Buying A House With Someone You Are Not Married To

Did you know the average cost of a pre-pandemic wedding was just under $30,000? That’s right — in just one night you can spend the same amount you’d pay for a brand-new car or half the recommended down payment on a $300,000 home.

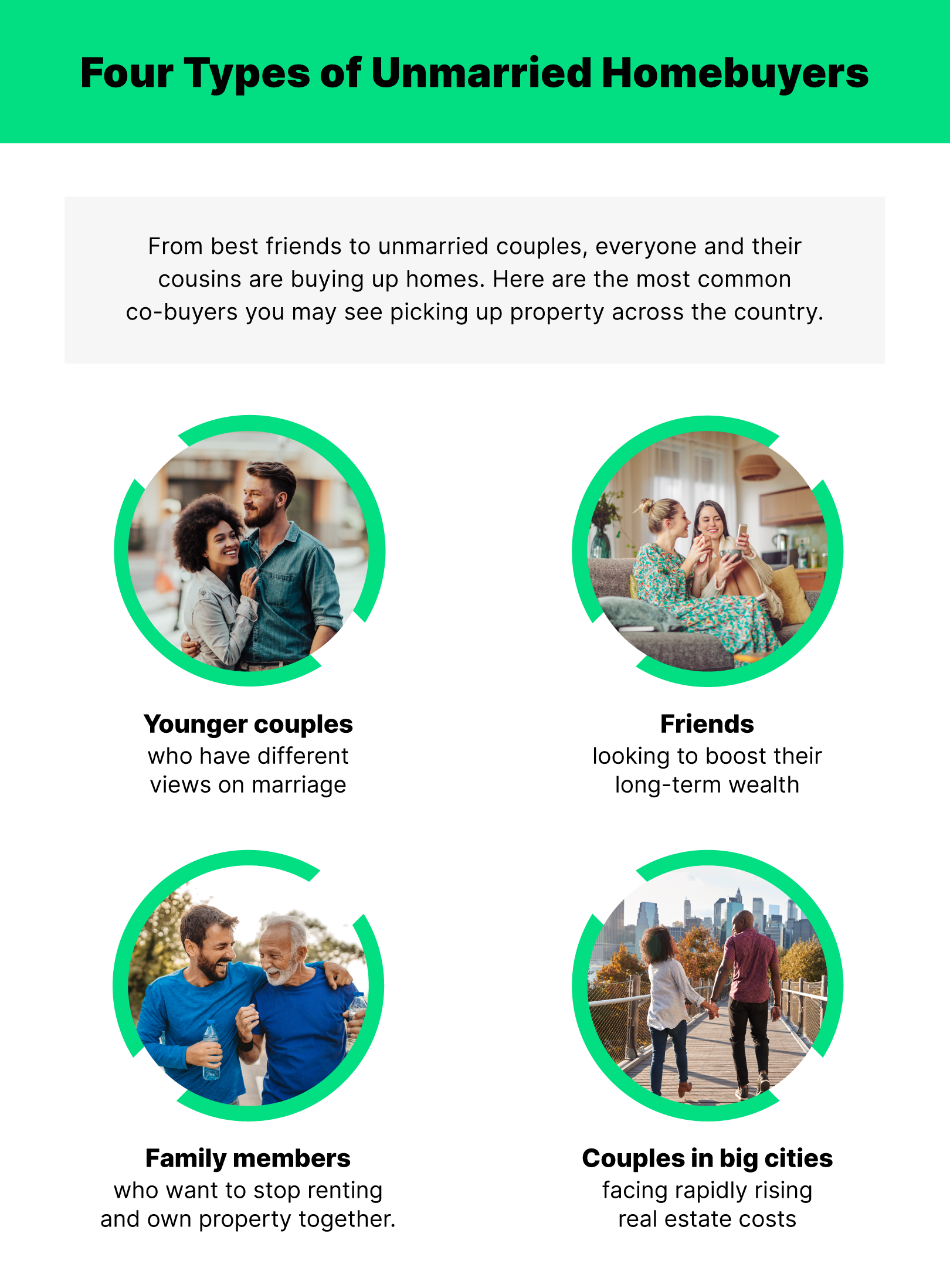

The sky-high price of saying “I do” has long been debated, with many choosing to forgo a fancy ceremony for something more intimate (and less expensive). In recent years, young couples have been trending away from holy matrimony entirely, focusing instead on building long-term wealth by investing that same money in real estate. The trend has even expanded to groups outside of romantic relationships, as friends and family team up to buy their first homes across the nation.

