The holiday season is officially here. Between family parties, holiday gift shopping and preparing for winter weather, it can be easy to forget about the traditional risks that tend to pop up during this time of year.

Home hazards can intensify around the holidays, but with a few home prevention strategies and proactive home insurance preparation, you’ll be able to rest easy and enjoy the next few months without your insurance premiums rising.

Here are 7 factors to consider to avoid holiday home insurance claims:

1. Liability

One component of your home insurance policy that comes in handy during the holiday season is the Personal Liability portion. This coverage pertains to situations where you as the homeowner are at fault for instances of bodily injury or property damage sustained by a guest to the household.

With holiday decorations, wet weather outside and increased use of your home, the potential for home-based accidents is higher. Here are just a few to be aware of:

Trips and falls: From moving furniture around to accommodate added holiday decorations, to wet floors in the entryway, there are plenty of ways people can get injured in your home during the holiday season. Take your time before guests arrive to look for problem areas and search for fixes.

Pet-caused injuries: Even the most gentle and laid-back pets can get overwhelmed by holiday guests and extra stimulation in the house, so it’s a good idea to create a designated space for your pets.

Intoxicated guests: If you plan to serve alcoholic beverages to your holiday guests, it’s important to address any trip-and-fall hot spots ahead of time, and make sure there’s a designated driver, rideshare or taxi option available. It’s also a good idea to talk to your insurance agent ahead of time to check that your current home insurance policy has the proper coverage.

Injured domestic workers: To keep any movers, caterers or cleaning crew you might hire safe in your home, do your due diligence to eliminate possible conditions that could lead to an accident. You may also want to review who and how these people are covered; talk to your home insurance agent to make sure you’re properly covered in case anyone gets hurt on your property.

Pro tip: Personal liability insurance coverage also pays legal fees if you’re sued because of these types of damages.

2. Personal property

The property and casualty sections of your home insurance policy most likely protect you from common pitfalls like theft, electric equipment malfunction and fire damage. Here are some common risks/claims your home may see during the holiday season:

- Candle fires

- Chimney fires

- Christmas tree fires

- Cooking fires

- Dryer vent fires

- Electrical outlet overload/malfunction

- Theft

- Water damage

3. Trees

Christmas trees can bring a lot of potential hazards into the home. Nearly half (45%) of holiday tree fires are caused by lighting or electrical issues, according to the National Fire Protection Association. If your family loves touring the tree lot or cutting down your own tree, take a peek at these rules of thumb to help keep your home safe:

- The fresher, the better: Look for green needles that don’t fall off when gently pulled.

- Tree placement is key: Keep your tree 3 feet tall or more, and situated away from heat sources like radiators, candles, lamps and fireplaces.

- Remember to water: Give your tree fresh water every day. In order to ensure good water diffusion, you may also want to trim 2 inches from the trunk before placing your tree in its stand.

- No candles: Don’t put candles near your tree—ever. It’s too big of a risk. Instead, consider using the flameless alternative.

- Know when it’s got to go: Dry? Needles falling? Then it’s time to remove your tree, even if Dec. 25 hasn’t arrived yet. A dry tree is still a fire hazard even if you’re no longer turning the lights on.

4. Holiday lighting and decorations

Holiday decorations like lighting, wreaths, trees and garland help keep your home feeling festive, but they can also create safety hazards. In addition to reading any and all manufacturer’s instructions for best practices, it’s smart to take a few other precautions as well. You can:

Prevent trip and fall risks by tucking away cords or decorations that may be on the floor.

Prevent electric shock by plugging any outdoor inflatable decorations or lighting into circuit protectors with GFCI (ground fault circuit interrupters).

Safely attach lights to your house with clips that are made for it; avoid hammering tacks or nails into electrical cords.

Inspect your strings of lights for damage like frayed wires or missing bulbs. If lights can't be repaired, discard them immediately.

Observe all ladder safety best practices whether you’re indoors or out.

5. Cooking concerns

The kitchen is already one of the busiest rooms in the home, but during the holidays it can turn hectic. Between prep work and cooking multiple meals to serving, there’s plenty of opportunities for accidents to happen. That’s why it’s crucial to take a proactive approach—starting with reducing fire hazards.

“The most important question we ask a homeowner when they call ahead of the holiday season is, ‘Do you know where your fire extinguisher is?’” says Chris Janiak, a business manager in our Hippo Home Care division. Knowing where your fire extinguisher is and how to use already puts you ahead of many American homeowners. Twenty-nine percent of Americans said they don’t have a fire extinguisher at all—and the numbers get worse when asked about location and confidence in using it.

In addition to obtaining and learning how to use a fire extinguisher, aim to follow the below guidelines to keep your kitchen fire-safe:

- Test or replace batteries in all smoke detectors.

- Keep the kitchen as kid-free as possible.

- Don’t leave anything cooking unattended.

- Keep flammable materials (i.e. cooking oil, oven mitts, bags or food packaging) away from stove burners.

- Keep stovetops and countertops clean—especially from grease or oi—to avoid flare-ups.

- Keep a first-aid kit handy and know how to treat a burn.

- Do not deep-fat fry a turkey indoors. This includes your garage or any other out-building.

- Keep holiday decorations out of the kitchen.

- Avoid wearing baggy clothing and secure any long hair away from your face when cooking.

