Historic Home Restoration: Your Guide to Grants + Renovations

From Austin to Jacksonville, the U.S. housing market is hot right now and shows no signs of cooling off anytime soon. Because of this competitive market, homeowners are thinking outside the box when it comes to getting a home for less. From taking on renovations themselves to buying older homes with potential, new trends have taken hold of homeowners nationwide.

But buying and restoring an older or historic home comes with some challenges, from getting the proper permits to staying within budget. Luckily, there are plenty of grants for historic homes out there to help your dream become a reality. To make sure you’re tackling your restoration properly, check out our guide to financing your remodel.

Table of Contents:

Financing your historic home restoration

There’s no denying the beauty of older homes. The crown molding, columns, and other architectural and decorative features are just some of the reasons homebuyers are drawn to historic properties. But add to that the ability to keep history alive and thriving for generations to come, and it’s no surprise that restoring historic homes has become such a popular choice in recent years.

And it turns out there are plenty of organizations that feel the same way. From federal grants to bank loans catered to renovations, below are the financing options available for your next project.

Looking to buy a more traditional home but still want financial help? Check out our post on creative ways to finance a home.

Grants for historic homes

When updating an older home, it's easier than you’d think to go over budget. From getting the right permits and hiring contractors to making important design decisions, you may wake up one day and realize your project is much more expensive than you originally planned.

To help keep your eyes on the prize, try applying for any of the following federal and organizational grants that you can use to finance your historic home remodel.

- Historic Preservation Fund

- Save America’s Treasures Grant

- Kinsman Foundation Historic Preservation Grant

- Semiquincentennial Grant Program

- Housing Preservation Grants

Many states have grants specifically for their residents — to see what options are available for your property check out the State Historic Preservation Offices.

Loans for historic homes

If you don’t qualify for any grants or just want to go the more traditional financing route, there are plenty of loans available to help you pay for your next project. Just make sure to check the eligibility and payment requirements so that you know what you’re getting into before you sign on the dotted line.

- 203(k) Rehabilitation Loan

- Fannie Mae HomeStyle Loan

- Section 108 Loan Guarantee Program

- Title 1 Property Improvement Loan

- Single-Family Housing Repair Loans

- Rural Housing Repair Loan

Tax breaks

Talking about taxes — though often boring — is extremely important. Your refund can help get you back on your feet after a major renovation project. While you often can’t deduct homeowners insurance from your taxes, there are several tax credit options available to those who decide to tackle historic home restorations.

- Federal Historic Rehabilitation Tax Credit (HTC)

- Historic Preservation Office by State

- Historic Property Easement

- Preservation Easement

Other financial options

Outside of grants, loans, and renovation-related tax breaks, there are other ways you can get help financing your next renovation project. Though these often have specific stipulations, the following trusts, scholarships, and other funds are available and dedicated to helping keep history alive.

Historic homes 101

While there are many older homes out there that deserve preservation — to qualify as a historic home, your property must meet certain criteria set by the National Park Service (NPS). Though this process can often vary by state, you can generally expect the following factors to be considered when deeming your home as historic:

- Age: Is the property older than 50 years?

- Integrity: Does the property still look the same as it did when it was first built?

- Significance: Is the property associated with people, events, or other factors that were historically significant?

If you’ve bought a home that’s already registered, or you’re in the process of registering your current place, you should know that depending on where you live, there may be local laws or ordinances that’ll dictate what you can and cannot change.

Unfortunately, there’s no national database to check your local laws or ordinances, so you’ll need to do some research and speak to your local government to get the low-down on everything you need to know before starting your renovation.

How can I get my property registered as historic?

To get your property registered as historic, you’ll need to submit your home for nomination through your State Historic Preservation Office. From there, your nomination will go through several stages including public comment, a National Register Review Board, and a final review by the NPS. This process can take a minimum of 135 days.

If you plan to open your home up to tourists or rent it out on sites like Airbnb or VRBO, getting your property registered can help add value to your property and draw in more people. Outside of that, proper registration is needed to qualify for a majority of the above loans and grants, so it's a must if you need financial assistance to complete your renovation.