No matter if you’re in a romantic relationship or not, if you’re interested in taking the real estate plunge with someone you’re not married to, there are important details to consider. Our guide below will help you and your co-signing friend, family member or domestic partner learn everything you need to know about buying a home together.

The unmarried housing boom

Though your grandmother may clutch her pearls when you tell her you bought a house with your partner before tying the knot, it’s becoming quite common for younger generations. Even back in 2013, one in four millennials had purchased a home with their partner before getting married. And that number has only grown in the years since.

This increase in popularity is due to a combination of shifting priorities and rising home prices. In fact, waiting just a few more years to buy a home can turn the American dream into a far-off fantasy for most couples (after all, houses across the U.S. have increased an astonishing 113% over the last decade). So instead of getting priced out of their hometowns, many are choosing to put a wedding on the back burner, signing mortgages instead of marriage certificates.

Six questions for unmarried homeowners

Whether you’re buying a home with your long-term partner, best friend or cousin, there are a lot of things that need sorting out before you put down an offer. By taking the time to answer critical questions now — like whose name will be on the mortgage and if you need a cohabitation agreement — you can avoid a lot of headaches down the road.

1. Will we both be on the mortgage?

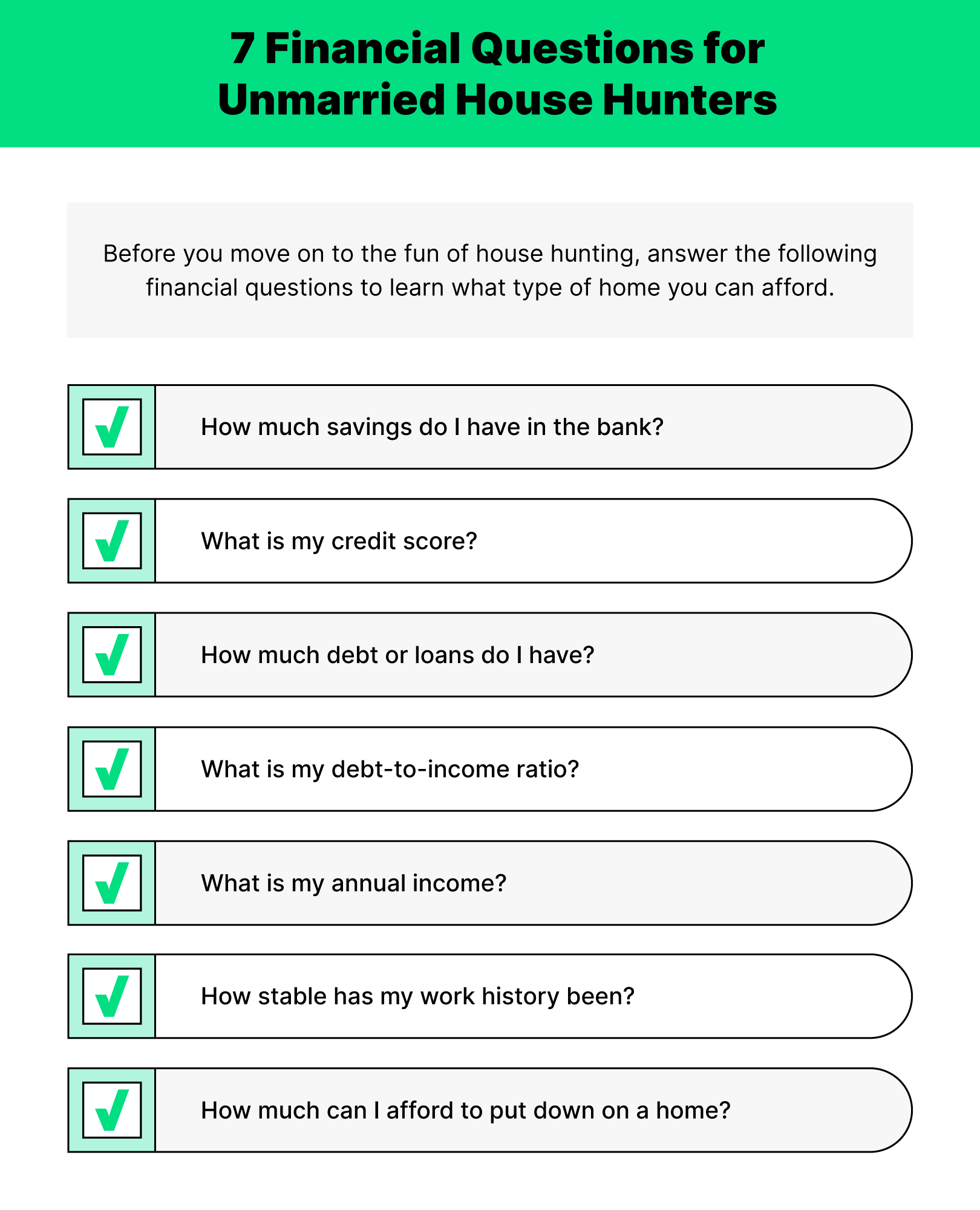

When applying for a mortgage, your income, credit score, work history, debt-to-income ratio and many other financial factors will be taken into account before getting approval. Because of this, it’s a smart move to put your best foot forward, meaning if one of your co-borrowers has a lot of debt or a low credit score, you may want to leave them off the mortgage application entirely.

However, if you both have similar financial backgrounds, applying as co-borrowers can be beneficial as both your incomes will be taken into account. Since a higher income level allows lenders to feel more protected, they’ll often offer a lower interest rate or higher borrowing limit to co-borrowers with steady incomes.

2. Who will hold the title?

