5 Things First-Time Homeowners Wish They Knew Before Winter

Owning a home in winter comes with responsibilities that can catch first-time buyers off guard. Suddenly, tasks like clearing snow, preventing frozen pipes, and keeping heating systems running smoothly are no longer a landlord’s job—they’re yours.

And with climate change making winters less predictable, even areas that once experienced mild conditions may now face costly weather risks, like wetter winters or higher snowfall.

Our Winter Home Damage Survey highlights just how unprepared many homeowners feel: 41% reported being only somewhat aware of the costs associated with winter damage. And with 69% of homeowners reporting some form of winter damage, the impact of cold weather may now reach even typically moderate regions.

As colder weather approaches, here are five of the most common risks—along with practical steps to help homeowners avoid costly repairs.

*All tips are considered general homeowner practices, not professional recommendations.

1. The true cost of heating and energy bills

Average cost of energy bills: $2,000 annually

Winter heating costs often surprise first-time homeowners. Drafts, poor insulation, and leaky windows can force heating systems to run longer, driving up bills.

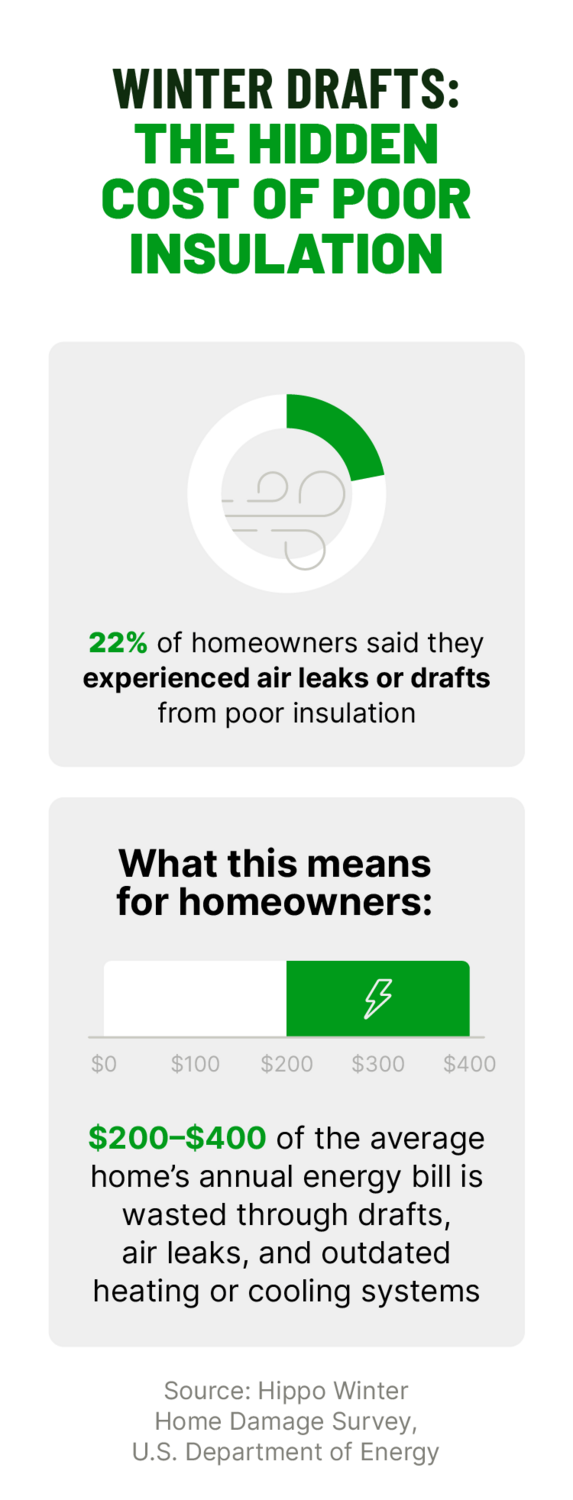

According to our Winter Home Damage Survey, 22% of homeowners dealt with air leaks or drafts from poor insulation, and 18% had heating or HVAC system failures (both of which can spike winter expenses).

