Are Home Improvements Tax Deductible? Guide to Tax Benefits

The past year has been financially turbulent for homeowners. In 2024, rising inflation and interest rates continued to put pressure on household budgets, while extreme weather events drove up disaster preparation costs and repair expenses.

Despite these challenges, homeowners remain resilient and are determined to maintain and improve their homes. This trend is reflected in our recent Housepower Report, which found DIY projects are surging in response to rising costs. Over one-half (55%) of homeowners indicate they’ll tackle more DIY projects in 2025.

To further offset these expenses and bring their visions to life, homeowners can leverage the tax benefits available for certain home improvements. The specific types of benefits and their applicability, however, vary depending on the project and the state.

We’ll go over examples of potential qualifying home upgrades below, including some you can DIY. Consult with a tax professional with questions regarding tax laws, upcoming changes, how tax benefits work, and professional advice regarding what projects may or may not qualify.

2025 update: What to know before you file

Recent executive orders from the Trump administration have introduced uncertainty around the tax benefits available to homeowners considering clean energy or energy-efficient upgrades.

While funding for certain federal programs under the Inflation Reduction Act (IRA) has been paused, current tax incentives remain in place for now. Homeowners who made eligible upgrades in 2024 should still get those tax benefits.

Tax season is already shaping up to be more complicated than usual. The Internal Revenue Service (IRS) recently announced staffing cuts, with 6,000 employees being laid off during the busy tax season. This downsizing effort could slow down tax processing and create additional hurdles for homeowners seeking deductions or credits.

Homeowners considering clean energy or energy-efficient upgrades in 2025 should stay informed about potential policy changes and take advantage of existing tax credits.

While energy-related tax incentives are uncertain, other home upgrades—particularly capital improvements—remain firm in their financial advantages.

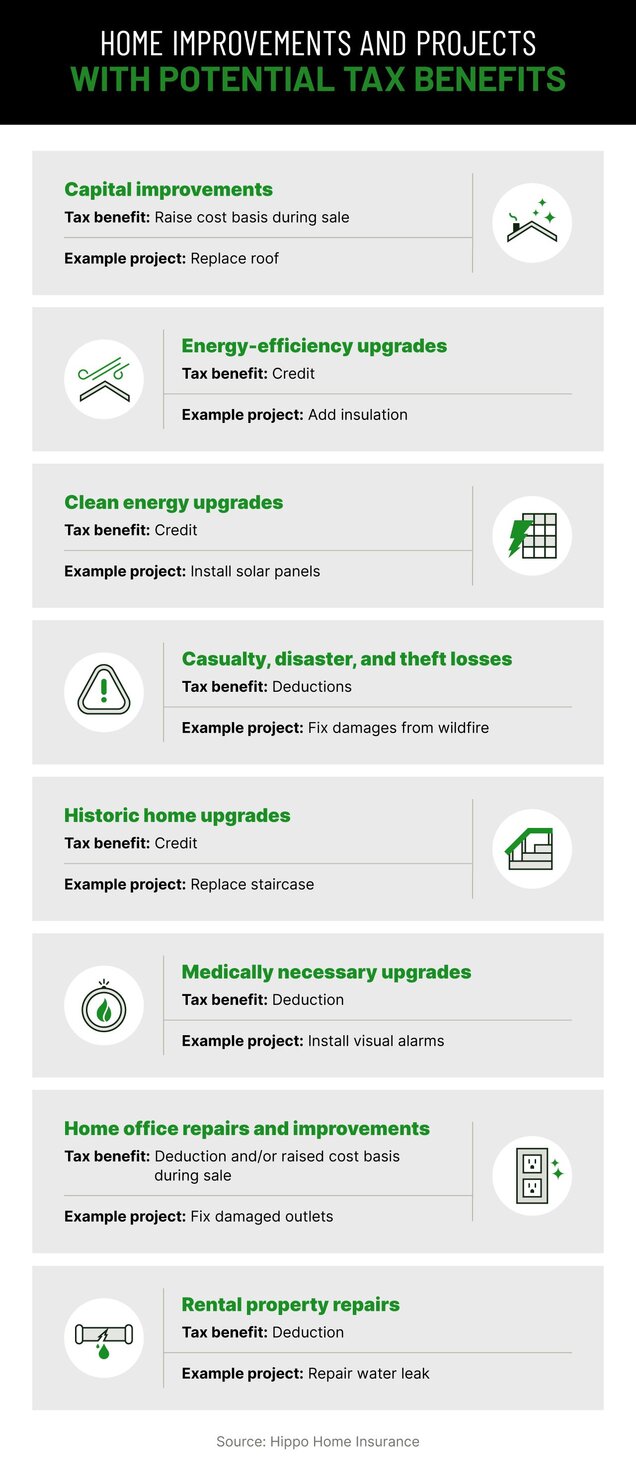

Capital improvements vs. repairs

The Internal Revenue Service (IRS) allows homeowners to take a tax deduction for certain home improvements classified as capital improvements. To apply for the deduction, the improvements must meet three key requirements:

- Extend the home’s lifespan.