The title may not seem like a big deal compared to the mortgage, but given that it dictates how much of the home everyone owns, it’s actually pretty important to get right. Co-buyers can choose to have one person own the property outright, or split it in any way they see fit. If you’re having trouble deciding how to split up ownership, consider having the percentage reflect how much money each person is putting in to make the process fair.

When buying a home, you may hear the terms “joint tenancy with rights of survivorship” and “tenant in common” thrown around. Understanding these terms is key, as it determines how ownership of the home is delegated in the event one of your co-borrowers passes away.

- Joint tenancy with rights of survivorship: the percentage of ownership passes along to the other co-borrowers in the event of a death

- Tenant in common: the percentage of ownership passes along to heirs of the deceased as determined in their will

Once you’ve determined who will hold the title and how much everyone owns, it may be a good idea to have the title-holder sign up for owner’s title insurance or enhanced title insurance for extra protection.

3. Do we need a property agreement?

Think of a property agreement as a prenup. You don’t think you’ll need it, but it can’t hurt, right? A property agreement is a legally binding document that dictates the share of finances when it comes to paying off the mortgage, utilities and other household expenses. Most property agreements, especially those with couples who aren’t married, will include information on who will own the property in the event of a breakup. It’s also a good idea to include information on how the profits will be split when it comes time to sell to get everyone on the same page.

To make sure this document is an accurate representation of what you both want, it’s best to hire a lawyer or mediator to help draft your property agreement. Hiring someone familiar with your situation will also be helpful down the line, especially if you need to make updates to the agreement after a breakup, wedding or the birth of a child.

4. Will we be living in the property full time?

Say you and your partner are looking to invest in property to turn it around and lease it out to renters. While becoming a landlord can be a great way to make a high return on your investment, there are a few unique things to keep in mind if you won’t be living in the property full time (and we aren’t just talking about buying landlord insurance — though that’s important too).

