Here at Hippo, we are working hard to transform the way homeowners look at and experience home insurance through an innovative lens. We’re building proactive, customer-focused products and services to solve homeowners’ potential issues now, and 10 years from now.

The first week of October, our leadership team descended on lively Las Vegas to both learn from and educate leading industry professionals at InsureTech Connect (ITC), the world's leading insurtech event after more than a year-long hiatus from in-person events. ITC featured various panels, breakout sessions and demos led by insurance industry professionals, entrepreneurs, and investors.

Over the course of three days, people came from around the world to showcase new technology-first innovations and industry optimizations, all to ultimately enrich the lives of insurance customers. Hippo leaders showed up, ready and excited to learn, to educate and to give insight into how we are making a difference in the industry now, as well as provide a glimpse of how we plan to innovate and modernize a decades-old business like home insurance.

Keep reading for an inside look at the particular panels that our Hippo leaders had the opportunity to lead, including their thoughts on topics that are shaping the direction of the insurance industry today, from cross-industry innovation to cutting-edge product innovation.

From the Chief Hippo

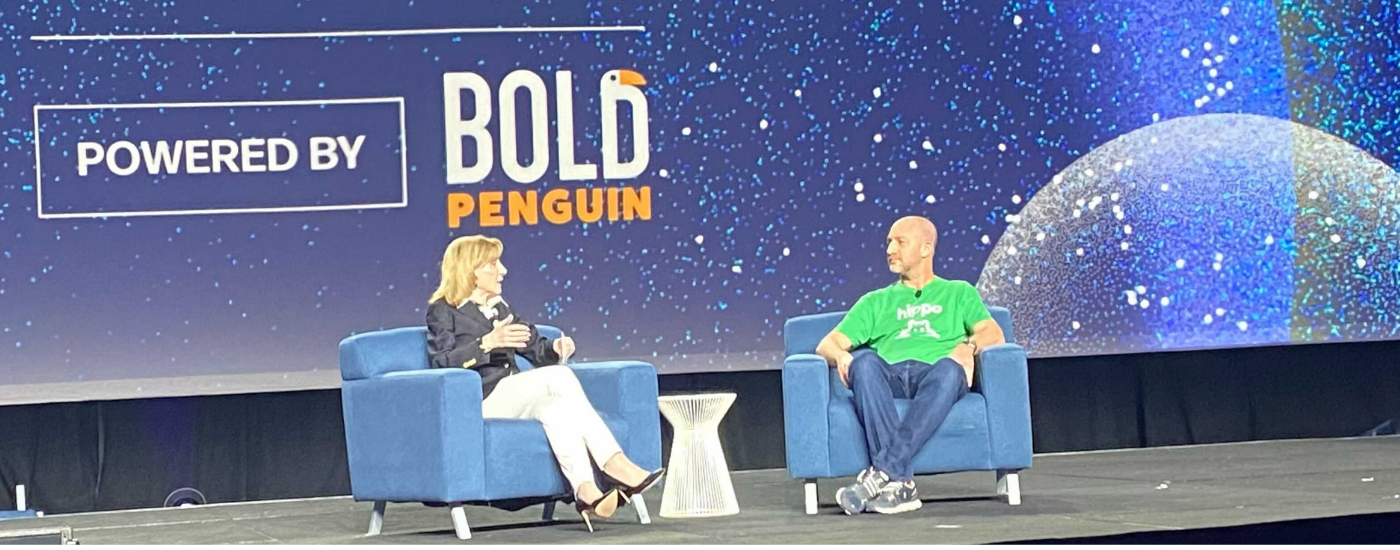

Our co-founder, Assaf Wand took the stage in a fireside chat to shed light on a banner year for the company and what the future looks like.

“It is every entrepreneur’s dream to see their company initials on the New York Stock Exchange. While that was a momentous occasion that we are all very proud of, we are always thinking in the long term, always looking 5 years into the future and going public was about solidifying the growth of Hippo.”

A very important component of being a home insurance company is being a company that customers know that they can trust. Technology, without a doubt, has revolutionized the way customers experience products and services. Just like any industry, it’s important for insurance to adapt to today’s buyer’s needs, and Hippo meets customers when and where they want to buy through various strategic channels. Insurance companies now have the opportunity to develop new experiences, whether they are analog, digital or the perfect balance of both to deliver exceptional customer experiences in an industry where that may not have always been the case.

“My job as the CEO of the company is to focus the entire company, all of its team members back on the customer and their communities. Whether we are thinking about additional products, partners, or processes. The focus must be solution-driven for the customer, that is the only way we can be successful.”

The hosts of the FNOInsuretech podcast were also able to catch up with Assaf and the team to learn more about Assaf’s vision for the future while at ITC and if you would like to listen to that, click HERE.

On Being an Insuretech Disruptor

Insurtech companies continue to take big strides in modernity, most importantly, in how they can improve customer experiences. In a world where the term “disruptor” is no longer a one-size-fits-all definition, on a panel titled, “The Role of the Disruptor,” posed numerous questions about what it takes to disrupt an industry, why the industry needs disruption and even how to begin thinking about where an industry can disrupt?

