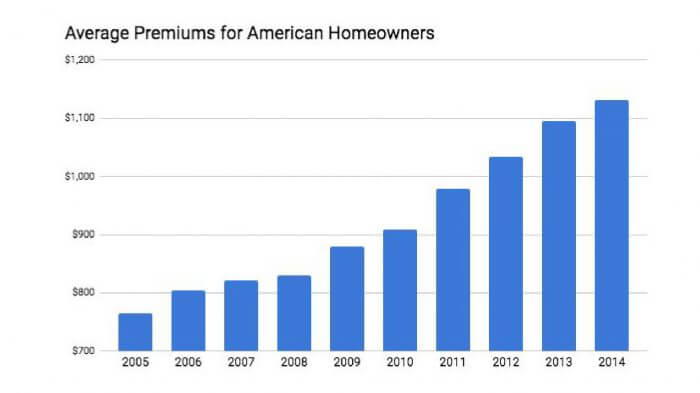

A recent study from the National Association of Insurance Commissioners found that the average cost of premiums for the most common type of homeowners insurance was $1,132 in 2014. That’s a 3.3% increase from the previous year and a 48% increase from 2005.

*Source: © 2017 National Association of Insurance Commissioners (NAIC)

Why are homeowners insurance premiums rising? Aging homes are part of the problem, but that’s not the whole story. Check out some of the other reasons why insurance costs for homeowners continue to climb.

Increasing natural disasters

No matter what you think about climate change, you must admit that people around the world seem to be facing a growing number of natural disasters. Not even America is immune from weather-related catastrophes. Hurricanes Harvey, Irma and Maria are just a few of the most recent storms that have caused widespread damage.

As the planet continues to heat up, weather and climate disasters may become more intense and more destructive. These incidents increase risks for homeowners and lead to higher insurance rates.

Larger claims

Some reports suggest that the number of insurance claims filed by homeowners is falling. But what’s increasing (and raising the cost of insurance premiums) is the amount of money homeowners receive when they do file claims. Claim severity, or the average amount insurers pay out for each claim, rose from $8,492 in 2011 to $11,402 in 2015.

Insurers companies are ultimately running a business and need to stay afloat. To make up for the money used to cover losses, they may charge customers more for coverage. The same way filing a claim can increase insurance premiums, an increase in the severity of claims throughout a network can mean higher premiums for everyone.

Rising repair costs

Increasing construction costs has also pushed up the price of homeowners insurance. As rebuilding homes has become more expensive, the number of construction workers available for projects has shrunk. Meanwhile, recent disasters have made certain building materials more scarce and more expensive.

When the cost of repairing a home is higher than anticipated, it helps to have extended replacement coverage. Providers like Hippo offer this type of insurance policy. It covers reconstruction cost increases and often pays up to 125% of a home’s insured value.

How to mitigate the high cost of insurance

Homeowners insurance doesn’t have to be expensive. If your premiums are threatening your bottom line, consider upgrading your home or making other changes that can lower your insurance costs.

Investing in smart devices, updating your roof and buying an advanced security system are just a few steps you can take to lower your risk profile and your monthly bill. You should also evaluate your policy annually to ensure it’s providing enough coverage.

Lastly, don’t be afraid to ask questions or request a discount. And if you can handle it, consider increasing your deductible. This is the amount you agree to pay before your insurance kicks in. You’ll have to pay more money out of pocket in the event of a disaster, but you could ultimately reduce your insurance premiums by 25%. Just make sure you understand the terms of your policy before you make any adjustments.