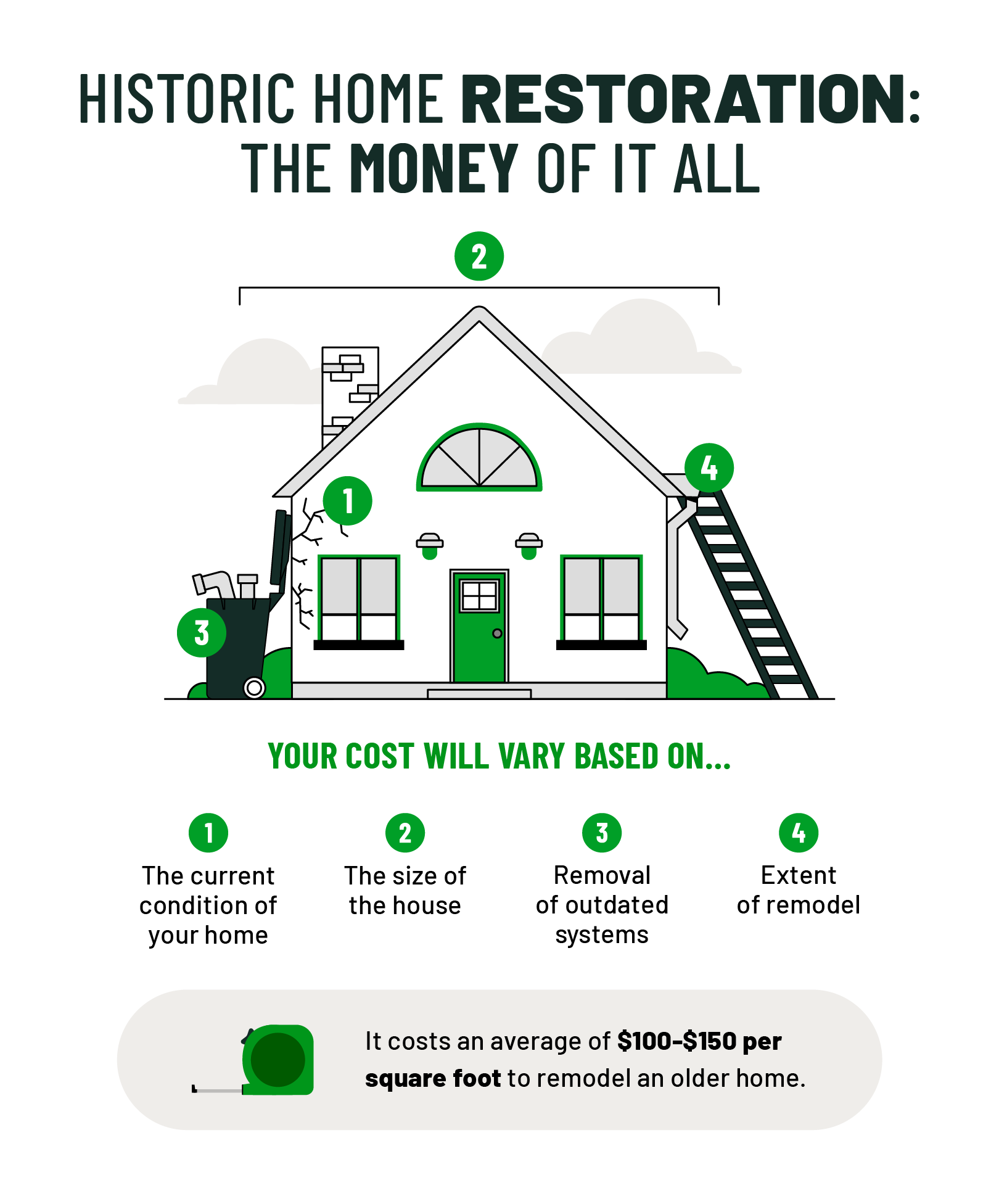

How much does it cost to renovate an older home?

It costs an average of $100-$150 per square foot to remodel an older home, though that price can vary dramatically by the current condition of your home, the updates planned, and any local laws you need to follow.

For example, if your older home is in pretty good shape, you can expect to pay a lot less for your remodel than if you have to completely gut your home and replace older pipes or remove mold.

Protecting your historic home

With all the different types of home insurance policies available, figuring out which policy is right for you can be as difficult as finding the perfect home in this competitive market. However, if you bought a historic home, there’s a specific policy catered to help protect your older property.

HO-8 policies offer more robust coverage to help protect older homes from the natural wear and tear that can damage the structure over time. In addition to protecting your home’s dwelling, your personal property, and liability, HO-8 policies also have higher coverage limits to help you pay for bigger repairs, often needed in these types of properties.

Looking to save more on your historic home’s insurance policy? Outside of your planned renovations, you should also consider updating the roof and adding in smart homes devices like smart water shut-off valve or a security system. These changes will help homeowners of all kinds get discounts on their premiums.

Additional resources

The reality is that when updating a historic home, you’ll need to read more than just one article to get a grasp of how to properly fund and plan your entire project. For more information on financial resources and renovation tips, check out the resources below.

- General funding resources (Historicfunding.com)

- National Trust for Historic Preservation (Savingplaces.org)

- Technical preservation services (NPS)

- How to get a construction permit and historic home experience (The Gold Hive)

- Historic property FAQs (Nolo)

No matter what stage you’re at in your renovation, you’ll want home insurance to have your back. For a modern policy that doesn’t leave older homes in the past, turn to Hippo.