Rick McCathron, Hippo’s President, threw the audience for a loop when, he stated that at Hippo, we don’t consider ourselves a “disruptor” but more as an “innovator” and that what the industry really needs is modernization.

“When you classify something for disruption, it happens when an industry is broken, and the insurance industry has done a great job of doing exactly what it is supposed to do, protecting the customer. What the home insurance industry has needed is modernization.”

The panel went on to dissect exactly how technology and the industry will have to change, how the leaders within it will have to drive innovation, in order to properly modernize. In an industry as complex and traditional as homeowners insurance, that can be a tall order to fill.

“Homeowners insurance has multiple levels of complexity. In just thinking about underwriting, it’s not just one thing. We underwrite a house, its location, the weather, macrotrends too like labor and building materials, and then a multitude of microtrends--those are just some of the seed components that go into deciding the most modern way to approach the data.”

In an industry like home insurance, where the purpose is to insure someone’s most financially valuable asset, it is imperative to put the customer at the center of the business. Rick also touched on some key areas where Hippo’s business approach and innovation played directly into new product offerings for homeowners.

“When we wanted to begin sending out smart home devices, regulators at first didn’t see it from the same perspective as we did. They saw it as enticing those customers when in actuality it is claims mitigation. Once we worked with the insurance regulators to show them our reasoning and process, we were able to make them just as excited about it as we were.”

Insurance companies are made of massive infrastructures but at the end of the day it is all about the customer and what they experience, so it is extremely important never to lose focus of that.

“Since the very beginning, Hippo has worked to differentiate itself by combining the insurance industry norms with the capabilities of technology to properly innovate for the benefit of the customer's whole experience.”

How Digital Acceleration & Data are Driving the Modern Customer Experience

Moving across the conference facility at Mandalay Bay, we dipped into the next panel, “Digital Acceleration and the Need for Speed”, a subject that Aviad Pinkovezky, Hippo’s Chief Product Officer (and first employee), holds particularly near and dear to his heart.

With layers of regulation on the city, state and federal levels, a “speedy” process can still take months if not years. But in the agile environment of technology, solutions can be introduced to customers at lightning speed. A presenter on the panel even pointed out that Elon Musk himself was able to go to space faster than Tesla could be approved to sell auto insurance in the state of New York.

Hippo worked tirelessly to create a purchase process that was not only fast, with an initial quote clocking in at 60 seconds, but one the customer enjoyed.

“When we started Hippo we knew the general home insurance quote process was something we needed to work on. First, it wasn’t customer-centric enough. A customer was expected to answer an average of 70 questions online and then, surprise, they still had to talk to an agent. When we pressed for answers on why the customer was expected to answer so many questions to just end up on the phone with an agent anyway, there was no clear answer to whether this was regulation or lack of optimization so we knew we needed to dig deeper.”

Through the process of integrating various data sources, Hippo can capture and analyze these powerful insights at scale to provide meaningful product offerings to our customers. Oftentimes, the questions that potential customers were having to answer weren’t directly at their fingertips, like how far is their home from a fire hydrant or what material is the roof made of? We pulled together reliable data sources to take that responsibility off of the customer. It was also this frame of mind that led Hippo to take the approach of meeting our customers where they are.

Hippo knows that bringing on a new customer is not the end of the road, but really the beginning of a proactive and engaging relationship. Once Hippo was able to modernize the quote process for the customer, we turned to the post-bind experience, looking to optimize and modernize where we could.

“Working to make the process as simple as possible for the customer behind the scenes required creative problem-solving. Whether it was to make sure their mortgage company is properly notified or the ability to switch coverage from another insurer with the customer’s permission; all of these backend processes needed to be developed and then optimized upon constantly.” Aviad went on to explain that for Hippo, the post-bind customer relationship also includes our smart home program, and how that initiative alone requires a cascade of events to take place post-bind but had to feel virtually frictionless to the customer to ensure their satisfaction.

“From activation, device positioning, app download, to verification, Hippo built in processes that feel very organic to the customer. But taking a step back from the technical side of things, Hippo’s strategy and vision is to not just be an insurance company. It is to protect the joy of homeownership.”

We do this in three ways :

- Provide the right coverage- From the very beginning, Hippo knew we needed to provide expanded coverage for technology items. This became even more important during the pandemic when our homes became our offices, kids’ schools, etc.

- Claims avoidance- Smart home devices empower customers to better take care of their homes through real-time alerts to potential disasters - like a water leak in their basement.

- Hippo Home Care- Another service Hippo provides for our customers. Virtual and on-site maintenance services, advice and checkups to prevent customers from having to experience the devastation of a claim.

In conclusion

As the leaders at Hippo began to wrap up for ITC 2021, they left Las Vegas feeling energized and motivated for what’s around the corner in the insuretech industry. Finally being able to meet up in person with like-minded people in such a fast-moving industry allowed our leadership to feel refreshed and renewed for what 2022 will bring. And if there is one thing a Hippo prefers, it’s to be prepared and proactive for the future.