When you buy a home — whether you’re co-buying or flying solo — you’ll be slated into two categories: occupant or non-occupant. If you aren’t living in the home full time — for example, if it’s a second home or rental property — you’d be considered a non-occupant. Non-occupant mortgages will likely require you to have a better credit score, put down a larger down payment and pay a higher interest rate due to the extra risk your lender is taking on.

5. What is our financial history?

There’s no getting around it: You and your partner will need to have a chat about finances before you begin house hunting. While the conversation can get uncomfortable, understanding each other’s financial status — including savings, student loans and other debt — will help better prepare you both for the journey ahead. Besides, your mortgage lender will do their own research into the both of you, so getting everything out in the open now means less stress when it comes time to put in an offer.

Before you begin house hunting, take a deep dive into your finances. Determine how much savings you have as a couple, the amount of debt you both still need to pay off and who has the better credit score. These numbers have a huge impact on how much you’re able to borrow (and your interest rate) so if one of you is in a better financial position than the other, you might want to put the loan application in their name to get the best deal.

6. Who will get the tax deduction?

When you take on a mortgage, you’re able to use it in your tax forms to get a deduction on how much you owe the government. According to Rocket Mortgage, when itemizing your deductions, you can count the interest you’ve paid on your loan against your income, meaning you don’t have to pay as much in taxes.

Married couples don’t need to worry about answering this question, as they’ll likely file their taxes jointly. But when you file separately from your co-buyer, only one of you will be able to list the home as a tax deduction. While who uses this deduction is up to each group of co-buyers, it’s a good idea to consider who makes the most, whose name is on the mortgage payments and who shoulders most of the financial burden when making this decision, as they may benefit the most from this tax break.

What do co-owners need to know about buying a home?

In addition to the questions above, there are a few other things co-owners need to understand before buying a home together. Purchasing real estate requires a lot of work, but that work doesn’t stop once you’ve settled in. Things like home maintenance, chores, lawn care and HOA fees will be regular items on your to-do lists, so understanding who will be handling each task will help avoid resentment down the line.

Speed dating: homebuyers edition

If you’ve ever gone speed dating, you know the excitement of getting to know someone as quickly as possible. While you may already know your future co-owner pretty well, going on a 'speed date' of your own, to determine future plans and goals, is a good idea before diving into the home buying journey together.

Get insight regarding saving goals, chore allocation and plans for the future by using the conversation starters below. Want to amp up the fun? Set a timer and try to answer as many questions as possible before the time runs out!

- How much savings should we have in case of emergencies?

- Will we repair the home ourselves or hire professionals?

- What features are you looking for in your future home?

- How long do you see us staying in this home before selling?

- How will we split the profits when selling?

- Who will mow the lawn and rake leaves?

- How often should we deep clean the house?

- Are there any upgrades you would like to add to our future home?

- Do you want to bring pets or kids into the home?

- What are your home buying deal breakers?

- How many homes do you want to look at before making an offer?

- What kind of neighborhood do you want to live in?

- What sort of entertainment options, amenities or businesses do you want nearby?