- Practice what to do in case of a fire emergency.

6. Water wreckage

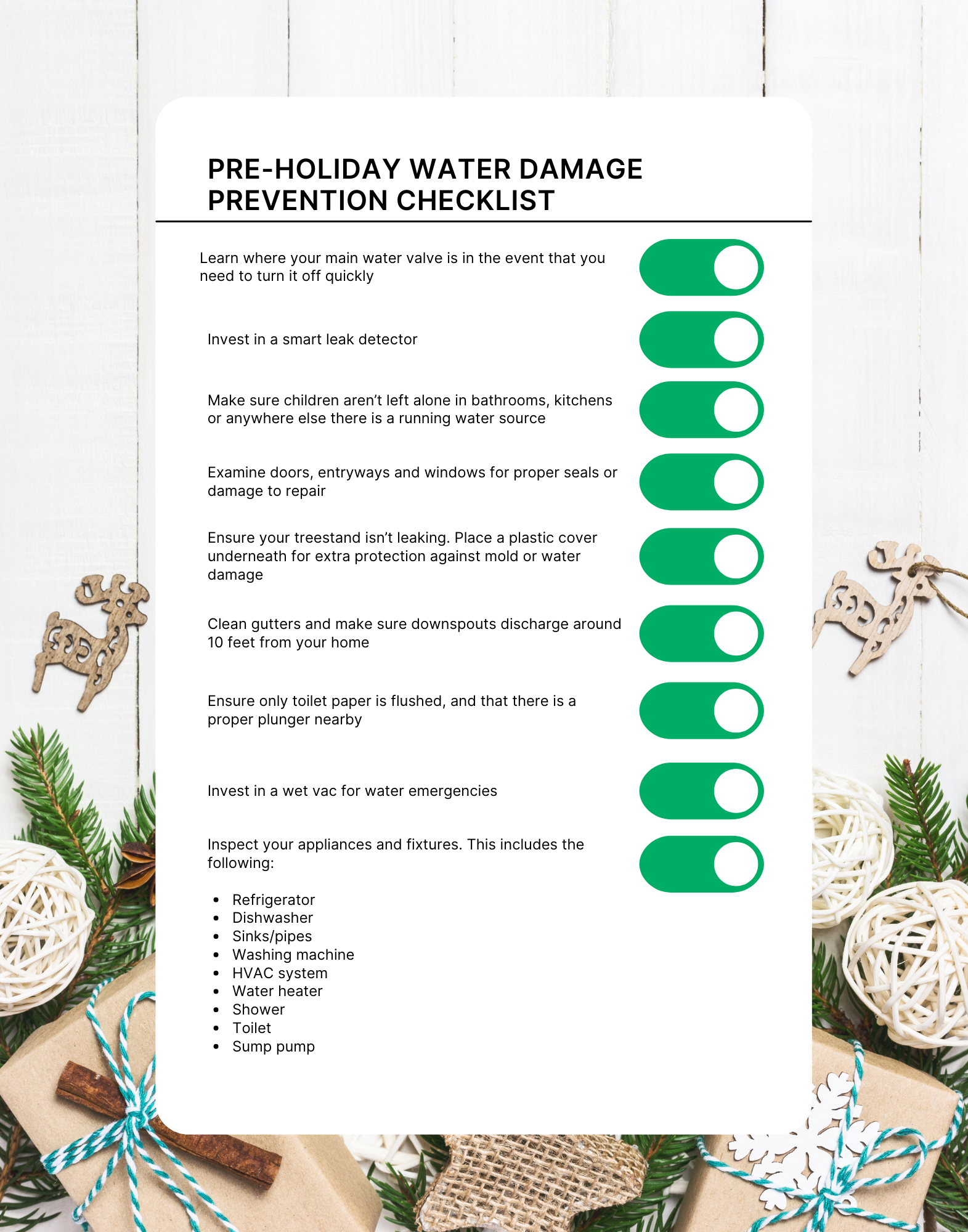

While there are many ways fire can damage your home during the holiday season, water damage claims are much more likely and much more costly. Water damage claims include water overflow and water backup, but even a small amount of water can be very pricey when it comes to the cost of repairs. Home Cost Helper reported that moisture amounts as small as 1-4 inches can average $7,800 to repair.

With the increased use of your home, the risk of water damage only grows. However, you can prevent many common water hazards with little foresight. Print or download the following checklist to keep your home safe and dry all holiday season long.

7. Porch piracy

According to research, gates and cameras aren’t always effective at stopping porch pirates, since only about 8% of thieves try to hide themselves, even when they see cameras. It's no surprise that package theft increases during the holiday season, but there are a number of ways to reduce the risk of porch piracy.

One of the most effective solutions is to hide your packages or remove them from your porch as soon as you receive an alert that your delivery has been dropped off.

You may even want to invest in a smart parcel delivery box for your front porch. These large boxes allow you to receive packages without the fear of them being stolen if you live in a neighborhood where theft is more common.

The gift of home insurance

While you may not think you need to update your home insurance because of the holiday season, it’s always better to be safe and proactive. Before you start decorating, hosting and cooking, take the time to talk to a professional about your liability or personal property coverage to make sure your home is safe and secure for the festivities.

Looking to extend your home protection before the holidays really get going? Receive a Hippo quote in as little as 60 seconds.