The Home Features Insurance Companies Fear Most

Most of us know that the age, size and location of a home affect the cost of insuring it. Newer homes built near emergency service providers tend to have lower risk profiles, which translates into lower premiums. If you live along a fault line, in Tornado Alley or near the coast, prepare to pay more for insurance. Homeowners in theft-prone neighborhoods can expect the same outcome.

Your home’s features indicate a lot more than style to insurance providers. Building materials like brick and concrete have a lower risk of catching fire than wood. Older properties are more likely to have antiquated systems that are more expensive to insure.

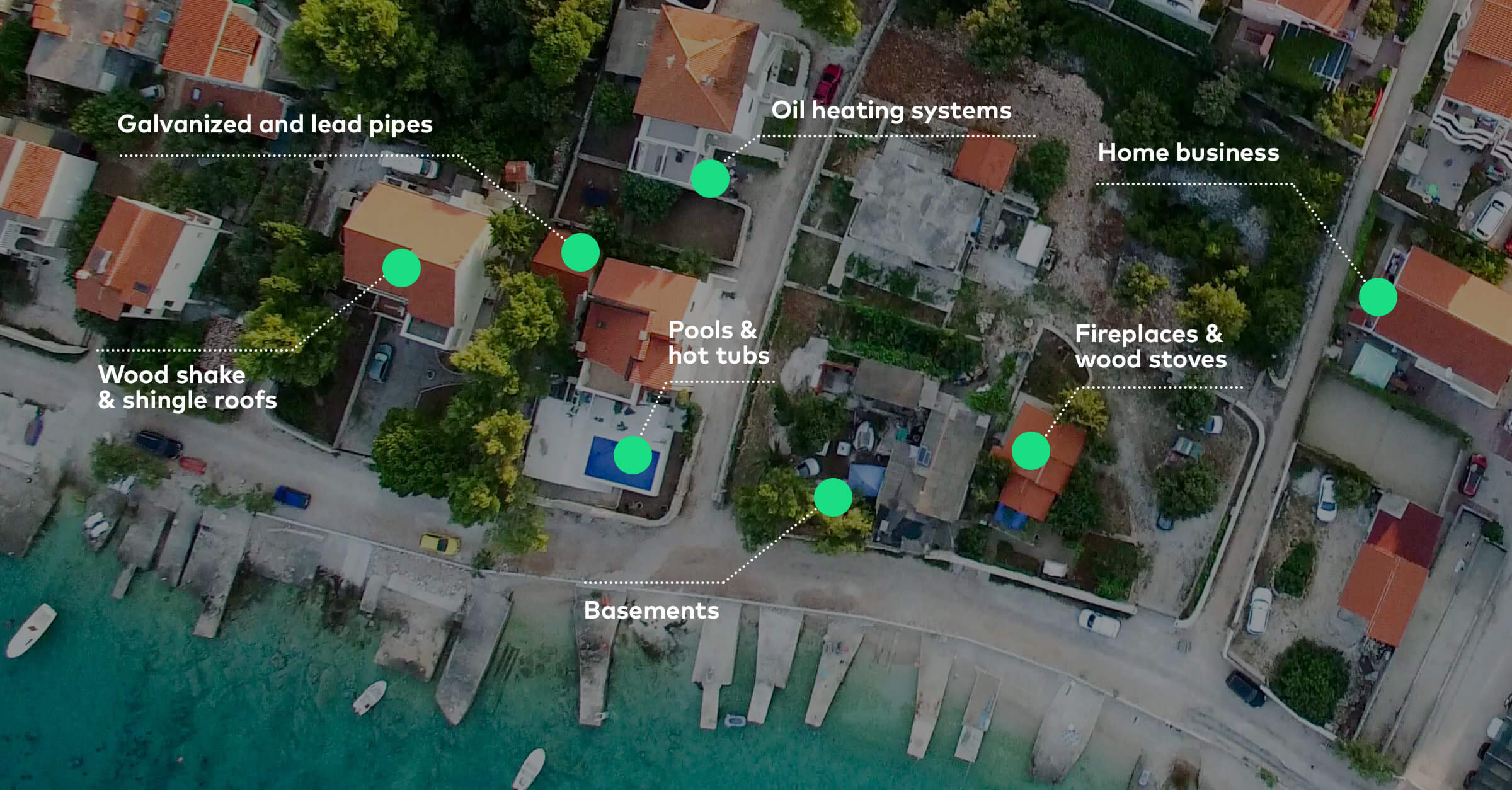

Here are seven home features that insurance companies fear. Although some of these features are beloved by homeowners they can be an insurer’s’ worst nightmares:

