People who have seen a sudden hail storm happen or live in “Hail Alley” know hail season is no joke. While storms have a reputation of showing up uninvited, author Alan Lanekin famously quoted, “Planning is bringing the future into the present so that you can do something about it now.”

Meet our expert

Being proactive is one of Hippo’s pillars. We wanted to get ahead of hail season and bring in an expert opinion. Our own Justin Kubicek, a senior claim manager and one of the first insurance experts hired by Hippo with a 21-year tenure in the insurance industry, was the unanimous choice. It is safe to say that he has seen *almost* everything, especially when it comes to hail, having lived his whole life in the great state of Texas.

Graduating with a degree in Communications from Sam Houston State University, Justin says he kind of fell into the insurance industry. He explains in his undeniably Texan drawl, “The one thing that I love to do is help people, actually anything--animals, people, whoever is in need--I want to be able to help out.” Justin’s degree gave him the ability to communicate and deal with the public expertly on a day-to-day basis. In an industry as complicated as insurance can be, he found out quickly that he could be of service to the customers, whom he sees as his neighbors.

“A freak hail storm was the first claim I had to go in-person to do an adjustment on, and boy, was it a doozy!” Justin goes on to explain that the hailstones stripped ALL of the granules from every roof shingle and that the hail had come in so hard at an angle that windows were broken everywhere, and the sides of most homes that had vinyl or aluminum siding looked like they had been pummeled with thousands of golf balls, which essentially, they had.

Being able to help people feel whole again after something so disastrous had occurred was the clincher for Justin.

Why prepare for Hail Season

Hail season has continued to set records for the amount of damage it has caused in the past few years. In 2019, Texas experienced the record number of 872 hail storms (that’s a 71% increase over 2018), as documented by the NOAA’s National Weather Service.

