What Is the Average U.S. Household Budget? (+ Downloadables to Help You Keep Track of Spending)

When Ariana Grande sang that retail therapy was her new addiction, she was speaking to the age-old belief that buying new clothes, shoes or food can improve your mood. However, when she adds that she bought a new house just for the closet? She might be going a little over budget.

According to the U.S. Bureau of Labor Statistics, the average household budget is $63,036 per year, a 3% increase from 2018. This includes all living expenses, from necessities like food, housing and transportation to other expenditures like apparel and education.

This article will break down how Americans spend their money and how you can be smarter with yours.

Average Household Expenses in the U.S.

You might be wondering how your spending stacks up to the rest of the U.S. We’ve compiled the data for the annual spending per U.S. household, according to the Bureau of Labor Statistics 2019 Consumer Expenditure Survey.

Average Household Budget

The following table breaks down how much Americans are spending on various life needs.

| Expenditure | Annual Spending | % of Budget |

| Food | $8,169 | 13 |

| Housing | $20,679 | 33 |

| Apparel | $1,883 | 3 |

| Transportation | $10,742 | 17 |

| Healthcare | $5,193 | 8 |

| Personal Care | $786 | 1 |

| Education | $1,443 | 2 |

| Entertainment | $3,050 | 5 |

| Cash Contributions | $1,995 | 3 |

| Pensions and Social Security | $7,165 | 11 |

| Other | $1,891 | 3 |

| Total: $63,096 | ||

Average Cost of Food

Americans spent an average of $8,169 on food in 2019. This includes groceries for food made and eaten at home and money spent dining out or ordering takeout to be delivered.

More people tend to spend money on food eaten at home. Of the annual food budget, 43% was spent on takeout food or food from outside the home; 57% of the food budget was spent on groceries and food prepared and eaten inside the home.

Food spend increased overall by 3.1% from 2018 to 2019, driven by an increase in spending for food eaten at home (4%) and food eaten out of the home (1.9%).

Average Cost of Housing

Housing is the most significant annual expenditure, with Americans spending an average of $20,679 on it in 2019. Spending on housing increased by 2.9% from 2018 to 2019.

It can be hard to afford a house. Housing costs include rent or mortgage payments, home insurance, utility bills and any property taxes. These costs also include appliances and any items needed to make the household run smoothly.

The cost of shelter accounted for $12,190 of the annual housing budget. Owned dwelling expenses including mortgages, interest, home equity loans, property taxes, refinancing charges, home insurance and maintenance accounted for 55% of the shelter budget and totaled $6,797. Rented dwelling expenses such as rent, maintenance and insurance accounted for 36% of the shelter budget and totaled $4,432.

The rest of the average annual housing budget includes utilities, trip lodging such as hotels, yard maintenance and housekeeping.

Average Cost of Transportation and Gas

Transportation cost averages totaled $10,742 in 2019, a 10% increase from the 2018 total. The main reason for the rise was vehicle purchases, which increased 10% from 2018 and accounted for half of the transportation spending.

Transportation spending includes anything that contributes to travel, such as vehicle purchases, taxis, rideshares, bus or train fare, airfare and gasoline. Gas prices vary by city and state, but Americans spend an average of about $174.50 on gas per month.

Average Cost of Insurance and Social Security

Personal insurance and pensions accounted for $7,165 of the annual household budget in 2019. The bulk of this came from the household’s contribution to Social Security. These payments are typically taken directly from a household member’s paycheck.

This figure also includes premiums for life insurance and accident insurance, but excludes auto, health and homeowners insurance, which are included in their respective categories.

Average Cost of Healthcare

The average healthcare spending per household was $5,193 in 2019, with $3,529 of that being spent on health insurance. This expenditure includes any health insurance premiums and out-of-pocket payments that are healthcare-related.

Average Cost of Entertainment

The cost of entertainment includes everything from seeing a movie to buying toys or playground equipment, as well as the purchase and caretaking of pets. The average entertainment spending in 2019 totaled $3,050.

Other Household Expenses

Apart from the main expenses like food and transportation, many other costs arise during the course of daily life. This includes everything from buying jewelry to making a charitable donation. When all is said and done, the average amount an American family spends on their household expenses is just over $60,000.