- Add to the home’s uses.

- Increase the home’s value.

We recommend consulting a tax professional to help understand what improvements may qualify and the tax implications of capital improvements and capital gains on the sale of your home.

- Installing a new HVAC system to replace one that isn’t running efficiently or is beyond repair can help you save money, protect your home, and even offer potential tax benefits. A modern and efficient HVAC system can improve air circulation, maintain temperature control, and help you cut down on utility costs in the process. Plus, if it qualifies for energy efficiency tax credits or adds to your home's cost basis, it could reduce your tax burden when you sell.

- Attic insulation installation can cost about $1.80 per square foot and can help reduce heating and cooling costs, easing stress on your HVAC system. A better-insulated attic can also help maintain your roof’s temperature and prevent related damage, like the expanding and contracting that can occur with winter ice dams. Certain insulation upgrades may also qualify for energy efficiency tax credits, providing potential savings come tax season.

- Installing water softeners can help reduce calcium and magnesium in your water. This helps reduce buildup in plumbing fixtures and pipes and helps appliances run more efficiently and last longer. In addition to these long-term savings, water softeners may qualify for energy efficiency tax credits.

Energy-efficient upgrades

- You can get a home energy audit from a professional home energy auditor for a tax credit of up to $150. An auditor will help you understand where you’re losing energy and identify health and safety issues in your home. According to the U.S. Department of Energy (DOE), a home energy audit could help you save up to 30% on your energy bill. To qualify for this credit, the audit must be conducted by a qualified home energy auditor or by one who is supervised by a qualified auditor. It must also include a written report prepared and signed by a qualified home energy auditor, and the report must be consistent with industry best practices. Find more information in Notice 2023-59.

- You can install ENERGY STAR’s Most Efficient exterior windows and skylights for a credit of up to $600 based upon eligibility. Similarly, replacing your exterior doors with ENERGY STAR-certified models could earn a tax credit of up to $500. Replacing windows and doors can help improve insulation and reduce the need to run your HVAC.

- You can install biomass stoves that meet Energy Star’s requirements for up to a $2,000 credit. Biomass stoves must have a thermal efficiency rating of at least 75% to qualify, and costs may include the installation cost. Biomass can include wood pellets and grasses. Although burning biomass can reduce energy usage, we recommend following wood-burning best practices to help reduce fire and other health risks.

Clean energy upgrades

- Installing a solar water heater can help reduce strain on your traditional water heater and help prolong its life, depending on the type you install. For example, in a two-tank system, the solar water heater stores and preheats water before sending it to your conventional water heater, reducing the energy needed to reach the desired temperature. This setup is typically installed in a garage or basement. Since water heating is often the second-largest energy expense in a home, switching to a solar-assisted system can lead to significant savings—and may also qualify for federal tax credits.

- Installing geothermal heat pumps can help heat and cool your home more efficiently than traditional heating and cooling systems by transferring heat to the ground rather than generating heat. They tend to be expensive, but according to the DOE, you can potentially see a return on investment (ROI) in five to 10 years, depending on available financial incentives.

- Battery storage technology helps store excess energy generated from clean energy sources. This gives your home a reliable energy source if the grid goes down during a blackout or extreme weather event. In addition to enhancing energy independence, certain battery storage systems may qualify for federal tax credits, offering potential savings while making your home more resilient.

Casualty, disaster, and theft losses

- Appraisal: A professional appraisal from a qualified appraiser is often the best way to determine the decrease in fair market value.

- Cost of repairs: If certain conditions are met, you may be able to use the cost of repairs as evidence of the decrease in fair market value. These conditions typically include that the repairs are necessary to restore the property to its condition before the event, that they are actually made, and that the cost is reasonable.

- Damage to your home from a fire (not caused by arson) is a classic example. This could include structural damage and improvements like flooring, cabinetry, or built-in appliances. The loss would be the decrease in fair market value due to the fire or the cost of repairs.

- Wind, hail, or falling trees can cause significant damage to roofs, siding, windows, and landscaping. If your home is in an area prone to such events, and you've made improvements to protect against them (like impact-resistant windows), damage to those improvements could also be considered.

- If your home is damaged in an event that the President declares a disaster (like a hurricane, flood, or severe storm), the losses are treated somewhat differently than other casualties. The IRS provides specific guidance for these events, and state-declared disasters have their own tax implications.

Historic home upgrades

- Upgrading or replacing old pipes may qualify for this tax credit and may be necessary to bring the home up to code and help prevent water damage.

- Replacing deteriorated parts in the structure of your home, like posts or beams, may qualify for this credit. Replacement should be visually similar to the original and at least equal to the original’s load-bearing capabilities.

- Fully replacing a deteriorating set of stairs using the same or compatible substitute material can make your home safer and may qualify for this tax credit. The new set of stairs should look similar to the original.

Medically necessary upgrades

- If the improvement increases your home’s value, your medical expense is considered the cost of the improvement minus the increase in home value.