1. Galvanized and lead pipes

Homes built or renovated before 1980 often contain lead or galvanized steel water pipes that can rust over time. Corrosion causes leaks and low water pressure. PVC and copper pipes are usually non-toxic and much more resilient. If you have older pipes that are prone to leaking, you may want to consider replacing them.

2. Oil heating systems

Americans used to rely on oil to keep their homes warm in the winter. Today, most homes have a forced-air furnace. While environmentalists want us to use solar or geothermal energy, natural gas has been the preferred choice for homeowners in recent years.

If you still have an oil furnace, you might want to convert to a different type of heating system. Oil is highly flammable and using it to heat your home could drive your insurance premiums up.

3. Wood roofs

You may not think about the roof over your head, but your insurance company does. It’s your home’s first layer of defense against wind and weather damage. Wood shake and wood shingle roofs are vulnerable to fires and other hazards and are more likely to rot. You’re probably better off using another conventional roofing material like slate, tile or concrete. Your insurer will note how expensive the material is to buy, repair and install.

4. Pools and hot tubs

Insurance companies think of pools and hot tubs as a constant liability hazard. It may be fun to have the neighborhood over for a summer party, but you become liable for anyone who uses your pool regardless of whether they have permission to do so. Between 2005 and 2014, there were more than 3,500 drownings annually, on average, in the United States.

If you’re installing a pool at your house, the Insurance Information Institute recommends raising the limits of your home insurance liability coverage to $300,000 – $500,000. You should also consider an umbrella insurance policy that provides additional liability coverage. Most insurance companies also require you to take pool safety precautions, like installing a fence around your pool to prevent injuries.

5. Basements

Finishing a basement is another way to increase your home’s value, but you’ll need insurance coverage for your new space. Standard homeowners insurance policies offer limited coverage for basements because they’re meant to be used as utility spaces, not extra bedrooms. Plus, they’re susceptible to sewage backups and water damage from burst pipes and flooding.

Bottom line: Adding carpet, insulation and plumbing to your basement may increase your insurance premiums.

6. Fireplaces and wood stoves

Adding a fireplace or wood stove to your home changes your risk profile. The U.S. Fire Administration estimates that nearly 11% of residential building fires were caused by heating equipment in 2015.

Before they agree to cover your home, some insurers will require your fireplace or wood stove to pass an inspection. To keep your home safe, consider investing in a mesh screen or curtain for your fireplace. You should also regularly check your smoke detector, do an annual chimney sweep and keep your fireplace damper closed when you’re not using it.

7. Home business

Using your home as a workspace can seriously drive up the cost of your homeowners insurance premiums. Having adequate insurance coverage is particularly important if you have customers coming in and out of your home, increasing the chance that you’ll find yourself involved in a personal injury lawsuit.

Storing inventory or extra equipment on your property can also be an issue for insurers. After all, it’s up to them to cover losses if anything is stolen or damaged. If you frequently work at home, you may need a separate insurance policy for your business.

Lowering your insurance premiums

While adding various features to your home can raise your premiums, there are things you can do to keep your insurance costs low. Certain home upgrades, like installing a new security system, updating your roof and buying smart home devices, can save you money.

In addition to thinking carefully about the kinds of changes you want to make to your home, it’s important to maintain an open line of communication with your insurer. Don’t let the fear of higher premiums keep you from telling your provider about your new basement or fireplace. Being underinsured won’t do you or your insurance carrier any favors.

Have questions about what features in your home could be underinsured? Contact a Hippo specialist. We’re here to help!