Give us a shout. We’ll figure it out.

THE Hippo Agency

Taking charge of your unique insurance needs through partners with our stomp of approval.

WHAT WE COVER

- HOME

- flood

- auto

- earthquake

your policy is out there. we’ll find it.

The Hippo Agency makes it quick and easy to find the homeowners protection and peace of mind you deserve, at a price you can appreciate, from providers you can trust.

Why homeowners insurance?

For starters, homeowners insurance is required with most mortgages. But more importantly, it offers smart protection against the unexpected such as damage, vandalism or theft.

Your home and belongings are important to you. Protecting them is important to us.

What does homeowners insurance cover?

Your house is just the start. Home insurance covers: your physical home (“dwelling”), other structures on your property (sheds, fencing, etc.), personal belongings, and temporary living expenses if you’re displaced.

Depending on coverage levels, policies can also include liability coverage for you and your family.

What is not covered by homeowners insurance?

While good homeowners insurance covers a lot, there are exclusions. Most notably, vehicles and damage from natural disasters such as earthquakes or floods, are not covered and require their own policies. But we can help with our coverage options for earthquake, flood, and auto.

The Hippo Agency vs. Hippo – what’s the difference?

Hippo sets the insurance standard for modern homeowners. But due to unique policy needs, coverage area limits, or other circumstances, coverage isn’t always available through Hippo. That’s where The Hippo Agency steps in, quickly finding the protection you need from other insurance providers.

Whose policies do you sell?

The Hippo Agency works with a wide range of A-list insurers, many that you know by name.

Our purpose and promise is to give you the broadest possible choice, at the best possible price, no matter what you want to protect.

How much does homeowners insurance cost?

Like other insurances, homeowners policies can offer a range of premiums and deductibles. The right protection depends on several factors: Your home’s value, where you live, your risk tolerance, and more.

Whatever your coverage needs, Hippo Agency seeks out competitively priced quotes for you.

don’t get hung out to dry.

From summer storms to snowmelt and more, every home is vulnerable to flooding. And a changing climate increases that risk. Protect yourself from the cost and inconvenience of flooding.

What is flood insurance?

Flood insurance is a separate policy that compensates homeowners and property owners for loss, damage or displacement caused by flooding, the most common natural disaster. Policies can cover buildings (such as your physical home), belongings, or both.

What does flood insurance cover?

Good flood insurance will cover:

- Your physical home, including electrical and plumbing systems, and permanently installed things such as carpet, cabinets, etc.

- Personal belongings such as clothing, electronics, artwork, and more

- Temporary living expenses if your home becomes uninhabitable

Does homeowners insurance cover flooding?

While leaks from pipes and water backups are typically covered, no type of “flood” damage, no matter the source of the water, is covered by standard homeowners policies or renters insurance. Make sure you’re safe.

Isn’t flood insurance just for homes near water?

Flooding isn’t just from rain, rivers, and shorelines – it can happen anywhere, anytime. In addition to storms and hurricanes, melting snow, broken dams or levees, neighborhood construction, and unexpected water runoff can all result in flooding.

Is flood insurance required?

Sometimes. Mortgage lenders often require flood insurance through the National Flood Insurance Program (NFIP) or a private lender for homes in high-risk areas such as shorelines and floodplains.

Because everybody is vulnerable to flooding, it’s advised that all homeowners consider the added protection of flood insurance.

NFIP vs. The Hippo Agency coverage

NFIP is the bare minimum. Limits max out at $250K for building and $100K for contents, and it lacks critical coverages for basement contents, temporary housing, and more. But we’ve got you. The Hippo Agency will find you personalized, real-world protection for your home, whether it’s primary coverage or an NFIP backup policy.

built for speed

From full-time coverage to pay-per-mile policies for cars, scooters, motorcycles and more, The Hippo Agency streamlines your car insurance search.

Why auto insurance?

Car insurance isn’t just for crashes. It provides a financial safeguard for accidents as well as theft, weather damage, and many other incidents out of your control. And it’s not just smart protection, auto insurance is actually required in every state (except New Hampshire).

But why car insurance through The Hippo Agency?

Speed, quality, service and ease. We partner with over a dozen A-list carriers – many you know by name – and do all the leg work to ensure you get fast, fit-for-you coverage at a competitive price.

Pay-as-you-go policies, too.