How to Make a Household Budget

For someone with Ariana Grande’s bank account, “buy myself all of my favorite things” might be a realistic mantra. But for everyone else? It’s essential to assess how smart you are with your spending. Doing a budget analysis can help you determine how you’re spending compared to what you’re bringing in.

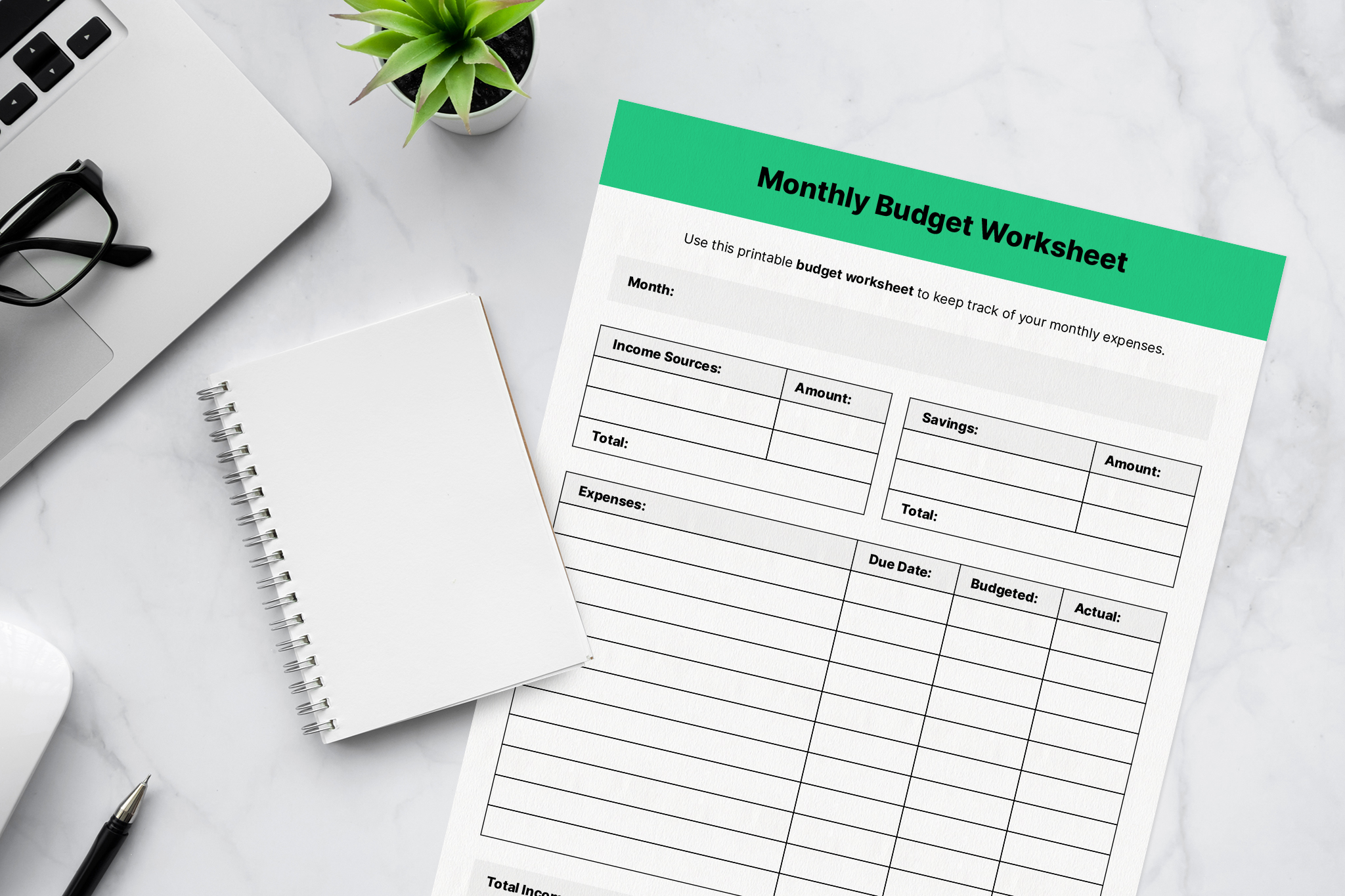

Step 1: Print a budget worksheet

A budget worksheet is a great reference tool that can help you create and maintain your budget. Use the downloadable worksheet below to visualize your income, expenses and plan for budgeting your household’s primary needs.