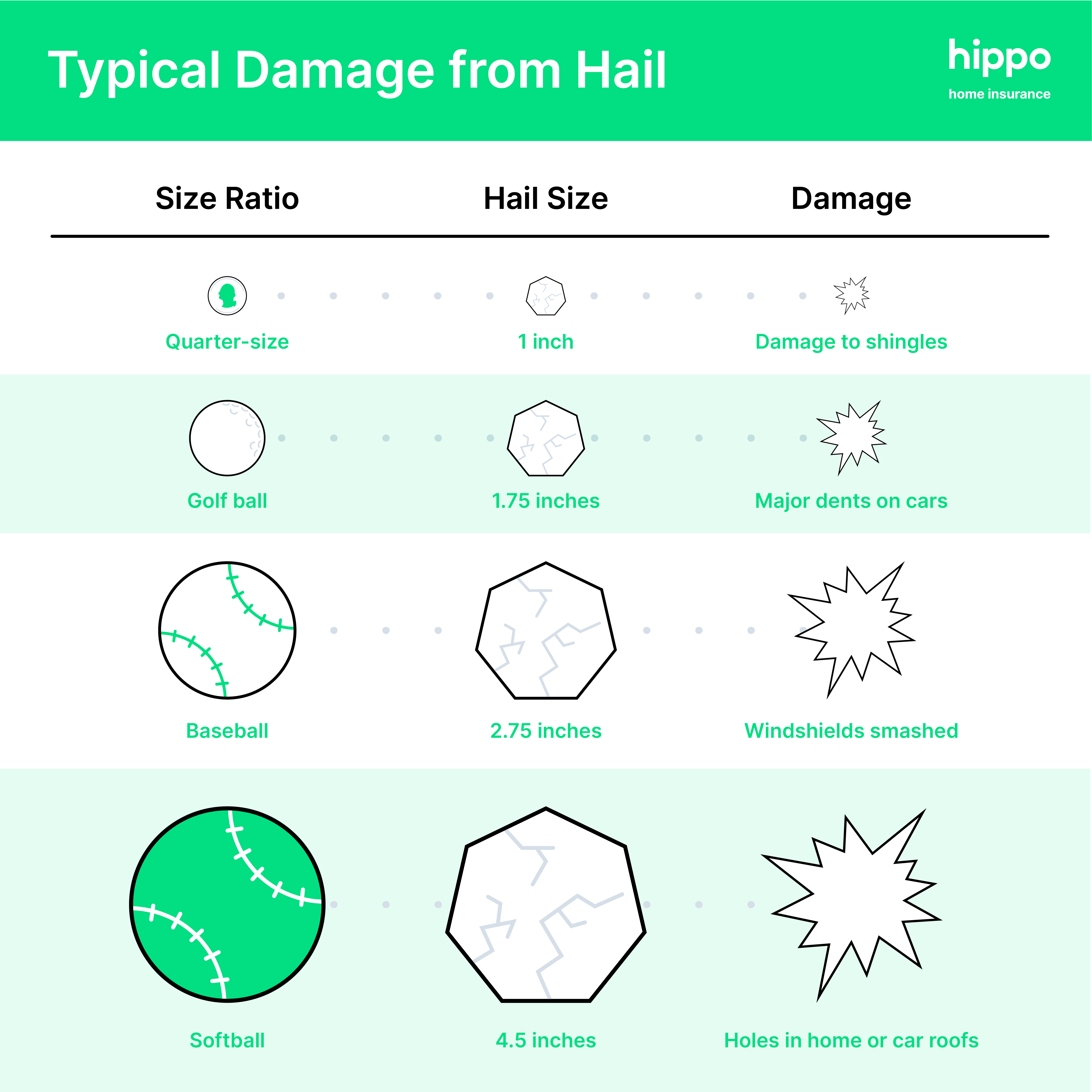

Hail season starts in early Spring, May being the most destructive month. According to the NOAA, in May 2020, South Texas saw golf-ball-sized hail that caused $1.4 BILLION in damage. Because of this, Kubicek said that being as proactive as possible when it comes to hail season can make all of the difference when it comes to having to file a claim or not.

Start from the top down

We can’t talk hail season without first talking roofs. Roofs see slow and costly damage done throughout the year. What looks like a few pockmarked shingles on the surface may actually be exposing the asphalt layer underneath. This can loosen the bond between the asphalt layer and remaining granules, which, after the summer’s high temperatures, that cause the shingle to expand and contract, further compromising any damaged areas. When the winter months hit, the damaged shingles crack in colder weather, causing holes where water can leak down into the roof, making it more susceptible to being torn off in high winds.

So first thing first, closely inspect your roof and make any repairs before the season hits.

Next, you will want to inspect the rest of your property closely. While you are walking around the outside of your home, begin to evaluate what could be damaged by an average hailstone, which is 1” inch, golf-ball-sized traveling upwards of 20 MPH towards anything that’s not protected. “Normally, people only think about their cars,” Justin starts, “but think of all the personal property that is exposed in your front and back yards. For example, those really nice barbecue grills, that expensive patio furniture--maybe with a glass-top table, greenhouses, fire pits, clay pots, right? Those have to, at the very least, be covered, preferably enclosed. Hail can come in at an angle or bounce up and still damage items under a covering. So enclosed is best, especially those higher-end items.”

Then it’s time to review your home insurance policy. If your policy reads like VCR instructions from 1982, call your insurance agency and ask them directly.

To help out, please check out this quick pre-season checklist. You can also read more about hail season preparation HERE.

Post Hail Storm Preparation

It is just as important to prepare for your post-storm responsibilities. First make sure the storm is completely over. Don’t be confused by a lull in the weather. Stay tuned to current weather updates and wait until the coast is clear. Once clear you may be asking, what’s next?

Now is the time to assess the damage that has been done. Walk around the inside and outside of your property to check for new damage. Remember to take pictures and notes along the way. Justin points out not to forget hard-to-see places like inside gutters, skylights, inside basements or root cellars. Check for broken glass, water leaks, cover any openings that may have been caused by the hail to prevent further water or wind damage, and carefully clean up but don’t yet dispose of anything because it may be needed for the claims records.

We also assembled a quick post-storm checklist, which can be found below. To read more about post hail storm, click HERE.

To claim or not to claim, that is the question

Then it’s time to decide if the damage warrants an insurance claim. The standard protocol is if the cost of damages exceeds your home insurance deductible, file your claim. “The sooner, the better” is Justin’s advice, “and with Hippo, we provide a network of vetted vendor partners that will work with Hippo to repair the damage quickly.”

Hippo’s Preferred Partner Network is a set of reputable contractors who not only provide quality work and materials but have experience with Hippo’s high expectations of customer service and quality of work.

We know filing a claim isn’t part of the customer’s everyday routine, so once a call is made to file a claim, they are assigned a Claims Concierge. This is a position designed explicitly by Hippo to ensure that the highest level of empathy and customer care is present when customers need it the most. The Claims Concierge is a single point of contact for the customer from start to finish. They walk the customer through the entire process, providing information, and answering questions. Claims Concierges assist with everyone involved in the claim, like inspectors and other service providers, to keep the process moving and provide real-time updates to the customer. They will also be the person who works with this network of vendor partners to ensure that our Prefered Partner Network provides enhanced service and warranties to ensure the customer’s best outcome.

Hippo is here to make your claims process go as quickly and smoothly as possible, being as transparent as we can throughout. Our Claims pledge can be found here.

Hippo from the heart

When asked what sets Hippo apart from the rest, having worked for some of the BIG GUYS, Justin points out that nothing matters more to Hippo than its customers. “When we were just starting out and only had a team of 5 or 6, I remember asking how many customers we had in a large area that was reported to get a record-setting hail storm in the next day or so, and I still remember the number of insured, it was 1,585. We needed to do what we could to prepare our customers for the incoming storm and prepare our team for the aftermath. Those were some long days and long nights for the next few weeks or so, but I was so proud of our team and what we were able to do for our customers.”

Hail storms can be tricky, and we didn’t want to leave anything out, so when Justin was asked if he had any final words of advice, he said, “Oh man, I almost forgot. Don’t forget your pets! Make sure you know where they are and bring them in before a storm hits.”

What a guy, always thinking of others.