There are eight types of homeowners insurance options available, and the one that’s right for you will be based on your coverage needs and the type of home you have. The types of home insurance policies include HO-1, HO-2, HO-3, HO-4, HO-5, HO-6, HO-7, and HO-8.

However, not all homeowners insurance policies are created equal, so it’s best to shop around and read carefully to find a policy that will best fit your needs. For instance, there are policies available for unique living situations. This includes those living in a condo or mobile home, those renting a home, or those who own an older or historically significant home.

Below, we break down what you need to know about home insurance policies and terms to make the best decision for you.

There are eight types of home insurance policies:

- HO-1: Basic form insurance only offers dwelling protection.

- HO-2: Broad form insurance extends beyond basic forms coverage to include personal belongings and additional perils.

- HO-3: The most common type of homeowners insurance, special form insurance includes dwelling, belonging, and liability coverage

- HO-4: Created specifically for renters, HO-4 policies protect personal property and liability but don’t include dwelling coverage.

- HO-5: Comprehensive insurance is typically only considered for brand-new homes and includes more coverage than the special form version.

- HO-6: Condo insurance covers limited parts of the structure of the condo, the items inside, and the owner’s personal liability.

- HO-7: A mobile home policy offers a very similar level of coverage as the special form, but for mobile homes instead of standalone houses.

- HO-8: An HO-8 policy offers a more robust coverage option for older and historically significant homes.

Special home insurance: HO-3 policy

The most common type of homeowners insurance, special form insurance (HO-3) includes dwelling, belonging and, liability coverage. This means that your insurance company will help you financially when repairing or replacing your home’s structure (including additional structures on the property), your personal belongings (even when it’s not inside your home) and any costs associated with injuries that occur at your home. This includes both resident and guest injuries, as well as protection in the event of legal action.

Special form homeowners insurance follows an open peril policy for dwelling protection. Though this means the structure of your home is covered for all different types of damage, your personal belongings are under a named peril policy. Special form protection for personal belongings typically don’t cover events such as earthquakes, floods, government seizures, mudslides, ordinance updates, sewer backups and sinkholes.

Basic homeowners insurance: HO-1 policy

Basic form (HO-1) coverage only offers dwelling protection. This means that while the structure of your home is covered, your belongings and personal liability are left unprotected. In recent years, this basic policy has become less common, as most lenders don’t consider them to provide sufficient coverage for homes.

Basic form is also a named peril policy, meaning you will only receive coverage for damage from the following named disasters: damage from an aircraft or vehicle, explosion, fire, hail, lightning, riots or civil commotion, smoke, theft, vandalism, volcanic activity and wind.

Broad form homeowners insurance: HO-2 policy

The coverage of broad form (HO-2) policy's extends beyond basic form’s (HO-1) to include personal belongings and additional perils. In addition to the basic form (HO-1) events, broad form policies also cover named perils such as artificial electrical current, cracking or other damage to pipes, falling objects, freezing, water or steam overflow and weight of snow or ice.

It’s important to note that broad form homeowners insurance is fairly uncommon, and is not usually recommended by lenders as it doesn’t include liability protection. This is because of the high cost associated with medical and legal fees that often occur in the event of a personal injury on the property and accompanying lawsuits.

Comprehensive homeowners insurance: HO-5 policy

Although not available with all insurance companies, comprehensive insurance (HO-5) is typically only considered for brand-new homes. This open policy includes more coverage than the special form (HO-3), but often excludes earthquake, flood, mold and nuclear damage. It also has higher limits to choose from for personal belonging and liability coverage.

Excluded events typically include animal damage, corrosion, earthquake, flood, foundation damage, fungus, government seizure, landslide, mold, mudslide, nuclear hazard, ordinance upkeep, rot, rust, sinkhole and smog.

Renters insurance: HO-4 policy

HO-4 insurance policies were created specifically for renters, as they benefit from personal property and liability coverage but don’t need coverage on the home itself. Often renters insurance will provide the same disaster coverage as a basic or broad form, and can even help you pay for lodging should you have to leave your rental due to unforeseen circumstances.

A full list of named perils covered include artificial electrical current, damage from an aircraft or vehicle, explosions, falling objects, fire, freezing, hail, lightning, riots or civil commotion, smoke, theft, vandalism, water damage from plumbing or HVAC overflow, water heater damage, weight of snow or ice and windstorms.

