When Is the Best Time To Buy a House? Expert Tips for Homebuyers

Successfully navigating the housing market depends on both financial readiness and strategic timing. While home prices, inventory, and competition fluctuate throughout the year, recent trends suggest that early fall is the best time to buy a house if you prioritize financial savings.

A Realtor.com study found that buyers in 2024 who signed between September 29 and October 5 saved an average of $14,000 for homes priced around $445,000.

While this opportunity can certainly provide an edge for buyers, timing a home purchase to one perfect week isn’t always realistic. Read on to better understand seasonal market patterns, explore how external factors disrupt long-held norms, and weigh the pros and cons of buying in any season.

Seasonal housing market snapshot

The housing market moves in relatively predictable cycles. According to the National Association of Realtors (NAR), you can expect the following fluctuations:

- Spring and summer see increased activity in existing and new home sales, typically when most houses go on the market, driving up inventory and competition.

- Fall and winter months typically experience a slowdown in market activity, which offers buyers negotiation opportunities due to reduced competition.

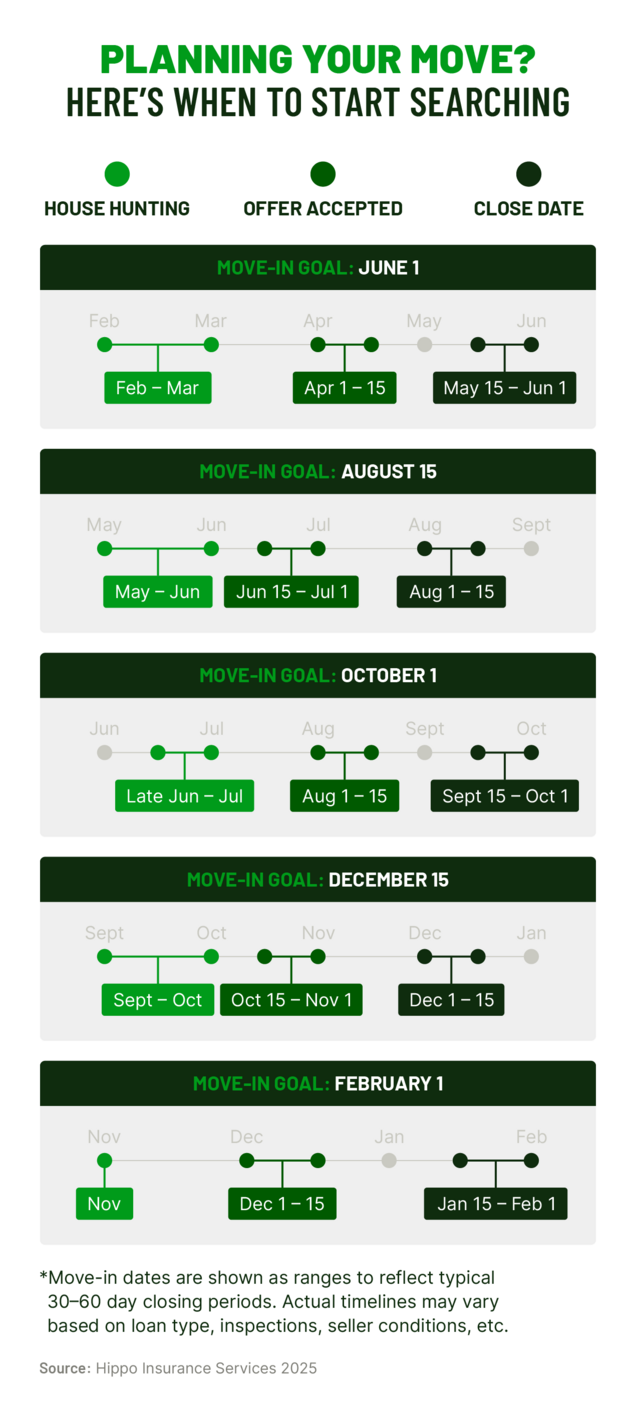

It takes an average of 30 to 60 days to close on a home after an offer is accepted.

Spring and summer: Most competitive home buying seasons

- Get pre-approved, not just pre-qualified. This shows sellers you're serious and ready to move.

- Have flexible closing timelines. A seller juggling their move may favor an offer with some wiggle room.

- Work with an experienced real estate agent. Someone who knows the seasonal rhythms of your local market can help you act quickly and negotiate smartly.

- Make a clean offer with minimal contingencies. For example, while potentially risky, a buyer might waive the right to a home inspection to make their offer easier on the seller and more competitive.

- Know your budget and stick to it—even when emotions run high. If you’re pushed beyond your financial means, that’s a sign it’s time to walk away.

Pros: Spring and summer home buying | Cons: Spring and summer home buying |

|---|---|

More homes on the market | Higher likelihood of bidding wars |

Better weather for moving and showings | Listings could go fast, making it difficult to tour homes |

Great timing for families before the school year starts | Homes may sell above the asking price |

Immediate access to outdoor features like patios and pools | More offers on a property may mean you sacrifice important contingencies to compete |

Winter and fall: Least competitive home buying seasons

- Build a timeline for possible HVAC upgrades, insulation fixes, or energy efficiency improvements. This home maintenance checklist can help you get started.

- Schedule inspections wisely. Ask about infrared scans or thermal imaging to catch what might be hidden beneath the surface.

- Factor in shorter daylight hours. You may need to tour homes earlier in the day to see the property in full light.

- Be prepared to move in poor weather. While not ideal, fall and winter often come with colder temperatures, icy sidewalks, or snowy terrain.

Pros: Fall and winter home buying | Cons: Fall and winter home buying |

|---|---|

Less competition from other buyers | Fewer home listings on the market to choose from |

Potential for better pricing and negotiation leverage | Weather can impact inspections and move-in logistics |

Sellers are often more motivated to sell due to lower competition | Limited curb appeal may make it harder to assess outdoor features |

Quieter market allows for more time to make thoughtful decisions | Potential for cold-weather-related maintenance issues |

Key market indicators to watch, regardless of the season

Smart buyers think bigger: Non-market factors that matter

Home insurance availability and extreme weather risks

Generational home-buying considerations

- Younger homebuyers, like those in Gen Z, are just beginning to enter the market, but many are facing challenges like high housing costs and competition. The best time to buy for this demographic may not always be in the traditional peak seasons. Instead, consider smaller homes or condos during the fall or winter, and be ready to act quickly when the right opportunity appears.

- Middle-aged homebuyers could consider buying when mortgage rates stabilize post-inflation. First-time buyers should also prioritize homes meeting current and future lifestyle needs, considering starter homes that still offer room for growth.

- Older homebuyers, such as empty nesters or those considering a property for retirement, are often looking for homes that can accommodate changing family dynamics. People in this group may be able to invest in their dream home. If that sounds like you, consider buying a home when inventory is high in the spring or summer.

Property taxes, HOA fees, and cost of living

Commute times, infrastructure, and access to amenities

A better way to buy, with protection built in

Download our seasonal home-buying tips

Related Articles

Hippo Housepower Report: Home Protection Priorities in 2025

Buying A House With Someone You Are Not Married To

What to Expect Your First Year After Buying a House

What Homebuyers Need To Know About Climate Change and Their Home

How Much To Budget for Home Maintenance