The U.S. Department of Energy (DOE) estimates that $200 to $400 of the average household’s $2,000 annual energy spending is wasted through drafts, leaks, and outdated systems.1 Sealing gaps and improving insulation could reduce energy waste by 5-30% per year, while improving comfort and heating efficiency.1

General prevention tips for homeowners:

- Add or replace weatherstripping around doors and windows.

- Seal gaps with caulk or expanding foam.

- Change HVAC filters every 1-3 months.

2. The critical role of gutter and roof maintenance

- Replace old caulk around chimneys or roof vents.

- Schedule a roof inspection before winter starts to catch loose shingles, worn sealants, or early signs of leaks.

- Review your homeowners insurance policy or consult a licensed agent to review your policy and understand how roof replacement coverage applies.

3. Why you should winterize your plumbing system

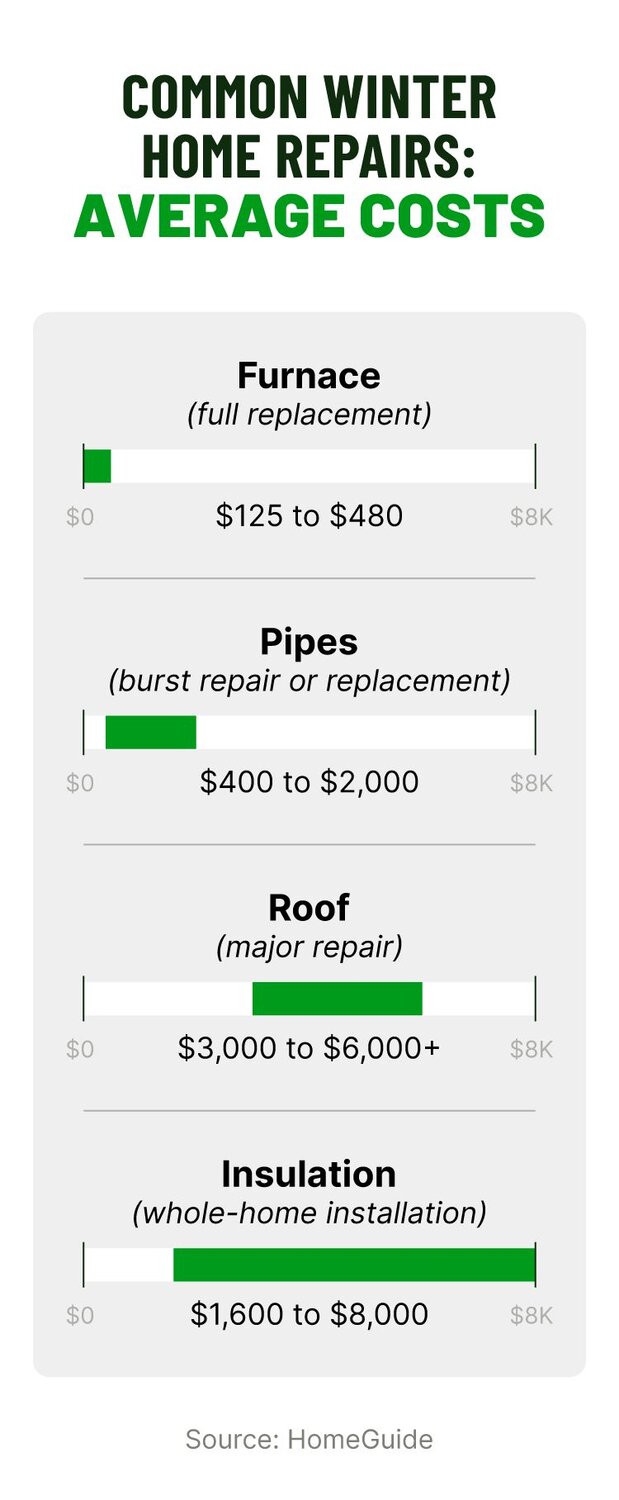

Average cost of repairing burst pipes: $400 to $1,500

When temperatures drop, water inside pipes can freeze, expand, and cause cracks. Once thawed, those cracks can release gallons of water — damaging floors, walls, and personal belongings.