Condo insurance: HO-6 policy

Condo insurance (HO-6) covers limited parts of the structure of the condo, the items inside and the owner’s personal liability. Condo insurance’s named peril policy covers common events such as damage from an aircraft or vehicle, explosions, fire, hail, lightning, riots or civil commotion, smoke, theft, vandalism and windstorms.

When purchasing condo insurance, it’s important to first determine what protection your building owner will provide. While most complex owners will protect external walls and common areas such as hallways and trash rooms, double-checking their coverage limitations can help save you headaches down the line. This way, you can ensure you aren’t paying double for coverage you already have through your building owner, or that there aren't any gaps in your protection in case of an emergency or natural disaster.

Mobile homes: HO-7 policy

A mobile home (HO-7) policy offers a very similar level of coverage as the special form (HO-3), but for mobile homes instead of standalone houses. Mobile home insurance includes an open peril policy for the structure of RVs, mobile homes and trailers.

Coverage for personal belongings, however, is a bit more limited and runs on a named peril policy including damage from an aircraft or vehicle, explosions, fire, hail, lightning, riots or civil commotion, smoke, theft, vandalism and windstorms.

Old or significant homes: HO-8 policy

An HO-8 policy offers a more robust coverage option for older and historically significant homes that often need more repairs and have higher costs associated with replacements and repairs. Dwelling, belongings and liability coverage are all included in a named policy that covers damage from an aircraft or vehicle, explosions, fire, hail, lightning, riots or civil commotion,

Additional insurance policy options

If you don’t find yourself fitting into any of the situations above, you may need a more unique insurance policy. Luckily, there are plenty of outlier protection plans available to suit your needs. Make sure to talk to your insurance provider about your situation to determine which option is right for you.

- DP3 insurance is similar to a special form (HO-3) policy but is tailored to landlords who are renting out their homes to tenants.

- Personal umbrella policy provides additional liability protection on top of what your homeowners insurance policy already covers.

- Scheduled personal property coverage extends your policy limit for high-risk or expensive items in the event of damage, theft or loss.

- Short-term home insurance covers vacation homes during peak seasons.

- Vacant insurance offers protection for empty homes that are more susceptible to major damages from events like fire and theft.

smoke, theft, vandalism and windstorms.

