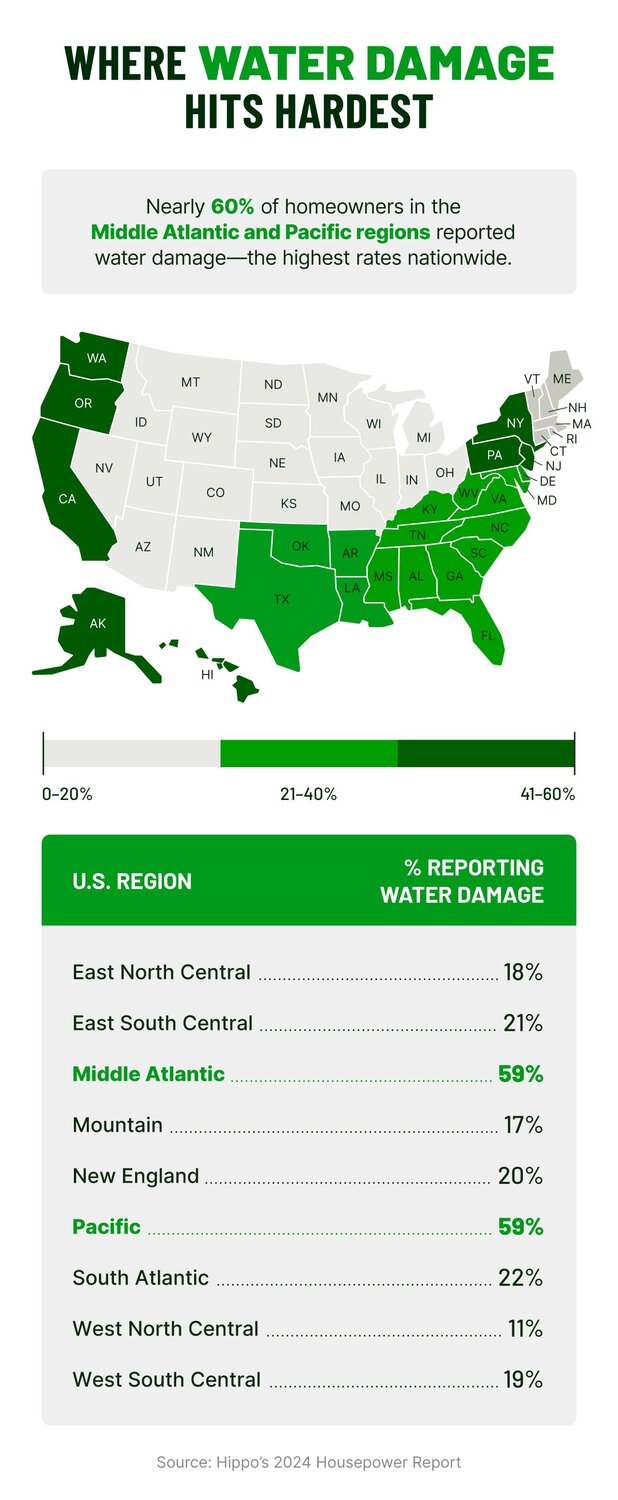

Where water damage is surging: Middle Atlantic and Pacific regions lead the way

Why water damage is so common (and costly)

- Plumbing repairs: $125 – $5,000+

- HVAC system repairs: $100 – $9,000+

- Septic system repairs: $600 – $5,000+

- Roofing repairs: $1,147 – $30,000+

Common sources of water damage in homes

Problem | Potential causes | Potential water damages |

|---|---|---|

Plumbing failures | Burst pipes, aging supply lines, worn-out water heaters | Leaks behind walls or under floors, damaged walls and floors |

Roof leaks and gutter issues | Damaged shingles, flashing issues, clogged gutters | Water entering attics and ceilings, mold growth, structural damage |

Appliance and HVAC leaks | Slow leaks at connections, worn components, aging systems | Pooling water, flooring damage, system malfunctions |

Weather-related events | Heavy rain, snowmelt, localized flooding | Basement flooding, foundation damage, erosion or soil shifting |

How to spot and prevent water damage

- Discoloration or stains on walls and ceilings

- Peeling or bubbling paint

- Warped or buckled flooring

- Musty odors near basements or appliances

- Unexpected spikes in water bills

- Smart water sensors – Detect moisture and send alerts

- Leak detectors – Monitor plumbing for real-time notifications

- Automatic shut-off valves – Stop water flow during leaks

- Smart water meters – Track usage; flag unusual usage spikes

- Moisture meters/thermal cameras – Reveal hidden moisture in walls, floors, or ceilings

- Check plumbing connections for leaks or corrosion

- Clean gutters to ensure proper drainage and avoid overflow

- Inspect roofs for damaged or missing shingles

- Seal around tubs and showers

- Maintain proper grading and drainage around the foundation

Plug the gaps in your home's defense

External sources:

- Realtor.com. (2025, September). 2025 Realtor.com Housing and Climate Risk Report

- Building Safety Journal. (2025, April). Flooded and Failing: What Happens to Plumbing, HVAC and Gas Systems?

- The New York Times. (2025, November). A Climate ‘Shock’ Is Eroding Some Home Values. New Data Shows How Much.

- FortifiedHome.org. (2025). Winter’s Unexpected Threat: Ice and Water Damage

- Homeguide.com. (2025, August). How much are average plumbing estimates? (2025)

- Homeguide.com. (2025, July). How much does HVAC repair, service, and maintenance cost? (2025)

- This Old House. (2025, May). 2025 septic tank repair costs

- Bill Ragan Roofing. (2025, June). How much does a new roof cost in 2025?

- This Old House. (2025, October). Water Damage Statistics

- All quotes sourced from Featured.com

Related Articles

The 9 Most Expensive Home Repairs to Watch Out for in 2025

Is Your Fixer-Upper a Mistake? 1 in 5 U.S. Homeowners Said Yes

From Gutters to Foundations: How Cold Weather Weakens Homes

Confronting Home Repair Scams: Experts Weigh In on How To Protect Yourself

5 Costly New Homeowner Maintenance Mistakes (and How to Fix Them)