Step 2: Add up reliable sources of income

First, determine your household’s reliable monthly income. Reliable sources of income are things that you can count on receiving monthly. Any money that isn’t received regularly shouldn’t be counted — this includes money received from hobbies, infrequent odd jobs or gifts.

Reliable sources of income include wages, alimony, Social Security payments and disability payments. Those who freelance full-time should budget by using the average amount they make per month or the amount they expect to receive.

Step 3: Add up expenses

Next, list your fixed and variable expenses. Fixed expenses include things like rent, child support, alimony, mortgage payment, subscription services and property taxes. Variable expenses include things like utility bills, entertainment and groceries.

For expenses like bills, estimate how much your bill is going to be and use that number. For expenses like groceries and entertainment, use the maximum amount that you are willing to spend on these things as your total.

Step 4: Calculate your net income

To calculate your net income, subtract your expenses from your income. This will give you the actual amount you earn per month, or the amount you will have after your expenses are paid.

Step 5: Adjust if needed

You want your net income to be a positive number, meaning you have extra money to use as a cushion or for any additional spending you might want to do. If your net income is negative, that means you are currently spending more money than you actually have. In this case, you’ll need to either seek out additional sources of income or cut down on spending wherever you can.

How to Track Your Spending

Tracking your expenses is an excellent way to determine how much you spend, making your budget planning more reliable and accurate. If you pledge to spend $500 on groceries for the month, you’ll want to see how much you actually spend so you can adjust if needed.

Budget tracking mobile applications like Mint, You Need a Budget and Pocket Guard can help you track your spending via app, making it easy to keep all of your information organized, accurate and in one place. If you prefer to go traditional, you can also opt to use an expense tracking worksheet to track your spending.

How to Choose a Budget Plan

A budget plan can help you decide on and stick to a budget. There are many ways to determine what type of budget and budget plan work best for you. You need to determine how disciplined you are, what type of organizational skills you have and how balanced you want to be. Below are a few common budgeting systems that could work for you.