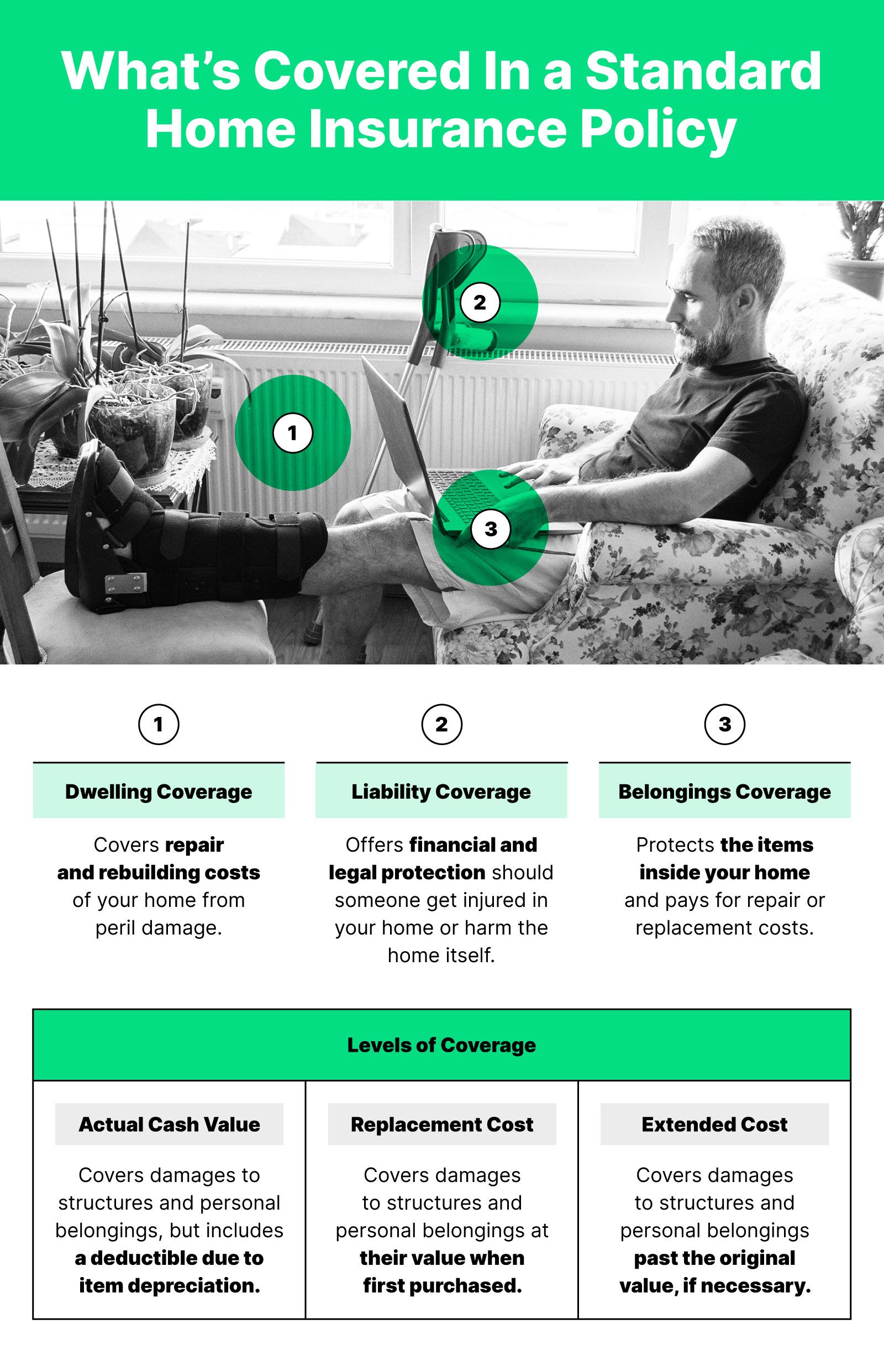

What are the three main types of property insurance coverage?

The three main types of property insurance coverage include actual cash value, replacement cost, and extended replacement cost.

Actual cash value coverage means that the insurance company will pay to replace the structure or personal belongings, but will deduct some money from their total payment due to depreciation on said items. Replacement costs take this policy a step further by agreeing to pay for the damaged home or items inside at their value when first purchased, no depreciation deduction taken.

Finally, extended replacement cost means that the insurance company will cover the full cost to repair or replace a damaged dwelling for a covered peril regardless of the policy limits. This can be especially helpful for homeowners after a natural disaster or when supply prices suddenly jump.

Are all homeowners insurance policies the same?

Not all homeowners insurance policies are the same. There are a variety of coverage and payout amounts available depending on the type of home you have and the items you want protected. It’s best to consider all belongings and structures on your property, as well as the daily wear and tear on your home before deciding which policy to move forward with.

What type of homeowners insurance is right for me?

To determine what type of homeowners insurance is right for you, it’s important to know what type of coverage you want and what deductible limits you can afford. Getting the proper coverage for your home can make or break how easy it is to recover from setbacks such as theft or fire. It’s also important to take into consideration how vulnerable your home may be, as you might need to add on additional peril coverage or increase your policy limits.

Determining the policy that fits your need takes a lot of consideration and shopping around, but rest assured the effort is worth it. Protecting your property and belongings is crucial to long-term home health and can help prevent a dip in your savings should a major repair arise. By taking factors such as market rates, customer service, coverage amounts and costs into account, you can ensure you’re making the best decision for your needs.

Ready to upgrade your coverage for total home wellness? Reach out to our home insurance experts to learn about our smart home and virtual maintenance packages that come standard with each policy provided by Hippo.

Save up to 25%*

Get a quote in 60 seconds.

Smart insurance coverage for your modern lifestyle.

Get Instant Quote *Estimated premium savings based on state rate comparisons of Hippo's prices as compared to average industry price.Sales

Customer Support

(800) 585-0705[email protected]We are here around the clock from Monday to Friday. We're closed from 6 pm CST on Saturday and resume service at 5 am CST on Monday. If you need assistance outside of these hours, please don't hesitate to email us at [email protected] or call us during our regular hours.

Claims

(855) 999-9746[email protected]Contact us to file a claim. We're here 24/7.

Agent Support

(650) 426-0546[email protected]We are here Monday - Friday, 7 a.m. to 7 p.m. CT.

Lender Support

(800) 585-0705 Opt #3[email protected]We are here Monday - Friday, 7 a.m. to 7 p.m. CT.

Hippo Home app

home.hippo.comStay on top of home maintenance with the Hippo Home app.