Vision boards and dream homes

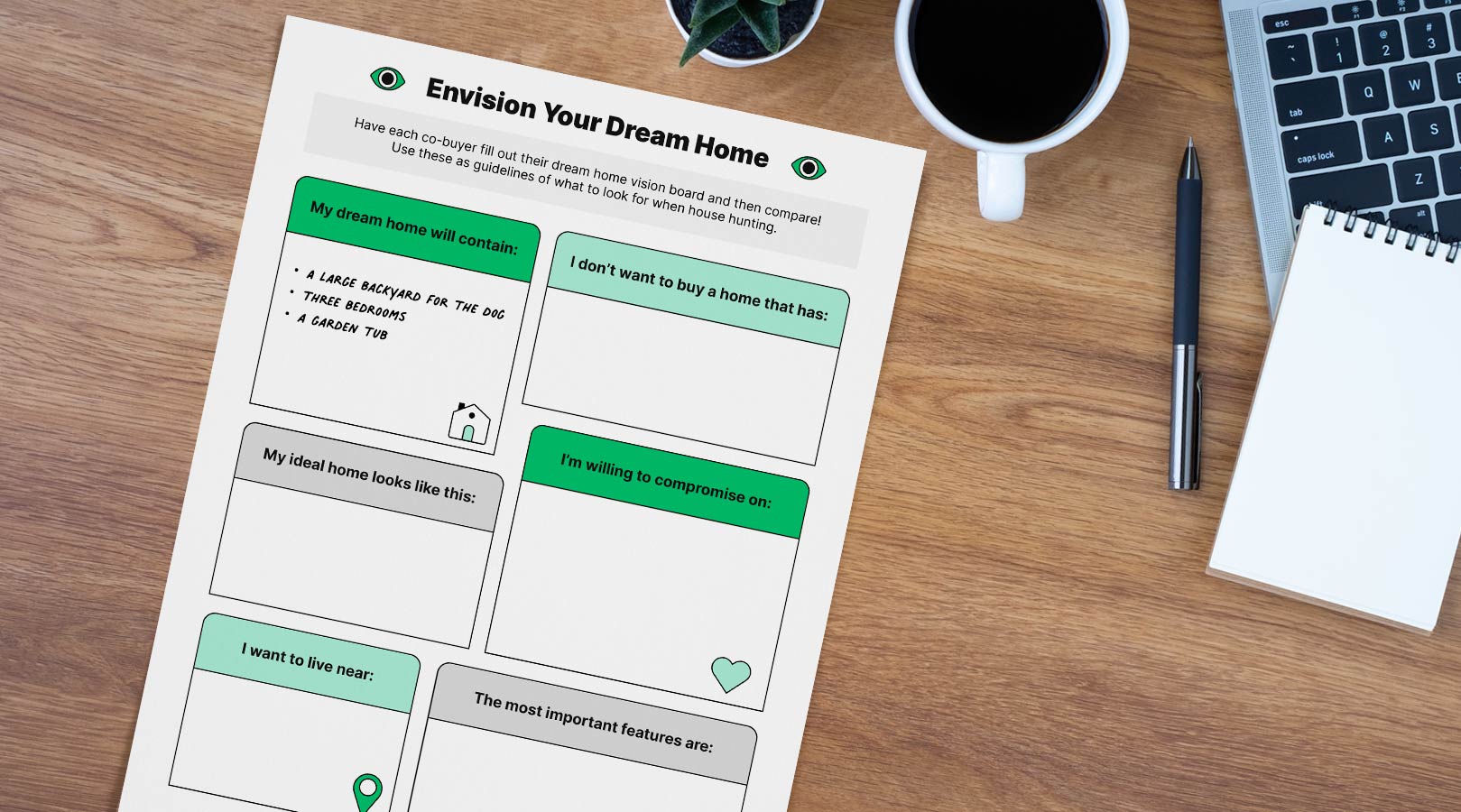

Once all the legal and financial questions have been answered, you can get to the fun part: dreaming up your perfect home! While many couples are aligned on the size and location of their future home, you may be surprised to learn that you and your partner have a lot of differences when it comes to must-have features.

From garden tubs to smart kitchen appliances, learning what the other partner is dying to have in your next home will help set expectations early on. Highlight your wants, needs and total deal-breakers by filling out the vision boards below. When comparing vision boards with your partner, make note of any commonalities and chat through differences for a conflict-free house hunting experience.

Your longest relationship is with...your home insurance provider?

Buying home insurance is also a lot like dating. Before settling down, it’s smart to play the field and keep your options open. While you can’t necessarily take your insurance agent out to a nice dinner, most will be available whenever you need to chat through questions and get to know your home's unique needs. This shopping period helps ensure you won’t get cold feet when it comes to making a commitment because you feel confident in your decision.

Much like dating, when you find the right insurance provider, you just know. Ready to go steady and buy a home insurance policy? Just give us a call. We’re standing by (with a boombox overhead) to help you get the coverage you need.