-

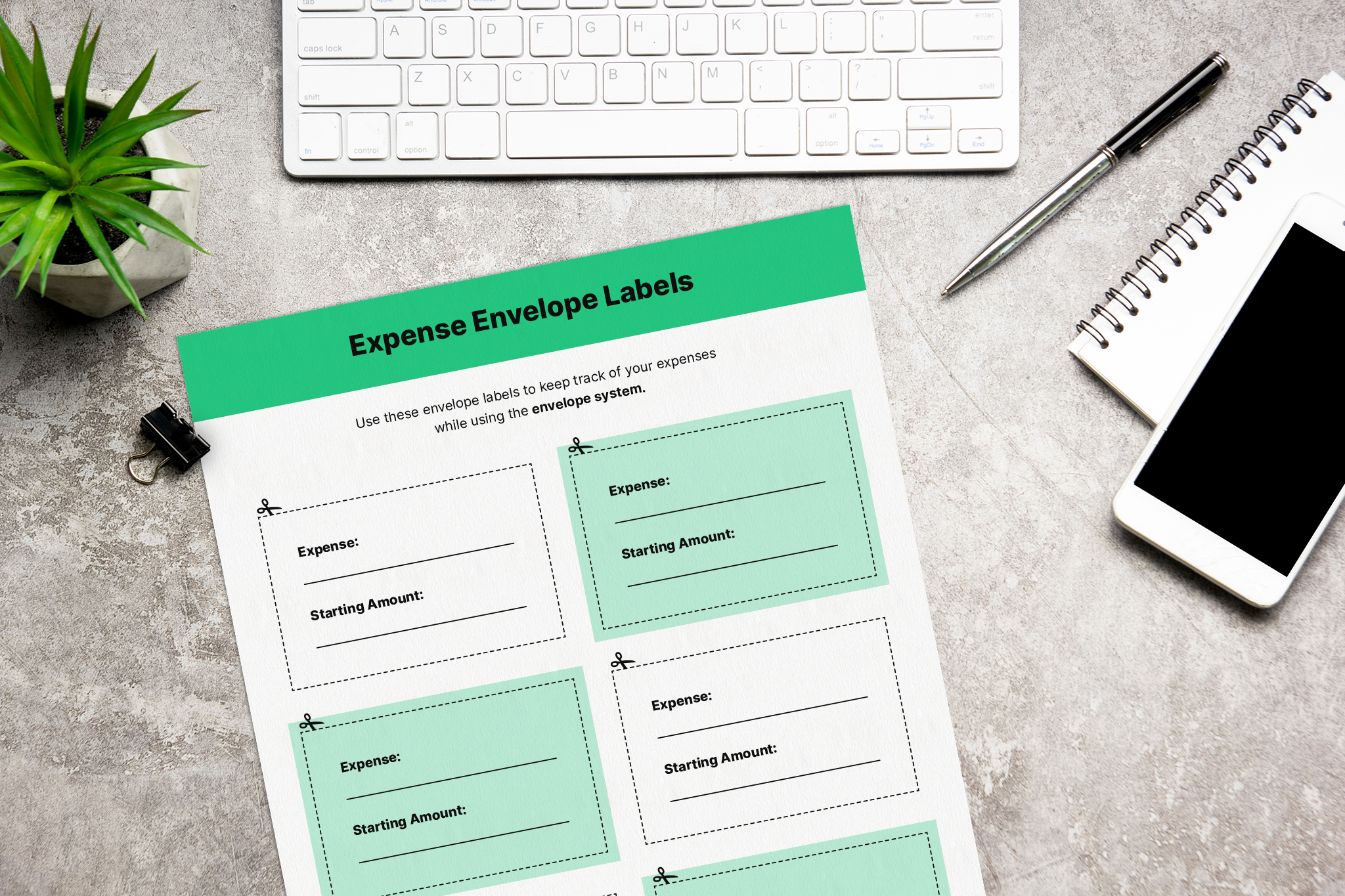

The Envelope System

The envelope system is a strict way to hold yourself accountable and physically track how much you spend. It also requires all-cash spending. To employ this system, label envelopes with your monthly expenses and put enough cash inside to cover that expense for the month. This helps you not only ensure you don’t overspend but can also help you determine how much you spent by subtracting the amount left in the envelope at the end of the month with the amount you inserted at the beginning. Use envelope labels like the ones below to help organize your envelopes.

-

The 50/30/20 System

The 50/30/20 is a more flexible system that allows you to focus on the bigger picture rather than your budget’s minute details. For this system, first, determine your monthly after-tax income. Your after-tax income is the amount of money you earn once taxes are deducted from your paycheck, also known as your net pay.

From your net income, put 50% toward needs such as housing, food, transportation and insurance; put 30% toward wants such as monthly subscriptions, travel and entertainment; and put 20% toward paying off debt or putting money into savings.

So, if your net income is $5,000 per month, you would put aside $2,500 for needs, $1,500 for wants and $1,000 for savings.

-

A Zero-Based Budget

Zero-based budgeting doesn’t rely on past budgets or templates, but starts from each month to make your income minus expenses equal zero. Every month, write down the income you have coming in that month and the expenses you’re expecting, from rent or mortgage payments to birthday gifts. Make sure to allocate money for miscellaneous expenses as well. You may always want to think through the calendar year and allocate in advance for big expenses that are coming up, like holidays or big purchases.

Track your spending so that the money that came in minus the money that went out equals zero. All that matters is that the total is equal to zero, that each dollar had a purpose, whether that is being spent on groceries or going into savings.

The Benefits of Budgeting

Worrying about money can be stressful and can put a strain on familial or romantic relationships. Keeping track of your expenses can help you ease this stress while also allowing you to save money for any emergencies or opportunities that arise.

Creating a healthy budgeting system is also a great way to teach your kids about money and how to be financially literate adults. Consider printing them their own budgeting worksheet or implementing the envelope system for their finances while they’re not old enough to have a bank account. This will help them learn to be comfortable talking about and managing their money.

Once you get into a groove, budgeting will become second nature. A budget can help you make sure you have the money to secure yourself and your family, and protect yourself in case of emergencies. When it comes to protecting your home, however, you might want to look to insurance.