Our Winter Home Damage Survey found that about 17% of homeowners have experienced frozen or burst pipes, making it one of the top winter home issues.

The risk is even higher in the East South Central region (Tennessee,

Alabama, Kentucky, and Mississippi), where 31% of homeowners said it was their top problem.

The damage often goes beyond plumbing. Water leaks can ruin drywall, warp flooring, and compromise insulation. Repairing a burst pipe costs an average of $400 to $1,500, while water damage cleanup can increase the total to $2,0002 or more.

General prevention tips for homeowners:

- Insulate exposed pipes in unheated areas, such as basements, attics, and crawl spaces.

- Disconnect and drain outdoor hoses before freezing temperatures hit.

- Check pipe insulation regularly.

4. The reality of critical system maintenance in cold weather

Average cost of furnace repairs: $132-$501

When temperatures drop, key home systems—like furnaces and water heaters—work overtime. Without regular servicing, they’re more likely to fail when demand is highest, leading to no heat, frozen pipes, or unsafe temporary fixes like space heaters.

Furnace repairs typically cost $132-$501, averaging $3173, while full replacements or new heat pumps can cost thousands. Regular maintenance helps prevent costly breakdowns and can extend systems by 15-20 years.

General prevention tips for homeowners:

- Replace furnace/heat pump filters every 3 months.

- Lower your water heater temperature to 120°F (if safe).4

- Insulate water heaters and hot-water pipes.

- Schedule yearly chimney cleanings to improve airflow and reduce fire risk.

5. Regions where homeowners spend the most on winter repair

Winter weather damage is becoming more widespread across the U.S., even in regions that once saw milder conditions. As climate change intensifies, regions once unaccustomed to harsh winters may face higher repair costs and greater property risks.

Our Battling the Elements Survey found that winter damage costs vary by region:

- In the Middle Atlantic (e.g., New York, New Jersey, Pennsylvania), nearly 33% of homeowners spent $501-$3,000 on winter repairs.

- In the East North Central (e.g., Illinois, Michigan, Ohio, Wisconsin), 14% reported repair bills from $501 to $1,000.

- Even in warmer areas like the South Atlantic (e.g., Florida, Georgia, the Carolinas), 12% spent between $501 and $1,000, and 9% paid more than $1,000.

According to NOAA's National Centers for Environmental Information, two winter storm/cold wave events in a single year caused more than $2 billion in damage.5

Expenses can quickly go from a few hundred to several thousand dollars. Preventive action and timely home maintenance are often your best defense against costly winter surprises.

General prevention tips for homeowners:

- Schedule annual inspections to spot issues early.

- Take proactive steps in the fall, like sealing air leaks and disconnecting exterior hoses.

- Review your type of homeowners insurance so you know how it covers winter-related damage.

Take on your first winter with confidence

Winter brings unique challenges for new homeowners, but planning ahead can help you avoid the most costly mistakes. From sealing drafts to keeping major systems in good shape, a little preparation goes a long way toward protecting your home.

At Hippo, we believe proactive steps today create stronger, more resilient homes tomorrow. Get a homeowners insurance quote to explore your options and find the coverage you need for the season ahead.

External sources:

- U.S. Department of Energy. (N.D.). Why Energy Efficiency Matters.

- HomeGuide. (2025, October). How much does a burst pipe cost to repair?

- HomeAdvisor. (2025, April). How Much Does Furnace Repair Cost in 2025?

- U.S. Department of Energy. (N.D.). Do-It-Yourself Savings Project: Lower Water Heating Temperature

- NOAA. (2025, January). 2024: An active year of U.S. billion-dollar weather and climate disasters

Related Articles

Battling the Elements: 69% of US Homes Damaged by Winter Storms

5 Costly New Homeowner Maintenance Mistakes (and How to Fix Them)

12 Winter Energy-Saving Tips For a Cozy and Efficient Home

Homeowners vs. Extreme Weather: Year-Over-Year Trends [2025]

When Is the Best Time To Buy a House? Expert Tips for Homebuyers