One size does not fit all. The Hippo Agency offers great auto insurance in all 50 states for cars, trucks, motorcycles, scooters, and more. And our policies include full-time coverage and pay-per-mile options (perfect for work-from-home types). We’ll find what’s right for you.

What does car insurance cover?

Car insurance can pay for vehicle theft, vehicle repairs, medical expenses for you and your passengers, and damages or injuries caused to another driver. Auto insurance can also cover roadside assistance costs and provide financial support if you're hit by an uninsured or underinsured driver.

Do I need car insurance?

Yes. Auto insurance is required in all states except New Hampshire (New Hampshire still requires financial responsibility if you cause an accident).

Driving without insurance can result in a fine, license suspension, or even jail time.

Can The Hippo Agency help with discounts?

Absolutely. We will always look for ways to stretch your dollar. We’ll save you money if you’re a homeowner and find you big savings when you bundle home and car insurance through the same carrier. Give us a call to see what deals we can discover.

for the wake of a quake

Call (800) 576-9565Earthquakes are as devastating as they are unpredictable. And as buildings age and property values rise, the potential cost of quake damage continues to soar. Let’s get you protected.

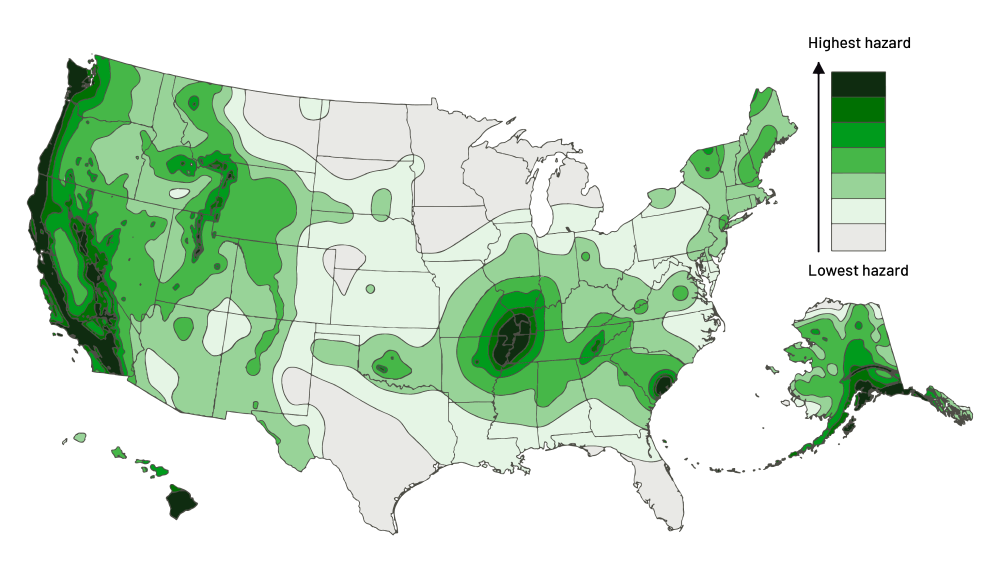

Source: USGS

Why earthquake insurance?

Earthquake insurance can help put a roof back over your head and gets you back on your feet after a seismic event. It offers reimbursement for damaged or destroyed homes and possessions, as well as temporary housing costs.

What does earthquake insurance cover?

Earthquake insurance coverage includes:

- Your home and extended structures, like your garage or pool

- Personal property that was damaged or destroyed

- Expenses for temporary housing (lodging, food, parking, etc.)

What’s not covered by earthquake insurance?

The main earthquake coverage exceptions are fire and water damage (even if the quake caused the fire or flooding), and damage to vehicles. But The Hippo Agency can help there too, with great options for auto insurance and flood insurance.

Does homeowners insurance cover earthquake damage?

No. Homeowners, renters, and condominium insurance policies do not cover damage from natural disasters such as earthquakes, floods, and landslides. You’ll need special coverage to fully protect your home and belongings.

What about rentals, condos and apartments?

If you’re renting or own an apartment or condo, you can get earthquake coverage for belongings and for any temporary housing. Condominium owners might also need insurance to help pay for the condo association’s building repairs.

Who should get earthquake insurance?

With its San Andreas Fault, earthquakes are a fact of life for California. But other regions such as the New Madrid Seismic Zone in the central U.S. have potential for catastrophic quakes, and fracking or mining operations can create man-made incidents. Give us a call to learn more about how you can protect your biggest investment.