- If your home’s value does not increase, you can include the entire cost in your medical expense deduction.

- Qualifying upgrades could include installing modified smoke detectors and other monitoring systems that can help alert those with disabilities, such as alarms with strobe lights for the hard of hearing.

- Grading, or leveling, the ground can improve accessibility and also help protect your home from water runoff. Grading can help reduce steep slopes and create more accessible pathways for those with mobility challenges. If done to accommodate a medical need, it may qualify as a medically necessary home improvement in the eyes of the IRS, potentially offering tax benefits.

- Bathroom modifications, like grab bars and railings, can help prevent slips and falls. When installed to meet a medical necessity, these upgrades may qualify for a tax deduction as a medical expense. Additionally, they can help contain water splashes, reducing the risk of mold or mildew over time.

Home office repairs and improvements

- Exclusively and regularly as your main place of business

- Exclusively and regularly as a place to meet with patients, clients, or customers

- In a separate building on your property (not attached to your home) for your business

- Regularly for storing inventory or product samples

- For rental purposes

- As a daycare facility

- If you install a full home security system, you can potentially deduct the cost of maintaining and monitoring the system that relates to the business part of your home.

- Repairing damaged outlets and wiring may be tax deductible and, more importantly, a crucial project to help prevent electrical fires and potential damage to your devices. Call an electrician for a professional inspection if you suspect electrical issues in your home.

- You can replace your home office windows with dual or triple-pane windows to help improve insulation and reduce noise. In addition to the tax benefits you may enjoy when you sell your home, this improvement can help lower the need for cooling and heating and lower strain on your HVAC system.

Rental property repairs

- Repairing leaks in a tenant’s bathroom is essential for preventing long-term mold and mildew issues, and it may also qualify as a deductible repair expense for rental property owners. Since leaks can lead to structural damage if left unaddressed, fixing them promptly also helps maintain the integrity of your home.

- Addressing air leaks in your tenant’s area can help improve insulation, keep them comfortable, and lower heating and cooling costs. Simple updates like replacing weatherstripping around windows and doors may qualify as deductible rental property repairs under IRS guidelines.

- Routinely checking the air vent(s) in your tenant’s part of the home can improve your chances of catching airflow issues early, including dirty vents or leaky ducts. Since vent maintenance and minor repairs generally fall under routine property upkeep, these costs may be tax-deductible for rental property owners.

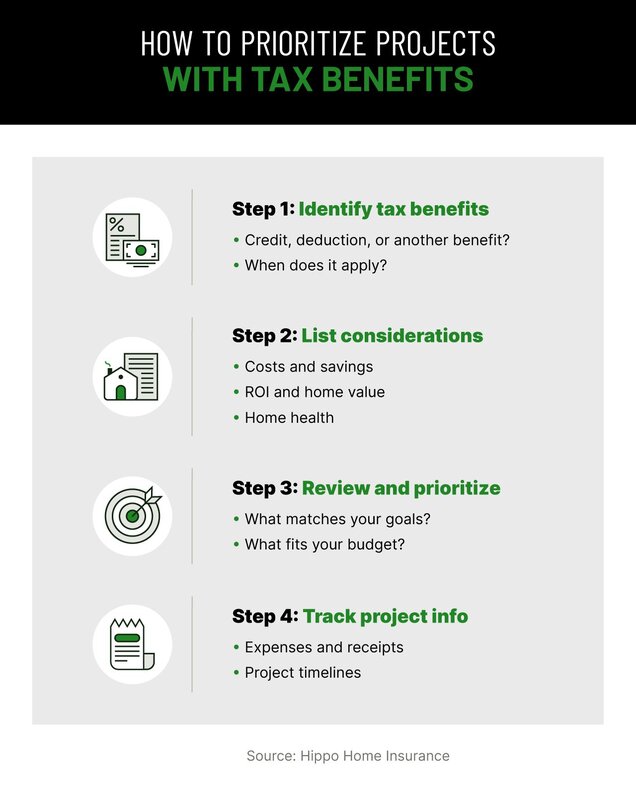

4 tips to upgrade your home with potential tax benefits

Step 1: Identify each project’s potential tax benefits

Step 2: List out considerations for each potential project

- Impact on home property value and ROI

- Potential to proactively protect the home from future risks

- Estimated cost savings for utilities and repairs, if applicable

- Tax benefits and when you can enjoy those benefits

- Necessity for a professional and related labor cost

- Total cost and available financing options

Step 3: Prioritize projects based on key considerations

Step 4: Keep track of project expenses and supplies

Download the homeowner's guide to tax-deductible improvements

Related Articles

Critical Home Maintenance Upgrades: 5 Best ROI Home Improvements in 2024

Report: Where Homeowners Turn for Maintenance Advice in 2024

3 Home Upgrades That Can Lower Your Insurance Premiums

The Hidden Cost of DIY: 58% of Homeowners Blow Their Budget

DIY Home Upgrades and Projects for All Homeowners