Whether it is your first dream home, or its been a while since you have been in the market for a house, you likely have questions about today’s homeowners insurance and its requirements.

While your mortgage lender may provide a referral to a home insurance agency, take your own time to compare coverage, pricing and consumer reviews. There is more selection in the insurance marketplace than ever before, and customers finally have the ability to find a home insurance policy that can fit their specific needs. Learn more about what you should consider for your homeowners insurance before deciding on your dream home and its protection.

What do the numbers look like?

Having the money you need for the down payment on your new home is often the only amount a new homeowner is considering while shopping, but it’s only one piece of the equation. Set yourself up for success by completing the puzzle of what the ongoing financial responsibilities of owning your home will be. Not just the mortgage but everything else that will impact your budgets like property taxes, property insurance, home maintenance, entertainment, etc.

According to the U.S. Bureau of Labor Statistics, the average household budget is $63,036 per year. This includes all living expenses, from necessities like food, housing, and transportation to other expenditures like apparel and education.

Knowing and keeping track of your numbers will ensure you are shopping for a home at the right price and will have the budget to protect it and make it everything you want.

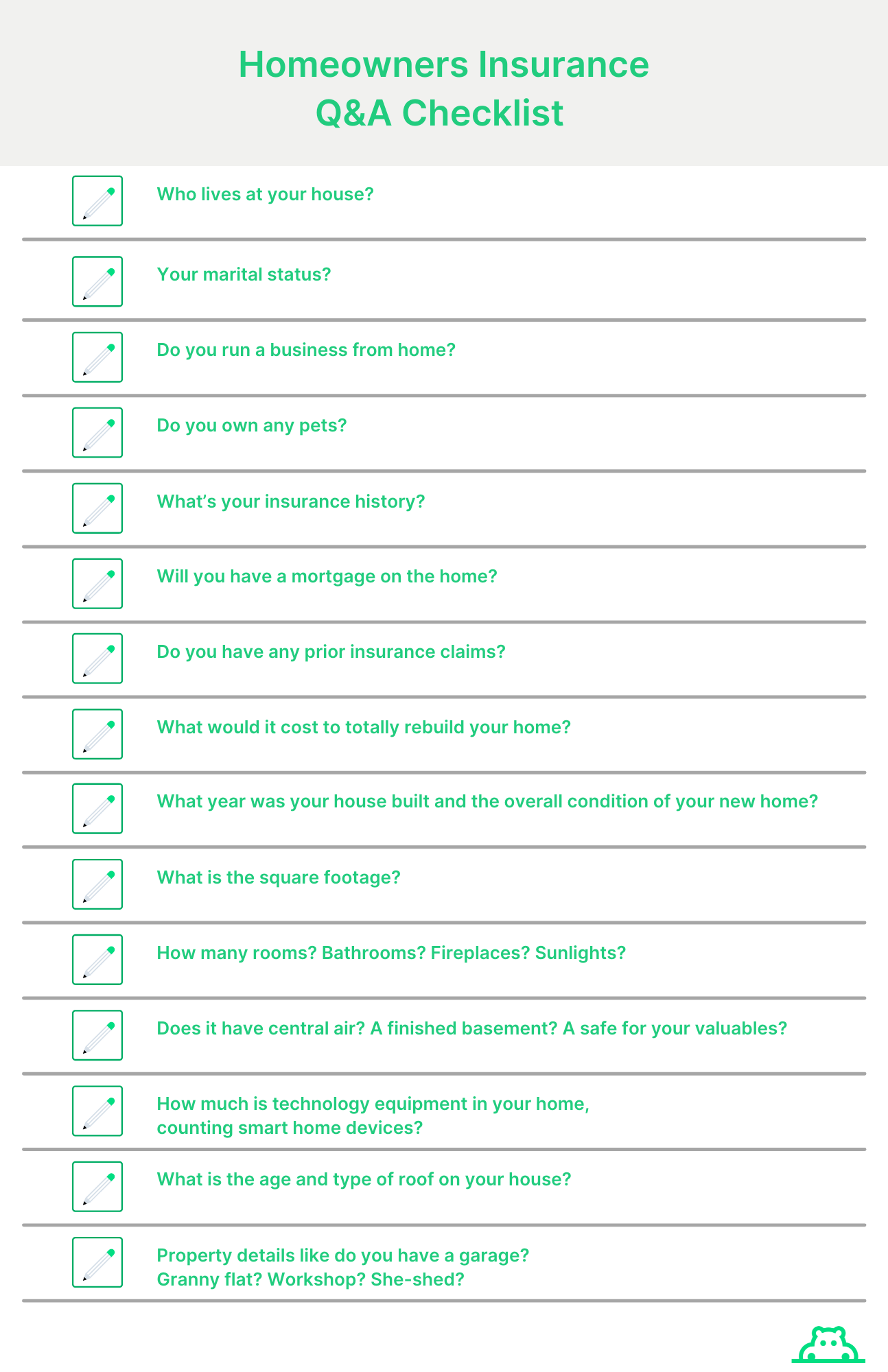

Q & A. What information is needed for a homeowners insurance quote

Save yourself the time and stress by answering the following questions to provide your prospective home insurance company when you are shopping for the best coverage.

Having your answers all in one place and ready to volunteer to several home insurance companies making it easy for you to get multiple quotes for the proper coverage that fits your needs.

Is homeowners insurance included in closing costs?

Most mortgage lenders will require the first term of your homeowners insurance to be paid at closing. They may also collect anywhere between 10% to 20% of your annual home insurance premium in closing costs to be deposited into your escrow account for the next billing cycle. Without escrow, you’ll often have to pay the entire first year’s home insurance premium at the time of closing.

Be aware of exclusions

Depending on your home location, there may be some things or instances not covered by a standard policy. Some examples of these are earthquakes, landslides, and flooding. If this is the case, make sure the home insurance agent or company gives you options to purchase protection for excluded incidents.

Know the difference between mortgage insurance vs. home insurance

This one confuses people, but the real difference is that if you pay mortgage insurance, it is to protect your lender’s investment in your mortgage but when you pay home insurance, it is to protect your home.

The mortgage lender may require a homeowner to pay private mortgage insurance (PMI) if your down payment is less than 20%. This is to safeguard your lender if you default on your mortgage loan and don’t insure your property in any way.

Home warranty vs. home insurance. Do I need one? The other? Both?

From weather-related damage to broken-down appliances, there are plenty of issues that can pop up in your home throughout your mortgage. And no matter how dedicated you may be to your monthly home maintenance plan, it never hurts to have a little extra coverage. And no, we aren’t talking about home insurance (although that’s important too).

Outside of your home insurance policy, you have another option to provide your home with even more protection.

What happens if I don’t have homeowners insurance?

The entire purpose of home insurance is to protect your home or property is damaged by a covered event. If damage happens to your home or on your property and you haven’t secured a homeowners insurance policy, you will most likely have to pay out of pocket for repairs or, in some cases, to totally rebuild your home. Getting home insurance and keeping it in good standing is a smart way to ensure you’ll have proper protection over your home, belongings, and property if they are damaged by a covered loss.

Since day one, Hippo has focused on helping our customers obtain modern home insurance coverage for themselves and their homes. We take a proactive approach to home insurance and provide eligible customers with smart home devices to help identify minor issues before they become big headaches, insure electronics at 4x the amount of traditional companies will and add our Hippo Home Care service at no extra charge. We think a smarter home is a safer home.