Find the best time to sell, before you plot your next move.

The best time to ask yourself this question, obviously, is before you actually need to sell. It’s always best to anticipate your future needs: is your family growing? Will you need a bigger home in the next five years? Are you in an area or neighborhood where you or your family want to remain?

If you have the time to plan ahead, make a selling checklist and decide when you sell, there are many factors that come into play when contemplating the sale of your home: how much equity you have in the home, fluctuations in the market, are you financially ready to purchase a new home or are you selling to pay off debts and restructure your finances, and are you emotionally ready?

Of course, life does happen to all of us and sometimes unforeseen events force us into the market. In any case, there are several things to consider before you make the decision to sell.

Equity

This is crucial in determining whether you can afford to sell your home. It’s fairly simple to determine how much equity you currently have in your home. Get your home accurately appraised. Even though it might be tempting to use online valuation sites that provide a general estimate, consider requesting a free market analysis of your home or get a professional appraisal that will cost between $288 and $374. For example, if your home is worth $500,000 and you’ve paid your mortgage down to $400,000, you subtract your mortgage balance from the appraised value of your home and you’re left with the equity: $100,000 in this instance.

However, as we’ve seen during the housing bubble of 2006, inflated home valuations do occur and occasionally, homeowners find themselves with negative equity — meaning, they owe more on their home than the home is worth. Selling your house with negative equity is referred to as a “short sale.” Obviously, a short sale should be avoided unless you’re facing foreclosure or bankruptcy.

Ideally, you’ll want enough equity in your home to put a 20% down payment on a new home after paying off your current mortgage. While 20% down is not always necessary to avoid Private Mortgage Insurance (PMI), it is highly…CLICK TO TWEET

Ideally, you’ll want enough equity in your home to put a 20% down payment on a new home after paying off your current mortgage. While 20% down is not always necessary to avoid Private Mortgage Insurance (PMI), it is highly recommended. The more equity, the better. Remember, when you sell, you’ll need to cover closing costs, broker fees and moving expenses.

The market

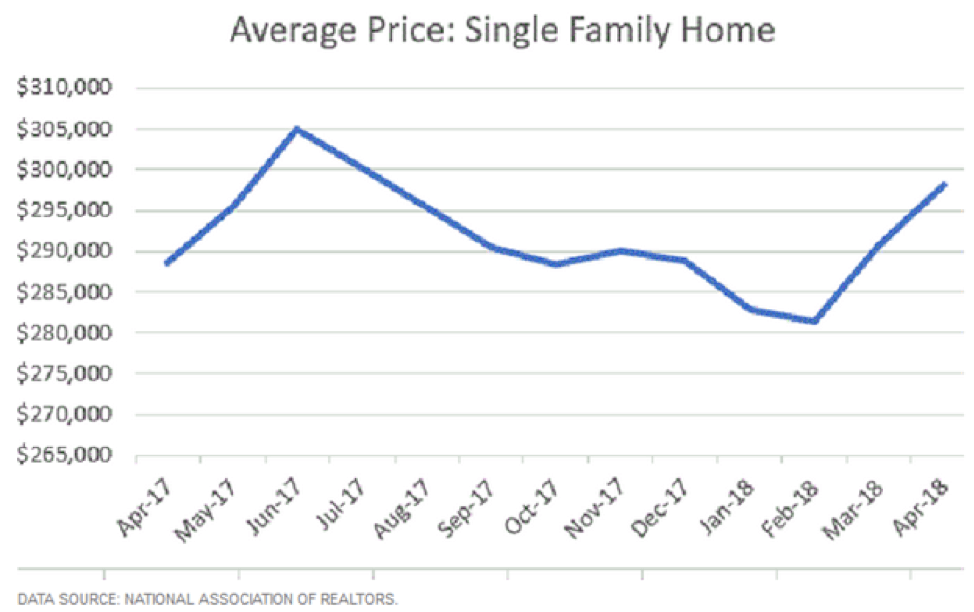

There are seasonal changes to the real estate marketplace. You’ll need some flexibility in your timeline to sell your home during the high season for home sales. According to the National Association of Realtors (NAR), the market generally begins to ramp up in spring and early summer months.

Average price of single family home in US

As homebuyers return to the market after winter hibernation, home sellers can make more money if they are able to list their homes during the months of May and June. Sellers can earn from $1,400 to $15,300 more on the sale of their home during these months than during fall or winter. Of course, the weather will more likely cooperate with you during the warmer months of spring and summer and the curb appeal of your home will be far easier to showcase during the lighter, brighter and warmer months. Also, most families and home buyers, in anticipation of finding a home to purchase, don’t want inclement weather to interrupt the actual moving process, and families do take into consideration spring and summer breaks for school-age children.

Sellers can earn from $1,400 to $15,300 more on the sale of their home during summer months than during fall or winter.CLICK TO TWEET

Do your homework and make yourself aware of the trends within your local real estate marketplace. Get an understanding of how seasons and weather impact the market. If possible, pick the brain of a local real estate agent; most will be comfortable sharing this type of information, or visit online resources such as the National Association of Realtors.

Doctor, I’m ready

As odd as this may sound, you need to make sure you’re emotionally prepared to sell. Selling your home, particularly when you’ve created meaningful memories under that roof, can be very difficult when hearing the inevitable and sometimes harsh criticism of real estate brokers or potential buyers. Your home has been your sanctuary, but when it comes time to sell, every crack in the drywall, window frame, carpet stain and leaky faucet will be examined under a microscope and this can sometimes feel hurtful when so much of your life has been poured into your home.

Be prepared for the harsh reality of third parties dissecting faults in the dwelling. You might be asked to pull down family photos or remove furniture for staging. But most importantly, make sure you’re emotionally prepared to leave your home.

Need more information about the best time to sell your home or to discuss if you’re ready? Contact a Hippo specialist today.